Three Graduating High School Students Shadow SJS Investment Services

For three graduating high school Seniors who shadowed us recently, we asked each student to write a 2-3 paragraph summary of what they learned during the week.

One of our favorite traditions at SJS Investment Services is when students shadow us for a week. Many current SJS Team members first learned about SJS through shadowing, so it brings back good memories for us. Additionally, it is an opportunity for us to teach the next generation of investors some of what we have learned, as well as learn from them.

From May 10-14, 2021, three graduating Seniors from St. John’s Jesuit High School - Max Bruss, Theodore Gothier, Nicolas Conway (in order, pictured above) - shadowed the SJS Team in Sylvania, Ohio. Throughout the week, they did activities including:

Learned about the importance of investing, as well as different ways of investing

Learned about retirement and other investment accounts (ex. IRA, 401(k), 529, HSA, etc.)

Created a LinkedIn profile (Max, Theodore, Nicolas) and resume

Read The Investment Answer by Daniel C. Goldie and Gordon S. Murray

Helped create financial presentations and simulations

Pitched an investment idea for the SJS Team to consider

We asked each student to write a 2-3 paragraph summary of what they learned during the week, which we share below. We thank Max, Theodore, and Nicolas for spending the week with us, and we wish them well as they embark on their college journeys!

Max Bruss

My experience at SJS Investment Services has been very beneficial for me in learning about many aspects of working in the real world. The sense of community as well as team efforts stand out tremendously here. Everyone combines their intelligence and diligence to keep the ship sailing. This allows for agreement on good ideas one may have that others aren’t thinking of, among other things. All colleagues here have something different to offer in a different aspect of the business. I would say the group of people working here is quite optimal for the business and they all fit into their positions quite well.

One reason I say they fit well here is because they all were able to educate us on everything that goes on here and who has which responsibilities. Mr. Schaetzke taught us about the connections with clientele and how new clients come to the firm for their services. Mr. Adusumilli taught us about how to decide which investments may be right for us. He also showed us how you can approach different situations including getting employed, treating people right, doing research on your investments, making pinpoint decisions based on your research, and starting early on your investments.

We spoke to Mr. Ludwig and he gave his expertise on bonds and how mass adoption changes the world constantly. An important lesson Mr. Savage gave us was his experience with running a business and making mistakes to get to where he is today. Another thing he presented to us was how important it is to have mentors to guide you in the right direction in becoming extremely successful. After all, if something has worked for someone in the past, it may work for someone else in the future. That, of course, applies to having success in running a business. I would love to include my experiences with all of the extraordinary people I have talked to over the past week but this was just meant to be a brief overview of my experience here. There was a lot of knowledge handed to us; it was quite an interesting experience to have shadowed here. I will be taking the things I have learned during this experience for the rest of my life and into the financial world.

Theodore Gothier

The opportunity to shadow at SJS has provided me with much more than I expected. Not only did I gain real world insight into the professional world but I was able to learn from everyone at the firm about what they do and how they tie in the needs of their clients to their constantly developing philosophy, MarketPlus Investing. Each individual of the team provided me with knowledge about investing and financial planning that I believe will be very beneficial for my future in finance. They even taught me things to potentially help me better handle my money for the long term prosperity of it, whether that be planning what to invest in retirement accounts or learning to choose a diversified portfolio in a market that is hard to predict.

Spending time with everyone exposed me to different sides of finance, like client facing as well as analytical, which really opened my eyes to the opportunities that exist and how each person plays a different part in the investment world but often work together to benefit the same client. A lot of the time spent was with Bobby Adusumilli, the main point of contact for this experience, who prepared me well to fully immerse myself with this time through planned presentations and a schedule that allowed him to educate us in the multiple facets of equities such as through mutual funds or ETFs, retirement accounts like a Roth IRA, or even bonds of which I was unfamiliar with until I came here. After this, I got to sit down with different SJS employees who each specialize in a different part of the business to learn more about what they do. I was often given resources to do more research and to help guide me. With each person at SJS, employees and in management, I felt like wisdom was passed down that will stick with me. I feel like this was not just a professional experience, but an educational one that will make me better prepared for my future endeavors.

Nicolas Conway

My time here at SJS has been something I will come to remember. Having the opportunity to shadow here has helped create the first step into a field I believe I will enjoy. I have gained a lot of knowledge on lots of aspects related to investing, as well as other things that have stood out about working in the real world. Learning from and listening to many different people throughout SJS has provided wisdom and can serve somewhat as a guide for the future. Through meeting everyone and seeing the different roles they play, I see the knowledge that comes along their strong interests in investing.

With Bobby as the main person talking with us and scheduling our days, he provided a lot of helpful knowledge that can greatly support my money managing when I get older. Through a lot of our talks and discussions, I learned about different types of investment accounts which can potentially help maximize returns over time. Starting to invest early is one of the biggest things for someone like me in order to help me potentially maximize my returns and be financially stable for the future. We also learned about different ways that someone can invest money through the different types of investments like stocks, bonds, real estate, etc., depending on the volatility that someone is willing to accept. All things together, I enjoyed shadowing here, as they showed me a lot of different aspects of the workplace environment and gave me an overview of the finance field.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What You Need to Know Before You Invest Your Money

Smart investors do their homework, find people they can trust and use strategies that work for them. Here are three things investors must know about themselves.

MarketPlus Investing® Helps Investors Choose What’s Right for Them

By SJS Investment Services President Kevin Kelly, CFA.

With countless investment options available to you, with so much written about the state of the markets, the state of the economy, and the state of the world, deciding how to invest your money - whether it be your own or an organization’s - keeps getting more complicated. Smart investors do their homework, seek out people they can trust, and find investment strategies that work for them. In words, that sounds easy. In practice it isn’t very easy at all.

SJS Investment Services has spent decades helping people choose what’s right for them when it comes to investments through our proprietary investment process called MarketPlus Investing. And through it all, we have discovered the three most important things investors need to know about themselves before they invest.

WHO ARE THE PEOPLE YOU CARE ABOUT AND HOW DO YOU WANT TO TAKE CARE OF THEM?

In the course of conversation, SJS Investment Services gets to the core of what’s important. It might be a person or a cause, but until we know who you care about and how you want to take care of them, we don’t know enough about you to fully guide you.

WHAT IS YOUR TIME WINDOW? (OR, HOW LONG IS YOUR RUNWAY?)

How long before you or the people you care about need your money? This makes a big difference when determining an appropriate investment vehicle for you or your organization. Some individuals have a time window of twenty years or more. Others, including organizations, want investments that cover their expenses next month or next year. Between the extremes are an infinite number of scenarios, and each imply a different investment strategy.

HOW RISK AVERSE ARE YOU?

When asked this question, investors are often quick to say that they are comfortable with risk. But the reality is that many investors are more risk averse than they think. That’s why SJS Investment Services digs deeper than just this question to find out the real answer. And more importantly, we ask about necessary or desired return on an investment*, so we can help design an investment portfolio appropriate for you.

At SJS Investment Services, these three questions are just a part of getting to know you. The more we know about you, the better we can design a MarketPlus Investing portfolio for you. Because MarketPlus Investing is our proprietary science-based process of structuring investment portfolios to help people achieve their specific financial goals, there are countless options. And the more we know, the better we can apply the academic models, the market trend analysis and consider ever changing key indicators on your behalf. SJS Investment Services through MarketPlus Investing seeks to develop the right portfolio design to meet your needs.

Important Disclosure Information:

*There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Are Stocks Riskier Than Bonds?

You have probably heard the saying, “Stocks are riskier than bonds.” While the logic makes sense, are stocks actually riskier than bonds?

By SJS Investment Services Investment Associate Bobby Adusumilli, CFA.

You have probably heard the saying, “Stocks are riskier than bonds.” The idea is that if investors take greater risk, they should get rewarded with a higher return over time; therefore, since stocks are riskier than bonds, then stocks should have higher returns over time. While the logic seems to make sense, we wanted to look at the historical data to answer the question: are stocks actually riskier than bonds?

The answer is: it depends on how you define risk. If you define risk as portfolio fluctuations over the short-term, then stocks have generally been riskier than bonds. However, if you define risk as loss of wealth over the long-term, or as lost opportunity to grow wealth over the long-term, then you may be surprised to learn that stocks may not actually be much riskier than bonds.

We want to illustrate these points via graphs. We use the S&P 500 Index as representative of the U.S. stock market, and the Bloomberg Barclays U.S. Aggregate Bond Index as representative of the U.S. bond market.[1][2] We want to focus on increases in purchasing power, so we use the U.S. Consumer Price Index (CPI) to calculate real (inflation-adjusted) returns.[3] Additionally, in order to use as much reliable historical data as we can, we chose the S&P 500 Index that has available data since 1926, while the Bloomberg Barclays U.S. Aggregate Bond Index has data since 1976.

It’s important to emphasize that indices are not directly investable. Before the last few decades, it was difficult for an individual to invest similar to a broadly-diversified index in a low-cost, tax-efficient, trading-efficient way. Therefore, it is unreasonable to expect that any investor could have matched the index returns below. However, with the increasing popularity of index funds over the past 25 years, an individual investor has a much greater ability to achieve returns similar to a well-known index in a low-cost, tax-efficient, trading-efficient way going forward.[4]

Risk: Portfolio Fluctuations Over The Short-Term

The U.S. stock market tends to fluctuate a lot from year-to-year. Since 1926 using end-of-year data, yearly real returns have ranged from -38% to +58%, rarely staying flat.

Source: Dimensional Returns Web. See “Important Disclosure Information” below.[1]

Comparatively, the U.S. fixed income market has been much more steady. Since 1976, yearly real returns have ranged from -10% to 27%, with most returns within the range of -7% to 7%.

Source: Dimensional Returns Web. See “Important Disclosure Information” below.[2]

These graphs above support the argument that stocks are riskier than bonds, if you define risk as fluctuations in value over the short-term.

Risk: Loss Of Wealth Over The Long-Term

Since 1945 based on end-of-year data, the U.S. stock market has not had a negative 20-year real return. The annualized 20-year real returns have ranged from 1% to 15%.

Source: Dimensional Returns Web. See “Important Disclosure Information” below.[1]

Similarly since 1995, the U.S. bond market 20-year real return has never been negative. The annualized 20-year real returns have ranged from 3% to 7%, and have generally been steadier than the U.S. stock market.

Source: Dimensional Returns Web. See “Important Disclosure Information” below.[2]

It’s surprising, but if you define risk as loss of wealth over the long-term, then U.S. stocks have not actually been much riskier than U.S. bonds over longer-term periods.

Why This Matters

You may be wondering why the definition of risk matters. To demonstrate, this graph below shows the real growth of $100 for both the U.S. stock market and U.S bond market since 1976. Although U.S. stocks had significantly greater short-term fluctuations than U.S. bonds, $100 grew to $3,184 for the U.S. stock market, compared to $510 for the U.S bond market. A big difference.

Source: Dimensional Returns Web. See “Important Disclosure Information” below.[1][2]

If you define risk as short-term fluctuations in value, then you may be tempted to invest more in bonds than in stocks. Conversely, if you define risk as long-term loss of wealth or lost opportunity to grow wealth, then you may be able to better withstand the yearly fluctuations in favor of more stocks. As Jeremy Siegel wrote in his best-selling book, you may be able to commit yourself to “stocks for the long run”.[5]

Considerations

Because of evolving needs, many investors use different definitions of risk at different periods of time as well as for different accounts. There are many legitimate reasons to focus on short-term portfolio fluctuations - and thus potentially invest more in bonds - including:

Cash flow needs in the short-term and / or intermediate-term

Potential expected return benefits through diversification and rebalancing

Belief that the stock market will not continue to provide positive returns in the future

Ability to psychologically withstand large market fluctuations

Focusing more on current self compared to future self

If you have varying goals and time horizons for your wealth, then you can consider the following:

For shorter-term (<5 years) cash flow needs, you can define risk as short-term portfolio fluctuations, and focus more on bonds.

For longer-term (10+ years) investing (e.g., 401(k), IRA, savings for future children / grandchildren), you can define risk as long-term loss of wealth, and focus more on stocks.

For intermediate-term (5-10 years) cash flow needs, you can combine the definitions of risk, and use a balanced portfolio of stocks and bonds.

Conclusion

Many investors have greatly benefitted from investment markets historically (particularly stocks), and we expect investors to continue to benefit going forward.[6] Defining how you think about risk can significantly impact your future returns. If you have any questions or want to talk about your situation, please feel free to reach out to us.

Important Disclosure Information & Sources:

[1] The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States.

[2] The Bloomberg Barclays US Aggregate Bond TR USD Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS.

[3] The US Bureau of Labor Statistics Consumer Price Index (CPI) All Urban Seasonally Adjusted is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers. This particular index includes roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force.

[4] “Index Funds Are the New Kings of Wall Street“. Dawn Lim, 28-Sep-2019, wsj.com.

[5] “Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies“. Jeremy Siegel, 2014, McGraw-Hill Education.

[6] “SJS 2021 Capital Markets Expectations: Making Sense Of The Future“. SJS Investment Services, 04-Feb-2021, sjsinvest.com/blog.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Better Together

At SJS, we know a team is only as good as how well its members work together – for you, and for each other. We strive to do both of these things really well.

By SJS Investment Services Founder & CEO Scott Savage.

Have you ever tried to do something really hard alone? How did you feel while doing it? Did you have to do it alone?

Many times throughout my life, I have tried to do hard things alone, such as starting my own business and training for my first Ironman Triathlon. While I feel very grateful for these experiences, I also learned that I much prefer being part of a team as opposed to going alone. While the daily work isn’t necessarily easier, working with a group of people I respect and trust makes all the difference!

I was reminded of the importance of teamwork when this past weekend, four members of the SJS team - Lisa Denstorff, Andrew Schaetzke, Michael Savage, Bobby Adusumilli - along with Brad LaClair teamed up to run the Glass City Marathon (for the fourth year in a row). As opposed to each person running the entire marathon alone, they participated in a relay, each running a portion of the 26.2 miles. They ran much faster together than if any one person ran the whole marathon alone.

SJS team members from left to right: Andrew Schaetzke, Michael Savage, Lisa Denstorff, Bobby Adusumilli, Jeff Yost.

One member of the SJS team - Jeff Yost - decided to run the full marathon alone, setting a personal record and we are hopeful will qualify for the famous Boston Marathon. He and fellow SJS team member Meredith Sleet joined the rest of the SJS runners in preparation before and celebration after completing the marathon. This is one of the main benefits of being on a team: doing something better by doing it together, while also having more fun. It reminds me of one of my favorite quotes:

“Coming together is a beginning. Keeping together is progress. Working together is success.” – Henry Ford

At SJS, we know a team is only as good as how well its members work together – for you, and for each other. We strive to do both of these things really well. When we say you come first, we achieve it by working together for you. So what are our secrets for achieving success as a team? Here’s our list:

Know your role – All team members know the responsibilities and the expectations of their role.

Support and trust – Team members care about each other and cooperate to get the job done.

Passionate for the cause – The best teams have been there and done that, but still love what they do.

Keep communicating – Teams with open channels of communication function better than those without.

Give even more – The team that has members who put others before self can do more than those with team members who focus on themselves.

You may not realize this, but when you work with SJS, you are working with this kind of team. We tend to be quiet about it; don’t even talk about it, really. It’s just how we work to serve you.

No one person is smarter or better than the collective whole, and the good news is, when you have one of us working on your side, you have all of us, even if you regularly meet or speak with only one or two. We call it ‘bench strength’ – with an emphasis on strength. We don’t fly solo, and neither do you.

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

How Would President Biden's Tax Plan Impact Your Finances?

President Biden’s administration recently released details of a proposed tax plan. To help you determine how the proposed tax plan may impact your finances, we provide these resources.

By SJS Investment Services Senior Advisor Andrew Schaetzke, CFP®.

As you might have heard, President Biden’s administration recently released details of a new proposed tax plan, to potentially go into effect starting in 2022 pending congressional negotiations and approval.[1] To help you determine how this proposed tax plan may impact your finances, we provide the below resources to help simplify the changes and address your questions. As always, please consult your tax professional for specific advice.

From this checklist you may come away with answers to the following:

How may federal income taxes, Social Security taxes, capital gains taxes, estate taxes, and corporate taxes change?

Will tax deductions for traditional retirement accounts (e.g., 401(k) & IRA) change?

Are there additional tax credits for small business owners?

How will the Child and Dependent Care Tax Credits change?

Will the step-up rule for inherited assets change?

Will first-time homebuyers receive a federal tax credit?

As always, we are here to help you analyze your personal situation and help you plan for your future. Please feel free to reach out to us if you have any questions.

How Might President Biden’s Tax Plan Affect Me?

As A High-Income Taxpayer, How Might President Biden’s Tax Plan Affect Me?

Important Disclosure Information & Sources:

[1] “Biden Will Seek Tax Increase on Rich to Fund Child Care and Education“. Jim Tankersley, 22-Apr-2021, nytimes.com.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide tax advice. Please consult your tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

The Case For International Diversification

While history has shown that US stock markets have handily outperformed international developed markets in nine of the last eleven calendar years, we may be due for a sea change.

By SJS Investment Services Managing Director & Senior Advisor Jennifer Smiljanich, CFP®.

We believe that diversification is one of the foundational principles of investing. While many of us might have a favorite stock or two, it is not ideal for most of us to invest in just a few names or in particular parts of the market, such as sectors, countries, or regions. While concentrating portfolios may certainly be a way to create wealth, it also concentrates risk.

Rather, if your concern is to protect your investments, reducing risk by investing across a broad spectrum of asset types may be the better strategy. American film producer Jerry Bruckheimer may have said it best:[1]

I mean if you put all of your eggs in one basket, boy, and that thing blows up you've got a real problem.

Film-making aside, as investors, we know that it is difficult to be able to predict the best part of the market to invest in over any length of time. Case in point, who would have predicted the strong US stock market performance of 2020, especially if we go back to March of last year?[2] While history has shown that US stock markets (as represented by the S&P 500 Index) have handily outperformed international developed markets (as represented by the MSCI EAFE Index) in nine of the last eleven calendar years, we may be due for a sea change. From 2002-2009, it was international stock markets that outpaced US stock markets.[2]

Source: Morningstar, as of 31-Dec-2020. See Important Disclosure Information.[2]

Another potential benefit of global diversification is exposure to different currencies. Diversified currency exposure can protect your portfolio from unexpected risks, such as inflation. Given the start of a weakening dollar, international markets might again take the lead in the performance race. When the US dollar weakens, international stocks are worth more in US dollar terms. This was generally true from 2001-2010, when the international markets last experienced their stretch of outperformance.[3]

Source: “U.S. Dollar Index (DXY)”. Wall Street Journal, 30-Mar-2021, wsj.com. See Important Disclosure Information.[3]

As we enter the modified “Awards Season,” cinema buffs may recall the 2020 Oscar for Best Picture went to the foreign film Parasite, which became the first non-English language film to win the Academy Award for Best Picture.[4] Could this be a coincidental foreshadowing of what’s to come in the markets? We’ll have to wait and see what the envelope holds! But know that you can sit back, relax, and enjoy the show, knowing that your MarketPlus Portfolio is well diversified and strives to be positioned for whatever the future brings.

Important Disclosure Information & Sources:

[1] “Jerry Bruckheimer Quotes”. quote.org.

[2] Morningstar, as of 31-Dec-2020. The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States. The MSCI EAFE GR USD Index is a free float-adjusted market-capitalization-weighted index that measures the performance of the large and mid cap segments of developed markets, excluding the US & Canada equity securities.

[3] “U.S. Dollar Index (DXY)”. Wall Street Journal, 30-Mar-2021, wsj.com. The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies.

[4] “Parasite (2019 film)”. Wikipedia, en.wikipedia.org.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Inflation: Necessity or Risk? And What Should We Do?

We believe economic inflation is a real risk - the other edge of the sword in contrast to the risk of stock-market volatility that is so often referenced in investment-risk discussions.

By SJS Investment Services President Kevin Kelly, CFA.

Have you ever had a flat? Re-inflating the tire is a good thing!

Ever over-inflated a tire? Or a balloon? Not so good!

Coming off the severe economic disruption from the early months of the COVID pandemic, you could justifiably argue that daily commerce had a flat tire - or four!

Never fear! Our duly elected leaders in Washington of BOTH parties were ready to help - a few trillion dollars in stimulus payments ought to do the trick!

A classic characterization of economic inflation, or its cause, is “too many dollars chasing too few goods.”

Of course, it is never quite that simple.

While “Money Supply” has increased measurably from this time one year ago, significant slack remains in our U.S. economy such that the “Velocity of Money,” or how frequently a dollar changes hands, has plummeted from the pre-pandemic rate. Both have an influence on inflation.[1][2]

Source: “Inflation, consumer prices for the United States“. Federal Reserve Bank of St. Louis, 03-Mar-2021, research.stlouisfed.org.

Anecdotally, we can point to price increases in housing, automobiles, some groceries, and fill-in-the-blank here based on your personal experience. Asset prices have increased as reflected by the stock market.[3] Producer Price Indices have surged, but this may not sustain as supply chains recover and stabilize.[4] The value of a dollar is on a downward trend compared to many foreign currencies.[5] The “breakeven inflation rate” indicated by the U.S. Treasury bond market suggests a 10-year rate of inflation approaching 2.4%, the highest this indicator has been in about eight years.[6]

But “what to do” quickly becomes the punchline, whether you anticipate inflation or not. SJS professionals believe economic inflation is a real risk - the other edge of the sword in contrast to the risk of stock-market volatility that is so often referenced in investment-risk discussions.

A primary motivation for taking investment risk to begin with is to maintain and grow the purchasing power of your assets. With cash deposits receiving close to a zero-percent rate of return, a general inflation rate of 2.4% will erode your purchasing power in a meaningful way over a period of years unless you invest beyond cash.

We recently “benchmarked” our model portfolios against the Consumer Price Index (CPI) to demonstrate

this inflation-beating characteristic of our investment strategies.

Benchmark: “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average (CPIAUCSL)”. Federal Reserve Bank of St. Louis, 31-Mar-2021, research.stlouisfed.org. See Important Disclosure Information.

Your MarketPlus Investing® design has allocations to inflation-adjusted bonds and inflation-hedging stocks for environments such as our current one. No hedge or adjustment is perfect, and inflation can put stress on your household budget no matter what. But as “professional worriers,” planners, and managers, your team at SJS has anticipated inflation and works daily on your behalf to align your investments with current valuations, our outlook on the markets, and your best interests.

We can all agree that a flat tire or a stalled economy is not a desirable state of affairs. Let’s hope the government stimulus spending, a resurgent economy, and inflationary dynamics find the right balance and keep us on a steady road of progress in the quarters and years ahead!

Important Disclosure Information And Sources:

[1] “M2 Money Stock (M2SL)“. Federal Reserve Bank of St. Louis, 25-Mar-2021, research.stlouisfed.org.

[2] “Velocity of M2 Money Stock (M2V)“. Federal Reserve Bank of St. Louis, 25-Mar-2021, research.stlouisfed.org.

[3] “MSCI ACWI IMI Index (USD)“. MSCI, 31-Mar-2021, msci.com.

[4] “Producer Price Indexes (PPI)“. Federal Reserve Bank of St. Louis, 25-Mar-2021, research.stlouisfed.org.

[5] “Foreign Exchange Rates - H.10“. Board of Governors of the Federal Reserve System, 05-Apr-2021, federalreserve.gov.

[6] “10-Year Breakeven Inflation Rate (T10YIE)“. Federal Reserve Bank of St. Louis, 31-Mar-2021, research.stlouisfed.org.

Past performance does not guarantee future results.

SJS Investment Services (SJS) has created hypothetical performance returns for each of its MarketPlus® Asset Allocation Models. The hypothetical performance was calculated by applying the actual performance of a mutual fund to the asset class percentage within a MarketPlus® Asset Allocation Model. The Model Portfolio Historic Returns do not reflect actual trading or the performance of actual accounts. Actual client results may be materially different than the hypothetical returns. All returns presented include reinvestment of dividends and other earnings. The hypothetical results presented reflect the deduction of a 1.10% annual SJS advisory fee, the maximum fee charged. Advisory fee may be less than illustrated. Performance may be reduced by other fees charged by your custodian. The effect of fees and expenses on performance will vary with the relative size of the fee and account performance. Please refer to Part 2A of SJS’ Form ADV for additional information on SJS’ advisory fees.

There are inherent risks in the presentation of hypothetical performance data because the data may no t reflect the impact of material economic and market factors. The results presented reflect the effect that material market and economic conditions had on the actual performance of the underlying mutual funds but does not reflect the impact that these factors might have had on decision-making.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Thanks IRS, Here We Go Again!

The IRS recently announced a delay to the date for filing and making 2020 federal tax payments, from April 15, 2021 to May 17, 2021. This change applies to individual returns.

By SJS Investment Services Managing Director & Senior Advisor Jennifer Smiljanich, CFP®.

The IRS recently announced a delay to the date for filing and making 2020 federal tax payments, from April 15, 2021 to May 17, 2021.[1] This change applies to individual returns.

While some states have adjusted their tax return filing and payment deadlines to match the new federal dates, each state is making their own decision. To see if your state has delayed its filing deadline, you may check the Federation of Tax Administrators website.

For those of you who make estimated tax payments, payments will be due April 15. As always, please be sure to check in with your tax professional for guidance.

Also of interest, the IRS has extended the deadline to make individual retirement account (IRA and Roth IRA) contributions for tax year 2020 from April 15, 2021 to May 17, 2021.[2] This May 17 deadline also applies for 2020 contributions to health savings accounts (HSAs).[2]

If you have questions, please let us know. We are happy to help!

Important Disclosure Information & Sources:

[1] “Tax Day for individuals extended to May 17: Treasury, IRS extend filing and payment deadline“. IRS, 17-Mar-2021, irs.gov.

[2] “IRS Extends IRA Contributions Deadline”. Melanie Waddell, 29-Mar-2021, thinkadvisor.com.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Congratulations Bobby Adusumilli, CFA!

Congratulations to SJS Investment Services Investment Associate Bobby Adusumilli, who recently earned the CFA Institute’s CFA charter!

Congratulations to SJS Investment Services Investment Associate Bobby Adusumilli, who recently earned the CFA Institute’s CFA charter!

Considered by many as one of the highest distinctions in the investment management profession, the CFA charter is meant to signify the commitment to maintaining ethics, professionalism, and analytical rigor by charterholders in the increasingly competitive field of investments.[1] To qualify for the CFA charter, a candidate must pass the three CFA exams that focus on topics relevant to investments professions. Additionally, candidates must have at least 4,000 hours of experience in an investments-related profession, completed in a minimum of 36 months. Once a candidate passes the exams and has the necessary work experience, then the candidate can apply for the CFA charter, needing 2-3 professional references. If approved for the CFA charter, the person must continue abiding by the CFA Institute Professional Conduct Statement as well as pay annual dues to the CFA Institute in order to continue using the CFA designation.[1]

Bobby joins fellow SJS colleagues President Kevin Kelly and Chief Investment Officer Tom Kelly as CFA charterholders. Please join us in saying congratulations to Bobby Adusumilli, CFA!

Important Disclosure Information And Sources:

[1] “CFA Program“. CFA Institute, cfainstitute.org.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

SJS Outlook: Q1 2021

SJS Q1 2021 Outlook on inflation, international stock diversification, Toledo-made gifts, and tax filing deadlines.

Do SPACs Deserve Our Blank Checks?

A SPAC is a publicly traded company that raises money from investors with the intent of taking some not-yet-determined private company public. Like giving your child a blank check to go buy whatever they want. What could go wrong?

By SJS Investment Services Chief Investment Officer Tom Kelly, CFA.

“What do you mean I don’t have any more money in my bank account? I have all these blank checks!”

I was reminded of this oft-quoted family teaching moment on the value of a blank check (the speaker of which will remain anonymous) when I first heard about SPACs. Special-purpose acquisition companies (SPACs), sometimes referred to as “blank check” companies, offer an alternative to the traditional Initial Public Offering (IPO) process of taking a company from private to public. A SPAC is a publicly traded company that raises money from investors with the intent of taking some not-yet-determined private company public. Like giving your child a blank check to go buy whatever they want. What could go wrong?

A SPAC is created by a sponsor (often of celebrity status) which issues publicly tradeable shares (typically $10 per share) in exchange for investor money. Once enough money is raised, the sponsor searches for a target company to acquire. The investors often have little idea what company will be acquired, or even if there is a targeted industry. After the SPAC finds a private company and completes a SPAC IPO, then the shares of the SPAC merge into the shares of the new publicly traded company. For their efforts, the sponsor typically receives 20% of the new publicly traded company’s post-SPAC IPO common shares (known as the promote). However, if a SPAC IPO is not completed within two years, then usually the SPAC is liquidated and investors get their money back.

SPACs are not new, but they have received notoriety as of late. There were 248 SPAC IPOs in 2020 raising $83 billion, and 288 deals with over $93 billion in proceeds so far in 2021 (through March 23). In contrast, there were 226 SPAC IPOs raising $47 billion total from 2009-2019.[1]

Compared to traditional IPOs, the potential benefits of SPAC IPOs include:

For the private company, a typically faster public listing from the merger announcement to completion.

For the private company, usually greater certainty regarding IPO money raised.

For investors, purported access to private companies which the average investor would not typically have access to.

On the flip side, investors do not know what the investment will be, so there is a high opportunity cost in waiting for a deal to be announced since the invested funds are typically sitting in an escrow account. Sponsors are incentivized to do a deal to receive the promote, even when private companies are expensive.

So, does giving a sponsor a blank check pay off? While there is a wide dispersion of results and a relatively limited dataset, the results are not pretty. From 2019 through early 2020, SPACs had both negative average and median returns in the 3-month, 6-month, and 1-year periods following the completion of a merger; SPACs had worse returns than both the Renaissance IPO Index and Russell 2000 Small Cap Index over all respective periods.[2]

Source: “A Sober Look at SPACs“. Michael Klausner, Michael Ohlrogge, & Emily Ruan, 16-Nov-2020, ssrn.com. Avantis Investors. Data reflects the 2019-2020 merger cohort. Of the 47 SPACs examined, 47 had sufficient history for the three-month period, 38 for the six-month period and 16 for the 12-month period. The IPO Index is the Renaissance IPO Index. The Small Cap Index is the Russell 2000 Index. See Important Disclosure Information.[2]

On the other hand, the SPAC sponsors - which receive the promote - have been rewarded handsomely, with an average 1-year return of 187% and median 1-year return of 32% for sponsors.[2] SPACs appear to be a much better “investment” for sponsors rather than the investors. In an effort to highlight potential risks for investors, the SEC has done the following:

December 2020: Issued guidance regarding SPACs, identifying potential conflicts of interest and disclosure concerns related to SPAC IPOs and subsequent transactions.[3]

March 2021: Issued an Investor Alert that states, “Never invest in a SPAC based solely on a celebrity’s involvement or based solely on other information you receive through social media, investment newsletters, online advertisements, email, investment research websites, internet chat rooms, direct mail, newspapers, magazines, television, or radio.“[4]

March 2021: Has opened an inquiry into SPACs and is seeking information on how underwriters are managing the risks involved.[5]

Investor beware.

So before investing in the next hot SPAC deal, it may be wise to reconsider who you are giving your blank check to. We think that most investors would instead be better off over the long-term using a science-based, low-cost, broadly-diversified investing strategy such as MarketPlus Investing®.

If you have any questions about SPACs or your investments, please reach out to us. We are happy to listen and assist.

Important Disclosure Information And Sources:

[1] “SPAC Statistics“. SPACInsider, 23-Mar-2021, spacinsider.com.

[2] “A Sober Look at SPACs“. Michael Klausner, Michael Ohlrogge, & Emily Ruan, 16-Nov-2020, ssrn.com. The Renaissance IPO Index® (IPOUSA) is a stock market index based upon a portfolio of U.S.-listed newly public companies that includes securities prior to their inclusion in core U.S. equity portfolios. The Russell 2000 Index measures the performance of the 2,000 smaller companies that are included in the Russell 3000 Index, which itself is made up of nearly all U.S. stocks.

[3] “Special Purpose Acquisition Companies: CF Disclosure Guidance: Topic No. 11“. U.S. Securities and Exchange Commission, 22-Dec-2020, sec.gov.

[4] “Celebrity Involvement with SPACs – Investor Alert“. U.S. Securities and Exchange Commission, 10-Mar-2021, sec.gov.

[5] “U.S. regulator opens inquiry into Wall Street's blank check IPO frenzy“. Jody Godoy & Chris Prentice, 24-Mar-2021, reuters.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Toledo-Made: Gifts From The 419

I love Toledo, Ohio. There are so many great businesses in this area, and the least I can do is to support them. Here is a list of local gifts that I usually consider.

By SJS Investment Services Founder & CEO Scott Savage.

I love Toledo, Ohio. I love living here, I love the people here, and I love working here. I was born and raised in this area, and I have spent the majority of my adult life here. Most of my family still lives in the Toledo area, and two of my adult children decided to move back here even after going to college in other cities (I am working on getting the other two to come back “home”). I enjoy my life here, and I don’t plan to leave anytime soon.

Toledo, also known as the Glass City, is in the early innings of a rebirth, a renaissance, making it a great place to live, work, and play. Toledo has so much to offer: small town values where you know your neighbors' names, affordable cost of living, you can get anywhere you want in less than 20 minutes. The Toledo area is home to a world class zoo & art museum, dynamic universities, two strong healthcare systems, the most iconic brand in minor league sports, and the birthplace of the first commercially successful cadmium telluride solar cell technology. The Detroit Airport, which will take you anywhere you want to go in the world, is less than an hour away. And we have the best metropark system in the United States![1][2]

I feel that I owe a lot to Toledo. Whenever I meet someone from somewhere else and we start talking about our backgrounds, I talk glowingly about the Toledo area and my experiences growing up here. Most people tell me that I have a love and enthusiasm for my city that they rarely encounter. And yet, I don’t feel I say anything odd - I genuinely love talking about Toledo.

When I go to an event such as a wedding, graduation ceremony, or birthday party for a family member or friend, I usually try to gift something from a business based in the Toledo area. There are so many great businesses in this area, and the least I can do is to support them. Below is a list of gifts that I usually consider giving:

Sports & Outdoors

Sciences

Arts

Apparel & Merchandise

Food & Drinks

Even we have our own SJS Investment Services umbrellas that we often give to people who visit the office on rainy days!

Source: Metroparkstoledo.com.

I hope that you enjoy the 419’s local businesses as much as I do. If you think I’m missing something on this list, please feel free to message me. I’m always looking for new great experiences in the Toledo area, and I hope to share these experiences with others as well.

Important Disclosure Information And Sources:

[1] “Cadmium telluride photovoltaics”. Wikipedia, en.wikipedia.org.

[2] “Metroparks Receives National Gold Medal Award“. Metroparks Toledo, metroparkstoledo.com.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

The information about providers and services contained on this website does not constitute endorsement or recommendation by SJS Investment Services. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Financial Gifting Strategies For Your Family

Many people want to explore how they can make gifts to family members without affecting their own financial security. We offer these possible gifting options.

By SJS Senior Advisor & Managing Director Jennifer Smiljanich, CFP®.

You'd like to experience the joy of gifting to your children and grandchildren during your lifetime. You'd like to be able to put a smile on the face of your child who is struggling to make ends meet. You are concerned about potential changes to estate tax laws and whether that may impact how much of your estate goes to Uncle Sam. Do any of these situations strike a chord with you?

In the last year, we have heard from many clients who would like to explore how they can make gifts to family members without affecting their own financial security. Some worry about potential tax changes, and how those may affect what legacy they can leave to future generations.

We have helped families create and implement gifting strategies for the past 25+ years. We are glad to help offer guidance to you and explain possible gifting options. Please note that all of the below gifting options apply to both children and grandchildren.

Gifting Money Directly

Each year, an individual may give up to $15,000 (for 2021) per child - or up to $30,000 for a child and their spouse - without using up any of the individual’s lifetime gifting limits.[1] A couple may gift a combined $30,000 per year per child, or a combined $60,000 to a child and their spouse.[2]

If an individual were to die in 2021, they could leave up to $11.7 million ($23.4 million for couples) to beneficiaries without paying federal estate and gift taxes.[1] There is discussion that these high estate and gift tax exemptions might be on the chopping block; President Biden has proposed decreasing estate and gift taxes levels to those last seen in 2009: $3.5 million per person for the estate tax, $1 million for the gift tax, and a top tax rate of 45%.[3]

Gifting For Specific Purposes

Tuition And Medical Expenses

Many parents want to gift money for specific purposes, instead of gifting cash with no limitations on potential uses. For example, there are some exceptions to the annual $15,000 gifting limits, including:[1]

Tuition for someone else

Medical expenses for someone else

Education Account: 529 Plan

To help pay for your child’s future education costs, you can create a 529 plan with your child (or grandchild!) as the beneficiary, and then donate to the 529 plan subject to gift tax rules. 529 plans can be invested in broad-market mutual funds, and can grow tax-free and penalty-free as long as withdrawals are used for the beneficiary’s qualifying education expenses.[4] A donor to a 529 plan has the ability to "frontload" gifts of up to five times the annual gift tax exclusion. However, if the donor were to pass away before the full five years, a portion of their gift could be added back into their estate and may result in gift taxes.[5]

Retirement Account: Roth IRA

You can also help your child save for retirement: as long as your child earns enough taxable income (but below the Roth IRA income limit) and has not contributed to a Traditional IRA or Roth IRA for the year, you can contribute $6,000 (2021 limit) directly to your child’s Roth IRA each year.[6]

Gifting Appreciated Securities

Generally, gifts can be made in cash or using appreciated securities (stocks, bonds, mutual funds, ETFs). Gifting highly appreciated securities to someone in a lower tax bracket may result in lower taxes for your family as a whole.[7]

Family Loan

If you want to help your child but don’t want to gift money, you can instead loan money. This may help your child get a loan for a specific purpose at a lower interest rate than third-party loan vendors may charge. To ensure the loan’s legitimacy, the IRS mandates that any family loan must have a signed written agreement, a fixed repayment schedule, and a minimum interest rate (you can use Applicable Federal Rates as the minimum).[8] If the loan exceeds $10,000 or the loan recipient uses the money to produce income (such as investing in stocks or bonds), you will need to report the interest income on your taxes.[8] We recommend that you consult with your tax advisor.

Summary

Parents often tell us: “We want to give our children enough so that they feel they could do anything, but not so much that they could do nothing.“ The better you manage your finances, educate your children on financial topics, and plan your specific gifting strategies, you may not have to gift as much as you think to help give your children all sorts of opportunities.

As always, we are here to help you go over gifting strategies, and help you choose and implement the best strategies for your family situation. If you have any questions or just want to talk with us about gifting strategies, please feel free to reach out to us.

Important Disclosure Information And Sources

[1] “Frequently Asked Questions on Gift Taxes“. IRS, irs.gov.

[2] “Will You Owe a Gift Tax This Year?“ ElderLawNet, 06-Mar-2021, elderlawanswers.com.

[3] “IRS Announces Higher Estate And Gift Tax Limits For 2021“. Ashlea Ebeling, 26-Oct-2020, forbes.com.

[4] “Topic No. 313 Qualified Tuition Programs (QTPs)“. IRS, irs.gov.

[5] “Do You Have to Pay Gift Taxes on 529 Plan Contributions?“ Mark Kantrowitz, 28-Jan-2020, savingforcollege.com.

[6] “Roth IRAs“. IRS, irs.gov.

[7]“How to Give Stock as a Gift (And Why Tax Pros Like The Idea)“. Chris Davis, 15-Dec-2020, nerdwallet.com.

[8] “Family Loans: Should You Lend It or Give It Away?“ Schwab, 24-May-2019, schwab.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this post that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What Do Millionaires Do Differently?

The typical millionaire may surprise you. I think these characteristics and actions tend to help people grow their wealth over time.

By SJS Investment Services Founder & CEO Scott Savage.

When you hear the word “millionaire“, what pops into your head? It may be a picture of Elon Musk. Or maybe an upward stock market chart. Or even a Wall Street trading floor.

And yet, the typical millionaire may surprise you. In the book The Millionaire Next Door: The Surprising Secrets Of America’s Wealthy, first written in 1996 and updated in 2010, authors Thomas Stanley and William Danko studied who are the millionaires within the United States and how they have become millionaires. They identify seven common denominators among people who successfully build wealth:[1]

None of these traits surprises me. I have repeatedly seen our clients exhibit these traits over the past 25+ years. We work with people from all sorts of different backgrounds with all sorts of experiences. In addition to the traits above, I think the below characteristics and actions tend to help clients grow their wealth over time:

They adjust their lifestyle to save money each year.

They come from all sorts of occupations, and many don’t make make large salaries, yet they almost always figure out a way to save some money each year.

They prepare for adversity.

Most have an emergency fund that gives them the confidence to survive unexpected job loss, health problems, or financial adversity. They have necessary insurance - such as health, disability, umbrella, and life insurance - to protect themselves and their families in case of unexpected events. Additionally, they ensure their important life documents are updated - including wills, trust documents, healthcare POA, and advance directives.

They have a larger goal for their wealth.

They are motivated to do something meaningful with their wealth, such as providing for their family as well as donating to charitable causes.

They focus on the long-term.

They know it may take decades for them to become millionaires. They create an investment plan that will allow them to not have to focus too much on their investments over the short-term. They know the power of compounding over the long-term, and control what they can while letting markets do the work.

They invest in what they understand.

Most invest in low-cost, broadly-diversified stock and bond mutual funds & ETFs. However, many invest in their businesses, or in certain niches of investing that they know a lot about. They know that if they don’t feel comfortable with their investments, they will probably not stick with the plan.

They don’t pay too much for their investments.

While there isn’t one right way to invest, there are many ways to lose wealth. Paying more than you need to for investments is one of them.

They continuously learn about the world.

They know the world is always changing, and they need to continuously learn and evolve to keep up.

They rely on advisors when they need to.

When they don’t know something or can’t put in the time, they work with advisors - such as accountants, financial advisors, and estate-planning experts - to accomplish their goals.

More than 90% of high net-worth families lose the family wealth after three generations.[2] My hope is that if we can better listen, understand, create strategies, and implement plans to help people invest better, then more people will be able to achieve their goals, and pay it forward by helping others along the way.

So the next time you hear the word “millionaire“, I hope the image that pops into your head is your modest, hard-working neighbor.

Important Disclosure Information And Sources:

[1] The Millionaire Next Door: The Surprising Secrets Of America’s Wealthy. Thomas Stanley & William Danko, 2010, Taylor Trade Publishing.

[2] “5 lies you’ve been told about generational wealth.” Pavithra Mohan, 18-Jul-2019, fastcompany.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Should You Convert Your IRA To A Roth IRA?

Depending on individual circumstances, some people consider converting their Traditional IRA to a Roth IRA in an effort to increase longer-term after-tax returns.

By SJS Investment Services Senior Advisor Andrew Schaetzke, CFP®.

Taxes may be one of your most important considerations in the design and implementation of your investment strategy. We want to help you increase after-tax returns, subject to your particular investment plan.

When you have some combination of taxable, tax-deferred, and tax-exempt investment accounts, assuming the same investments, we expect your after-tax returns to be higher for tax-advantaged (tax-deferred and tax-exempt) accounts compared to taxable accounts.

One specific tax-advantaged account - the Individual Retirement Account (IRA) - has an important feature that can potentially help you increase your after-tax expected returns over time.

Individual Retirement Accounts (IRAs): Traditional IRA Vs. Roth IRA

An IRA is meant to help people save for retirement in a tax-efficient way. There are two types of IRAs:[1]

Traditional IRA: As long as your taxable income (MAGI) is not above the Traditional IRA deduction limit, the money you put into the account is not taxed and may be deducted from your income up to $6,000 in 2021 ($7,000 if over age 50). When you withdraw money from the account at a later date, it is taxed at ordinary income tax rates.

Roth IRA: As long as your taxable income (MAGI) is lower than the Roth IRA income limit, the money you put into the account is taxed now with no deduction. The money taken out of the account at a later date after age 59 1/2 is not taxed at all.

For a more thorough explanation of Traditional IRAs and Roth IRAs, please see this IRS website.

Converting A Traditional IRA To A Roth IRA

Depending on your individual circumstances, you may consider converting your Traditional IRA to a Roth IRA in an effort to increase your longer-term after-tax expected returns. As part of the process, you have to pay federal & state income taxes now on the amount of money that you convert. There are many reasons you may consider converting to a Roth IRA, including:

More tax-free withdrawals in retirement

Watch your money potentially grow tax-free longer

Decreasing future tax burden for beneficiaries of your Traditional IRA

You may be a good candidate for a conversion if:

You are paying lower federal & state income tax rates now compared to expected taxes in the future.

You have lower taxable income this year compared to expected future years.

You want to lower the required minimum distributions (RMDs) from the Traditional IRA.

You are interested in lowering your Medicare IRMAA surcharges by decreasing future taxable income (MAGI).

You want to feel more in control of your future tax burden.

For more information on IRA conversions, please see this IRS website.

Risks of Converting A Traditional IRA To A Roth IRA

Rolling over a significant balance to a Roth IRA could put you into a higher income tax bracket and leave you with a bigger tax bill this year. If tax rates decrease in the future, you may end up paying more taxes by converting now relative to in the future. The regulatory rules and income limits surrounding conversions can be complex, and it is easy to make mistakes during the conversion process, which may complicate filing your taxes, potentially lead to the 10% penalty, and could lead to an IRS audit. Assets converted to a Roth IRA must be held in the Roth IRA for at least five years before withdrawing in order to avoid a 10% penalty. Depending on your conversion method, you may not be invested during the conversion period. Additionally, the conversion may cause you unnecessary stress.

Summary

Converting a Traditional IRA to a Roth IRA is highly dependent on your unique circumstances. SJS can help you review your current situations, and analyze the benefits and tradeoffs of conversions. As always, please work with your tax advisor to appropriately complete any IRA conversion and associated paperwork.

IRA conversions are just one of the many ways that SJS helps people potentially increase their after-tax expected returns over time. If you want to learn more about other ways and how SJS may be able to help you, please feel free to reach out to us.

Important Disclosure Information And Sources:

[1] “Traditional and Roth IRAs“. IRS, irs.gov.

[2] “IRA FAQs - Rollovers and Roth Conversions“. IRS, irs.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this post that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Is Your Cash Keeping Up With Inflation?

Cash management remains vital to both risk mitigation and capital preservation. How can you increase your expected return via cash-like holdings?

By SJS Investment Services Chief Investment Officer Tom Kelly, CFA.

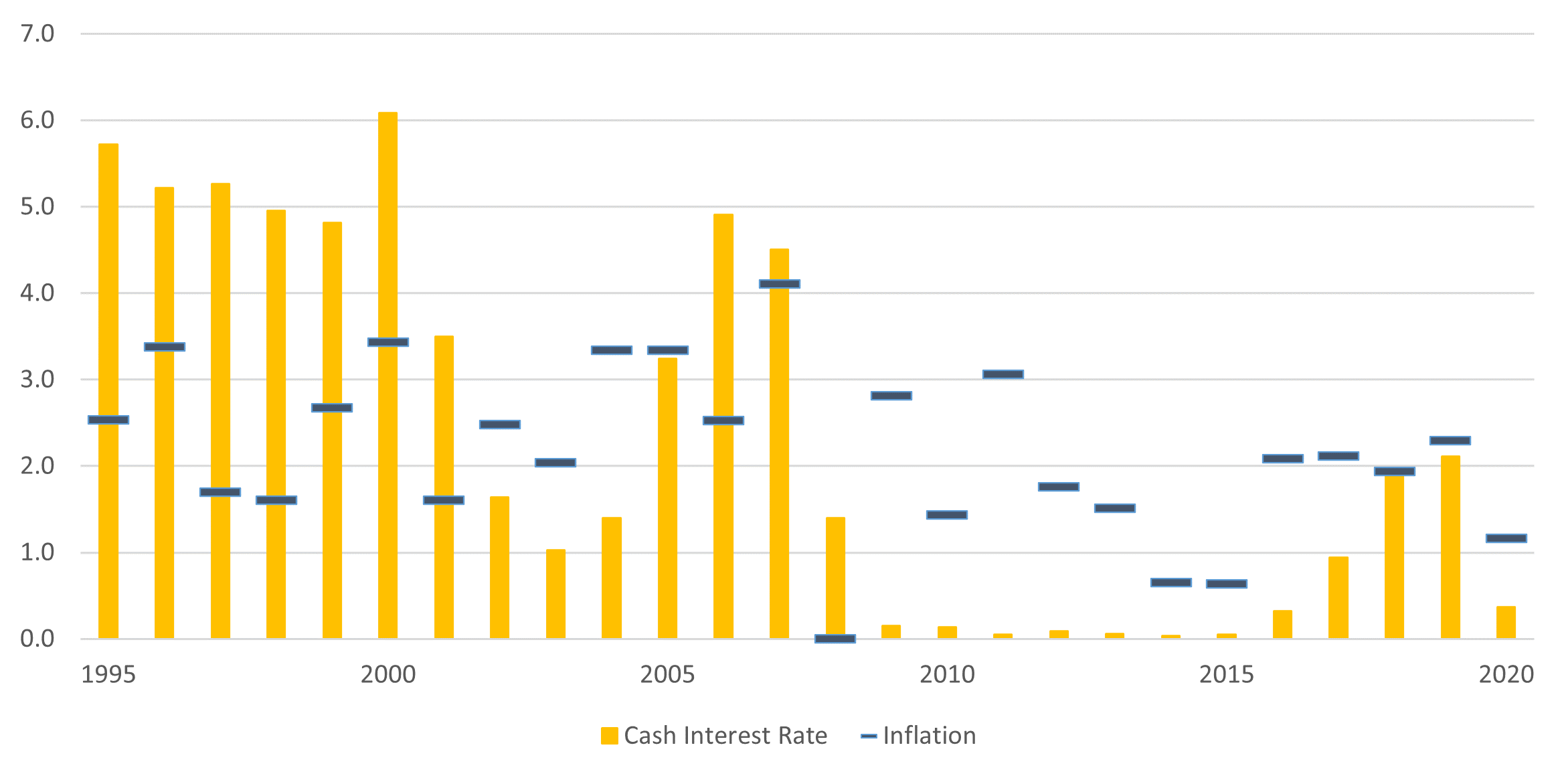

The adage “Cash is King” has been used in investing to highlight the value of holding on to cash to both protect an investor from having to withdraw when the markets are down, as well as the ability to deploy cash and purchase when prices become cheaper. However, over the last decade, with interest rates kept low near the anchoring Fed Funds rate, inflation has outpaced the interest rate on cash, leading to that cash losing its spending power over time.[1]

In the US, the erosion of cash value has been greater in recent times than previous periods, with cash trailing inflation since 2009, seen below. We believe this trend is likely to continue, with the Federal Reserve indicating they will continue to keep interest rates near 0%, all the while continuing to provide stimulus to the economy, leading to a 5-Year Breakeven Expected Inflation Rate of 2.35% as of February 23, 2021.[2][3]

Source: Morningstar. Cash represented by the US Treasury T-Bill Secondary Market 3 Month Rates. Inflation represented by the US Bureau of Labor Statistics Consumer Price Index All Urban Seasonally Adjusted Index. See Important Disclosure Information.[4]

Cash management remains vital to both risk mitigation and capital preservation. How can you increase your expected return via cash-like holdings? Online banks sometimes offer higher savings account interest rates than traditional banks due to their lower fixed physical costs. Depending on the holding time horizon, cash alternatives may include Treasury Inflation-Protected Securities (TIPS) or other higher-quality short-term bonds. Furthermore, both real estate and stocks have historically significantly outperformed inflation over the long-term, though they typically add significantly more volatility over the short-term.[5]

Prudent cash management can add incremental value to your overall portfolio investment return. If you have any questions regarding your cash management, please feel free to reach out to us.

Important Disclosure Information And Sources:

[1] “How Inflation Affects Your Savings Account.“ Justin Pritchard, 07-Jan-2021, thebalance.com.

[2] “Powell Pledges to Maintain Fed’s Easy-Money Policies Until Economy Recovers.” Paul Kiernan, 24-Feb-2021, wsj.com.

[3] “5-Year Breakeven Inflation Rate.” Federal Reserve Bank of St. Louis, 23-Feb-2021, fred.stlouis.org. The breakeven inflation rate represents a measure of expected inflation derived from 5-Year Treasury Constant Maturity Securities and 5-Year Treasury Inflation-Indexed Constant Maturity Securities. The latest value implies what market participants expect inflation to be in the next 5 years, on average. See Important Disclosure Information.

[4] The US Treasury T-Bill Secondary Market 3 Month Rates are the daily secondary market quotation on the most recently auctioned Treasury Bills for the 13 week maturity for which Treasury currently issues new Bills. Market quotations are obtained at approximately 3:30 PM each business day by the Federal Reserve Bank of New York. The rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year.

The US Bureau of Labor Statistics Consumer Price Index All Urban Seasonally Adjusted is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers. This particular index includes roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force.)

[5] Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies. Jeremy Siegel, 2014, McGraw-Hill Education.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

Statements contained in this post that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Financial Considerations When Facing Divorce

We understand the transition when facing divorce, and will support your well-being, financial and otherwise. Some topics you should consider include the following.

By SJS Investment Services Associate Advisor Catherine Stanley.

You didn’t begin your married relationship thinking it will end in divorce. But life and people are imperfect, and if you find yourself facing a divorce, you know that significant changes are impending. Not the least of these changes is your financial situation. Fear of the unknown and uncertainty about outcomes can cause anxiety, and even take a physical toll.

During this emotional time, it is important for you to acknowledge the magnitude of this life transition, recognize that you don’t have to have all the answers now, and leave space to take care of yourself. Finding the support of qualified legal and financial advisors is an important step to take. At SJS, we are here to make this difficult time manageable for you and help you navigate to a life of new opportunity.

The divorce process requires couples to make decisions about dividing the property that was acquired during the marriage. State laws govern divorce, and each state has different laws that determine how property is divided. In addition, there may be consideration of whether one partner will provide child and / or spousal support, and how much. When dividing resources, it’s important to consider your full financial picture so you understand what is available to you. This includes a thoughtful consideration of the division of retirement assets, even if retirement seems a long way off. Tax implications and timing regarding division of the assets involved can have an important impact on your long-term financial health.

We understand this transition, and will support your well-being, financial and otherwise. Some topics you should consider include:

The most tax-efficient way to split assets, including a home, investments, and deferred compensation plans such as a pension, 401(k), or other type of retirement plan.

Consideration of all retirement plans from current and previous employment.

A possible new home purchase, and resources available to accomplish this.

Caring for children as a single parent, and resources available to accomplish this.