Important Financial Planning Numbers For 2026

By Senior Advisor Andrew Schaetzke, CFP®.

As you look ahead to 2026, it’s easy to feel overwhelmed by all the new financial and tax updates. To make things simpler, we want to highlight the key numbers to keep on your radar this year, including:

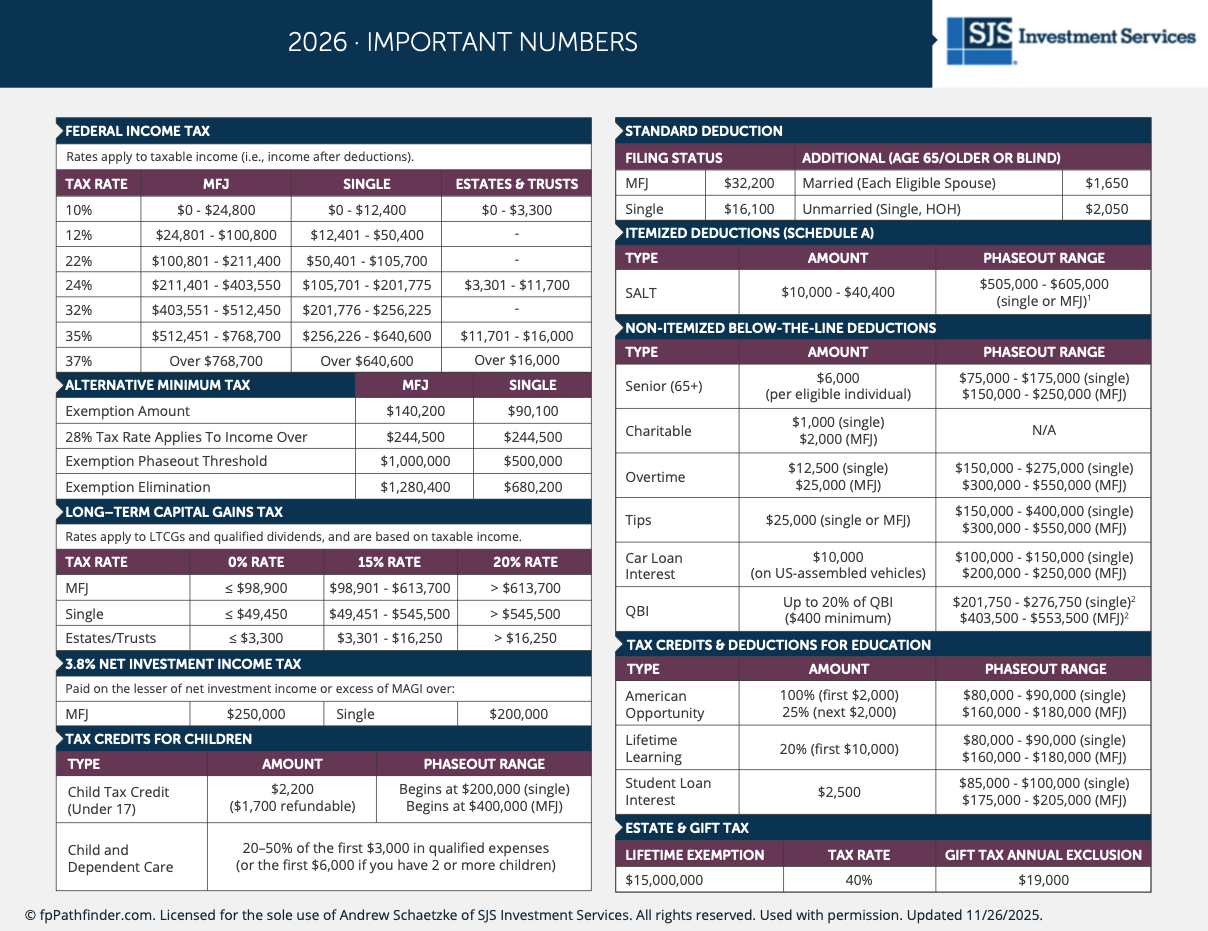

Updated tax rates and brackets for federal income, capital gains, Social Security, and estate taxes

Changes to deductions, exemptions, and available tax credits

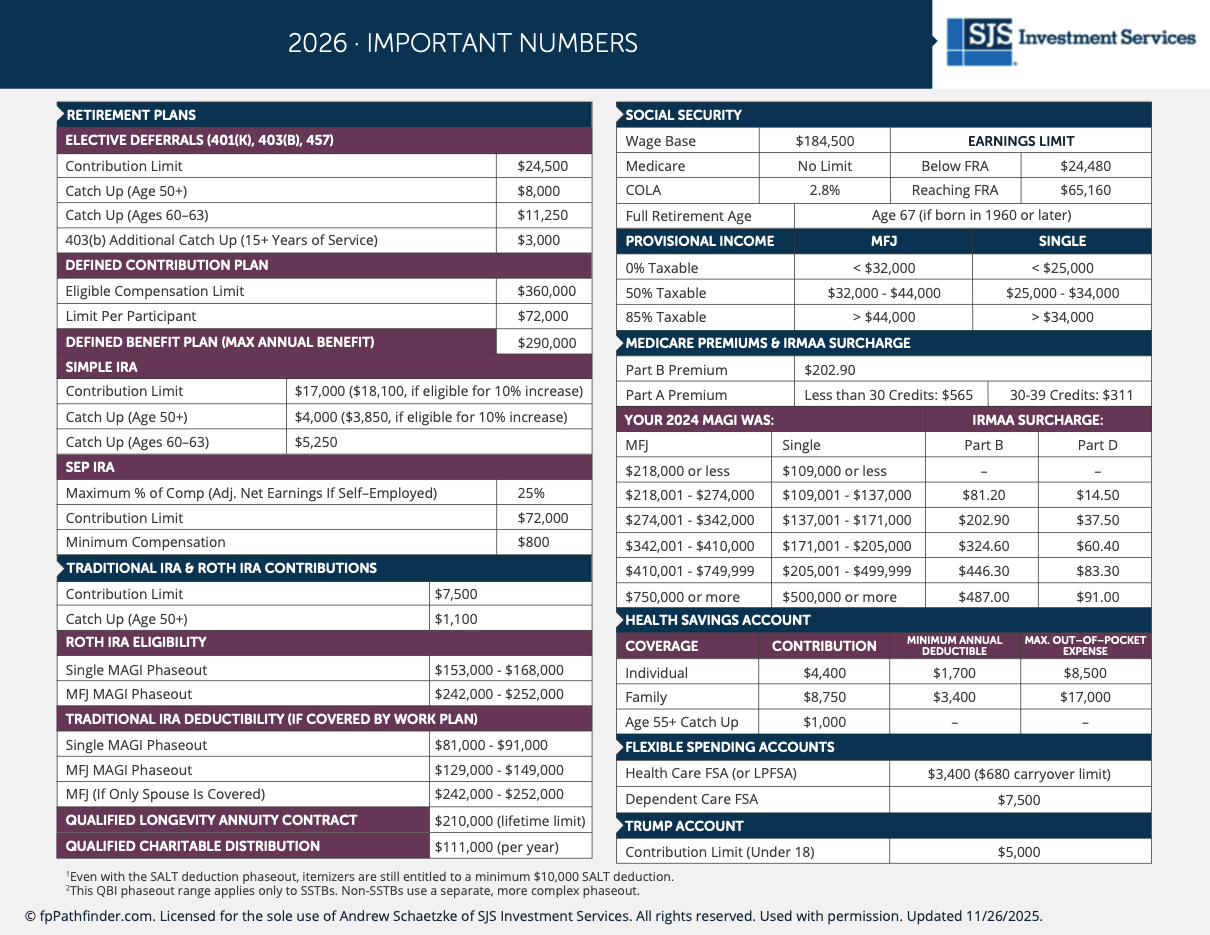

New contribution limits for retirement plans (401(k), 403(b), IRA, SIMPLE IRA) and Health Savings Accounts (HSAs)

Required minimum distribution (RMD) rules for tax-deferred retirement accounts

Medicare premiums and IRMAA thresholds

To support your planning, we’ve included a helpful reference guide below. And as always, our team is here to walk with you through every step of your financial journey. If any of these updates raise questions for you or your family, please reach out to us—we’re here to help.

Please click on the images below to view the PDF.

Important Disclosure Information & Sources:

This resource was created by fpPathfinder. SJS pays an annual subscription in order to license resources from fpPathfinder.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice.