Your Wealth in 2026: New Year, New Limits

The beginning of 2026 is a natural checkpoint to make sure your saving, gifting, and protection strategies still match the life you are living today. Your financial planning can benefit from a fresh look at the start of each year and we have a some actionable ideas to start the new year on the right foot, financially.

Transition From Work Income To Retirement Income

When we spend as much as thirty or more years of our life working and saving for retirement, the idea of “undoing” our life’s work might seem a little unsettling.

What Is The Value Of Your Advisor? - Retirement Plans

What do plan sponsors find important when it comes to structuring and managing retirement plans for their participants?

Mid-Year Updates: IRA And PPP Rules

The government passed the CARES Act and other stimulus to help provide more financial flexibility. We offer a summary of how those rulings may affect you.

The SECURE Act Shifts The Rules Of Retirement

We’ve highlighted some of the more significant modifications within the SECURE Act that affect your retirement planning.

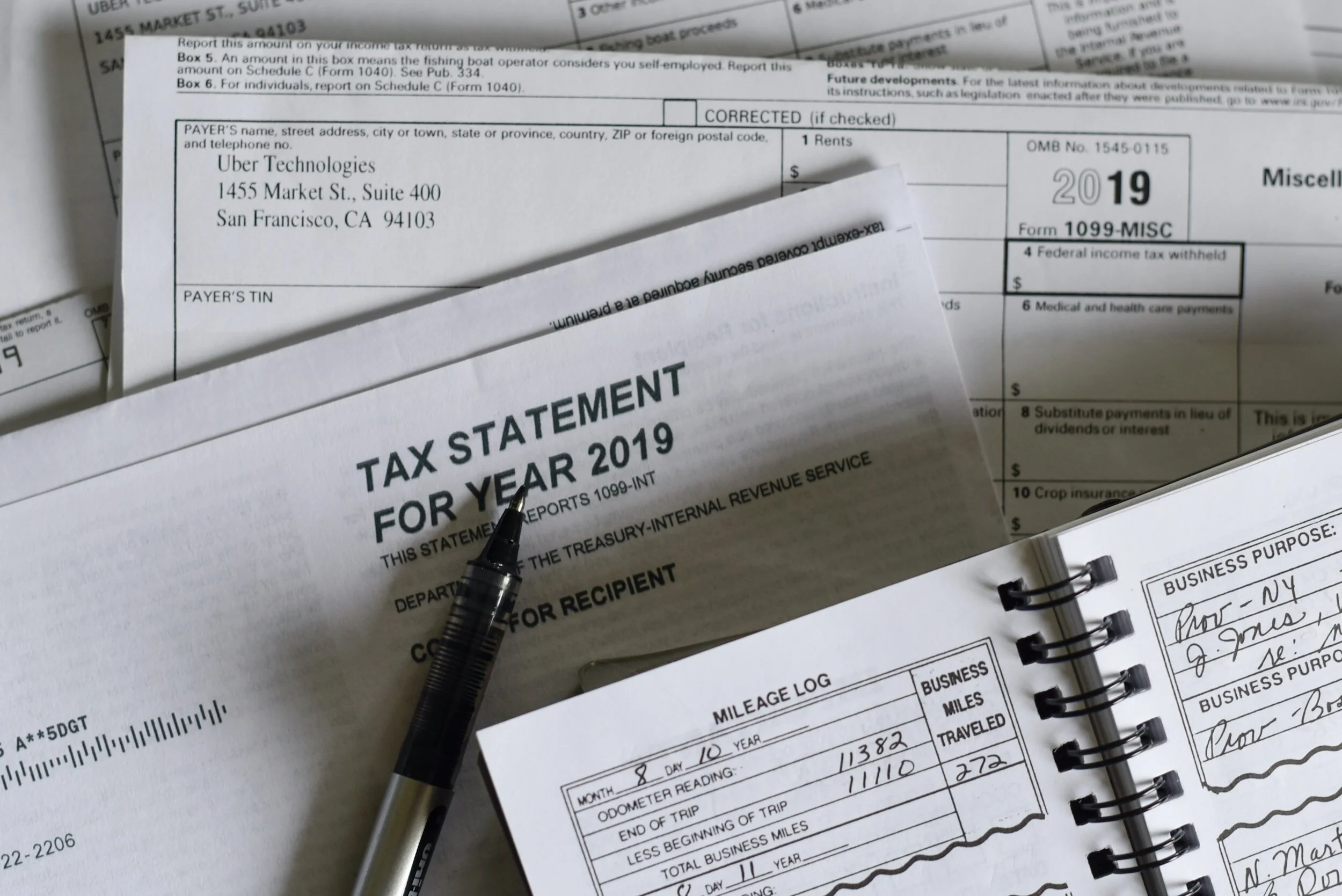

Increased 401(k), 403(b) Contribution Limits In Effect For 2020

The IRS has announced new retirement account contribution guidelines for 2020. Contributing more to your retirement accounts now can lead to a lower tax bill – not to mention more income in retirement.

Is It Time to Throw Out the ‘Three-Legged Stool’?

Social Security and private pensions are less secure than in the past. It’s up to us to do more individually to save for retirement. What tools do we have?