Stay On Target

Every January, Wall Street releases its newest flurry of S&P 500 year‑end predictions. And inevitably, we’re asked where we think the market is headed. At SJS, we certainly have opinions, but we don’t publish short-term market forecasts or build client portfolios around them. Because, quite simply, no one knows where markets will land. Not us, not the loudest voices on TV, and not even the banks that publish those targets with great confidence.

Don’t Let Bubble Talk Burst Your Plan

Are valuations excessively high? Do record earnings justify selling? Headlines that stir fear are not new. Investors often get caught up in market noise, but recognizing that news headlines are often written to prioritize clicks over nuanced truth can reduce stress.

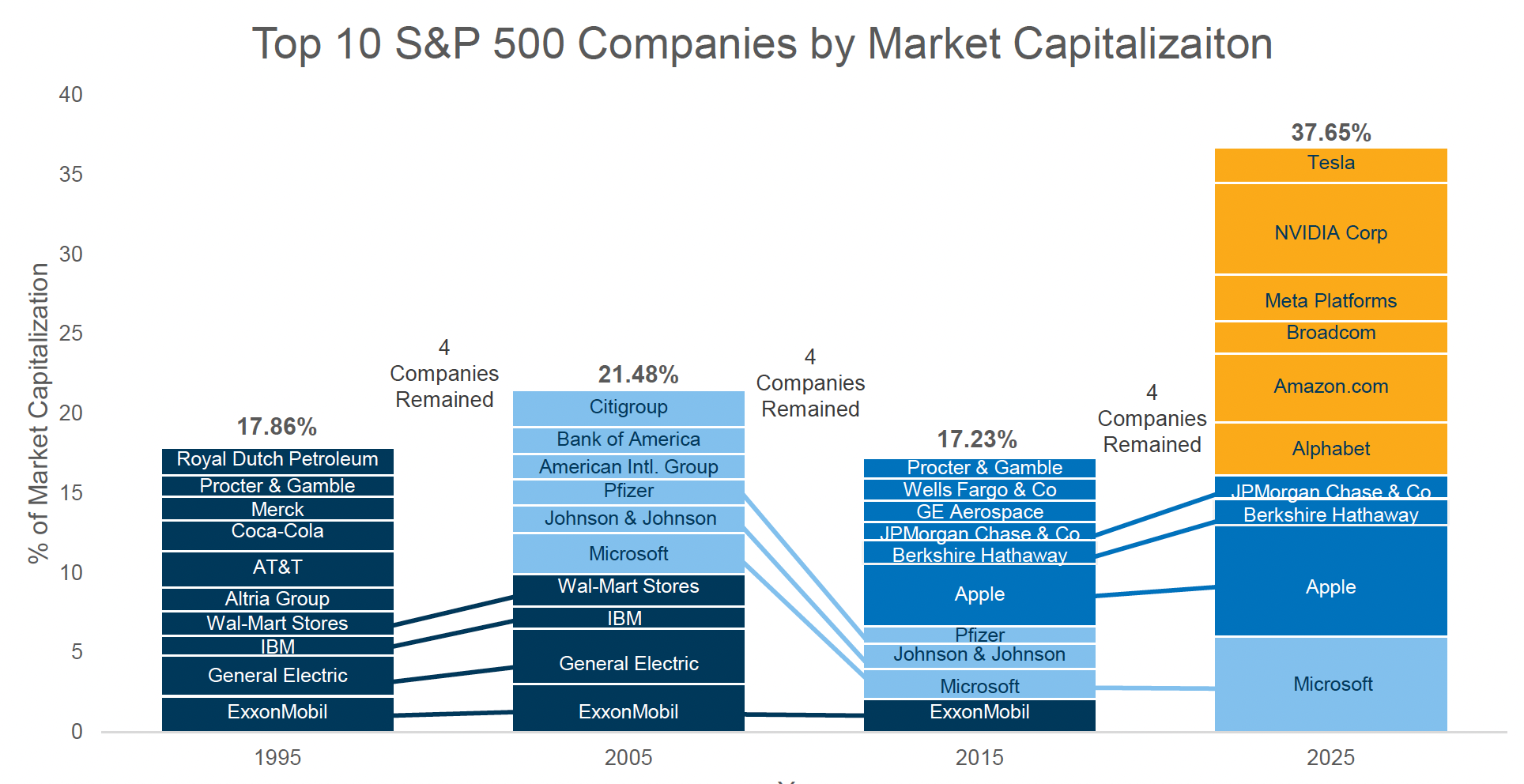

AOL to AI: How Innovation Keeps Reshaping Market Leadership

Do you remember when AOL was the internet? When hearing “You’ve got mail” felt like a small event, and logging on meant you were connected to the future?

Your Wealth in 2026: New Year, New Limits

The beginning of 2026 is a natural checkpoint to make sure your saving, gifting, and protection strategies still match the life you are living today. Your financial planning can benefit from a fresh look at the start of each year and we have a some actionable ideas to start the new year on the right foot, financially.

Imagine Peace of Mind

As we excitedly look forward to the year ahead, we remain deeply committed to empowering you to build a better life and providing the peace of mind you deserve.

SJS Quarterly Report – January 2026

Each quarter, we create an outlook that covers topics including general investment market conditions, financial planning considerations, and SJS news.

Thank You Isaac Saffold!

This fall, we had the pleasure of working with Isaac Saffold, an intern from Georgetown University. Isaac joined us through a meaningful connection — he was referred by the Georgetown football coach, as SJS Senior Advisor Andrew Schaetzke also played on the team. It’s a great example of how strong relationships open doors and create opportunities.

Important Financial Planning Numbers For 2026

As you look ahead to 2026, it’s easy to feel overwhelmed by all the new financial and tax updates. To make things simpler, we want to highlight the key numbers to keep on your radar this year.

From Capitol Hill to Main Street: How the Big Beautiful Bill Impacts Your Business

As we discussed in our last blog post, Congress passed the long-anticipated One Big Beautiful Bill Act (OBBBA). True to its name, this legislation covers a wide range of tax and financial provisions. And for business owners in particular, the impact is meaningful [1].

Walking the Tightrope: The Fed, the Market, and Your Bonds

Interest rates don’t always make headlines, but when they do, they tend to shake everything else. That’s because rates sit at the heart of the economy: they influence borrowing costs, savings yields, and business investment.

How Much Is Too Much? Reflections from "Next Generation Philanthropy"

At SJS Investment Services, we’re always looking for fresh perspectives on wealth and how it impacts families, communities, and future generations. On March 11, we attended an event at the Toledo Museum of Art’s Glass Pavilion, Next Generation Philanthropy: Purpose, Not Privilege, featuring a conversation between Kristen Keffeler, author of The Myth of the Silver Spoon and Aly Sterling Philanthropy.

SJS Outlook: Q4 2023

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.