Stay On Target

Every January, Wall Street releases its newest flurry of S&P 500 year‑end predictions. And inevitably, we’re asked where we think the market is headed. At SJS, we certainly have opinions, but we don’t publish short-term market forecasts or build client portfolios around them. Because, quite simply, no one knows where markets will land. Not us, not the loudest voices on TV, and not even the banks that publish those targets with great confidence.

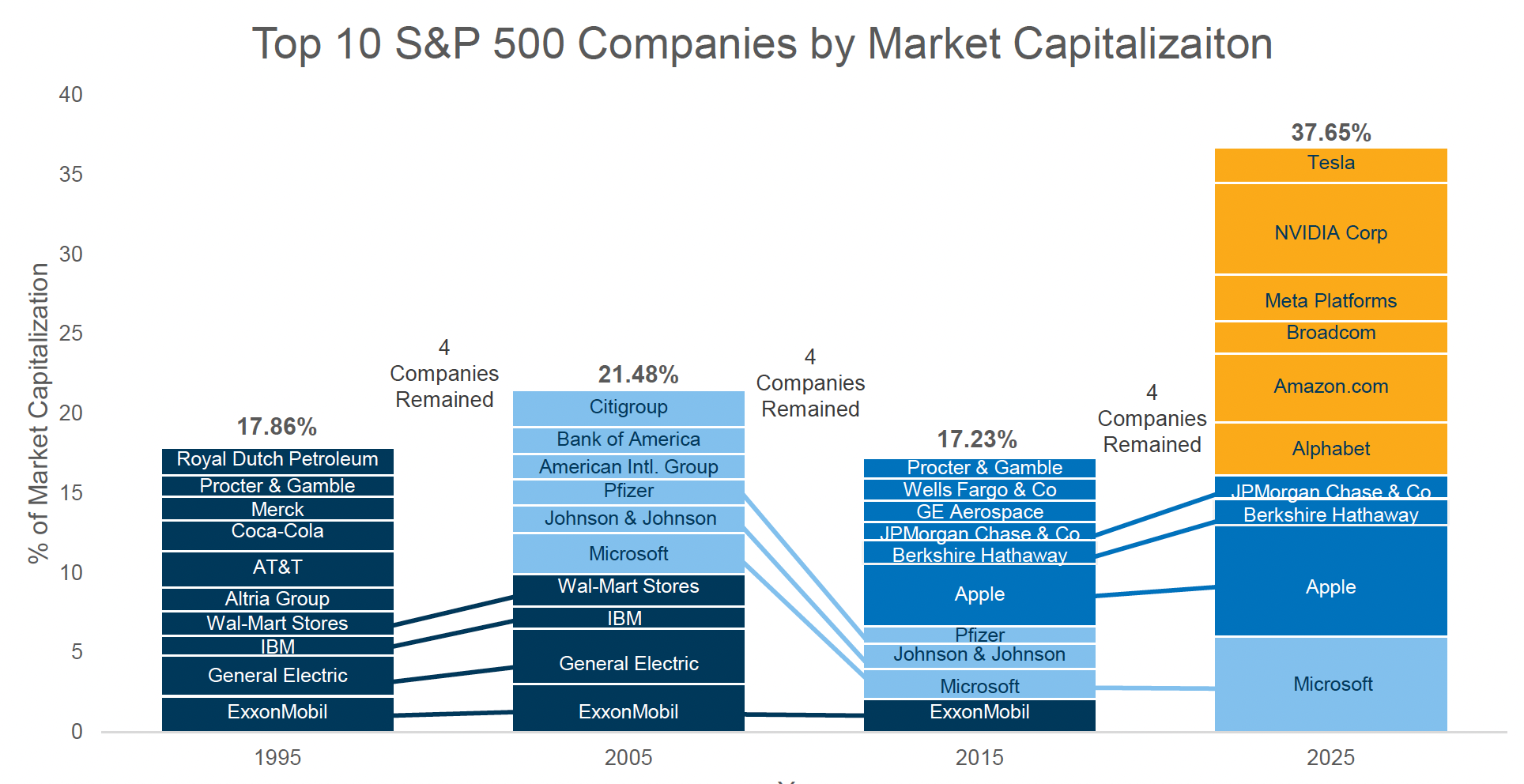

AOL to AI: How Innovation Keeps Reshaping Market Leadership

Do you remember when AOL was the internet? When hearing “You’ve got mail” felt like a small event, and logging on meant you were connected to the future?

Roaring Returns: 2025 Market Recap and Outlook

2025 closed out with global stock markets delivering another remarkable year, capping one of the strongest three-year stretches in stock market history. The April correction now feels like a distant memory as tariff shocks came and went.

SJS Quarterly Report – January 2026

Each quarter, we create an outlook that covers topics including general investment market conditions, financial planning considerations, and SJS news.

A Cautionary Tale of Concentration & Exuberance

The value of investment markets lies in the unknowable future. No one knows exactly what comes next - despite what some may claim. What we do know, grounded in academic research, is that valuations matter.

SJS Quarterly Outlook: July 2025

In our Quarterly Outlook, we reflect on 30 years of SJS with a letter from our Founder & CEO, share our latest investment insights, and highlight our continued commitment to community through SJS Cares. Plus, download a copy of our featured SJS Personal Information Organizer, which can serve as a comprehensive record of your essential family, financial, and personal information.

Walking the Tightrope: The Fed, the Market, and Your Bonds

Interest rates don’t always make headlines, but when they do, they tend to shake everything else. That’s because rates sit at the heart of the economy: they influence borrowing costs, savings yields, and business investment.

SJS Outlook: Q1 2025

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

SJS 2024 Annual Report

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

SJS Outlook: Q4 2024

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Outlook: Q3 2024

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Outlook: Q2 2024

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

SJS Outlook: Q1 2024

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SJS Outlook: Q4 2023

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

SJS Outlook: Q3 2023

The SJS Q3 2023 Outlook includes our insights on gifting and charitable contributions as well as U.S. real estate. We also look forward to Q4 2023.

SJS Outlook: Q2 2023

The SJS Q2 2023 Outlook includes our insights on building up our local communities as well as market performance so far in 2023. We also share even more members of the SJS family and look forward to Q3 2023.

SJS 2022 Annual Report

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

SJS Outlook: Q1 2023

The SJS Q1 2023 Outlook includes our insights on planning for your legacy, tomorrow’s headlines today, how the SECURE 2.0 Act may impact your finances, and looking forward to Q2 2023.

SJS Outlook: Q4 2022

The SJS Q4 2022 Outlook includes our insights on the U.S. bond market over the past year, steps to help you plan financially for the new year, a thank you to Bev Langley, and looking forward to Q1 2023.

SJS Outlook: Q3 2022

The SJS Q3 2022 Outlook includes our insights on the performance of global markets so far in 2022, supporting our communities, a new member of the SJS Team, and looking forward to Q4 2022.