Are You Starting To Invest? Some Considerations

By SJS Associate Advisor Michael Savage.

During the COVID-19 pandemic, there has been a mass movement by younger people to establish investment accounts.[1] They see the potential value of taking extra cash from work, economic stimulus checks, etc., and putting it to work in investments.[1] Online investment services like our own MarketPlus Online offering, Acorns, Betterment, Wealthfront, Robinhood, and others are allowing younger generations to easily establish investment accounts. For example, online brokers such as Charles Schwab, TD Ameritrade, and eTrade have seen major increases in new account openings in 2020, with some online brokers experiencing year-over-year new account growth of more than 100%.[1] Many if not most of these new accounts have been opened by millennials (ages 24-39 in 2020).[1][2]

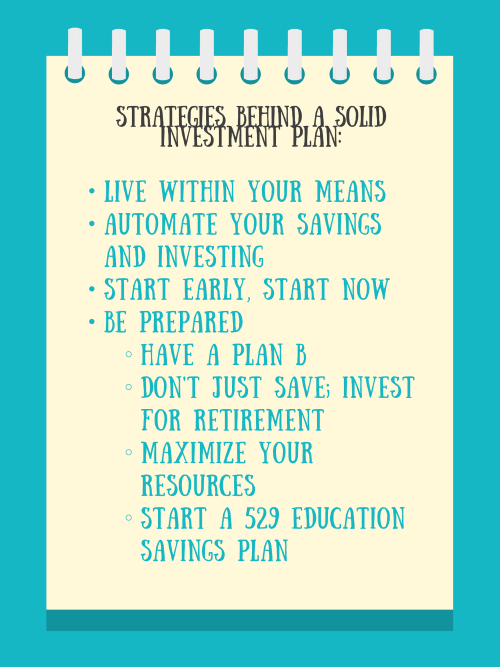

We think having the next generation beginning to invest is a great thing. They (We) will develop years of experience and knowledge on the markets. We previously wrote about strategies to help create solid investment plans for young professionals, emphasizing the following:

Building off of the above, investors have experienced a lot over the past year. 2020 has been one of the most volatile years - in particular, March was the most volatile month - in U.S. stock market history.[3] Many growth stocks have experienced a lot of volatility, and yet have grown significantly over the past year.[4] Other stocks have not experienced similar success.[4] Particularly over the short-term, so much can happen in the stock market that doesn’t necessarily align with what is happening in the economy and society at large, as partially evidenced by how global stock markets have provided positive returns in 2020 despite the COVID-19 pandemic and associated shutdowns.[5] We think investors can learn a lot from uncertain and volatile times, and we believe the below points can help you on your investment journey.

Invest For The Long-Term

Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it…. He who doesn’t, pays it.“[6] We believe that the longer you invest in a well-designed portfolio, the more you can increase your chances of positive expected returns and higher portfolio values.

For example, Warren Buffett, the famous 90-year-old investor with an estimated net worth around $85 billion in 2020 (even after donating $37 billion to charities since 2006), has repeatedly said, “If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes.“[7]

Beware of Taxes and Dividends

Dividends may seem like the best thing about investing. Lets say you have a stock worth $10 and you receive a dividend of $1. At first glance you may think “Hey, I just got a free dollar!”.

The truth to the matter is you didn’t. If a company pays $5 million in dividends, then the enterprise value (market value of equity + market value of debt) of that company would decrease by $5 million dollars. The stock value declines, in your case, by $1 to create an equal transaction. So, theoretically you still have a stock worth $10.

But we aren't done yet. Within taxable accounts, that $1 dividend will then be taxed. If your dividend income is taxed around 20%, that leaves you with $0.80. So in reality your $10 just turned in $9.80.

Additionally, if you sell a stock for a capital gain, you may end up paying taxes on the gain. You also pay more taxes if you held the stock for < 1 year.

While selling a stock for a gain may make sense under various circumstances, and while dividends can help prevent companies from spending too much money, young investors should be careful with taxes and dividends within taxable accounts.

Contribute to and Invest via a Traditional IRA and / or Roth IRA

To decrease the amount of taxes you pay, contributing to and investing via a Traditional IRA and / or Roth IRA can help you set yourself up for long-term success in the future.

Depending on your current income, when you contribute part of your income (up to $6,000) to a Traditional IRA, you don’t pay taxes on the contributions and growth until you begin withdrawing some time after turning 59 1/2. When you contribute part of your income to a Roth IRA (up to $6,000), you pay taxes now on the contribution, but do not pay taxes on the contributions and earnings as long as you wait until 59 1/2 to withdraw. This website from the U.S. IRS summarizes important information about IRAs.

Beware of Margin Trading

Margin means borrowing money, often to invest. Margin trading can amplify your gains, but it also amplifies your losses, particularly during volatile market periods like March 2020.[3] Additionally, investors usually have to pay interest on the margin, thus decreasing investment returns. Margin usually ends up hurting investors when they are not cautious using it. Just be aware that you are paying interest on the cash you borrow, and stay on top of it.

“Free Trades” Are Great, But Don’t Get Carried Away

Many investing platforms offer “free trades“, meaning that investors don’t have to pay a commission per trade. However, there are still less obvious costs to any stock trade, including bid-ask spreads, moving market prices, wash sales, capital gains taxes, etc. On its own, paying no commissions means lower costs for investors. However, since they no longer pay commissions, many investors are trading more and more, thus paying more of the less obvious costs. Additionally, increased trading can decrease the habit of investing for the long-term. Therefore, we advise people to not get carried away by “free trades.”

Summary

Starting to invest can be really valuable at a younger age. Your portfolio can grow or decline over time, and you will learn more and more as you keep investing and keep up with what is happening in the markets. We want you to be aware of what you are paying to enter the markets, do your due diligence on any investment service before opening an account, and remember that nothing is free or guaranteed.

If you would like to discuss how to better design and implement your investment portfolio, please reach out to us. We are always happy to listen and assist.

Important Disclosure Information And Sources:

[1] “Young investors pile into stocks, seeing ‘generational-buying moment’ instead of risk.“ Maggie Fitzgerald, 12-May-2020, cnbc.com.

[2] “Robinhood’s Addictive App Made Trading a Pandemic Pastime.“ Annie Massa & Sarah Ponczek, 22-Oct-2020, bloomberg.com.

[3] “The Craziest Month in Stock Market History.“ Nick Maggiulli, 01-Apr-2020, ofdollarsanddata.com.

[4] “Growth versus value: Will the tides change?“ Vanguard, 02-Sep-2020, vanguard.com.

[5] “Performance Derby: Global Markets.“ Ed Yardeni & Joe Abbott, 25-Dec-2020, yardeni.com.

[6] “Albert Einstein - Compound interest.“ Quotesonfinance.com.

[7] “How Warren Buffett’s winning investing strategy can be applied to any purchase you make.“ Emmie Martin, 04-May-2018, cnbc.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

![Sources: Statista, U.S. FBI Internet Crime Complaint Center. See Important Disclosure Information for additional details.[4]](https://images.squarespace-cdn.com/content/v1/5ee8ee8eb4fb337e3b806c1e/1609182572909-N6UBJ0ISN3EN0KXY735C/2020.12.29+Starting+To+Invest+-+Some+Considerations.png)