Gary Geiger, CLU®, AIF®

Senior Advisor

Gary has more than 30 years of experience in the investment and insurance industries. He has worked with both businesses and individuals in helping to implement qualified retirement plans, business succession strategies, investment programs, and estate plans. Gary also serves as the Director of the Retirement Plan Solutions Team at SJS.

Gary holds both the Chartered Life Underwriter (CLU®) and Accredited Investment Fiduciary (AIF®) designations, and also earned a Bachelor of Science degree in Business Administration from The Ohio State University, where he majored in Finance.

Gary was born and raised in Toledo, and is active in his home-town community serving on the boards of several local organizations, including on the Foundation Youth Services Committee of the Rotary Club of Toledo and Devils Lake Yacht Club. He also is an active Board Member of the Greater Toledo Classic in Sylvania, Ohio and sits on the Executive Committee and serves as chairman of the Jamie Farr Scholarship Committee. His job at SJS opens him up to such a wide variety of interesting people, and to him that is the best part.

When he is not in the office, meeting with clients, or working in the community, you can find Gary doing the things he loves: exercising, gardening, enjoying all things cars, and spending time with his family.

Retirement has long been treated like a finish line, but the truth is much different than that. It is a multi‑decade journey of living with purpose and meaning. The mosaic of your retirement may be composed of a mix of time spent with family and friends, travel, volunteering, and an active lifestyle.

SJS Investment Services creates a weekly market update to summarize performance characteristics for major stock and bond indices.

This winter, we had the pleasure of hosting two students from Northview High School through our six-week financial literacy student shadow program in our Sylvania, Ohio office.

At SJS, we often talk about what it means to build a better life. While investing and financial planning play an important role, we know the foundation of a better life is much broader than simply making sound financial decisions. Living a more meaningful life often starts with small, consistent habits.

Every January, Wall Street releases its newest flurry of S&P 500 year‑end predictions. And inevitably, we’re asked where we think the market is headed. At SJS, we certainly have opinions, but we don’t publish short-term market forecasts or build client portfolios around them. Because, quite simply, no one knows where markets will land. Not us, not the loudest voices on TV, and not even the banks that publish those targets with great confidence.

Are valuations excessively high? Do record earnings justify selling? Headlines that stir fear are not new. Investors often get caught up in market noise, but recognizing that news headlines are often written to prioritize clicks over nuanced truth can reduce stress.

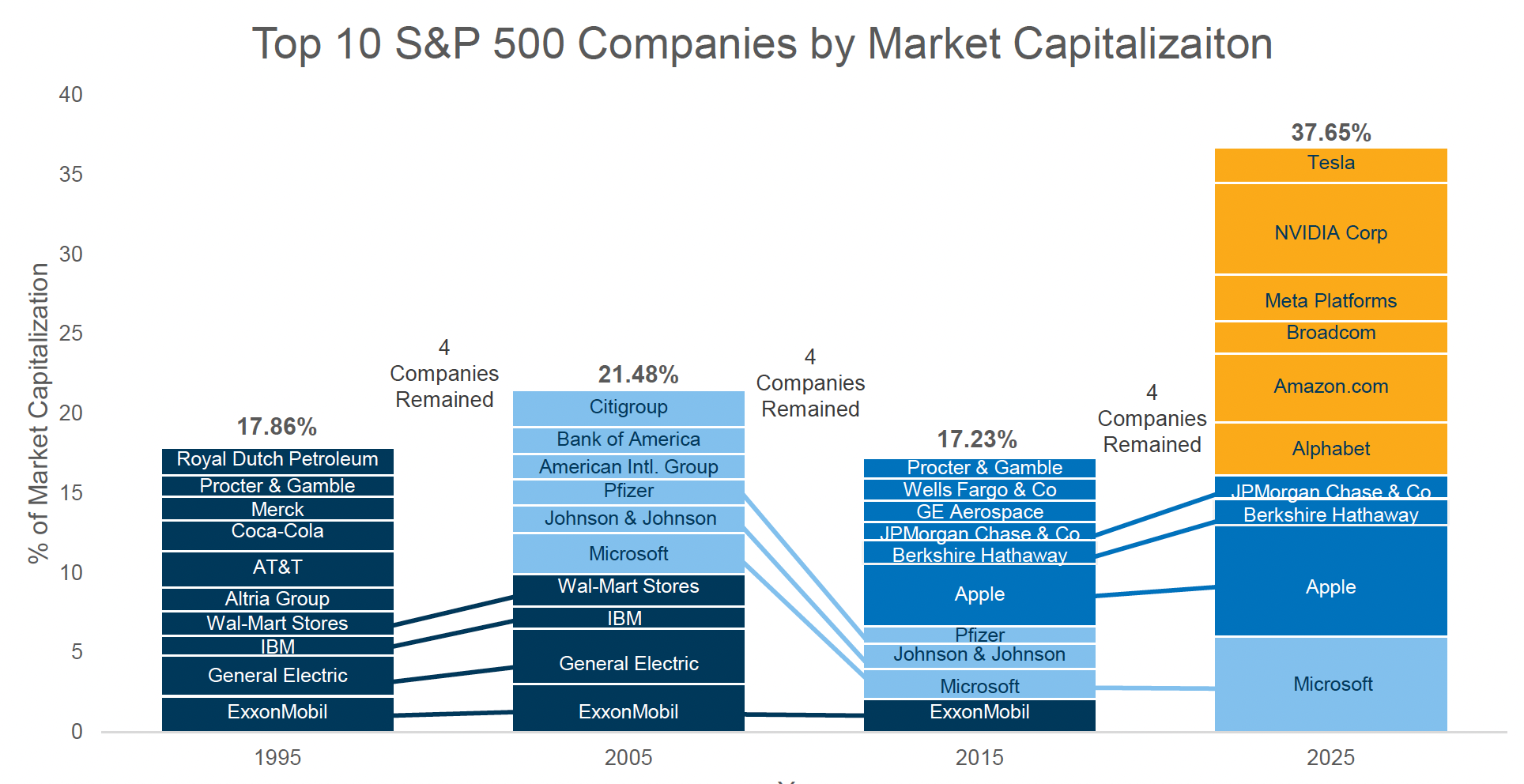

Do you remember when AOL was the internet? When hearing “You’ve got mail” felt like a small event, and logging on meant you were connected to the future?

The beginning of 2026 is a natural checkpoint to make sure your saving, gifting, and protection strategies still match the life you are living today. Your financial planning can benefit from a fresh look at the start of each year and we have a some actionable ideas to start the new year on the right foot, financially.

2025 closed out with global stock markets delivering another remarkable year, capping one of the strongest three-year stretches in stock market history. The April correction now feels like a distant memory as tariff shocks came and went.

As we excitedly look forward to the year ahead, we remain deeply committed to empowering you to build a better life and providing the peace of mind you deserve.