The Growth of Real Estate

As anyone who was looking to purchase or sell a home in 2021 knows, the US real estate market grew a lot in value in 2021. Will this continue?

By Investment Associate Bobby Adusumilli, CFA.

As anyone who was looking to purchase or sell a home in 2021 knows, the US real estate market grew a lot in value in 2021. For example, the US publicly-traded real estate market, as measured by the Dow Jones US Select REIT Index, returned nearly 46% in 2021, the best year since the index began in 1987.[1]

One driver of REIT performance is property and housing values. Heavily driven by the decline in interest rates resulting from the COVID-19 pandemic, Americans spending more time working remotely, as well as record amounts invested from investment firms, home purchases have been driven by a surge in demand combined with a relatively steady supply.[2][3]

Source: S&P Dow Jones Indices LLC, S&P/Case-Shiller U.S. National Home Price Index [CSUSHPISA], Federal Reserve Bank of St. Louis, 16-Feb-2022, fred.stlouisfed.org.

In the second edition of his famous book Irrational Exuberance that was released in 2006, Nobel Prize-winning economist Robert Shiller wrote, “It is true that for the United States as a whole real home prices were 66% higher in 2004 than in 1890, but all of that increase occurred in two brief periods: the time right after World War II (with the first increases occurring in the early 1940s, just before the war ended) and a period that appears to reflect a lagged response to the 1990s stock market boom (or a response to its boom and crash), with the first signs of increase occurring in 1998. Other than those two periods, real home prices overall have been mostly flat or declining.“[4]

The above data suggests that this past decade - particularly in 2020 and 2021 - are a third such period of a rise in real home prices in the United States.

However, we believe that some of the factors driving this rise are unsustainable. According to the Wall Street Journal as of late 2021, the median time a home stays on the market in the US is around one week, which is a record low.[5] Many purchasers today are no longer taking advantage of low interest rates, often paying all-cash at a price above listing in order to beat out other purchasers.[5] In a sign of exuberance, many homebuyers are not even inspecting these homes as a contractor would recommend.[5]

With short-term interest rates expected to increase significantly throughout 2022, as well as an already growing home supply projected over the next few years, we do not expect this current housing boom to sustain its pace.[6][7] As a result of this and other evidence, we believe that publicly-traded REIT investments will have lower expected returns over the medium-term compared to the last ten years, though we still expect returns to remain positive over the medium- to long-term.

Important Disclosure Information & Sources:

[1] Source: Dimensional Returns Web. The Dow Jones U.S. Select REIT Index tracks the performance of publicly traded REITs and REIT-like securities and is designed to serve as a proxy for direct real estate investment, in part by excluding companies whose performance may be driven by factors other than the value of real estate.

[2] “U.S. Existing-Home Sales Reached a 15-Year High of 6.1 Million Last Year“. Nicole Friedman, 20-Jan-2022, wsj.com.

[3] “Building and Renting Single-Family Homes Is Top-Performing Investment“. Will Parker, 09-Nov-2021, wsj.com.

[4] Irrational Exuberance. Robert Shiller, 2006, Crown Business.

[5] “Homes Now Typically Sell in a Week, Forcing Buyers to Take Risks“. Nicole Friedman, 11-Nov-2021, wsj.com.

[6] “Fed Signals Rate Increase in March, Citing Inflation and Strong Job Market“. Jeanna Smialek, 26-Jan-2022, nytimes.com.

[7] “New Privately-Owned Housing Units Started: Total Units“. Federal Reserve Bank of St. Louis, 31-Dec-2021, fred.stlouisfed.org.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

What's Happening With The Chinese Stock Markets?

China has been growing rapidly from an economic perspective. So what’s happening with the Chinese stock markets?

By Investment Associate Bobby Adusumilli, CFA.

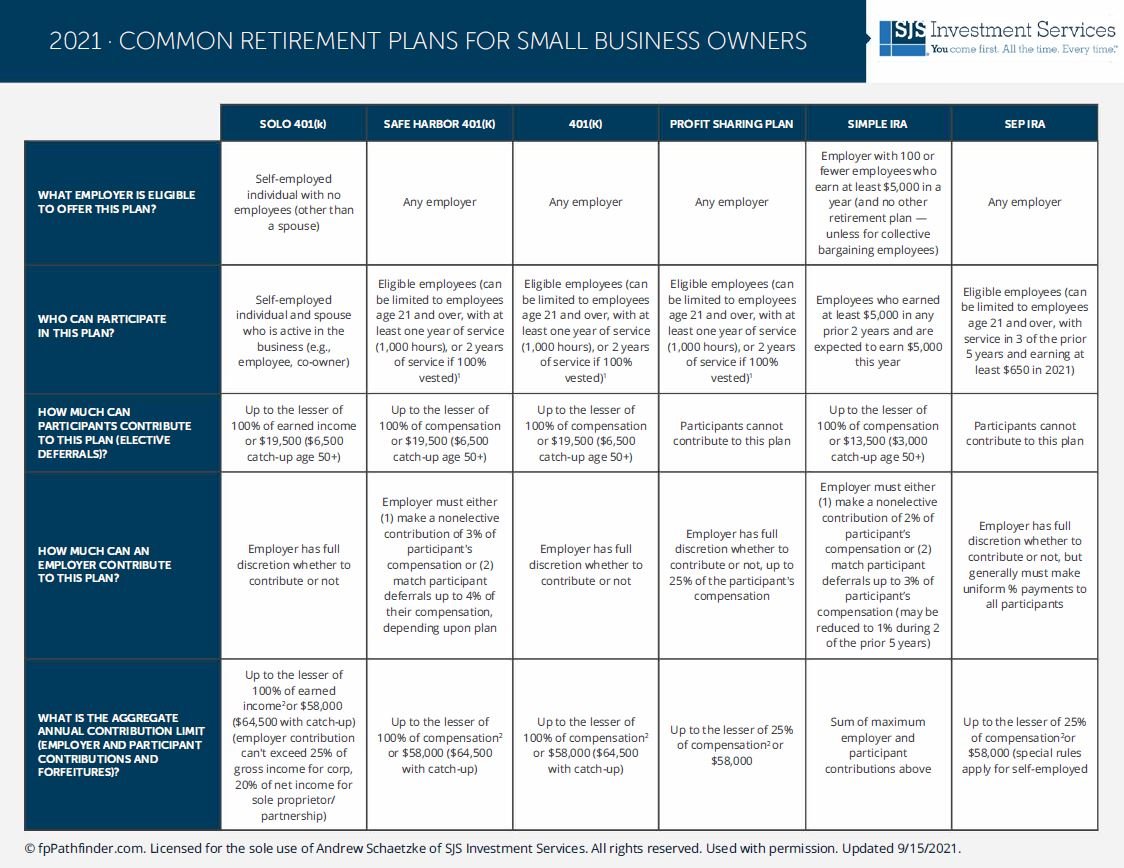

2021 was a turbulent year for Chinese stocks. Partially due to concerns about government involvement in businesses, human rights, and the repercussions of the COVID-19 pandemic, the MSCI China Index declined nearly 22% in 2021, compared to a 10% gain for the MSCI Emerging Markets ex China Index.[1][2][3] To demonstrate the significance of China to emerging markets stock performance, the MSCI Emerging Markets Index fell roughly 2.5% in 2021, of which Chinese stocks make up approximately 29%.[4]

Source: MSCI, as of December 31, 2021. Please see Important Disclosure Information.

As the above illustrates, Chinese stocks and emerging markets stocks more generally have had rough performance relative to the United States over the past ten years.[5] However, that does not mean that investors should abandon emerging markets stocks. As the above fundamentals demonstrate, emerging markets (including China) stocks are significantly cheaper than US stocks. Additionally, even with the poor performance in 2021, Chinese stocks have outperformed other emerging markets stocks over the past ten years while also having similar forward-looking valuation metrics, suggesting Chinese stocks can help emerging markets investments.

Demographic trends seem to indicate there will be more economic growth in emerging markets like China compared to more developed markets such as the US.[6] To illustrate this trend, the below graph shows the gross domestic product (GDP) - a measure of the goods and services produced in a country during a period of time - of China and the US. In 1980, China’s GDP was 11% of the United States' GDP; by 2021, China’s GDP had grown to 86% of the United States' GDP.[7]

Source: “GDP, current prices“. International Monetary Fund, imf.org/en/Home. Please see Important Disclosure Information.

Many of the world’s top investors are also investing heavily in China. For example, according to the Wall Street Journal, venture-capital investors invested $129 billion into more than 5,300 startups in China in 2021.[8] These investments made up roughly 20% of the approximately $643 billion in global venture capital investments in 2021.[8][9] For comparison, Chinese stocks currently only make up 4% of global stock market capitalization as measured by the MSCI All Country World Index (ACWI).[10] This venture capital activity suggests that the aggregate market capitalization of Chinese stocks will grow considerably in the years to come.

While the various investor concerns about China are legitimate, it is important to note that among companies on stock exchanges in developed markets (including the US), nearly 20% of their revenues come from emerging markets, with China being the single-biggest revenue source.[11] Given the global nature of business today, it is very difficult to invest in stocks without having direct or indirect exposure to China. Investors worried about certain practices in Chinese companies can invest in ESG (Environment, Social, & Governance)-focused emerging markets mutual funds and ETFs, which can help people decrease exposure to companies that don’t match their values. Or investors can invest in emerging markets mutual funds and ETFs that exclude Chinese stocks.

China has been growing rapidly from an economic perspective, with the amount of people in the middle class rising significantly, as well as innovative companies starting in China at a number only rivaled by the United States.[12][7] Given all of the above, we believe Chinese stocks are positioned to have positive expected returns over the intermediate- and long-term.

Important Disclosure Information & Sources:

[1] “Chinese Companies Listed at Home Surge While Crackdowns Clobber Those Abroad“. Rebecca Feng, 03-Jan-2022, wsj.com.

[2] “MSCI China Index (USD)“. MSCI, 31-Dec-2021, msci.com. The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). The index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization.

[3] “MSCI Emerging Markets ex China Index (USD)“. MSCI, 31-Dec-2021, msci.com. The MSCI Emerging Markets ex China Index captures large and mid cap representation across 24 of the 25 Emerging Markets (EM) countries excluding China. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

[4] “MSCI Emerging Markets Index (USD)”. MSCI, 31-Dec-2021, msci.com. The MSCI Emerging Markets Index captures large and mid cap representation across 25 Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

[5] “MSCI USA Index”. MSCI, 31-Dec-2021, msci.com. The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. The index covers approximately 85% of the free float-adjusted market capitalization in the US.

[6] “Real GDP growth“. International Monetary Fund, imf.org/en/Home.

[7] “GDP, current prices“. International Monetary Fund, imf.org/en/Home.

[8] “China’s Startups Are Awash With Money as Beijing Shifts Focus to ‘Hard Tech’“. Liza Lin, Jing Yang, & Keith Zhai, 13-Jan-2022, wsj.com.

[9] “Global Venture Funding And Unicorn Creation In 2021 Shattered All Records“. Gene Teare, 05-Jan-2022, crunchbase.com.

[10] “MSCI ACWI Index (USD)“. MSCI, 31-Dec-2021, msci.com. The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (DM) and 25 Emerging Markets (EM) countries. The index covers approximately 85% of the global investable equity opportunity set.

[11] “The Ever Given, Suez Canal and Impact of One Stuck Ship on the Global Economy“. Avantis Investors, March 2021, avantisinvestors.com.

[12] “China’s Influence on the Global Middle Class“. Homi Kharas & Meagan Dooley, October 2020, brookings.edu.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Who We Are: SJS Vision, Mission, People, & Process

Video on our Vision, Mission, People, & Process.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this video that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Suggested Reading

Selling Your Business To Employees

All business exits have pros and cons. Recently, I was introduced to a business owner who had just completed selling his company to a long-time loyal employee.

By Founder & CEO Scott Savage.

Recently, I was introduced to a business owner who had just completed selling his company to a long-time loyal employee. He described to me that despite higher offers from private equity-backed buyers, he chose to sell it at a lower price to a key employee who has the respect of other employees and the business' customers.

The business owner felt strongly that had an outsider purchased his small business, then before too long his key employees would be looking for another job. Additionally, he reasoned that his loyal customer base would be better served - after all, they are the reason he was going to be able to exit on his terms.

The buyer came up with a down payment. Rather than using a bank to finance the balance of the purchase price, the business owner took a seller’s (promissory) note, so the new owner can pay off the balance over time with profits from the business.

All business exits have pros and cons, but I am convinced that the sentiments shared with me and the actions taken by this benevolent business seller increase the likelihood that the business he started nearly 30 years ago will survive and thrive!

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

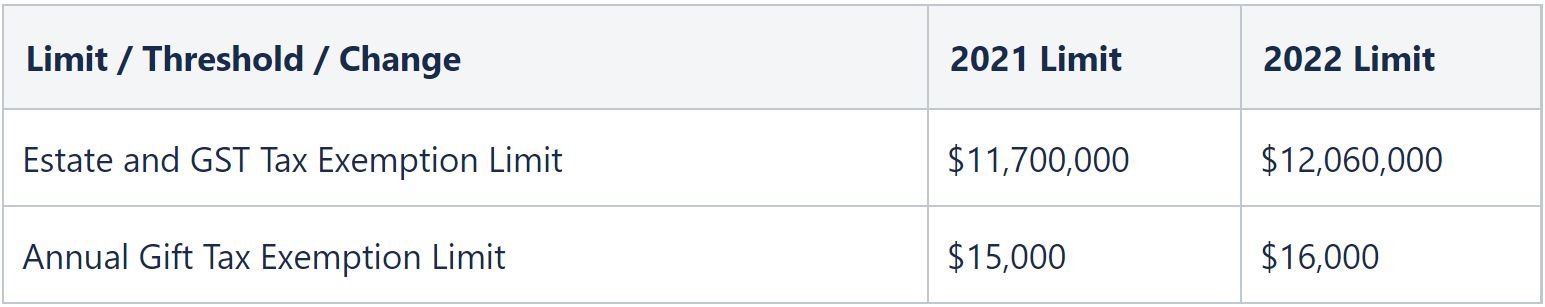

Pension Plan Options For Small Business Owners

To help you differentiate among the most commonly adopted pension plans by small businesses, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

For many people, retirement plans, pension plans, and Social Security serve as their primary means for income during retirement. As a small business owner, the specific plans that you offer within your business can dramatically improve the financial behaviors and long-term investment results of your colleagues.[1]

While defined-benefit pension plans were very popular through the 1970s, only 15% of private-sector workers are offered defined-benefit pension plans through their employers today.[2] Nevertheless, when implemented well, pension plans can still be a potentially cost-effective way to help employees have more income in retirement.

To help you differentiate among the most commonly adopted pension plans by small businesses, we provide the below resource. From this, you may come away with answers and action items for the following:

Who can participate in the pension plan?

Can employees contribute to the plan?

How and when are benefits paid?

What are the possible vesting schedules?

As always, we are here to help you evaluate the best pension plan for your business. Please feel free to reach out to us if you have any questions.

Please click on the below images to view.

Important Disclosure Information & Sources:

[1] “Nudge: The Final Edition“. Richard Thaler & Cass Sunstein, 2021, Penguin Books.

[2] “The Demise of the Defined-Benefit Plan“. James McWhinney, 18-Dec-2021, investopedia.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

SJS Outlook: Q4 2021

SJS Q4 2021 Outlook including our reflections on 2021 and what we are excited about for 2022, how your finances may change in 2022, important dates and events in Q1 2022, and Tom Kelly’s healthy newborn child Oliver Kelly.

How Your Finances May Change In 2022

We detail changes to official federal legislation, proposed legislation, and other financial planning considerations that may impact you and your family in 2022.

By Senior Advisor Andrew Schaetzke, CFP®.

Last fall when the Build Back Better Act was introduced in Congress, we expected taxes could increase significantly for certain families as well as businesses. However, the proposed tax plan has changed often and significantly during congressional negotiations. While the legislation is not yet finalized, if passed in 2022, we do not expect that the Build Back Better tax plan will result in as many big changes as we initially anticipated.

Based on current proposed legislation, the following points summarize the provisions that could impact you and your family:

New federal income tax surcharge on higher earners: Households would have to pay an additional 5% surcharge on modified adjusted gross income (MAGI) above $10 million, as well as an additional 3% on MAGI above $25 million. For earners with greater than $25 million in MAGI, this could result in a top federal tax rate around 45%, which could not be decreased by taking large itemized deductions or the qualified business income deduction.[1]

Expansion of the 3.8% net investment income tax (NIIT) for S corporations and partnerships: The 3.8% net investment income tax on capital gains, taxable interest, dividends, passive rents, annuities, and royalties would be expanded to apply to active business income for pass-through firms.[1]

State and local tax (SALT) deduction for federal income taxes: The cap on the SALT federal income tax deduction would increase from $10,000 to $80,000 starting in 2022 through 2030.[1]

Extension of the enhanced Child Tax Credit (CTC) through 2022: The enhanced child tax credit - $3,600 for each child under age 6, as well as $3,000 for each child ages 6-17 - would extend into 2022 for joint filers with MAGI less than $150,000 ($112,500 for single filers).[1]

Limitations on Individual Retirement Accounts (IRAs) contributions for wealthier households: No longer would allow for contributions to IRAs with balances greater than $10 million. Additionally, IRAs with balances greater than $10 million may have accelerated required minimum distribution (RMD) requirements.[1]

Increased IRS funding: The IRS would receive increased funding for hiring and improving operations, which could lead to more audits for wealthier households.[1]

While the effective date for this legislation is uncertain, we expect the changes could be effective retroactively, as of January 01, 2022.

There have been some other annual cost-of-living and government-controlled changes that may affect you and your family in 2022:

5.9% cost-of-living adjustment for Social Security: For individuals currently or planning to receive Social Security payments in 2022, your benefits will be 5.9% higher than 2021 due to inflation.[2]

Lower required minimum distributions RMDs from Traditional IRAs, Traditional 401(k)s / 403(b)s / 457 plan, and Roth 401(k)s / Roth 403(b)s: If you are required to take an RMD from one of these accounts, your RMD as a percentage of your portfolio will be slightly lower in 2022 due to an increase in life expectancy.[3]

Federal student loan interest payments frozen until May 01, 2022: Due to ongoing effects from the pandemic, the Biden administration extended a freeze on federal student loan interest payments from February 01, 2022 to May 01, 2022.[4]

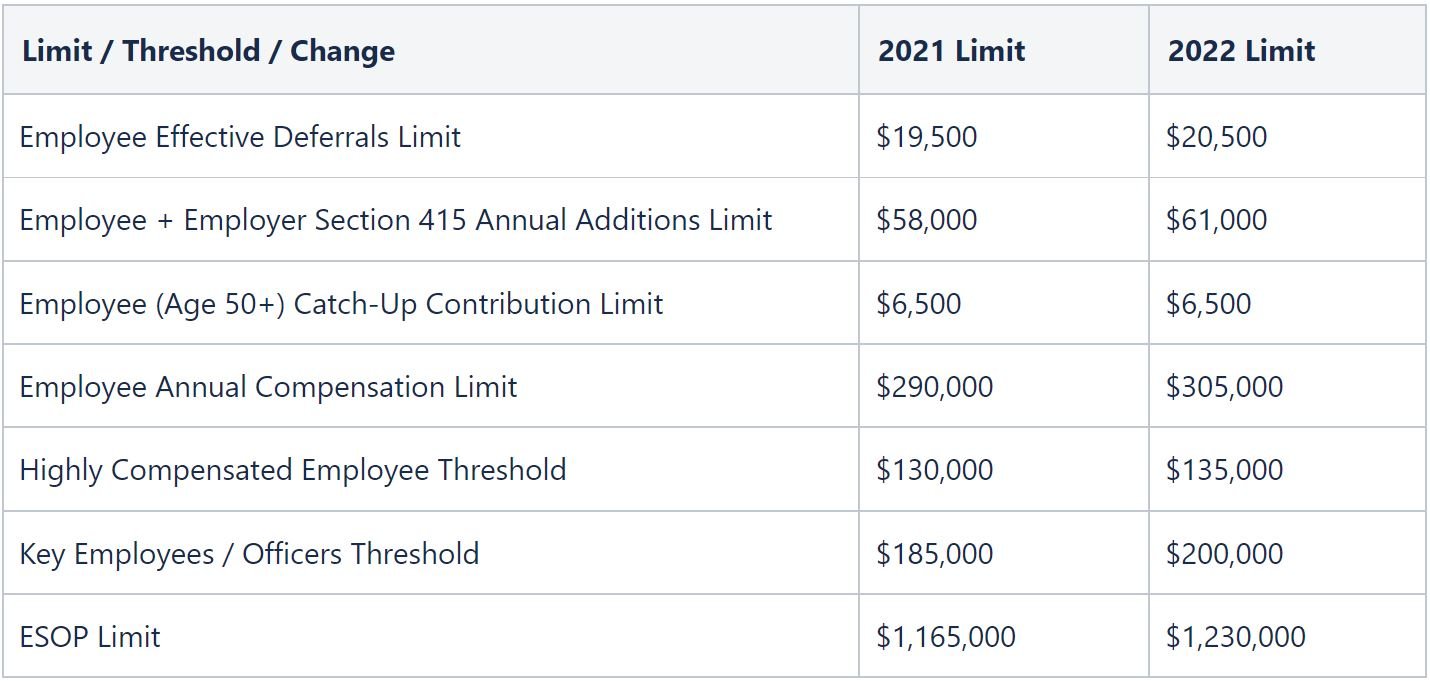

Changes to retirement plan contribution limits, estate tax exemption, and gift tax exemption: Various limits and exemptions have increased for 2022, primarily resulting from inflation. For example, the maximum employee contribution limit to 401(k)s / 403(b)s / 457 plans is increasing from $19,500 to $20,500. Additionally, the annual gift tax exemption is increasing from $15,000 to $16,000. You can find more information here.

As part of your financial planning process for 2022, there are a few ways that you can implement your plan while potentially lowering your federal income taxes:

Contribute to tax-advantaged investment accounts: Depending on your eligibility, you may be able to contribute to tax-advantaged investment accounts such as 401(k) / 403(b) / 457 retirement plans, IRA, Health Savings Account (HSA), and 529 plans in order to save for specific purposes while also potentially lowering your taxes. Additionally, you have until April 15, 2022 to contribute to your IRA and HSA for 2021 if eligible.

Charitable contributions and donor-advised funds: Because of the rise in many investment markets over the past few years, many people hold taxable investments with large unrealized gains. By directly gifting these taxable investments to eligible charitable organizations or creating a donor-advised fund, you can potentially lower federal income taxes for 2022 while giving to the organizations you want to support.

Tax loss harvesting: Particularly during volatile market periods, tax loss harvesting allows you to sell eligible taxable investments with losses, and use these losses to offset realized taxable capital gains. With tax rates expected to increase for certain taxpayers in 2022, tax loss harvesting could prove increasingly valuable.

As federal legislation evolves, we will continue to update you on any changes that may impact you. Additionally, you can find well-written summaries of the proposed financial changes on the Tax Foundation (taxfoundation.org) website. As always, please feel free to reach out to us if you have any questions or want clarity on how the proposed changes may affect you.

Important Disclosure Information & Sources:

[1] “House Build Back Better Act: Details & Analysis of Tax Provisions in the Budget Reconciliation Bill“. Tax Foundation, 02-Dec-2021, taxfoundation.org.

[2] “Cost-of-Living Adjustment (COLA) Information for 2022“. Social Security, ssa.gov.

[3] “Required Minimum Distribution Calculator“. U.S. Securities and Exchange Commission, investor.gov.

[4] “The White House Will Freeze Federal Student Loan Repayments Until May 1“. Katie Rogers and Tara Siegel Bernard, 22-Dec-2021, nytimes.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Looking Back On 2021, Looking Ahead To 2022

We asked four SJS Team members across the country to look back on 2021 to describe what they will remember, and to talk about what they are excited about for 2022.

2021 was an exciting year at SJS. We celebrated our 26th anniversary, welcomed three new Team members, and had the pleasure of meeting with many of you in-person more than in 2020.

To offer you an SJS perspective on 2021, we asked four SJS Team Members across the country to look back on 2021 to describe what they will remember, and discuss what they are excited about for 2022. We hope you enjoy reading their individual takes on the past year, and we look forward to seeing you in 2022!

Scott Savage; Founder & CEO; Sylvania, Ohio Office; Founded SJS in July 1995

Thank YOU for another year of partnership! We continue to be grateful and humbled by the faith and trust you place in Team SJS. We will never take your faith and trust for granted.

It is our custom at the end of the year to reflect on the previous 12 months and look forward to a brand new year. What did we learn? What are we worried about? What opportunities can we seize?

2021 will be known as year two of the Coronavirus pandemic. Early in 2020, a friend of mine who understands viruses and pandemics said to me, “COVID is going to be a marathon.” I can only hope that we are in the last painful miles - weary, legs heavy, and closing in on the finish line. In my opinion, we have been in this together, whether we realize it or not.

Ironically, many of the world’s equity markets rose, fueled by accommodating central banks like the Federal Reserve.[1] Global bond markets, plagued by low interest rates and eye-popping inflation, generally disappointed investors.[1]

We continue to evaluate the world’s investable markets that we believe will reward you over the long-term for the risks being assumed. We remain cautiously optimistic that 2022 will see the supply chain disruptions ease, labor shortages abate, inflation slow, and economic growth persist.

Jennifer Smiljanich, CFP®; Managing Director & Senior Advisor; Scottsdale, Arizona Office; Started at SJS in August 2010

One of the things I enjoy about coming to work every day is that I get to really know people: who they are, what they want, and what is important to them. I also am fortunate to have an opportunity to make a difference to you when you call on SJS. Finding a solution to a problem, taking away a worry, listening, showing you whether you are progressing towards a goal, and helping you to live a life that is meaningful to you. So as much as SJS manages investments, all of these other responsibilities are just as important.

Living in our current world has helped bring clarity to many people about what is most important to them. It might not be working in a job that historically has comfortably paid the bills. For some, their work has become more stressful with more to do and fewer hands to help. For others, income may not be as compelling given considerations of health, family dynamics, and fulfillment. This year, I’ve had the opportunity to help several clients review whether they could make a job change, move to part-time work, and even retire early to spend more time with loved ones. Providing guidance to someone who is wrestling with these kinds of decisions is rewarding. We are glad to help co-think the financial and other considerations of these life changes.

There seem to be no lack of pulls on our time. Like you, I find my inbox is always full and the “to do” list is never quite done. I appreciate being able to help you find time in your day to do the things that are important to you. So whether it’s helping you make sure you’ve done everything you need to do before year-end (from charitable giving, to distributions, to contributions), co-thinking options for financing or refinancing a home, figuring out how to get tax documents to your accountant securely, or helping you to consolidate your accounts on MySJS so you can view your financial status in a single place, we are glad to help!

Finally, while many people have been challenged in so many ways in 2021, you have cared. You care about your children and grandchildren. You care about your communities. And you give generously of your time and money to the people and causes you care about. I’ve spent many hours chatting with you about different ways to support the people and causes you care about, whether it’s giving to charities in tax-smart ways, helping support children or grandchildren though 529 plans or gifts, or in Arizona, making use of the state tax credits that support different organizations. As we head into a new calendar year, I am energized to help you potentially accomplish the things that matter to you, so you can focus on living your life to its fullest!

Tom Kelly, CFA; Chief Investment Officer; Chicago, Illinois Office; Started at SJS in June 2018

Reflecting on 2021, I am most struck by the resiliency of the human condition. Amidst continued uncertainty, trials and tribulations, the ups and downs, we are resilient. I was inspired by stories of resiliency of families, communities, and economies. One in particular (perhaps especially captivating after hearing my wife’s stories as a NICU Nurse) is Curtis Means, who was born 132 days premature at just 21 weeks and one day.[2] After round the clock care for nine months by the UAB medical team, Curtis was discharged and eventually named by the Guinness Book of World Records as the World's Most Premature Infant to Survive.[2] Resiliency of a child to fight, medical professionals to care, and a family to love!

In my life this year, one of the biggest accomplishments was the addition of diversified alternatives to our portfolios. While investment performance is not guaranteed, we believe many of the underlying strategies will provide some resiliency against forces of inflation, low-yields, and extended valuations, as well as potentially get stronger during times of market stress. Personally, I would be remiss if I didn't mention the blessing of our new baby, Oliver, at the end of the year – hopefully I’m developing resiliency to a little less sleep.

2022 will surely bring new challenges and new opportunities, and I am most focused on ensuring our portfolios are staying up to date with new research and strategies that are MarketPlus worthy. Additionally, I am excited to move into our new office at 55 W. Monroe in downtown Chicago, so next time you are in the Windy City, please stop by and say hi. We can toast to resiliency!

Katie Floyd; Associate Advisor; Sylvania, Ohio Office; Started at SJS in September 2021

After another year of ups and downs, the rollercoaster of 2021 came and went in the blink of an eye. Never knowing what turn the year might take next, I started to evaluate what was most important to me and realized that life was too short to wait for the “sign” to change. So, I stopped measuring my successes by the title of my job and more about how I felt each night before bed. I knew that I wanted to give more back to my community and leave the world a little better than how I found it. And then I found SJS Investment Services.

Starting over is always scary, but I felt the reward would far outweigh the risk. Although I’ve only been here for a few months, I feel like I’ve known my co-workers for years and have comfort that I made the right choice to change my career. At SJS, I feel empowered to explore the unknowns around me and take a chance at something new, and I encourage you to do the same. During my first few months, I’ve been able to meet with some of you and help prepare financial analyses and presentations to help you plan for your future. Additionally, I’ve assisted with marketing efforts and continue to help shape the future of SJS.

Looking to 2022, I’m excited to continue expanding my career with the amazing resources SJS has to offer, as well as getting to know you better, the people who make coming into work worthwhile. There is so much out there for us to discover, and I’m happy that I get to be a part of that journey with you. I hope that this next year brings you nothing but health, wealth, and normalcy, and when you aren’t sure what turn the year will take next, just know that we are here for you.

Important Disclosure Information & Sources:

[1] “SJS Weekly Market Update“. SJS Investment Services, 27-Dec-2021, sjsinvest.com.

[2] “Curtis Means, Alabama boy weighing less than a pound at birth, is world’s most premature surviving baby“. The Associated Press, 10-Nov-2021, al.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

SJS Investment Services Welcomes Katie Floyd!

We would like to welcome Katie Floyd to the SJS Team in Sylvania, Ohio! Katie serves as Associate Advisor.

We would like to welcome Katie Floyd to the SJS Team in Sylvania, Ohio! Katie serves as Associate Advisor, working alongside Senior Advisors to serve our clients, particularly with financial planning and investment analyses.

An Ohio native, Katie grew up in Walbridge, graduating from Lake High School. She received a Bachelor of Science in Business Administration with a specialization in Accounting from Bowling Green State University (BGSU), where she also received her Master of Accountancy. While at BGSU, Katie was a member of Beta Alpha Psi, a national accounting society.

Katie began her career at PwC Toledo as a Core Assurance Associate, assisting in the financial statement audits of Fortune 500 companies. During her time there, she passed the four-part exam and met the experience requirements in order to receive her Certified Public Account (CPA) license. Following her time at PwC, Katie became a Senior Financial Analyst in the External Reporting Group at Dana Incorporated, helping to create financial statements as well as perform account analyses.

Katie is a lifelong learner, and she wants to help others do better financially. At SJS, Katie serves clients alongside Senior Advisors Kirk Ludwig, Gary Geiger, and Andrew Schaetzke. Additionally, she is helping to improve SJS-designed financial literacy programs, which we use with students who shadow at SJS as well as may use in potential future community involvement initiatives.

Outside of work, Katie loves spending time with her family, particularly her golden retriever Winnie. In her free time, Katie enjoys playing volleyball, going to basketball games for her husband Mike, and travelling around the world.

We feel very grateful that Katie decided to join SJS. Please join us in welcoming Katie to the SJS Team!

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What's Next? Life After Selling Your Business

In my experience, a successful business exit requires honesty, especially with the person in the mirror. Acknowledging your dependence on the success of the business is worthy of contemplation and soul-searching.

By Founder & CEO Scott Savage.

Many business owners I have had the honor to advise over the years share a common experience: Their identity is linked to that of their business. One client told me he was terrified to sell his business because he couldn’t imagine a life post-sale.

As I wrote in my ebook, a common experience for most business owners immediately after the sale is an emotional let-down, and in some instances regretting their decision. One client told me that knowing what he knows now, he would never have sold his business at the price he did. That was 5 years after the sale!

In my experience, a successful business exit requires honesty, especially with the person in the mirror. Acknowledging your dependence on the success of the business is worthy of contemplation and soul-searching before you assemble your team of advisors, get a valuation of your company, decide on strategic buyers or private equity buyers, and launching a sales process.

One client of mine was at the closing table after a year-long sale process, and just could not close for fear of becoming “irrelevant”.

In most instances, this emotion letdown - “seller’s remorse” - is quickly replaced with new opportunities, overdue time spent with loved ones, volunteering time and talents with a beloved not-for-profit, or finally having the time to focus on physical and mental health & wellness.

My Dad always said, “We’re all replaceable.” Even as I write this, I wonder how much of my identity is linked to my business.

Important Disclosure Information & Sources:

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Saving For Emergencies

Emergency savings can help you weather the toughest times, providing a cushion so that you can stay committed to your financial plan for the long-term.

By Senior Advisor Andrew Schaetzke, CFP® and Investment Associate Bobby Adusumilli, CFA.

Do you have money saved for emergencies?

Emergency savings can provide support in case something very unexpected happens. Unfortunately, most people and businesses don’t have enough saved. According to Bankrate’s 2021 Emergency Savings Survey, half of Americans have less than three months’ worth of expenses covered in an emergency fund.[1] That total includes 1 in 4 Americans who specified that they don’t have an emergency fund.[1] Based on research from the JPMorgan Chase Institute from 2016, approximately 50% of small businesses have 27 cash buffer days or less, meaning they would run out of cash within 27 days if revenue suddenly stopped coming in.[2]

By preparing for emergencies in advance, you are controlling what you can in order to be ready for the unexpected. Emergency savings can give you some peace of mind and allow you to maintain your focus on the long-term with your finances. We hope the below information helps you figure out what to do with your emergency savings.

How much should I save for emergency savings?

For most people, we recommend that you have at least 3-6 months' worth of living expenses in emergency savings. Some people like to have >1 years' worth of living expenses, particularly if they have health problems, dangerous jobs, or would just sleep better knowing they have more money saved.

How quickly should I fund my emergency savings?

Below are some general considerations, though please work with your financial professional to develop a plan appropriate for you:

First pay off any necessary short-term expenses.

Prioritize paying off any high-interest debts. However, many people like the security of also having emergency savings. Even if you prioritize paying off high-interest debts, you can still save slowly (such as $20 per week) for emergency savings.

After high-interest debts are paid off, prioritize growing your emergency savings to at least 3-6 months' worth of living expenses. While doing this, continue paying off any lower-interest debts.

After you paid off your high-interest debts and have enough emergency savings, then consider saving and investing more via tax-advantaged accounts. You can come up with a plan to help you save a little each week while also continuing to pay off any lower-interest debts.

When should I use my emergency savings?

When this cash is necessary for an urgent expense. While each situation is different, we typically recommend that people use their emergency savings before withdrawing from any long-term investments. However, we believe that people should replenish their emergency savings as soon as feasible.

Where should I keep my emergency savings?

The goal of emergency savings is to have cash for when you need it. Behaviorally, people are more likely to spend their savings unnecessarily if they frequently view the balance and if it is stored in the same place as other financial assets.[3] Therefore, we think people should keep their emergency savings separate from other financial assets.

Below are some options on where you can store your emergency savings:

Savings Account

Many online banks, local banks, and credit unions offer secure and low-hassle savings accounts that provide you with some monthly interest. The interest is subject to federal, state, and local income taxes, but the interest is usually more than you would receive in a checking account.

Make sure to choose a savings account which is FDIC-insured up to $250,000, as well as a trusted and reliable financial institution that will allow for quick and penalty-free withdrawals when needed.[4] For additional information on potential savings accounts, see this website from Nerdwallet.[5]

High-Quality Short-Term Bonds

Another option is to invest in high-quality short-term bonds. These bonds may provide more interest / yield than a savings account, but these bonds will fluctuate more in value compared to savings accounts. Certain high-quality short-term bonds (particularly municipal bonds) may be exempt from federal, state, and / or local taxes.

For many people, the easiest way to invest in high-quality short-term bonds is via a well-diversified low-cost ETF or mutual fund.

Short-Term Treasury Inflation Protected Securities (TIPS)

TIPS are offered by the US government to protect against inflation. The principal increases with inflation and decreases with deflation, as measured by the Consumer Price Index.[6] When it matures, you are paid the adjusted principal or original principal, whichever is greater. While TIPS are subject to federal income taxes, they are typically exempt from state and local taxes. Particularly if TIPS are in high demand, then investors may earn less than the rate of inflation.[6]

While you can buy short-term TIPS directly from the US government via the TreasuryDirect website, many people find it easiest to invest in TIPS via a well-diversified low-cost ETF or mutual fund.

Source: FRED, as of October 01, 2021. The Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL) is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers.

Series I Savings Bonds

Series I savings bonds are 30-year savings bonds offered to US residents by the US government, designed to match the US inflation rate.[7] Each individual can buy up to $10,000 of Series I savings bonds per year, and you can buy in increments of $25. You are restricted from selling your Series I savings bond within the first year, but after that you can redeem directly with the US government. If you sell within the first five years, you forfeit three months' worth of interest. When a Series I savings bond matures, you are paid the adjusted principal or original principal, whichever is greater. Series I savings bonds are subject to federal income taxes, but they are typically exempt from state and local taxes.[7]

You can buy Series I Savings Bond online directly from the US government via the TreasuryDirect website.

Conclusion

We can’t predict the future, but we can prepare for it. Particularly when times are toughest, that is when emergency savings can provide the most security for you. Emergency savings can help you weather the toughest times, providing a cushion so that you can stay committed to your financial plan for the long-term.

The idea of emergency savings is not new. The legendary investor Warren Buffett routinely talks about the importance of holding a large cash reserve for his company, largely driven by the teachings from his grandfather Ernest Buffett.[8] Below is a letter from Ernest Buffett to his family on the benefits of a cash reserve. [8] We hope you enjoy this, and as always feel free to reach out to us at SJS if you have any questions about emergency savings.

Source: “Berkshire Hathaway 2010 Shareholder Letter“. Warren Buffett, 2011, berkshirehathaway.com.

Important Disclosure Information & Sources:

[1] “Survey: More than half of Americans couldn’t cover three months of expenses with an emergency fund“. Sarah Foster, 21-Jul-2021, bankrate.com.

[2] “Cash is King: Flows, Balances, and Buffer Days: Evidence from 600,000 Small Businesses”. JPMorgan Chase & Co. Institute, September 2016, jpmorganchase.com.

[3] Your Money & Your Brain. Jason Zweig, 2008, Simon & Schuster.

[4] “Deposit Insurance FAQs.“ Federal Deposit Insurance Corporation, fdic.gov.

[5] “8 Best High-Yield Online Savings Accounts of November 2021“. Margarette Burnette, 01-Nov-2021, nerdwallet.com.

[6] “Treasury Inflation-Protected Securities (TIPS)“. U.S. Department of the Treasury, treasurydirect.gov.

[7] “Series I Savings Bonds“. U.S. Department of the Treasury, treasurydirect.gov.

[8] “Berkshire Hathaway 2010 Shareholder Letter“. Warren Buffett, 2011, berkshirehathaway.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

The "NOT SO" Great Resignation

Successful leaders I have been around focus on their employee experience because their employees are the folks who usually interact with their customers.

By Founder & CEO Scott Savage.

Do you treat each and every one of your employees like they are the most important person in the world?

In my opinion, there are two reasons to do so:

First: To each of your employees, they are the most important person in the world!

Second: They are the people who control your customer experience!

Business owners and leaders usually tell me that they are customer-centric. “It’s all about the customer.” Heck, my company’s tagline is “You come first. All the time. Every time.”

Successful leaders I have been around focus on their employee experience because their employees are the folks who usually interact with their customers.

In business circles, 2021 is being called “The Year of The Great Resignation.”[1] According to the Bureau of Labor Statistics, a record 8.7 million people resigned from their positions in the months of August and September alone.[2]

Many have speculated on the “Why” behind these numbers, and just about every business we work with has numerous unfilled positions that are stunting growth prospects and forcing innovation in hiring and retention practices. COVID-19, career switching, trouble with child and family care, and a surge in early retirements are combining to empower the workforce like never before.[1]

Source: U.S. Bureau of Labor Statistics, Job Openings: Total Nonfarm [JTSJOR], retrieved from FRED, Federal Reserve Bank of St. Louis, as of November 29, 2021. The job openings rate is computed by dividing the number of job openings by the sum of employment and job openings and multiplying that quotient by 100.

Many employers react to this “threat” with fear-based behavior. One company I am aware of stopped their drug screening for prospective new employees.

I believe employers who see this time as an opportunity to understand what their employees and prospective employees value about their work - and create the conditions that reflect these values - will thereby elevate both the employees' as well as the business' experiences. For example, we often help employers design their 401(k) plans in a way that both reflect their company values and are valued by their employees. This may require a newer and deeper understanding of what your business stands for.

Research is clear that after an employee feels like they are paid a “market” rate, their job satisfaction at work is driven by non-compensation factors.[3] As Daniel Pink writes about in his bestselling book Drive: The Surprising Truth About What Motivates Us, people are looking for three essential elements in order to find meaning and motivation in their careers:[3]

Autonomy - the desire to direct our own lives

Mastery - the urge to get better and better at something that matters

Purpose - the yearning to do what we do in the service of something larger than ourselves.

As employers, if we can help our colleagues focus on what they do best, then we as founders and CEOs can focus more on what we do best. This can help everyone enjoy their careers more, decrease employee turnover, and lead to better business results.

Important Disclosure Information & Sources:

[1] “Who Is Driving the Great Resignation?“ Ian Cook, 15-Sep-2021, hbr.org.

[2] “Job Openings and Labor Turnover – September 2021“. U.S. Bureau of Labor Statistics, 12-Nov-2021, bls.gov.

[3] Drive: The Surprising Truth About What Motivates Us. Daniel H. Pink, 2011, Riverhead Books.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

2022 IRS Changes - Retirement Plans and Social Security

To help you plan for 2022, we provide this information regarding limits, thresholds, and changes for retirement plans and Social Security.

By Senior Advisor Andrew Schaetzke, CFP®.

Every year, the Internal Revenue Service (IRS) updates dollar contribution limits and other aspects of defined contribution plans like 401(k)s, tax-qualified defined benefit plans, and Social Security. Particularly with the rise in inflation this year, some of the dollar limits have gone up significantly more than in years past.[1][2]

To help you plan for 2022, we provide the below information regarding limits, thresholds, and changes for these retirement plans and Social Security.[1][3] Additionally, we are actively monitoring other legislation making its way through Congress, particularly relating to President Biden’s Build Back Better Framework.[4] As legislative bills become law, we will provide you with more important updates.

401(k), 403(b), 457(b), ESOP, Profit-Sharing Plans

Traditional IRA / Roth IRA

Defined Benefits Plan

Social Security

Estate and Gift Taxes

Important Disclosure Information & Sources:

[1] “2022 Limitations Adjusted as Provided in Section 415(d), etc.“. IRS, irs.gov.

[2] “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average“. Federal Reserve Bank of St. Louis, stlouisfed.org.

[3] “2022 IRS Plan Limits“. Newport Group, 04-Nov-2021, newportgroup.com.

[4] “The Build Back Better Framework“. The White House, whitehouse.gov.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

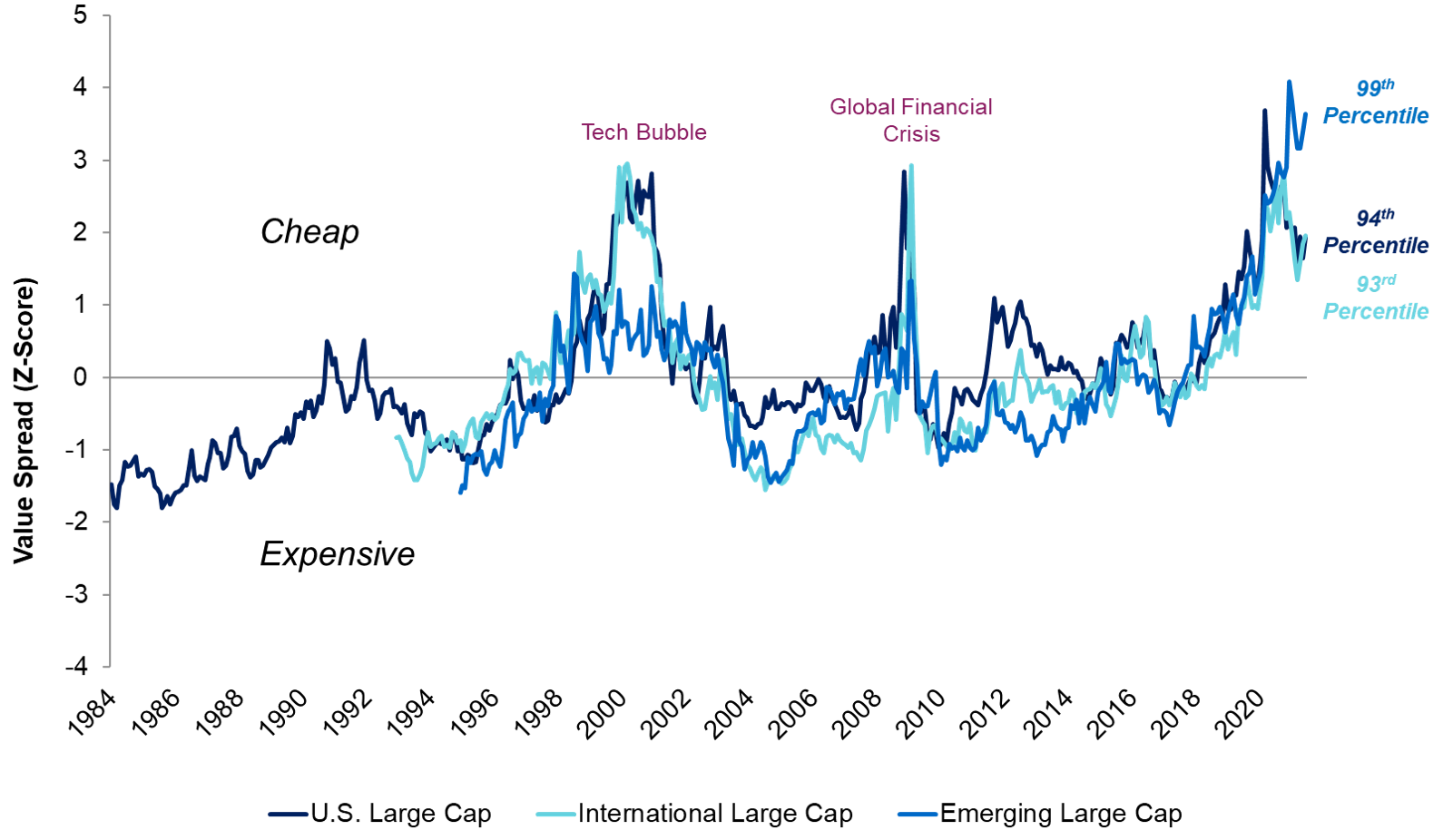

Retirement Plan Options For Business Owners

To help you differentiate between the most commonly adopted retirement plans by small businesses, we provide this resource.

By SJS Investment Services Founder & CEO Scott Savage.

For many people, retirement plans serve as their primary means for growing wealth throughout their lives. As a business owner, the specific retirement plan and features that you choose for your business can dramatically improve the financial behaviors and long-term investment results of your colleagues.[1] Additionally, because there are many retirement plan options for you to choose from, you can select the retirement plan that is most appropriate for your business from an operational and cost perspective while also still providing the features that most benefit your team.

To help you differentiate between the most commonly adopted retirement plans by small businesses, we provide the below resource. From this, you may come away with answers and action items for the following:

Which employees can participate in the retirement plan?

How much can each employee as well as the employer contribute to the plan each year?

Does the plan allow for Roth contributions?

What are the regulatory and compliance requirements for the plan?

Can we create a vesting schedule for employer contributions?

As always, we are here to help you evaluate the best retirement plan for your business. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

[1] “Nudge: The Final Edition“. Richard Thaler & Cass Sunstein, 2021, Penguin Books.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

6 Tax-Saving Strategies For You And Your Portfolio

For taxable investors, the following strategies may help you save money on taxes without lowering your potential investment returns.

By Senior Advisor Andrew Schaetzke, CFP® and Investment Associate Bobby Adusumilli, CFA.

Why do you invest?

Each of us has our own goals for investing. For some, we want to support our families. For others, we want to donate to charitable causes. For business owners, you want to successfully grow your business over time.

If along the way we can legally save on taxes, then all the better. All else equal, lower taxes leave us with more money to achieve our specific goals.

For taxable investors, the following strategies may help you save money on taxes without lowering your potential investment returns. As always, please consult with your tax advisor as well as other advisors before implementing these strategies.

Use Tax-Efficient Investments

Taxes are only one of the criteria that investors consider when designing their portfolios. Yet there are usually multiple investment options to choose from in whatever area you want to invest in. Particularly for mutual fund and ETF investors, when choosing between multiple investment options, the below considerations may help you save money on expected taxes without sacrificing expected return.

Invest in lower turnover mutual funds / ETFs: Because they sell less of their holdings on an annual basis, mutual funds / ETFs with lower turnover typically realize less net capital gains than mutual funds / ETFs with higher turnover, and thus are likely to pay less capital gains distributions each year.[1]

Invest in tax-sensitive mutual funds / ETFs: Some investment managers actively consider tax consequences when making investment decisions, such as selling higher cost basis positions for a particular investment or selling a comparable investment with a higher cost basis. By choosing a tax-sensitive mutual fund / ETF, you may lower your annual capital gains distributions.

Consider ETFs: Because of their structure, ETFs are typically less likely to pay capital gains distributions than similar mutual funds.[2] Therefore, ETFs are becoming an increasingly popular choice for taxable investors.[3] However, particularly for larger investors as well as lower-AUM ETFs, ETFs may not outperform similar tax-sensitive mutual funds after taxes and fees, so it is important to choose the right investment for your specific situation.

Invest Via Tax-Advantaged Accounts

There are three general types of tax-advantaged accounts:

Tax-deferred: Money you contribute to the account is not taxed, but money you withdraw in the future is subject to taxes. Examples include Traditional IRAs, Traditional 401(k)s, Traditional 403(b)s, and 457 plans.

Tax-exempt: Money you contribute to the account is taxed, but money you withdraw in the future is not subject to taxes (subject to specific rules). Examples include Roth IRAs, Roth 401(k)s, Roth 403(b)s, and 529 plans.

Tax-free: Money you contribute as well as withdraw from the account is not subject to taxes, so long as the money is used for specific purposes. While these accounts are rare, a popular tax-free account is a Health Savings Account (HSA).

All of the above tax-advantaged accounts allow investing the balances. Additionally, if you already have a Traditional IRA, Traditional 401(k), or a Traditional 403(b), you may be able to convert some or all of the account balances to a Roth account - known as a Roth conversion.[4]

Depending on your employment, income, and age, you may be able to use some combination of these tax-advantaged accounts to help you save on taxes over time.

Asset Location

If you have a combination of taxable and tax-advantaged accounts, you could invest your most tax-inefficient investments within your tax-advantaged accounts. Once you decide which tax-inefficient investments you want in your tax-advantaged accounts, you could place your highest expected-return investments into your tax-free and tax-exempt accounts, and place your lower expected-return investments in your tax-deferred accounts.

Figuring out how to rank your investments based on tax-efficiency is complicated, and is highly dependent on your income, net worth, and age. For more comprehensive information on asset location, you can check out this webpage.[5]

Tax Loss Harvesting

Within taxable accounts, if you realize a net loss on an investment position, you are able to use that net loss amount to offset any current or future realized capital gains (subject to the wash-sale rule).[6] Additionally, if you have extra net capital losses at the end of the year, you may be able to offset up to $3,000 in federal income for this and potentially future years.[6] However, it’s important to emphasize that tax loss harvesting involves tax deferral, not tax avoidance.

If you want to learn more about tax loss harvesting, you can read our article on harvested losses.

Analyze Your Withdrawal Order

If you have a mix of taxable and tax-advantaged investment accounts, then you are subject to various withdrawal limitations and tax consequences. If you are able to selectively withdraw from each of these accounts over time, you may be able to pay lower your taxes in the short-term while allowing more time for your investments to grow.

Some general rules you can consider for how to generate cash from your investments:

First use the distributions - dividends, interest income, capital gains distributions - from your taxable accounts.

If you are age 72 or older, use the required minimum distributions (RMDs) from your relevant tax-advantaged accounts.

Within taxable accounts, sell positions that are subject to long-term capital gains taxes.

Within the taxable accounts, sell positions with higher cost bases.

Gifting and Charitable Donations

The ultimate goal of saving on taxes is to have money to accomplish our goals. Particularly for those who are inclined to gift money to your family or donate to charitable institutions, the below options may decrease your taxes over time.

For each member of your family, you may gift them up to $15,000 per year, via cash or investments.[8] Particularly if a family member has a lower tax bracket than you, it may be advantageous for you to gift a low cost basis investment, which could help decrease future taxes paid on that holding. For more information, you can read our article on gifting.

From your taxable accounts, you can donate cash or investments directly to a charitable institution. This can help you save on future taxes, up to federal deduction limits.[9]

As long as you are age 72 and meet the specific IRS rules, you can donate up to $100,000 annually directly from your Traditional IRA (without paying taxes) to a qualified charity through a qualified charitable distribution.[10]

Conclusion

While each of the above strategies may help, combining some or all of these strategies could significantly improve your investment portfolio over time, leaving you with more money to accomplish your goals. As always, please consult with your tax advisor as well as other advisors before implementing these strategies. If you have any questions on how you can incorporate the above strategies in your portfolio, feel free to reach out to us.

Important Disclosure Information & Sources:

[1] “Turnover Definition“. Will Kenton, 14-Jul-2020, investopedia.com.

[2] “Do ETFs Generate Capital Gains for Shareholders?“ Andriy Blokhin, 23-Sep-2021, investopedia.com.

[3] “The Future of ETFs“. Irene Huhulea, 23-Aug-2021, investopedia.com.

[4] “Roth IRA Conversion“. Julia Kagan, 23-May-2021, investopedia.com.

[5] “Tax-efficient fund placement“. Bogleheads, bogleheads.org.

[6] “Topic No. 409 Capital Gains and Losses“. IRS, irs.gov.

[7] “6 tax-saving strategies for smart investors“. Jessica McBride, 18-Feb-2021, vanguard.com.

[8] “Frequently Asked Questions on Gift Taxes“. IRS, irs.gov.

[9] “Charitable Contribution Deductions“. IRS, irs.gov.

[10] “IRA FAQs - Distributions (Withdrawals)“. IRS, irs.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Tax Smart Considerations Before Year-End

In collaboration with your SJS Advisor and other trusted professionals, here are some tax smart things you can consider before year-end.

By SJS Investment Services Chief Investment Officer Tom Kelly, CFA.

“Death, taxes and childbirth! There's never any convenient time for any of them.” ― Margaret Mitchell, Gone with the Wind.[1]

While there never seems to be a good time to talk about taxes, the topic has been unavoidable this year. With a $large infrastructure plan in the works, the House Ways and Means Committee recently introduced a draft bill advancing many tax proposals, such as raising the top long-term capital gains tax rate from 20% to 25%, a potential net investment income tax of 3.8%, and increasing the top individual federal income tax rate from 37% to 39.6%.[2][3] While none of these are set in stone, the right time to talk about taxes is now!

In collaboration with your SJS Advisor and other trusted professionals, here are some tax smart things to consider before year-end:

Tax-Deferred Contributions

Contribute the maximum amounts to tax-deferred retirement accounts - including 401(k), Individual Retirement Account (IRA), and Health Savings Account (HSA) - to reduce your taxable income.

Roth Conversions

With your SJS Advisor and trusted tax professionals, identify if there are opportunities to accelerate income into 2021 through a Roth Conversion.

Charitable Donations

Gifting of highly appreciated securities held for more than one year, either directly to a qualified charity or to a charitable fund. You could reduce taxable income and avoid realizing capital gains on those donated securities.

Estate Planning

With your SJS Advisor and trusted estate professionals, review your estate and financial plans to understand how you are positioned to achieve your financial and legacy goals

While we may have just added a few things to your to-do list, know that SJS has been reviewing opportunities on your behalf throughout the year. Using our MarketPlus Investing principles and our disciplined approach to long-term investing, we strive to manage tax-efficient portfolios by utilizing asset location (putting tax-disadvantaged investments in tax-advantaged accounts), tax-efficient investments (using mutual funds and ETFs with low capital gains distributions), and tax loss harvesting (realizing losses in order to offset future realized capital gains). We are always looking for ways to decrease your April 15th bill. Wherever taxes go in the future, we will continue to be here for YOU. All the time. Every time. At whatever time is convenient for you.

Important Disclosure Information & Sources:

[1] “Margaret Mitchell > Quotes > Quotable Quote“. Goodreads, goodreads.com.

[2] “What’s in Democrats’ $3.5 Trillion Budget Plan—and How They Plan to Pay for It“. Wall Street Journal Roundup, 09-Aug-2021, wsj.com.

[3] “How House Democrats Plan to Raise $2.9 Trillion for a Safety Net“. Emily Cochrane & Alan Rappeport, 13-Sep-2021, nytimes.com.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Your Business Exit: Monetizing Your Life's Work Webinar

SJS Founder & CEO Scott Savage’s webinar on “Your Business Exit: Monetizing Your Life’s Work“.

Transcript

Good afternoon everyone. I’m Scott Savage from SJS Investment Services. I’m the Founder of SJS. Welcome to today’s webinar on “Your Business Exit: Monetizing Your Life’s Work”. We are really thrilled you could join us today. We’re going to talk about monetizing your life’s work from a business owner’s perspective, what to think about and what to plan for based on some experiences I’ve had - a few ideas we hope to be helpful as you contemplate potentially your exit or what you’ve got up to in selling your business.

I’m gonna share my screen here with you today and get started. So again, “Your Business Exit: Monetizing Your Life’s Work”. We want to be helpful today as you think about what you’re doing and get out ahead of what will probably be the single most important financial transaction of your life. So we will jump right into it here.

Here’s what we are going to cover today. Just a little bit of how we want to start thinking about the exit and the planning. Some of the family dynamics - we all are part of families and often times business transactions put the “fun” in dysfunctional, so we are going to talk about that a little bit. Get into the mind’s side of the financial nitty-gritty. We are going to talk about the heart side as well. As you put your team together - what we are calling the Dream Team - to help you navigate the process. And there is going to be the heart side, your emotions that are a really big part of this process. And then we will give you a little peak as to what comes next after a transaction based on some of our experiences. And we will wrap it all up. Really excited to be here.

Given the world of compliance that we live in, and it’s a very important part of who we are here at SJS, the proverbial disclosure of what we are going to talk about today are just some shared experiences. There are not necessarily any guarantees or anything that you want to necessarily rely on in this presentation in and of itself. We are here to just provide some guidance, ideas, and thoughts. Of course you ought to consult your own tax professionals, legal professionals, and advisors to help you through your process. So we appreciate you understanding that (see Important Disclosure Information at the end of this Transcript).

This is a big deal. The goal of today is to get inside the mind side of preparing for a transaction and for the heart side, and do this on your terms. This is really an important first part of today’s conversation. There’s really two ways to do this. First, you can do this from the perspective of today-forward - making incremental decisions to plan for an exit. I want to challenge you to think a little different when it comes to preparing to sell a business. I would challenge you to think of it from the future-back - so in your mind’s eye, getting down the road say 5 years when you want a transaction to happen, and really getting a clear picture in your mind of what you want that day to be like, what you want to feel like, who’s there, what is that ideal future state. And then we can from there do the planning back to today so that all the steps can happen to get you to that ideal state. If nothing else happens today, that notion of starting with the future and working your way back is to me a really great way to think about preparing your business for sale. So future-back.

Again you want to start with the end in mind. Anyone in the movie business will tell you that for most major motion pictures, the final scene is shot first. I learned that a number of years ago. And then the movie builds toward that final shot. We want you to think about the future and bring it back. And have plenty of options. There are a lot of different ways to go about monetizing or exiting a business. There are pros and cons to each - we will talk about them. To me, it’s really important that you have a really crystal clear idea of what those non-negotiables are in your mind. If you aren’t clear on them, no one else is going to be clear on them. So you have to be really clear yourself, and communicate to your advisors on exactly what the non-negotiables are, and the things you are flexible about.

Fast fact here: 3 in 5 businesses do not have a written business succession plan.[1] As hard as we all work in our businesses, it sure makes a lot of sense to slow down in order to speed up, which is what I think about this process. You have to slow down in order to speed up to make this exit the way you want it to be. So let’s not be one of the 3 in 5 who don’t have a written business succession plan.[1] Let’s be one of the 2 in 5. It can be one page, but write it down.

Managing family dynamics - what a big topic this is. We all have families. That notion of communicating on an ongoing basis well ahead of time. I can’t tell you how many times a person has sold a business and picked up a phone to call their kids to say, “Guess what - we just sold our business to a strategic buyer or a private equity buyer.” One of the kids says, “Gee, I thought we would get a shot at buying the business.” There is often no communication. Starting early is important.

The other piece of this: often bringing in an outside advisor or consultant is often really important, because some of us are not as good at communicating as we maybe think we are. In my own case, I’m building a 100-year business, but I do have 4 adult children, 2 of them in the business and 2 of them not. I have hired a firm to consult with me and my kids to make sure we are communicating in a way that everyone is heard and can have their opinions. Even though we are not preparing to sell the business, this business will have a succession within my family. We have absolutely hired an advisor to help us, even though that is what I do for a living. It’s very difficult to have that objectivity with your own organization. I’m putting my money where my mouth is, so to speak. I’m suggesting you have a professional’s help, and I’ve done the same thing - a very important part of the process.