AOL to AI: How Innovation Keeps Reshaping Market Leadership

By Senior Advisor Kirk Ludwig, AIF®

Do you remember when AOL was the internet? When hearing “You’ve got mail” felt like a small event, and logging on meant you were connected to the future? Or when pulling out a BlackBerry in a meeting to check a stock quote or send an email made you feel one step ahead of everyone else in the room? At the time, these companies didn’t just participate in innovation – they defined it. They launched technologies that fundamentally changed how people communicated, worked, and accessed information. It was hard to imagine a world where they wouldn’t always be on top.

AOL and BlackBerry earned their leadership. AOL introduced millions of households to the internet for the first time, eventually reaching more than 26 million subscribers and merging with Time Warner in what was once one of the most valuable corporate combinations in history. BlackBerry became the backbone of business and government communication, so secure and universal that many organizations required employees to use it. Yet in both cases, leadership faded quickly. Broadband replaced dial-up faster than AOL could pivot. Touchscreens and app ecosystems reshaped smartphones faster than BlackBerry could adapt. What once felt permanent proved to be surprisingly fragile.

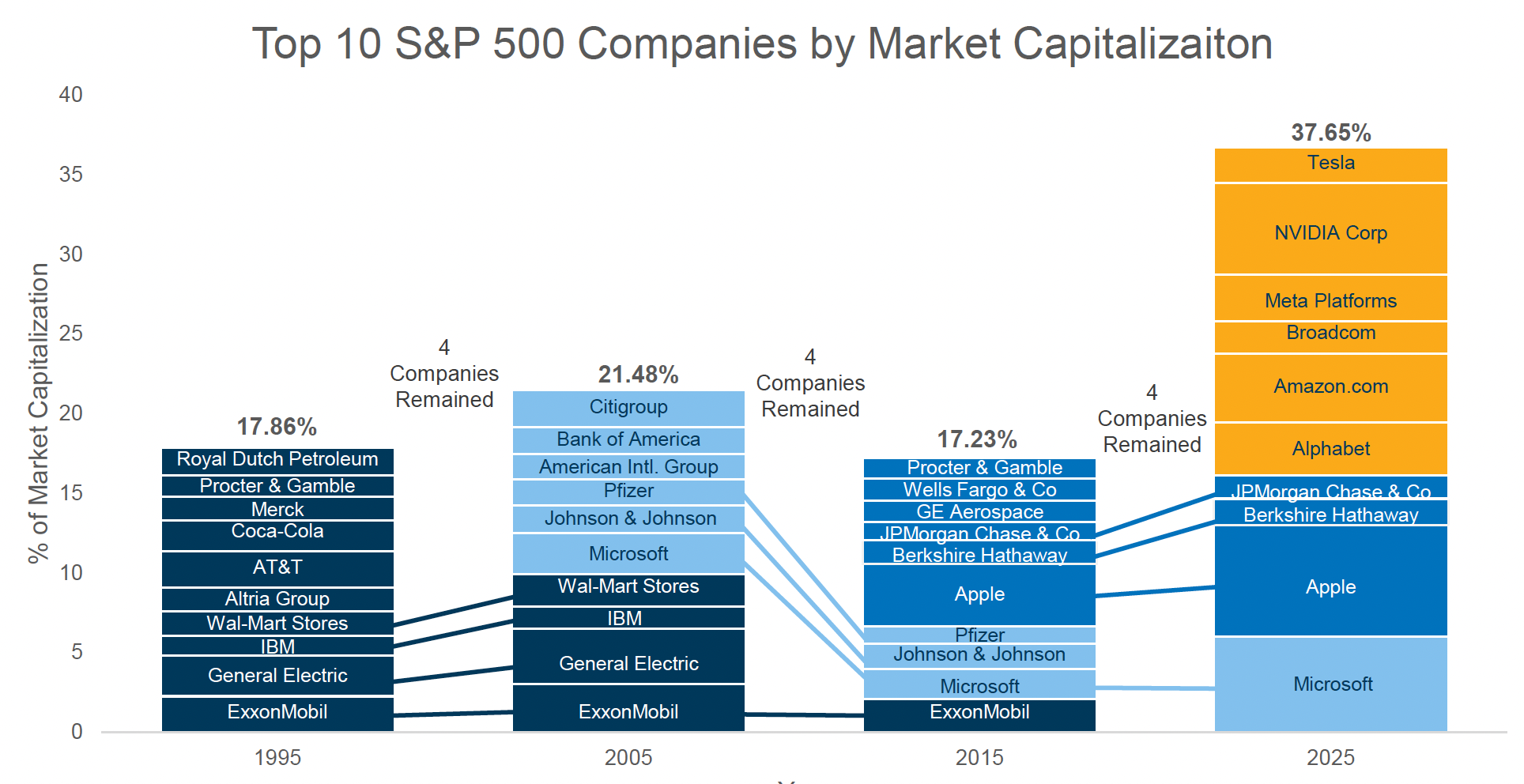

That historical perspective matters, because investment markets have always been shaped by waves of innovation where the leaders of one era are often replaced by the leaders of the next. The chart we’ve included illustrates this clearly. Over the past four decades, the names occupying the S&P 500’s top 10 holdings have changed dramatically. Oil companies, industrial conglomerates, consumer brands, telecom giants, and now technology and AI-driven firms have each taken turns at the top. While the individual companies rotate, one pattern tends to repeat: leadership concentrates around the dominant technologies of the time, then eventually shifts.

Today’s stock markets have a familiar feel. Artificial intelligence has become the latest transformative force, and a small group of companies has grown at an extraordinary pace, as AI, cloud computing, and advanced semiconductors scale globally. NVIDIA is the clearest example. At the start of 2015, the company had a market capitalization around $10 billion. Today, it exceeds $4 trillion, with revenue and profitability growing at rates rarely seen at this scale. Amazon, Alphabet, Meta, and others have similarly benefited as AI capabilities are embedded into commerce, advertising, logistics, and digital infrastructure.

As these companies expanded, they reshaped the S&P 500 itself. Historically, the largest ten companies represented about 20–25% of the index. Today, they account for nearly 40%, diminishing the relative impact of the other 490 companies. In other words, the “broad market” now looks quite different than it did in prior decades. This concentration has rewarded investors as these companies earned their positions through innovation, scale, and execution, but it also means index performance is increasingly influenced by a relatively small group of leaders.

Microsoft stands out as a rare long-term success story across multiple eras shown in the chart. It has remained among the market’s largest companies for nearly three decades by repeatedly reinventing itself – from operating systems to enterprise software, to cloud infrastructure, and now to artificial intelligence. Few companies have managed that level of sustained relevance. Most market leaders do not get multiple reinvention cycles.

Source: Morningstar as of October 31, 2025. The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States. Index performance is measured in US dollars, and assumes reinvestment of all distributions. See Important Disclosure Information.

Which brings us to the key question investors face today – will today’s AI leaders follow the path of adaptation? Or will some eventually resemble AOL or BlackBerry where companies that were once essential, widely admired, and seemingly unstoppable before being overtaken by faster-moving change? The honest answer is that we don’t know. Innovation cycles are moving faster than ever, and competitive advantages can narrow quickly.

This is why understanding concentration matters. While a top-heavy index is not automatically poorly diversified, investors should recognize how dependent outcomes can become when a small group of companies drives a large share of returns. Owning the index means accepting that concentration by default.

Our MarketPlus® Investing approach is built around flexibility through diversification. It allows participation in today’s winners while managing how large any single position becomes. Just as importantly, it ensures exposure to the next generation of innovators. The companies that may not yet appear in the top 10, but could define the next wave of disruption.

We can’t predict which names will dominate the next decade. What we can do is build portfolios that recognize how quickly leadership can change, participate in innovation as it unfolds, and thoughtfully manage concentration along the way.

Important Disclosure Information & Sources:

Market performance data is sourced from Morningstar.

The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.