Stay On Target

Every January, Wall Street releases its newest flurry of S&P 500 year‑end predictions. And inevitably, we’re asked where we think the market is headed. At SJS, we certainly have opinions, but we don’t publish short-term market forecasts or build client portfolios around them. Because, quite simply, no one knows where markets will land. Not us, not the loudest voices on TV, and not even the banks that publish those targets with great confidence.

Don’t Let Bubble Talk Burst Your Plan

Are valuations excessively high? Do record earnings justify selling? Headlines that stir fear are not new. Investors often get caught up in market noise, but recognizing that news headlines are often written to prioritize clicks over nuanced truth can reduce stress.

SJS Weekly Market Update

SJS Investment Services creates a weekly market update to summarize performance characteristics for major stock and bond indices.

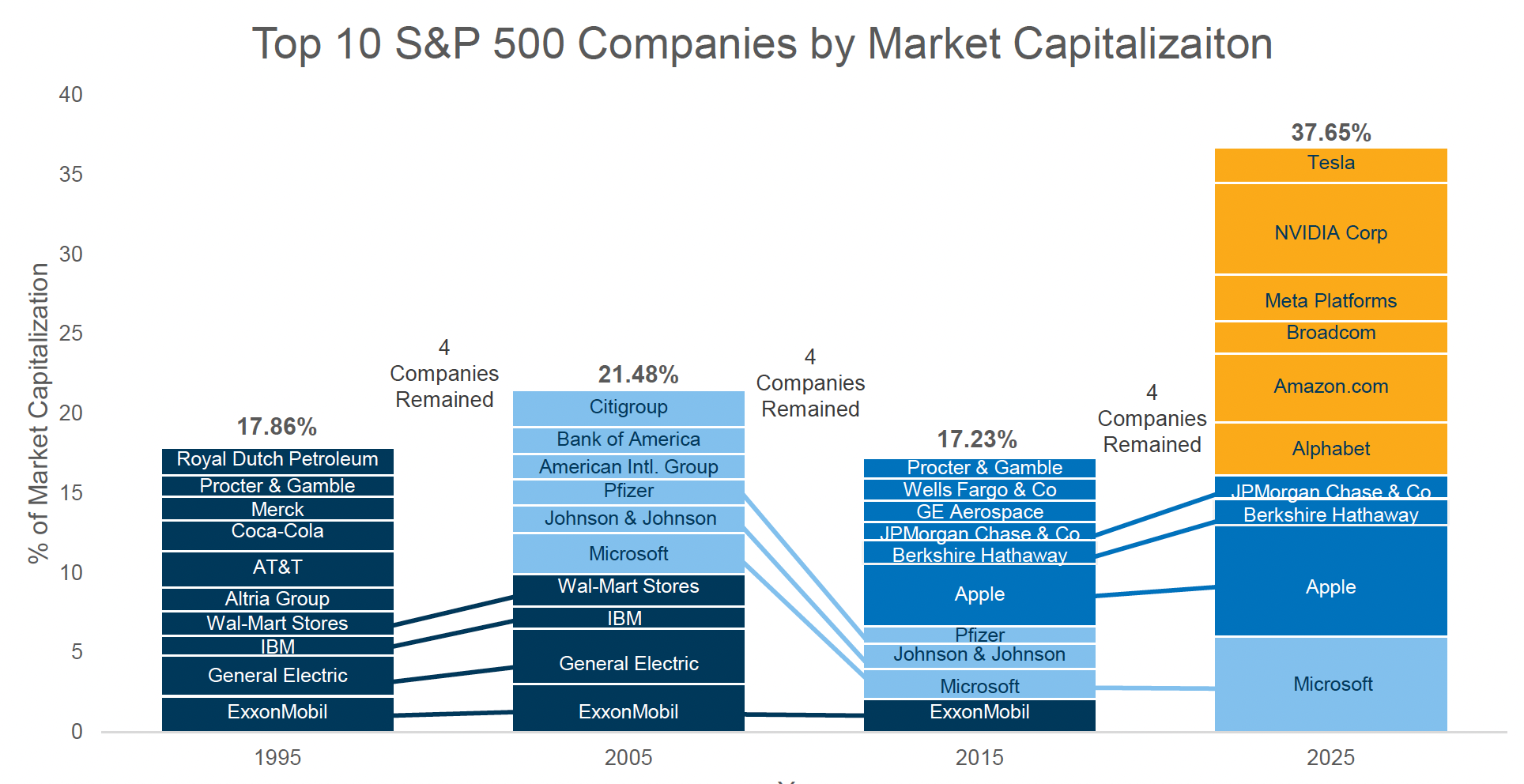

AOL to AI: How Innovation Keeps Reshaping Market Leadership

Do you remember when AOL was the internet? When hearing “You’ve got mail” felt like a small event, and logging on meant you were connected to the future?

Roaring Returns: 2025 Market Recap and Outlook

2025 closed out with global stock markets delivering another remarkable year, capping one of the strongest three-year stretches in stock market history. The April correction now feels like a distant memory as tariff shocks came and went.

What's The (Gold) Rush?

Gold has delivered eye-catching gains in recent years, surging past $4,000 per ounce this year and headlining financial media with talk of safe havens, inflation fears, and geopolitical uncertainty. This performance has increased investor enthusiasm, but history and research suggest caution.

A Cautionary Tale of Concentration & Exuberance

The value of investment markets lies in the unknowable future. No one knows exactly what comes next - despite what some may claim. What we do know, grounded in academic research, is that valuations matter.

From Capitol Hill to Main Street: How the Big Beautiful Bill Impacts Your Business

As we discussed in our last blog post, Congress passed the long-anticipated One Big Beautiful Bill Act (OBBBA). True to its name, this legislation covers a wide range of tax and financial provisions. And for business owners in particular, the impact is meaningful [1].

How To Know A Good Innovation From A Bad One

It’s no secret that the pace of innovation these days is supersonic. We all see the online videos of near-daily rocket launches and miraculous landings. And everyone seems to be asking the same question: how do we discern a good “innovation” from a not-so-good one?

Walking the Tightrope: The Fed, the Market, and Your Bonds

Interest rates don’t always make headlines, but when they do, they tend to shake everything else. That’s because rates sit at the heart of the economy: they influence borrowing costs, savings yields, and business investment.

Navigating Market Volatility — SJS Perspective

Given recent price drops in US stocks, we wanted to offer our perspective on why maintaining discipline to target allocations may be one of the most important things we can do as investors.

The Tale Of Two Curves: What The Yield Curve Means For You

The yield curve isn’t just an academic concept; it impacts real-life decisions.

Election Time

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

Earning More Interest On Your Cash

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

Standing On The Shoulders Of Giants: The Evolution Of MarketPlus® Investing

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

Inside MarketPlus® Investing – Fund Spotlight: SRDAX

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

Growing Your Cash

You can consider putting excess cash into a money market fund, short-term U.S. Treasury bonds, or a short-term bond mutual fund / ETF.

In The Hopes Of A "Soft Landing", There May Be A Crack In The Foundation

The future of the housing market is uncertain, and its resilience will be a crucial factor in the broader economic landscape.

Unexpected Good News: Market Performance So Far In 2023

It’s important to recognize how difficult it is to predict what will happen in the short-term for investment markets, and how much margin for error there should be for any prediction.

Tomorrow's Headlines Today

The market’s reaction to tech in the first quarter is another reminder of how hard it is to time and predict the market, even if you “know” what is going to happen.