The Importance Of Preparation

Financially Preparing For Future Life Events

By SJS Manager of Client Services Lisa Denstorff.

No matter how much you prepare, unexpected events will sometimes cause you financial stress. It could be a new health problem, a sudden job loss, a pandemic, or some other unexpected event. And yet, over our 25+ years of working with clients, we have learned that effective preparation can help you avoid potential problems and undesired outcomes in the future.

For example, we recently assisted a surviving spouse who had NOT been the primary caretaker of the family’s investment and estate planning. Unfortunately, some basic organizational and planning strategies such as beneficiary designations on investment accounts had not been completed. And the result was the need for the surviving spouse to hire a lawyer and work through the probate process – one more challenge to face during the grieving process.

The surviving spouse also reached out to us at SJS. We were able to help organize important financial documents, provide a summary of existing assets and liabilities, collaborate with the estate attorney and accountant, and simplify and consolidate investment accounts. Our new preparations helped design a more diversified investment portfolio.

Now, with proper account titling and beneficiary designations in place, the client can feel confident that one day the assets will pass on appropriately to loved ones or for charitable gifts as intended, without complications to the loved ones.

Working through important financial issues (such as applying for Social Security survivors benefits, selling / buying a new home, creating a new estate plan, filing taxes, etc.) is difficult, and can be exacerbated during periods of grief, anxiety, and stress. If we better prepare for these issues in times of relative calm, then we can potentially avoid much of the stress in more troubling times.

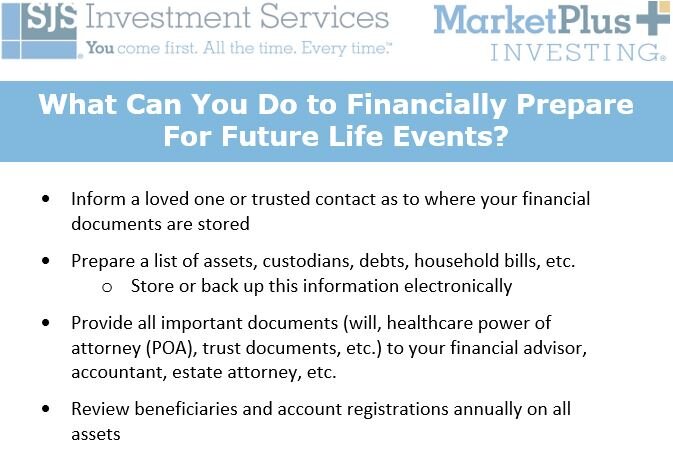

What can you do to financially prepare for future life events? We suggest you consider the following:

Inform a loved one or trusted contact as to where your financial documents are stored

Prepare a list of assets, custodians, debts, household bills, etc.

Store or back up this information electronically

Provide all important documents (will, healthcare power of attorney (POA), trust documents, etc.) to your financial advisor, accountant, estate attorney, etc.

Review beneficiaries and account registrations annually on all assets

If you have any questions or want to discuss handling life events, please feel free to reach out to us. The team at SJS is always here to listen and to help ensure your financial peace of mind.

Important Disclosure Information:

Advisory services are provided by SJS Investment Services, Inc., a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide tax advice. Please consult your tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.