Office: (419) 885-2626

Chicago, Illinois

Elizabeth Molique

Investment Analyst

Elizabeth began working at SJS in August 2025 as an Investment Analyst in the Chicago office, primarily supporting Tom Kelly, SJS’s Chief Investment Officer. Her responsibilities include investment research, portfolio analysis, performance monitoring, and client/advisor support.

Originally from Arizona, Elizabeth interned at SJS' Arizona office in 2024, gaining early exposure to investment research and client service. She also fulfilled roles as a data management intern at a real estate firm in Madrid and as a financial modeling intern at an annuity development company.

She recently graduated from Trinity University in San Antonio, Texas, where she earned a degree in Mathematical Finance and Spanish. While at Trinity, she was a member of the varsity Swim & Dive team, competing in sprint freestyle and butterfly events. She also studied abroad at Universidad Complutense in Madrid.

Elizabeth is passionate about investments and committed to continuous growth in the financial industry. She is currently pursuing the Chartered Financial Analyst (CFA) designation to deepen her expertise in portfolio management, financial analysis, and ethical investing. She thrives on learning, analyzing markets, and identifying long-term value.

Outside of work, Elizabeth enjoys traveling, especially to Spanish-speaking countries, and discovering new cuisines and restaurants. She also has a deep appreciation for art, which was sparked by a class she took at the Museo del Prado in Madrid.

Retirement has long been treated like a finish line, but the truth is much different than that. It is a multi‑decade journey of living with purpose and meaning. The mosaic of your retirement may be composed of a mix of time spent with family and friends, travel, volunteering, and an active lifestyle.

SJS Investment Services creates a weekly market update to summarize performance characteristics for major stock and bond indices.

This winter, we had the pleasure of hosting two students from Northview High School through our six-week financial literacy student shadow program in our Sylvania, Ohio office.

At SJS, we often talk about what it means to build a better life. While investing and financial planning play an important role, we know the foundation of a better life is much broader than simply making sound financial decisions. Living a more meaningful life often starts with small, consistent habits.

Every January, Wall Street releases its newest flurry of S&P 500 year‑end predictions. And inevitably, we’re asked where we think the market is headed. At SJS, we certainly have opinions, but we don’t publish short-term market forecasts or build client portfolios around them. Because, quite simply, no one knows where markets will land. Not us, not the loudest voices on TV, and not even the banks that publish those targets with great confidence.

Are valuations excessively high? Do record earnings justify selling? Headlines that stir fear are not new. Investors often get caught up in market noise, but recognizing that news headlines are often written to prioritize clicks over nuanced truth can reduce stress.

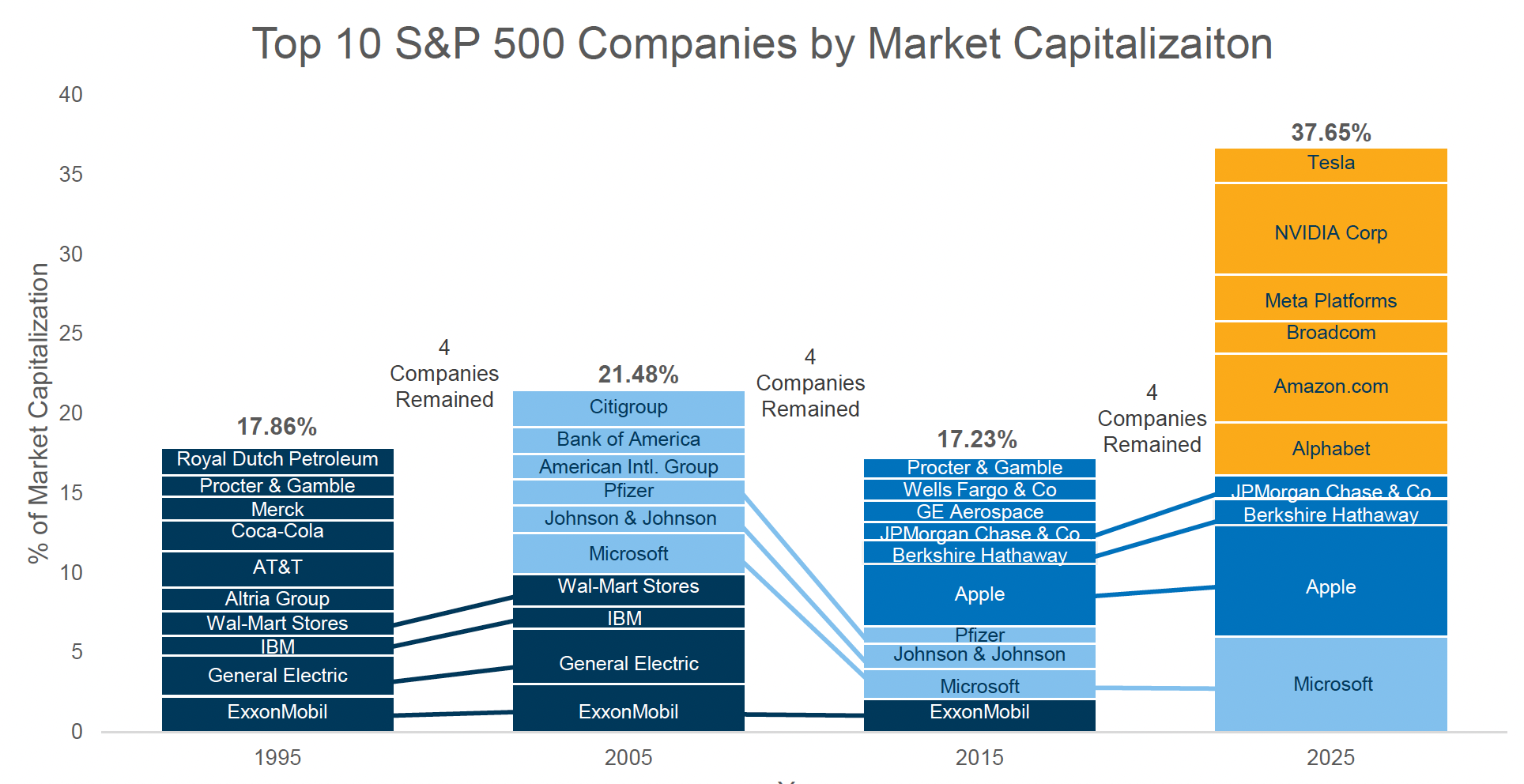

Do you remember when AOL was the internet? When hearing “You’ve got mail” felt like a small event, and logging on meant you were connected to the future?

The beginning of 2026 is a natural checkpoint to make sure your saving, gifting, and protection strategies still match the life you are living today. Your financial planning can benefit from a fresh look at the start of each year and we have a some actionable ideas to start the new year on the right foot, financially.

2025 closed out with global stock markets delivering another remarkable year, capping one of the strongest three-year stretches in stock market history. The April correction now feels like a distant memory as tariff shocks came and went.

As we excitedly look forward to the year ahead, we remain deeply committed to empowering you to build a better life and providing the peace of mind you deserve.