Your Wealth in 2026: New Year, New Limits

The beginning of 2026 is a natural checkpoint to make sure your saving, gifting, and protection strategies still match the life you are living today. Your financial planning can benefit from a fresh look at the start of each year, and we have some actionable ideas to start the new year on the right foot, financially.

A fresh look at savings and gifting

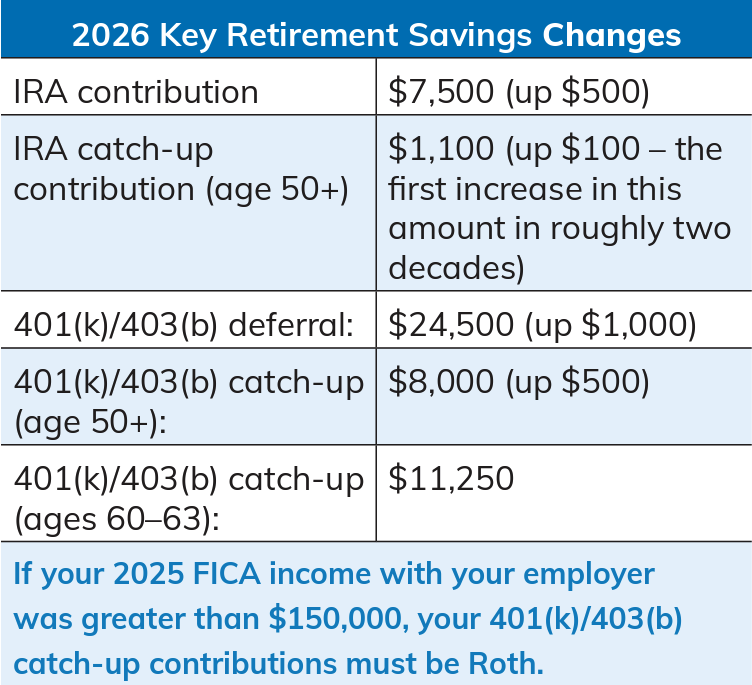

The IRS has increased several retirement plan limits for 2026, which gives you more room to save on a tax-advantaged basis. This is also a good time to revisit how much you are giving to family and charity and whether those gifts are structured in the most tax-efficient way.

If you want to dive into every inflation-adjusted figure, you can review the IRS’s detailed notice for 2026 retirement accounts here: https://www. irs.gov/pub/irs-drop/n-25-67.pdf

Loop in your accountant

It is important to notify your accountant about retirement plan contributions, charitable gifts (including qualified charitable distributions (QCDs) from a Traditional IRA if you are over age 70½), and 529 plan funding, as all of these can influence your tax picture. If you invest in private funds, be sure they know you may not receive K-1 tax forms until later in 2026 so they can plan accordingly.

Keep your SJS team aligned

Your financial life works best when your advisors work as a team. If you have recently changed attorneys, accountants, or bankers, please share those updates so coordination with your broader advisory group stays seamless. A quick email or mention at your next review meeting is usually all it takes.

Revisit your estate plan

Beneficiary designations and estate planning documents should reflect your current wishes, not the way things looked five or ten years ago. Consider reviewing your estate plan at least every five years or after major life events such as marriage, divorce, a birth or death in the family, or a significant change in net worth. Small updates now can prevent confusion and conflict later.

Protect what you have built

Growing wealth is only half the job; protecting it is just as important. Avoid sending sensitive personal information by regular email and expect your advisory team to verify one-off requests directly with you. Simple habits like enabling multi-factor authentication, updating passwords periodically, and monitoring accounts for unusual activity go a long way toward keeping your financial life secure. The start of a new year is an ideal time to step back, make a few intentional decisions, and set the tone for the months ahead. For a more complete list of the 2026 financial numbers and tax updates, please read our blog post Important Financial Planning Numbers For 2026.

Your SJS team is ready to sit down with you, walk through these updates, and help fine-tune your 2026 plan so you can move forward with influence your tax picture. If you invest in private confidence.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.