The SJS 100-Year Vision

I am very proud to say that SJS celebrated its 26th anniversary in July 2021. I want SJS to be a 100-year firm, serving multiple generations of your families and organizations.

By SJS Investment Services Founder & CEO Scott Savage.

When I started SJS 26 years ago, I had a big vision to better serve you, the investor and client: you should have a local choice that competes with the major money center Wall Street firms that were full of conflicts of interest that I experienced early in my career. You should be better served by a firm that combines major money center expertise with the small-town values that I grew up with right here in Sylvania, Ohio. Your SJS advisor should sit on the same side of the table as you so our interests would be aligned.

I am very proud to say that SJS celebrated its 26th anniversary in July 2021, and I feel we have achieved that initial vision. Our philosophy, practices, and clients have evolved over the past 26 years, but our fundamental principles have remained the same. We aim to do the right thing for you, all the time, every time. We want to give you the same investment experience that we would provide for our mothers and grandmothers. We want to help you and your family grow financially, and we want to enjoy the journey with you along the way.

I am happy to say that 26 years later, SJS is alive and well. And that is thanks to you, our client. Thank you for the confidence and trust you have placed in us. You have allowed us to continue to reinvest in the business and keep the organization on the leading edge in terms of people, resources, and technology.

And other firms have started to notice too. Over the last year, I have received many calls from other investment firms asking if I would be interested in selling SJS. And I always say no. I have no intention of selling SJS. I strongly believe that the heart of the business leaves at the closing table. The connection I have built with you and the strong sense of purpose in our work are much more important to me than the benefits of selling the business. I still love coming to work every day - maybe even more than 26 years ago - and I don’t want that to change.

I want SJS to be a 100-year firm, serving multiple generations of your family and / or organization. We want to continue growing with you and those that rely on you, helping you evolve as the world continues to change. In order to build a 100-year firm, we have made significant investments in areas including:

Team

In order to serve our over 800 clients, we need a strong team. I believe that people are the most important factor in the longevity of a company, which is why we invest so much in finding the right team members. It has taken a village to build SJS, and it will take an even larger village going forward. Each team member brings their own personality and experiences to SJS, and we work together to provide you with the best experience we can. And our team is growing: we now have team members all across the country, from Sylvania to Naples to Chicago to Phoenix. I am proud of the work we do, and I would stack up the SJS Team with anyone, anywhere, anytime in terms of smarts, experience, and caring.

Technology

26 years ago, I could not have imagined all of the technology we would be using today. I believe that SJS has been able to use technology to provide you with an increasingly better investment experience. Technology is changing rapidly, and in order to keep improving your experience, we invest heavily in areas including financial programs, cybersecurity, high-quality hardware, and tools for safekeeping your data & information.

Client Experience

The more we can improve your experience, the better. Whether speeding up the account opening and management process, providing you with better account access and accountability via your MySJS Portal, and improving your investment experience through evolving research and better implementation practices, we are trying to improve your overall experience each year. We are available via in-person visit, phone, email, or video conference to discuss what you want to talk about in the way that you want to talk about it. We want to be there for you any time you want or need our help.

We approach every day as learners, seeing each day with new eyes, not assuming that we have all of the answers. SJS will continue to evolve, but our fundamental principles will remain the same. Thank you for trusting us and for allowing us to be part of your journey. We hope to serve you and future generations for the next 100 years.

Important Disclosure Information & Sources:

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

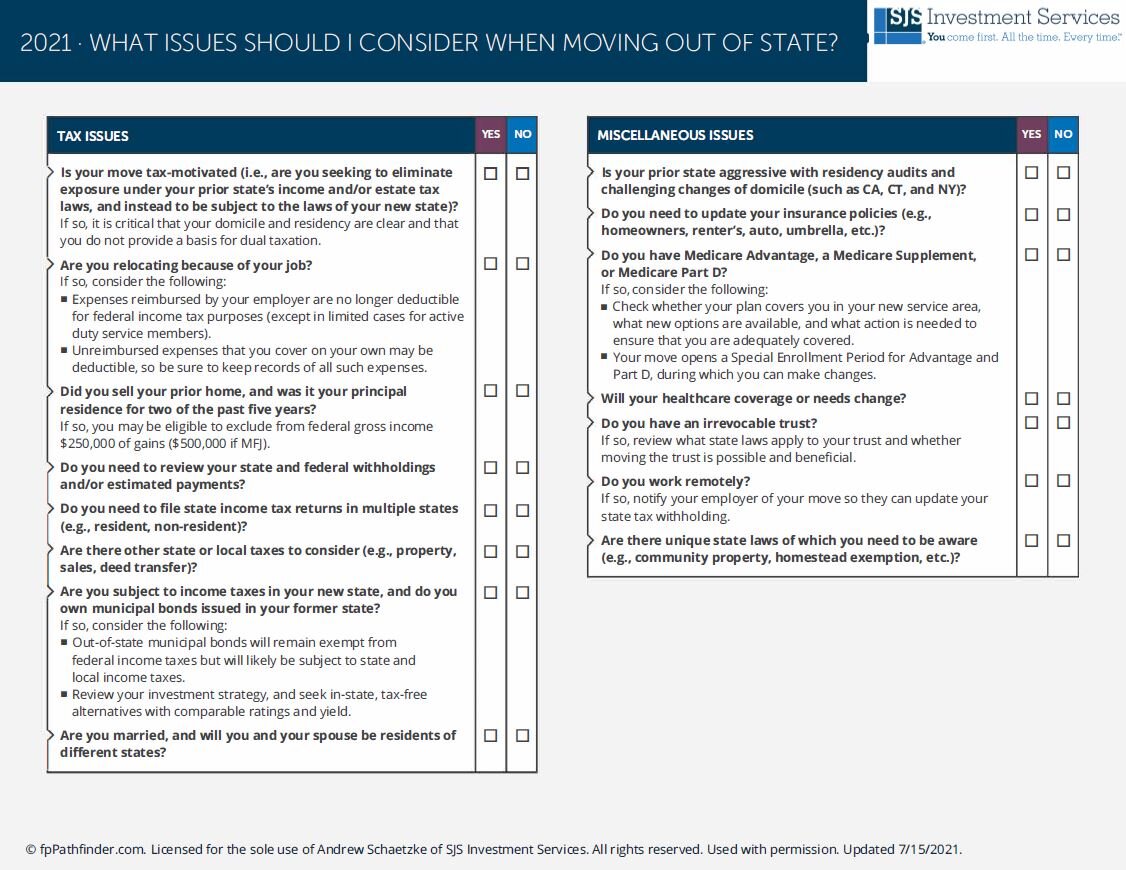

What Should You Consider When Moving Out Of State?

To help you figure out what issues to consider if you move out of state, we provide this resource.

By SJS Investment Services Senior Advisor Andrew Schaetzke, CFP®.

Especially since the start of the pandemic, many people have moved in order to live in a less expensive place, to have more space, or to have different pace of life.[1] Moving can be exciting, as it may allow you to experience something new. At the same time, there a lot of logistical details to account for when you move. Particularly if you move out of state, it can be easy to forget or not even know that you have to do something important.

To help you figure out what issues to consider if you move out of state, we provide the below resource. From this, you may come away with answers and action items for the following:

Do I need to distinguish between residency and domicile?

What agencies do I communicate with in order to update records?

Do I need to update my family’s estate planning documents?

Are there potential tax advantages or additional expenses (such as for Medicare) that I should be aware of?

If I move because of a job, are my moving expenses tax-deductible?

As always, we are here to help you evaluate your personal situation and help you figure out what you need to do when moving out of state. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

[1] “Americans Up and Moved During the Pandemic. Here’s Where They Went.“ Yan Wu & Luis Melgar, 11-May-2021, wsj.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What's Love Got To Do With It?

We love our clients. How that love is delivered by SJS and felt by our clients depends on the Love Language we use.

By SJS Investment Services Founder & CEO Scott Savage.

We love our clients. The loving relationships developed over the decades with business owners, their families, and people leading institutions we serve are hard to distill into words. Why? Because the words used to describe this love are unique to the individual.

How that love is delivered by SJS and felt by our clients depends on the language we use. Author Gary Chapman wrote in 1992 about the 5 different ways that people love to be loved.[1] These “Love Languages” - or different ways people feel loved - is the key to letting them know they are loved.[1]

Some people need words of affirmation that the decisions we are helping them make are right and true. Others like to receive gifts such as flowers, because those gifts make them feel loved. Others just want to spend quality time with their advisor so they can be understood. Still others love when we can do some things to help their child, grandchild, or employee in need. And some people just need a hug to feel loved.

Understanding each client’s Love Language has made all the difference. Here’s the secret I have learned: Knowing which of these Love Languages your loved one responds to can go a long way towards peace and harmony in your life.

Important Disclosure Information & Sources:

[1] “The 5 Love Languages“. Gary Chapman, 1992, 5lovelanguages.com.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Checklist For Selling Your Business

Your process for selling your business will likely include these steps.

By SJS Investment Services Founder & CEO Scott Savage.

Your process for selling your business will likely include the following steps:

Determine the age at which you want to leave the company

This will help set the framework for your plan.

Assess your financial situation and your desired retirement lifestyle

This step will help you determine the cash flow you need for retirement.

Determine the gap between your savings and your desired lifestyle

Ideally, the sale of your company will cover that gap. You’ll need to problem-solve if it won’t.

Decide how you want to transfer the company

Knowing the “how” will help you understand the appropriate steps forward.

Get a valuation of your company

Many people think they can ignore a valuation since the sale is years down the road. However, a valuation is essential. By understanding your present value, you can act to increase the value and get the sale price you need to retire.

Assess and implement the steps you need to increase value

You want to look at factors such as your customer base, systems and processes, and cash flow. We would argue, however, that the most important factor is you - or better yet, the lack of you.

Your buyer will want to know that the company can function without you. Start stepping back from the day-to-day running of your company and give your management team the opportunity to hone their skills. Giving up control may challenge you, but it is essential for maximizing your company’s value.

Review your financial picture

If you have always kept your cash in the business, now is the time to diversify your wealth. Factors outside of your control such as a recession can hurt your company’s bottom line. Diversifying your wealth can help see you through rough times and allow you to adjust your plans from a place of strength rather than weakness.

Review your professional and personal financial picture, including retirement accounts and other investments, insurance, and estate plans.

This step may be difficult as many business owners feel in control of their company’s destiny but not in control of an investment portfolio.

Understand the tax impact

Your tax picture will depend on your company’s structure and the type of sale. You want to understand this picture and implement strategies across all areas of your wealth to reduce the tax impact. The fewer taxes you pay, the more you will have for retirement.

Find a buyer and agree on financing terms

Most agreements allow the seller to purchase the business over time. This can be ideal for both of you, as it will allow for a slower transition out of the company, increase your team’s strength in running the firm, and allow the buyer to avoid an upfront investment they cannot afford. But you may have different plans, and by this point in your journey, you should understand those plans and seek a purchaser who will meet as many of those terms as possible.

Implement the sale

Make sure to communicate with your employees and customers. Provide the pertinent details, and if it’s feasible, make in-person introductions. Both your clients and staff will have questions; be prepared and be transparent. It’s in your best interest that everyone affected by the transition of leadership is prepared.

Retire

Congratulations! If you are wondering what’s next, you can check out this blog post.

To help business owners work through their emotions as well as make better decisions when considering selling their businesses, we wrote an ebook entitled Your Business Exit: Monetizing Your Life’s Work. We explore how your situation can come together - the dollars and the cents, as well as the behavioral - so that you can create a successful business exit.

If you have any questions or want to talk through your potential business exit, please feel free to reach out to us. We have helped many business owners successfully handle the financials as well as the emotions of exiting their businesses, and we would be happy to help you as well.

Important Disclosure Information & Sources:

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What Accounts Should You Consider If You Want To Save More?

To help you figure out what accounts to use if you want to save more, we provide this resource.

By SJS Investment Services Senior Advisor Andrew Schaetzke, CFP®.

Having the money to save more can be a welcome and exciting feeling, allowing you to better prepare for your future while also feeling more confident in the present. You can save for your family, retirement, unexpected expenses, or many other causes important to you. At the same time, figuring out how to save can also be confusing, as there are a lot of options to choose from.

The good news is that once you figure out what you want to save for, there are usually a few accounts / options that are most beneficial for your situation, that can help you save on taxes and expenses. Additionally, by knowing some of the accounts ahead of time, you may better handle the situation if you do ever find yourself with more money to save.

To help you figure out what accounts to use if you want to save more, we provide the below resource. From this, you may come away with answers and action items for the following:

What retirement accounts should I prioritize, for anyone ranging from a young investor to a mid-career professional to a business owner?

How should I save for future healthcare expenses?

How should I save for my child’s future education?

Would an annuity or life insurance help me save more for retirement?

How much should I save in an emergency account for myself and my family?

As always, we are here to help you evaluate your personal situation and help you figure out what accounts may be best for you. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide tax advice. Please consult your tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Generating Cash Without Selling Your Business Or Investments

I offer two cash-generating ideas in lieu of selling your business or investments that have gone way up in value.

By SJS Investment Services Founder & CEO Scott Savage.

Andrew Carnegie – steel tycoon, philanthropist, and one of the wealthiest businessmen of the 19th century – once commented about creating wealth:[1]

“Put all of your eggs in one basket, and then watch that basket.”

Does that advice surprise you? Many SJS clients have generated their wealth through concentrated bets that began as small investments - often creating their own businesses - and grew over time.[2]

As these investments increase in value, some clients no longer want their individual business concentration risk, and instead want to diversify their investments in order to preserve their wealth for the long-term. They are willing to pay the necessary taxes associated with realizing capital gains from selling a portion of their business.[3]

Conversely, others want strategies that help them generate cash without selling their business - in order to maintain ownership, keep voting authority, avoid associated taxes from selling, or just to wait to implement their estate plan.[4]

My Dad used to tell me, “Scott, there are two ways to get to the top of an oak tree. One, you can climb it. Or two, you can sit on an acorn and wait!”

As business owners, if we sit around waiting for something good to happen to us, we may be in for a long wait! The “trick” that most successful business owners know is we have to get out of our comfort zones and make something happen. So, I offer two cash-generating ideas in lieu of selling your business or investments that have gone way up in value.

Securities-Based Lines of Credit

Securities-based lines of credits (SBLOC), also known as securities-based loans, are becoming an increasingly popular go-to option to allow business owners to generate cash without selling their businesses.[4] When a business owner says they are “recapitalizing” their business, they may be referring to SBLOCs.

Negotiated directly with a bank or other lending institution, SBLOCs are highly customizable; depending on the lender, you can receive an SBLOC up to 50% of the value of your collateral, which is typically valued based on a third-party evaluator. Investments that can serve as collateral include a private business, public stock, and certain derivative holdings.[5]

Depending on the specific terms, potential benefits of SBLOCs include receiving cash without giving up voting authority in your business, lower interest rates than other types of loans, flexible repayment schedules, avoiding capital gains taxes that would result from selling appreciated assets, and not showing up on credit reports.[4] If you work for a publicly-traded company and are required to disclose your holdings, then you may be required to disclose the collateralized loans against that particular security. However, most other loans collateralized against other assets often do not need to be disclosed.[4]

As with any customized loan arrangement, it is critical to thoroughly understand the details ahead of time. The SEC released an Investor Alert in 2015 to help people considering SBLOC loans better evaluate specific details, particularly emphasizing ten questions to ask before taking out an SBLOC:[6]

Many regional and major banks offer SBLOCs. If you are comfortable taking on a loan, paying interest, and using your business or investments as collateral, then an SBLOC may be a good option for you.

Covered Call

If you own large amounts of a publicly-traded stock, you can potentially generate cash by selling a call option on that stock (also known as a covered call). A call option is a derivative contract that enables the holder of the call option to purchase the underlying security at a pre-specified price. By selling a call option, you receive an upfront premium, but if the call option holder decides to exercise the call option, then you may be required to provide the call option holder with the underlying stock, or pay the difference in value between the call option strike price and the current value of the underlying stock.[7] Therefore, a covered call limits your downside as well as limits your upside of your underlying stock holding.

Covered calls are generally only available for larger public stocks. Since call options are relatively expensive to create and trade, they are usually used by larger investors. Because call options typically expire within one year, you would need to sell a call option at least once per year, or use another strategy to generate recurring cash. Additionally, any net income from the covered call as of the call option’s expiration date is subject to the appropriate capital gains (usually short-term) taxes.[8]

Because you may be required to deliver the underlying stock to the counterparty, as well as the complexity and taxes associated with selling call options, we generally advise for investors to only consider covered calls if they need money in the short-term, don’t have other simpler sources of financing, and would be agreeable to selling the security if it reaches an acceptable price.

Conclusion

There are many ways to generate cash without selling your business, each coming with its own benefits and tradeoffs. SJS has over 26 years of experience helping business owners and high net-worth individuals implement these strategies. If you want to discuss whether any of these strategies are appropriate for you and how you could implement them, please feel free to reach out to us.

Important Disclosure Information & Sources:

[1] “Put All Your Eggs in One Basket, and Then Watch That Basket“. Quote Investigator, 16-Feb-2017, quoteinvestigator.com.

[2] “How People Get Rich Now“. Paul Graham, Apr-2021, paulgraham.com.

[3] “Ways to Cash Out of Your Business”. Laura Lorber, 11-Sep-2008, wsj.com.

[4] “Buy, Borrow, Die: How Rich Americans Live Off Their Paper Wealth”. Rachel Louise Ensign and Richard Rubin, 13-Jul-2021, wsj.com.

[5] “Securities-Based Lending“. Lucas Downey, 26-Aug-2020, investopedia.com.

[6]“Investor Alert: Securities-Backed Lines of Credit“. U.S. Securities and Exchange Commission, 21-Dec-2015, sec.gov.

[7] “The Basics of Covered Calls“. Alan Farley, 20-Apr-2021, investopedia.com.

[8] “Tax implications of covered calls“. The Options Institute At CBOE®, 2013, fidelity.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Four Investment Accounts Young Investors Should Know About

Knowing which investment accounts to store your money can be challenging. We detail four investment accounts that can aid you in growing your wealth over time.

By SJS Investment Services Intern Jake Matthews.

You probably remember working your first job. The feeling after receiving your first paycheck is both rewarding and refreshing. But now, how do you store your hard-earned money? How do you protect your money from inflation? What steps should you take now to save for retirement?

Knowing which investment accounts to store your money can be challenging. Yet, the rewards to investing can be tremendous over your lifetime. Choosing the right investment accounts to use at a young age can be the first step in building generational wealth. Below, we detail four investment accounts that can aid you in growing your wealth over time.

IRA: Roth & Traditional

One of the most popular investment accounts is the Individual Retirement Account (IRA), which offers tax advantages to encourage U.S. workers to save and invest for retirement. There are two types of IRAs available to most income-earning U.S. workers: Roth IRA and Traditional IRA.

Roth IRAs and Traditional IRAs are subject to many of the same rules. In any given year, as long as you have enough taxable income, you can contribute up to $6,000 ($7,000 if age 50 or older) to a Roth IRA and / or a Traditional IRA. You can open a Roth IRA or Traditional IRA at many large brokerage firms in the U.S. (such as Schwab, Vanguard, and Fidelity), and can invest in a very broad range of investments including mutual funds, ETFs, stocks, and bonds. While the money is held in your Roth IRA or Traditional IRA, you do not pay taxes on any dividends or realized gains on your investments. Any money you withdraw before age 59 1/2 may be subject to income taxes and a 10% penalty.[1]

There are important differences between a Roth IRA and Traditional IRA. For a Roth IRA, you contribute after-income tax money, and any investment gains that you withdraw after age 59 1/2 are not taxed. If you are a single tax filer, your contribution limit starts declining once you earn $125,000 in a year, and you cannot contribute if you earn more than $140,000.[2]

For a Traditional IRA, you contribute pre-income tax money, and money (both what you contributed and any gains) that you withdraw after age 59 1/2 are subject to income taxes. If you are a single tax filer and have an employer-sponsored retirement plan, you gradually lose the tax advantages of a Traditional IRA once you earn over $66,000 in a year, and lose nearly all of the tax advantages after you earn more than $76,000.[3]

Particularly for young investors, we believe that a Roth IRA is generally more beneficial over the long-term than a Traditional IRA.

401(k): Traditional And Roth

Another popular investment account for young investors is the 401(k), a retirement account sponsored by your employer. While all employers with a 401(k) offer the Traditional option, only some offer the Roth option. 401(k)s are subject to many of the same rules as IRAs.

Unlike IRAs, no matter how much you earn, you can contribute up to $19,500 ($26,000 if age 50 or older) of your income per year to a 401(k). Because 401(k)s are employer-sponsored accounts, many employers will match their employees contributions up to a specified amount. 401(k)s usually have limited investment options (typically a lineup of mutual funds), and are often subject to higher annual expenses than IRAs. Instead of a 401(k), certain employers may offer a 403(b), which has similar rules.[4]

Many investors retire with their 401(k) as their single largest investment account.

Health Savings Account (HSA)

Some employer-sponsored health insurance plans offer for employees to contribute to a Health Savings Accounts (HSA), which allows you to save pre-tax dollars to pay for future medical expenses. Some employers also contribute to the HSA. For an individual, the total employee and employer contributions cannot exceed $3,600 ($7,200 for a family) per year. Some HSA plans allow you to invest in a limited lineup of mutual funds, and any dividends and gains are not taxed as long as they are used for future medical expenses.[5]

Because of the tax advantages, many young investors use their HSA as an investment account for the long-term.

529 Plan

If you plan to go back to school one day or have other qualified education expenses, you can consider contributing to a 529 Plan. You contribute after-income tax money to a 529 account, which can be invested in a limited number of investments. Any money you withdraw from the 529 account is tax-free as long as the money is used for qualified education expenses.[6]

Each state offers a different 529 plan, and you are able to participate in whichever state’s plan is most beneficial to you. Each state offers a different investment lineup, contribution limit, state income tax benefits for residents, and expenses. If you do not use all of the money in your 529 account, you can change the beneficiary to a qualifying family member with no penalty, subject to gift tax rules.[7]

Overall, a 529 account can be a great way to start saving for future education expenses for you or your family.

Benefits Of Compounding Returns

Albert Einstein reportedly said, “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”[8] By using these four investment accounts, you can invest to potentially allow your wealth to compound for the long-term while paying less in taxes.

To demonstrate this, the below graph shows what would happen if you contribute the maximum to your Roth IRA ($6,000 in 2021, expected to grow 2.00% annually due to inflation) at the beginning of each year, and invest the Roth IRA in a portfolio that earns a 5.00% annual expected return.

Graph created by Jake Matthews, and reflects hypothetical information based on the assumptions above. Actual investment results may be materially different than hypothetical returns. See Important Disclosure Information.

After 50 years, the above Roth IRA grows to over $1,842,920.47. That’s the power of compounding.

Conclusion

As a young investor, knowing which investment accounts are available to you as well as the associated benefits & tradeoffs can dramatically help you grow your net worth over your lifetime. We believe these four accounts provide a very strong foundation for any investor to begin the journey of saving for their future.

About The Author:

Jake Matthews is a rising fourth-year undergraduate student at Miami University, majoring in Economics & Finance. Jake is a member of Miami University’s Track Team, running the 200-meter and 400-meter. Jake enjoys learning about a wide variety of industries, particularly about alternative investments including real estate, collectibles, and cryptocurrencies.

Jake spent the last ten weeks interning at SJS, helping with client portfolio analyses, investment recommendations, and improving financial planning processes. We are very grateful to have gotten to know and work with Jake this summer, and we wish him all the best as he heads back to college!

Important Disclosure Information & Sources:

[1] “Individual Retirement Arrangements (IRAs)“. IRS, irs.gov.

[2] “Amount of Roth IRA Contributions That You Can Make For 2021“. IRS, irs.gov.

[3] “IRA Deduction Limits“. IRS, irs.gov.

[4] “401(k) Plans“. IRS, irs.gov.

[5] “Health Savings Account (HSA)“. Julia Kagan, 01-Mar-2021, investopedia.com.

[6] “An Introduction to 529 Plans“. U.S. Securities and Exchange Commission, 29-May-2018, sec.gov.

[7] “Complete Guide to 529 Plans“. Julia Kagan, 07-Jul-2021, investopedia.com.

[8] “Why Einstein Considered Compound Interest the Most Powerful Force in the Universe“. Jim Schleckser, 21-Jan-2020, inc.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Emotions Of Selling A Business

In our work with business owners, we ask them, “What does your life look like after you sell your business?” Many times, we get a blank look.

By SJS Investment Services Founder & CEO Scott Savage.

In our work with business owners, we ask them, “What does your life look like after you sell your business?” Many times, we get a blank look.

That blank look is understandable. These very busy business owners have their focus in the here and now - on the needs of their families, employees, and customers. They have little time left over to think about tomorrow, and they may even be avoiding it. Change is unnerving, the future is unknown, and it’s more comforting to focus on what seems certain and controllable.

But that future will come, planned or not, and you can help yourself with the change by envisioning your business succession process. By spelling out what you want your future to look like, you can help counter the loss of identity you might feel when you wake up one morning and realize that you don’t have a company to wake up for.

We urge anyone who is planning to exit their business, or who has already exited, to read The Second Mountain by New York Times best-selling author David Brooks. He writes of two metaphorical mountains. The first encompasses what many business owners have pursued, as these are the goals that our culture tells us to focus on - social status, happiness, a nice home, a loving family, great vacations, good food, wonderful friends, and on and on.[1]

But some people get to the top, sell their business, and find it unsatisfying. “Is this it?” they ask themselves. They sense that there must be a more meaningful journey they can take. As Robert Powell once wrote, “Without purpose, many retirees begin to decline. When we ask a pre-retiree what they’ll do when they retire, and they respond with ‘golf,’ it’s a good indicator that they are not prepared.”[2]

The second mountain is where people realize their ego can never be satisfied. They find out they don’t want to be a full-time consumer - they want to be consumed by a moral cause. They realize independence is lonely, and they long for connection, relationships, intimacy, responsibility, and commitment. They seek long-lasting joy rather than temporary happiness.

In our experience, the second-mountain perspective is a helpful way to think about your life when you are still on top of the first mountain!

To help business owners work through their emotions as well as make better decisions when considering selling their businesses, we wrote an ebook entitled Your Business Exit: Monetizing Your Life’s Work. We explore how your situation can come together - the dollars and the cents, as well as the behavioral - so that you can create a successful business exit.

If you have any questions or want to talk through your potential business exit, please feel free to reach out to us. We have helped many business owners successfully handle the financials as well as the emotions of exiting their businesses, and we would be happy to help you as well.

Important Disclosure Information & Sources:

[1] The Second Mountain. David Brooks, 2019, Random House.

[2] “Why you need to have purpose in your daily life even when you retire“. Robert Powell, 26-Dec-2018, USA Today.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What Should You Consider If You Suddenly Receive Wealth?

To identify some considerations that may arise if you suddenly receive a large amount of wealth, we offer this guide.

By SJS Investment Services Senior Advisor Andrew Schaetzke, CFP®.

Suddenly receiving wealth can be life-changing, allowing you to make purchases or investments, pay down debts, and / or give you more financial freedom to accomplish your goals and dreams. At the same time, receiving a large amount of wealth can also complicate your life - financially, psychologically, and relationship-wise.

The good news is that you don’t have to figure out everything on your own. There are many good people and resources available that can help answer your questions and offer you guidance. By knowing some of the issues ahead of time, you may better handle the situation if you do ever find yourself with a lot more wealth.

To identify some considerations that may arise if you suddenly receive a large amount of wealth, we offer the guide below. From this, you may come away with answers and action items for the following:

How may surplus wealth impact my spending habits and annual cash flow?

What tax considerations should I be aware of?

Should I pay off or restructure certain debts, such as student loans, mortgages, family loans, etc.?

What long-term planning issues should I consider, such as philanthropy, gifting, retirement changes, etc.?

As always, we are here to help you evaluate your personal situation and help you better handle the present while also planning for the future. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide tax advice. Please consult your tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

SJS Investment Services Recognized In Financial Advisor Magazine’s 2021 Registered Investment Advisor Ranking

SJS has been recognized in Financial Advisor Magazine’s 2021 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2021 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.[1]

“Recognition by one of the financial industry’s most respected publications is humbling, and simply reflective of the faith, commitment, and loyalty our clients have demonstrated in SJS over the last 26 years,” says SJS Founder & CEO Scott Savage.

Financial Advisor (FA) Magazine’s 2021 RIA Survey & Ranking is a ranking based on assets under management as of 31-Dec-2020. FA Magazine orders firms from largest to smallest, based on AUM reported by firms that voluntarily complete and submit FA Magazine’s survey by the given deadline. FA Magazine verifies AUM by reviewing ADV forms. To be eligible for the ranking, firms must be independent Registered Investment Advisors and file their own ADV statement with the SEC, and provide financial planning and related services to individual clients. Corporate RIA firms and Investment Advisor Representatives (IARs) are not eligible. There is no fee to apply or to secure placement within the ranking. 607 RIA firms are included in the 2021 ranking. FA Magazine does not track the number of firms that applied but failed to meet the required criteria. Additional disclosure information regarding the 2021 RIA Survey & Ranking can be found on the Financial Advisor Magazine website.[1][2]

If you would like to learn more about how we work with families and organizations, please reach out to us. We are always here to listen and assist.

Important Disclosure Information & Sources:

[1] “The Future Is Now”. Eric Rasmussen, 16-Jul-2021, fa-mag.com.

[2] Additional information regarding the rankings can be found in the 2021 RIA Survey & Ranking PDF: “2021 RIA SURVEY”. Financial Advisor Magazine, July / August 2021, fa-mag.com.

Past performance is no guarantee of future results. There is no guarantee investment strategies will be successful.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Transition From Work Income To Retirement Income

When we spend as much as thirty or more years of our life working and saving for retirement, the idea of “undoing” our life’s work might seem a little unsettling.

By SJS Investment Services Managing Director & Senior Advisor Jennifer Smiljanich, CFP®.

Retirement. There is a lot of emotion and change tied up in this single word - beginnings, endings, opportunities, uncertainties, regrets, excitement. In our conversations with clients over the last 25+ years, we have observed that one of the most challenging transition points in life is the move from “work” to “retirement.” In some ways, as much as this change results in a physical shift - no longer going to work - the mental shift from saving to spending sometimes is a bigger adjustment.

We spend a lot of our adult lives developing habits; hopefully, most of them good ones! Author James Clear has written about human behavior and how we form habits. He commented on a study by Phillippa Lally that found that people take somewhere between 18 to 254 days to form a new habit, depending on behavior, the person, and the circumstances.[1] So if we think about developing a retirement mindset as a new habit, transitioning from the idea of saving our nest egg to being comfortable spending it, it might take between two and eight months to gain comfort. Clear’s takeaway is that “understanding this (is a process) from the beginning makes it easier to manage your expectations.”

So how do we get comfortable with transitioning our nest egg to an income stream? In our working lives, we are used to receiving a regular income stream, whether from a bi-weekly paycheck, paid invoices for consulting income, or payment on completion of a project. So why should it be different in retirement? Receiving a distribution of income on a regular basis - monthly or even twice a month - helps to create that regularity that is comforting. Others may find that a quarterly distribution is adequate for meeting cash flow needs. Consider the frequency that seems most comfortable, and we can work with you to support it!

Second, the need for emergency or “rainy day” funds doesn’t go away. Just because you may now be retired, the twists and turns of life don’t stop. Emergency funds can cover pleasant opportunities like taking an unplanned trip, or it might be available to cover unexpected necessities like an air conditioning unit that suddenly needs replacement or a bill for a dental emergency. We typically recommend setting aside three to six months’ worth of expenses, so when life throws a new opportunity or cost our way, we can feel a little more comfortable knowing there is some financial leeway!

Third, we understand that your “routine” is bound to change. As you have more time to spend time with family, friends, & loved ones, to enjoy new or old hobbies & activities, to travel, or to focus on all those neglected home projects, normal routine is about to be redefined. Take some time to find the rhythm of your new life and endeavors, and we will help guide you along the way.

Finally, we can help you answer the questions of “how much to withdraw” and “from what account do I take it.” We can model how your nest egg can best supplement income from part-time work, pensions, and / or Social Security to meet your lifestyle needs, as well as when you might start those different income streams. In collaboration with your tax professionals, we can help evaluate whether your income should come from after-tax or retirement accounts. Likewise, we can help you determine the stock-to-bond mix that supports the growth you might need, at a risk level you are comfortable with.

When we spend as much as thirty or more years of our life working and saving for retirement, the idea of “undoing” our life’s work might seem a little unsettling. At SJS, we have had the privilege of guiding many of our clients through the preparation and transition to retirement. We are here for you, to lend an ear, to listen, and hopefully to help make the transition a more smooth and enjoyable one!

Important Disclosure Information & Sources:

[1] “How Long Does it Actually Take to Form a New Habit? (Backed by Science)“. James Clear, jamesclear.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

The Topic That Keeps Rising To The Top: Inflation

Before worrying too much about runaway prices and the inability to pay the rising costs, we believe it’s important to look at a few underlying factors.

By SJS Investment Services Chief Investment Officer Tom Kelly, CFA.

As the summer vacations and barbeques kick back into full swing, one conversation topic continues to rise to the top – inflation. Thankfully for many of us, gone are the days of masks, social-distancing, and awkward elbow bumps. The new “fear” is now, “Are things in the economy too good?” What a difference a year makes!

In last quarter’s SJS Outlook, our headline piece asked, “Inflation: Necessity or Risk? And What Should We Do?” Since then, inflation has continued to rise, as we’ve seen year-over-year inflation rates come in at 4.9% in May 2021 and 5.3% in June 2021, leading to continued questions and worries of “hyperinflation.”[1] However, before worrying too much about runaway prices and the inability to pay the rising costs, we believe it’s important to look at a few underlying factors.

As I mentioned earlier, what a difference a year makes. If you think back to all the uncertainty, and therefore lack of spending, that existed in Spring 2020, you would not be surprised to know that inflation was falling and near zero at this point last year. The year-over-year inflation numbers, which make the headlines, look a bit magnified because of where we were last year. When looking at prices compared to “pre-pandemic” levels, by observing annualized inflation over the last two years, inflation was only 3.0% in June 2021.[1]

“Consumer Price Index for All Urban Consumers: All Items in U.S. City Average”. U.S. Bureau of Labor Statistics, June 2021, fred.stlouisfed.org.

Additionally, when breaking down some of the components of inflation, indications point to some of the main causes of the recent rise as more transitory vs. pervasive. As of June 2021, areas such as airline fares (up 25% from a year ago) and used cars & trucks (up 45% from a year ago, due largely to a chip shortage) suggest that pent-up demand and temporary supply chain bottlenecks will lead to the dramatic rises being short-lived rather than enduring.[2][3]

We welcome the continued growth of the economy and potential of increased inflation as opposed to the alternate reality of stagnation and weak economy. Could inflation become a major problem? Certainly. Do we think inflation is a major problem right now? Probably not. Should you make drastic moves to ward it off? Not prudent in our opinion.

As Mark Twain purportedly said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” We continue to be humble about what we don’t know – the direction of inflation and corresponding market movements included – and focus on what we can control: designing portfolios to help you achieve your financial goals and putting you first. All the time. Every time.

Important Disclosure Information & Sources:

[1] “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average”. U.S. Bureau of Labor Statistics, June 2021, fred.stlouisfed.org. US Bureau of Labor Statistics Consumer Price Index All Urban Seasonally Adjusted is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers. This particular index includes roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force.

[2] “Consumer Price Index for All Urban Consumers: Airline Fares in U.S. City Average“. U.S. Bureau of Labor Statistics, June 2021, fred.stlouisfed.org.

[3] “Consumer Price Index for All Urban Consumers: Used Cars and Trucks in U.S. City Average“. U.S. Bureau of Labor Statistics, June 2021, fred.stlouisfed.org.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Paying It Forward

Inspired by many clients throughout the years, SJS Team Members are encouraged to “pay it forward“ with their time, talents, and resources to advance the missions of worthy non-profit organizations.

By SJS Investment Services Founder & CEO Scott Savage.

Inspired by many clients throughout the years, SJS Team Members are encouraged to “pay it forward“ with their time, talents, and resources to advance the missions of worthy non-profit organizations.

For the last 13 years, I have had the good fortune of being appointed by Probate Judge Jack Puffenberger to the Board of Park Commissioners responsible for the governance of Metroparks Toledo. The five-member Board meets monthly in a public forum, as the majority of funding for this 90-year-old conservation and preservation agency comes from property owners in Lucas County.

Source: “Cannaley Treehouse Village”. Metroparks Toledo, metroparkstoledo.com.

Similar to SJS' story over the last 26 years, Metroparks Toledo has been guided with a big Vision, an unwavering Mission, Core Values, and a Team of people who Exceptionally Execute on a daily basis to make the Vision real.

For years, the Vision focused on access to parks and trails. Research tells us that the closer one lives to a park or trail, the more likely they will enjoy the physical, mental, and emotional benefits of a Metropark![1] Our North Star was for every citizen of Lucas County to live within five miles of a Metropark. Aggressive expansion and increased connectivity between parks ensued. In 2020, we dedicated Manhattan Marsh Metropark in North Toledo, thus achieving the Vision.

Source: “Manhattan Marsh Preserve Metropark”. Metroparks Toledo, metroparkstoledo.com.

What did this mean? Time for a new Vision!

With incredible input from fellow Board Members and the Team at Metroparks, the new Vision was adopted:

Metroparks Toledo will be, in its culture and community engagements, the beacon for conservation of natural resources; diversity, equity, and inclusion; and the activation and promotion of spaces that enhance physical and mental health. The communal pursuit of these aspirations will elevate our region and transform its identity.

I believe that Metroparks Toledo has always been on the short list of community assets that help distinguish the Northwest Ohio region in a positive way. In fact, Metroparks Toledo was the recipient of the 2020 National Gold Medal Award for excellence in parks and recreation management, the most prestigious honor in the parks and recreation industry.[2]

Bold Vision combined with Exceptional Execution has created a culture of excellence as we strive to preserve and protect some of the world’s most precious resources. Making sure each contribution is “Metroparks-worthy“ drives the actions of all associated, from employees to volunteers. All agree, the future of Metroparks Toledo is clear and bright. Guided by our Vision, the best is yet to come!

My hope is this story inspires you to engage your passion and make the world a little better place for our children and grandchildren.

Important Disclosure Information & Sources:

[1] “The Value Of Metroparks“. Metroparks Toledo, metroparkstoledo.com.

[2] “Metroparks Receives National Gold Medal Award“. Metroparks Toledo, 28-Oct-2020, metroparkstoledo.com.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

SJS Outlook: Q2 2021

SJS Q2 2021 Outlook on inflation, transitioning from work income to retirement income, the MySJS app, new SJS Manager of Human Resources Tiffany Wilson, and a new member of the Schaetzke family.

Why Do Investors Underperform?

We want to emphasize six aspects of investor psychology - also known as cognitive biases - that tend to hurt investor performance, and what investors can do to address these biases.

By SJS Investment Services Investment Associate Bobby Adusumilli, CFA.

Over the past 40 years, advances in investment offerings and technology have provided investors with far more opportunities to invest in stocks and bonds compared to the past. From their laptops, people can now invest in markets all around the world. Mutual fund and ETF expense ratios have been decreasing, with many index mutual funds and ETFs approaching a 0.00% expense ratio.[1] Congress has created tax-advantaged accounts such as IRAs, 401(k)s, 529 plans, and HSAs to encourage people to invest while saving on taxes over time.[2] And more recently, many brokerage firms no longer charge trading commissions on stock and bond trades.[3]

Given all of these advances, you would think that investors have gotten better at earning their fair share of investment returns. However, you may be surprised to learn that most stock and bond investors in the US still significantly underperform the market averages.

For example, as of 31-Dec-2019, DALBAR found that the average equity mutual fund investor underperformed the S&P 500 (a benchmark for the US stock market) by nearly 5% annually over a 30-year span.[8] For a $100,000 initial investment, that’s a 30-year ending portfolio balance of $437,161 for the average equity mutual fund investor compared to $1,726,004 for the S&P 500.[4]

What explains this underperformance? We think that part of the explanation is that many investors trade too much, as well as pay too much in transaction fees (including bid-ask spreads), high expense ratios, and unnecessary taxes. However, we think a bigger part of the explanation relates to investor psychology. In particular, we want to emphasize six aspects of investor psychology - also known as cognitive biases - that tend to hurt investor performance, and what investors can do to address these biases.[5]

Overconfidence

Overestimating our skills or circumstances, which interferes with our ability to make good decisions. For example, when evaluating a particular investment, an investor may feel really confident that they have a much better analysis than the general market.

Loss Aversion

The tendency to be driven more strongly to avoid losses than to achieve gains. For example, even when presented with better investment opportunities, an investor may decide to keep holding a stock that has declined in value until it can be sold at a gain.

Confirmation Bias

The tendency to seek out and interpret information that confirms or strengthens our existing beliefs. For example, after making an investment in a particular stock, an investor may actively search for news and analyses that support the decision to invest, as opposed to considering other news or alternative analyses.

Recency Bias

Believing that recent events are more likely to occur than they actually are. For example, a year after a major stock market downturn, many investors still avoid investing because they believe that another major downturn is likely to happen in the short-term.

Endowment Effect

The tendency to place more value on an investment that you own compared to the price it can be purchased / sold at on the open market. For example, particularly for an inherited stock or stock in the family business, an investor may value their shares more than the current market price.

Optimism Bias

The belief that our chances of experiencing negative events are lower and our chances of experiencing positive events are higher than the averages. For example, many investors believe that if they just have good returns over the short-term, they will be much happier and better off in the future.

What Can You Do About Your Cognitive Biases?

Cognitive biases are easy to write about, but hard to actually prevent from negatively impacting our investment returns. Based on our years working with clients, we find that the below actions tend to help investors achieve better investment returns:

Define Your Circle Of Competence, And Don’t Stray Beyond That

There are many different investment styles that have helped people become wealthy over time. However, because there are so many investors competing to find the best investments, many top investors only focus on one particular style of investing that they understand really well, and don’t even consider other potential investments. This frees them to focus on what they do best, and ignore everything else.

Create Strategies And Systems That Do The Work For You

Instead of making a new decision each time you have money to invest (which is often stressful and time-consuming), you can instead create a strategy and system that automatically makes the decision for you. For example, many of our clients benefit from the below investment process:

Invest in broadly-diversified, low-cost, tax-efficient global mutual funds and ETFs.

Maximize contributions to tax-advantaged accounts, such as IRAs, 401(k)s, and HSAs.

Dollar-cost average: every time you have money to invest, immediately invest according to your pre-specified asset allocation.

Have a pre-specified and largely automated rebalancing strategy.

Cap Your Downside Risks

As investor Warren Buffett says about investing: “Rule Number 1: Never lose money. Rule Number 2: Don’t forget Rule Number 1.“ When deviating from a well-crafted and implemented investment strategy, much more can go wrong than can go right. We generally advise for investors to limit all of their niche investments to less than 10% of their overall portfolio. Additionally, we encourage investors to have an emergency fund with six months' worth of expenses, as well as all appropriate insurance coverage, in order to protect themselves in case something happens to them or their investments.

Respect The Averages, And Only Deviate From Your Plan If You Actually Have An Advantage

Many studies have found that investors who buy and hold broadly-diversified, low-cost, global index mutual funds and ETFs outperform the vast majority of investors over the long-term.[6] Investing in stocks and bonds is extremely competitive. As a result, if you don’t have a particular competitive advantage, or if you are not able to spend the necessary hours to do thorough research on a regular basis, then you probably won’t benefit from attempting to time the market or investing in niche investments.

More Money Probably Won’t Make You Much Happier

Through his research, Nobel-Prize-winning psychologist Daniel Kahneman has found that while being poor makes people miserable, for most people with a basic level of wealth, more wealth does not significantly increase day-to-day well-being.[7] Once an investor has a good investment strategy in place and reviews this strategy periodically, spending more time analyzing investments is unlikely to significantly improve investment returns or make someone happier over time.[4][6][7]

Summary

As the data shows for the majority of people, investing well over the long-term is tough.[4][6] By understanding ourselves better and creating well-thought-out & systematic investment processes, we think that investors are more likely to earn their fair share of investment returns over time.

Important Disclosure Information & Sources:

[1] “Pay Attention to Your Fund’s Expense Ratio“. Jean Folger, 27-Oct-2020, investopedia.com.

[2] “The Basics of a 401(k) Retirement Plan“. Mark Cussen, 29-Mar-2021, investopedia.com.

[3] “In the race to zero-fee broker commissions, here’s who the big winner is“. James Royal, 04-Oct-2019, bankrate.com.

[4] “2020 QAIB Report”. DALBAR, 2020, wealthwatchadvisors.com.

[5] How to Decide. Annie Duke, 2020, Portfolio / Penguin.

[6] Unconventional Success: A Fundamental Approach to Personal Investment. David Swensen, 2005, Free Press.

[7] Thinking, Fast and Slow. Daniel Kahneman, 2013, Farrar, Straus and Giroux.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this post that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Certain advisors of SJS may recommend the purchase of insurance-related products. Certain advisors of SJS are licensed insurance agents with various insurance companies and may receive additional compensation for such transactions.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio.

The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States.

Bloomberg Barclays US Aggregate Bond TR USD Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS.

Inflation represented by the US Bureau of Labor Statistics Consumer Price Index All Urban Seasonally Adjusted, which is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers. This particular index includes roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What Should You Consider When Reviewing Your Investments?

To help you figure out what to consider when reviewing your investment plan, we provide this resource.

By SJS Investment Services Senior Advisor Andrew Schaetzke, CFP®.

Like most people, your financial situation will probably change significantly over time, whether due to new family members, new career, new expenses, additional assets, or various other changes. As your financial situation and financial goals change, your investment plan also probably needs to change in order to reach your financial goals. We find that people with well-thought-out investment plans are more likely to accomplish their financial goals than people who don’t create a plan.

To help you figure out what to consider when reviewing your investment plan, we provide the below resource. From this resource, you may come away with answers and action items for the following:

Do the goals, time horizon, and objectives of your investment portfolio need to be reviewed, updated, or documented? Do you need to create or update your written investment strategy and plan?

Do you need to review your risk tolerance or asset allocation?

Do you need to open a new account specifically tied to an investment objective, or consolidate existing accounts?

Are you trying to minimize your tax liability? If so, what are some ways to potentially decrease your tax liability?

As always, we are here to help you analyze your personal situation and help you plan for your future. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide tax advice. Please consult your tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Scott Savage Discusses His Book, "Your Business Exit: Monetizing Your Life’s Work"

SJS Investment Services Founder & CEO Scott Savage sat down with the Family Wealth Alliance to discuss insights from his book, "Your Business Exit: Monetizing Your Life’s Work."

SJS Investment Services Founder & CEO Scott Savage sat down with The Family Wealth Alliance to discuss insights from his book, "Your Business Exit: Monetizing Your Life’s Work." Watch below!

Transcript:

Tom Livergood: Welcome back to Alliance Talks. I'm Tom Livergood founder and CEO of The Family Wealth Alliance. And I'm joined today by Scott Savage. Scott is founder and CEO of SJS Investments. And they're a new member of the Alliance. We're delighted to have you Scott and happy to have you today on this episode.

Scott Savage: Well, it's a pleasure to join you Tom. I'm really excited to be a part of The Family Wealth Alliance, and we're really looking forward to learning, and contributing, and being part of The Family Wealth team.

Tom Livergood: Well, you're contributing today with this segment. And I think our listeners really neat to hear this. You recently put out an ebook called Your Business Exit: Monetizing Your Life's Work, which is really a terrific resource for clients with a unique take on business succession. And what I call a next chapter. Please tell us a little bit about the book and why you chose to write it, Scott.

Scott Savage: Well, we work with so many business owners and as a business owner myself, I started SJS 25 years ago. And as a business owner myself, I can really empathize with some of the issues and questions that our business owner clients have. And so there's that real connection that I feel to a business owner that we're advising. And so I thought, well, there are some lessons that I think I can bring on behalf of all this experience that I've had advising business owners over the years. And I thought, well, I'll get it out there in the ether. And hopefully help people avoid some of the pitfalls that are often made in this process by people who are generally selling a business one time in their life. And so you get one chance at doing it right.

Tom Livergood: I really liked that last point that you really have one chance to do it and you want to do it right. And I think that resonates more than anything that you've said. There's an interesting component that you've alluded to Scott, and of their resource mentioned in the subtitle, which is how to manage the financials and the emotions so that you can leave on your own terms. Business owners certainly would relate leaving on their own term, but the psychological journey I'd love for you to talk about. Because I wouldn't think that'd be top of mind with business owners as they prepare their deal team, as you've talked. Can you explain why you chose to address that particular aspect?

Scott Savage: Well, it's like the gold medal athlete bit. Wins the gold medal, stands on the podium, goes to bed that night and wakes up the next day, depressed and down. And I've had dozens of experiences of clients that have properly prepared to sell a business, sell a business on their terms financially and wake up the next day, feeling very, very down. And so to me, it's important that just let somebody know ahead of time, hey, look, this is how you're going to feel the day after you closed. And so then when it happens, they know, oh my gosh, this is normal. I'm in a big canoe and I'll get through that. But it's a really big component whether you're selling to family members, or to private equity, or to a strategic buyer. Irrespective when that life's journey kind of comes to an end or is monetized, it's a tough psychological leap that people need to make. And I just thought, gosh, let's give them a heads up about that.

Tom Livergood: Yeah. I think that's really smart. I know that parents can do a similar analogy about getting their kids ready to go to college, right. And it's just so exciting and the buildup and all that, and the selection, you drop them off and you leave and,

Scott Savage: And you're going to cry.

Tom Livergood : You're not happy. Right. No, I get it. Business owners really do go through a lot and you've given a lot of thought and consideration. What's the, maybe the one piece of advice that you would leave with them in preparing for that transition?

Scott Savage: Well, I think in this country, Tom, I'm sure you'll agree that the way to create wealth in our country is still through a very concentrated bet on a certain industry, oftentimes in one geography. So having all your eggs in one basket, and this person has been watching that basket for sometimes decades. But the job is to monetize that basket. The job becomes then to preserve and protect what you've spent your life creating. And it's a very different mindset. You give up a lot of control. A lot of people have a really tough time with that transition of depending on the financial markets to send them their paycheck in the future. So their financial issues, and there are emotional issues, and they're absolutely connected.

Tom Livergood: Yeah. Well, Scott, thanks for sharing. I appreciate your insights. Very grateful that you've joined me on this episode for a discussion about this. If you haven't picked it up, get SJS Investments ebook, Your Business Exit: Monetizing Your Life's Work. You can find it on your screen here. You can go to our resource and SJS's. But you've done great work as a leader at SJS Investments, Scott. And we appreciate you sharing that today. That's all we have time for. Thank you for joining us for another installment of Alliance Talks. Make it a great day.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this video that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Growing A Business Is A Series Of Mistakes

26 years later and having tasted every flavor of humble pie, I offer a number of experienced-based ways to reduce the risk of making the next big mistake.

By SJS Investment Services Founder & CEO Scott Savage.

When I founded SJS Investment Services 26 years ago, self-confidence was not in short supply. How hard could it be to grow SJS into a billion-dollar firm? 2 billion? 5 billion? In retrospect, it was much harder than first thought, and landmines called “mistakes” were more numerous than I care to admit!

26 years later and having tasted every flavor of humble pie, I offer a number of experienced-based ways to reduce the risk of making the next big mistake.

Separate “Stimulus” And “Response”