SJS 2024 Annual Report

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

SJS Welcomes Marketing Director

We are thrilled to welcome our new Marketing Director, Rae Navarre, to the SJS team! Rae brings extensive experience in branding and strategic marketing to the firm.

We are thrilled to welcome our new Marketing Director, Rae Navarre, to the SJS team! Rae brings extensive experience in branding and strategic marketing to the firm. She also serves on the Community Involvement and Events Committees, reinforcing her passion for fostering connections and engagement.

A Toledo native, Rae attended St. Ursula Academy before earning her Bachelor of Science in Visual Communication Technology from Bowling Green State University. She also studied at the Studio Arts Center International in Florence, Italy—where her true love of coffee began.

With expertise in branding, websites, video, photography, social media, and digital marketing, Rae is passionate about crafting meaningful messages that help brands connect with their audiences. Her dedication to community-driven marketing was evident in her role as Marketing Manager for the Downtown Sylvania Association, where she fostered business collaboration, strengthened branding efforts, and enhanced economic development through strategic branding initiatives and events.

Most recently, Rae worked at Owens Corning as a Creative Project Manager, leading teams to ensure projects stayed on track and within budget. Now, she enjoys collaborating with the SJS team to bring ideas to life and elevate the firm’s brand presence.

Outside of work, Rae enjoys spending time with her family – including her two children and golden retriever, Nelson – exploring the Metroparks, traveling, practicing yoga, reading, going to local coffee shops and playing pickleball.

How Much Is Too Much? Reflections from "Next Generation Philanthropy"

At SJS Investment Services, we’re always looking for fresh perspectives on wealth and how it impacts families, communities, and future generations. On March 11, we attended an event at the Toledo Museum of Art’s Glass Pavilion, Next Generation Philanthropy: Purpose, Not Privilege, featuring a conversation between Kristen Keffeler, author of The Myth of the Silver Spoon and Aly Sterling Philanthropy.

At SJS Investment Services, we’re always looking for fresh perspectives on wealth and how it impacts families, communities, and future generations. On March 11, we attended an event at the Toledo Museum of Art’s Glass Pavilion, Next Generation Philanthropy: Purpose, Not Privilege, featuring a conversation between Kristin Keffeler, author of The Myth of the Silver Spoon and Aly Sterling Philanthropy.

Kristin’s viewpoint challenged common narratives around inherited wealth and offered valuable insights on how the next generation—often receiving resources they didn’t earn—can redefine their relationship with money. She highlighted the emotional complexities that come with affluence, from identity struggles to the pressures of navigating financial privilege.

Kristin’s insights sparked a powerful conversation for us at SJS: How much is too much? People’s relationships with money exist on a spectrum. Some cling to it, always wanting more, yet never feeling like they have enough. Others see money as impermanent, freeing themselves from its grip. Most of us fall somewhere in between, navigating wealth with both ambition and uncertainty.

So how do we redefine wealth in a way that feels balanced and meaningful? A few takeaways from the event stood out:

💡 Money vs. wealth – Money is a tool, but real wealth is about purpose, connection, and values.

💡 The power of mindset – Shifting from fear to creativity and generosity can transform our relationship with wealth.

💡 Family conversations matter – Talking openly about money, privilege, and responsibility can help the next generation navigate wealth in a healthy way.

Kristin’s book, The Myth of the Silver Spoon, explores these themes further—offering a guide for families, advisors, and the rising generation looking to navigate the complexities of wealth with confidence and purpose. Whether you’re building a financial legacy or supporting clients in their journey, we recommend this book as a powerful resource for redefining what wealth really means.

At SJS Investment Services, we believe in fostering open, thoughtful conversations about wealth and legacy. If these ideas resonate with you, let’s start the conversation.

Disclosures: Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Navigating Market Volatility — SJS Perspective

Given recent price drops in US stocks, we wanted to offer our perspective on why maintaining discipline to target allocations may be one of the most important things we can do as investors.

By Founder & CEO, Scott J. Savage

Given recent price drops in US stocks, we wanted to offer our perspective on why maintaining discipline to target allocations may be one of the most important things we can do as investors.

It’s natural to wonder if moving to cash or otherwise “getting out” of certain investments might help during volatility. While market declines pose a risk, often the greater risk is missing the recovery that follows. Historically, the best days in the market tend to follow the worst, and missing just a handful of those best days can drastically impact long-term returns. Timing the market consistently is nearly impossible, which is why staying invested has been the best approach to ensure that your portfolio is there to capture the recovery when it happens.

Nothing is ever certain, of course, but managing uncertainty by weighing historical evidence has been critical to the success of SJS investment strategies for nearly 30 years.

We understand that volatility can be unsettling, so we want to reassure you:

We expect market fluctuations and plan for them.

We are continuously monitoring opportunities on your behalf.

We remain focused on managing your investments for long-term success.

We are here for you. Please reach out to the SJS Team if a meeting or conversation would be of value.

Very truly yours,

Scott J. Savage

Founder + CEO

Disclosures:

This does not constitute a complete description of our investment services or performance. SJS offers investment advisory services only in states where we are registered, have completed a notice filing or where an exemption or exclusion from such notice filing exists. SJS Investment Services does not provide legal or tax advice. Please contact your legal or tax professionals for specific advice.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market. Statements contained in this material that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Protecting Your Personal Information and Financial Assets

While the returns on your investments are important, so is the safety of your personal information and assets.

While the returns on your investments are important, so is the safety of your personal information and assets. With technology advancements in recent years, protecting your information is becoming as important as ever. We have been updating our practices and policies to ensure that your information and assets remain secure.

We also want to emphasize some best practices that can help us work together on this:

MULTI-FACTOR AUTHENTICATION

Using an additional login layer, like an authentication app, PIN, email, or text message, greatly reduces the risk of your data being compromised.

SHARING INFORMATION SECURELY

Sending sensitive information via email can expose your data to hackers. To share it more securely, use a trusted document-sharing portal (like MySJS Portal), password-protect the file, encrypt the email, or consider mailing physical documents.

SKEPTICAL OF REQUESTS FOR SENSITIVE INFORMATION

Our rule is that all information requests are considered illegitimate unless proven otherwise. Also, for one-time requests to withdraw money, SJS requires verbal confirmation.

AVOID PUBLIC COMPUTERS AND WI-FI

Public computers and Wi-Fi are common ways hackers access personal information. When security is a concern, using a personal Wi-Fi hotspot from your cell phone is a safer alternative.

STORING YOUR PERSONAL INFORMATION IN SAFE PLACES

Store personal information securely, whether digital or physical, and share it only with trusted people and services. Use secure online password storage, password-protected files, or a safe-deposit box in a hidden location.

CHECK YOUR CREDIT REPORTS AND FREEZE YOUR CREDIT

The three major credit bureaus—Equifax, Experian, and TransUnion—offer free annual credit report checks. To protect your information, consider freezing your credit with each bureau and only unfreezing it when needed.

WHEN IN DOUBT, MEET IN PERSON

Despite the many communication technologies available, in-person interactions are often the most effective and secure way to get work done.

We’re always happy to meet with you to discuss ways to better protect your information. Contact your advisor today!

Important Disclosure Information:

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

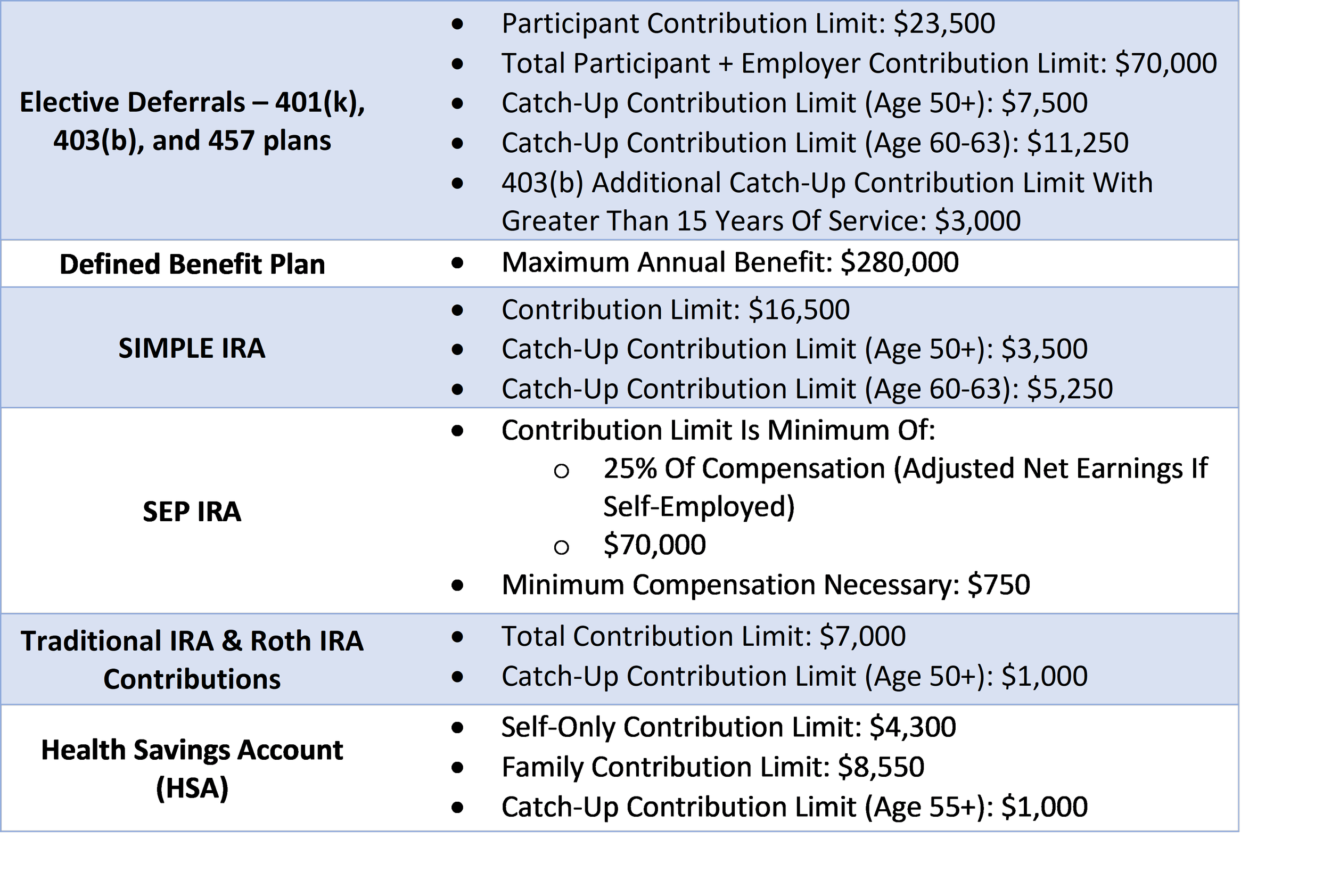

Important Financial Planning Numbers For 2025

To help you financially plan for 2025, we provide this resource with important numbers for the year.

By Senior Advisor Andrew Schaetzke, CFP®.

When planning for the coming year, it can be hard to keep track of all of the new financial and tax information. There are many important financial numbers to be aware of for 2025, including:

Tax rates and brackets, such as for federal income tax, capital gains tax, Social Security tax, and estate tax

Certain tax deductions, exemptions, and credits

Retirement plan (401(k), 403(b), IRA, SIMPLE IRA) and Health Savings Account (HSA) contribution limits

Required minimum distribution (RMD) table for certain tax-deferred retirement accounts

Medicare premiums & IRMAA surcharges

To help you financially plan for 2025, we provide the resource below. As always, we are here to help your family throughout your financial journey. We can provide resources, experience, and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

This resource was created by fpPathfinder. SJS pays an annual subscription in order to license resources from fpPathfinder.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

The Tale Of Two Curves: What The Yield Curve Means For You

The yield curve isn’t just an academic concept; it impacts real-life decisions.

By Senior Advisor Kirk Ludwig, AIF®.

In September 2024, the Federal Reserve started lowering interest rates after a long stretch of raising them to combat inflation. This marked a notable shift, as the Fed appears to have achieved a soft landing - taming inflation without derailing the economy. But here’s the catch: not all rates have followed suit. In fact, some rates are higher today than they were at the start of the year. Below is a graph of the Treasury yields along the maturity spectrum at the beginning of the year and the end of the year, known as the yield curve, and reflecting the changing market sentiment.

Source: “Daily Treasury Par Yield Curve Rates”. U.S. Department of the Treasury, 02-Jan-2024 through 31-Dec-2024, treasury.gov. See Important Disclosure Information.

At the start of the year, short-term interest rates were elevated due to aggressive Federal Reserve action to manage inflation. Over the year, inflation levels eased, and the Fed shifted to lowering rates, and short-term yields followed. But the longer-term rates have risen, incorporating expectations for growth, inflation, borrowing needs, and many other factors. This divergence tells us something important: while the Fed controls the Fed Funds rate, the market determines all other rates. The front end of the yield curve reflects what the market thinks the Fed will do next, while the back end reflects everything else into the future.

The yield curve isn’t just an academic concept; it impacts real-life decisions. If you’re watching your money market yields, you’ve likely noticed they’ve been dropping. On the other hand, if you’re shopping for a 30-year mortgage, rates have drifted higher. For investors, money market and short-term bonds are experiencing lower yields, while longer-term bonds are paying more income. That’s not to say that you should be shifting everything to longer maturities; it just simply means that the market is pricing future risk differently. Paying attention to maturity terms is critical, and that’s why we focus on the shift in all interest rates - not just the Fed Funds rate.

The yield curve has often been labeled the market’s crystal ball, supposedly predicting recessions and expansions. But a crystal ball might be giving it too much credit. A Magic 8-Ball is probably more fitting - you shake it and get a random answer like “Ask again later” or “Outlook not so good.” What the yield curve does exceptionally well is capture the collective thoughts of the market today. It’s a snapshot, not a prophecy, and tomorrow’s new information could change the picture entirely.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Planning Financially For The New Year

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

By Advisor Bobby Adusumilli, CFA.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Review retirement contributions and gifting goals: In 2025, the IRS is boosting retirement contribution limits to new highs, as detailed in the table below. The IRS is also increasing the amount you may gift to an individual recipient to $19,000 in 2025, without affecting lifetime gift tax exemptions.

2025 Select Retirement Plan Contribution Limits

Source: “Retirement Topics - Contributions”. IRS, irs.gov. See Important Disclosure Information

Notify your accountant: It is important to notify your accountant of any contributions or donations that may have a tax consequence, as your tax documents may not explicitly state all of your contributions and donations. For example, retirement plan contributions, charitable donations (particularly qualified charitable distributions (QCDs) from your Traditional IRA if you are over age 70 1/2), and 529 plan contributions can all potentially help you save on taxes. Also, if you are invested in private funds, notify your accountant that you may not receive K-1 tax forms until later in 2025.

Keep SJS apprised of trusted advisor changes: We want to keep up with changes affecting your family, including changes to your attorney, accountant, or banker. Please let us know if you have made changes to the professionals you work with.

Update your estate plan: It is a good practice to regularly review your beneficiary designations to ensure they match your current wishes and align with your estate planning documents. Reviewing your estate planning documents periodically is also recommended, at least every five years or when there is a major change in your life.

Keep your wealth protected: Wealth accumulation is only part of the equation; the other piece is wealth protection. We strive to help keep your personal data safe, including avoiding sending personal information via email (unless encrypted) and reaching out to you to confirm that requests we receive from you are legitimate. Taking additional steps like adding multi-factor authentication and changing passwords periodically can help to keep your information safe.

As always, we are here to help you put your best foot forward. We are glad to meet with you to help keep you on track!

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice.

Suggested Reading

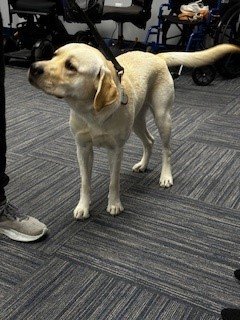

What A Difference A Year Makes: SJS Puppy

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

In 2024, SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence by aiding with the individual's daily needs.

SJS was tasked with naming a puppy born to a litter at The Ability Center. We recently visited Lira, who has grown by leaps and bounds. While still early in her training, we are hopeful that she will remain on track to become a service dog, skilled companion dog, or school facility dog. Training and placement is usually completed by age 2.

The trainers are gifted specialists and do a phenomenal job. The Ability Center is always grateful for the volunteers who step up to foster the dogs. Their need for volunteers never ends.

We are lucky to have such a great organization in our area. To find out more about The Ability Center, you can visit abilitycenter.org.

Suggested Reading

Letter Of Gratitude & Excitement

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

By SJS Founder & CEO Scott J. Savage.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

For three decades, we've had the privilege of being your trusted partner, empowering you to build a better life. While our fundamental commitment to your financial well-being remains unchanged, the way we pursue that mission today bears little resemblance to our methods of just five years ago, let alone when we first opened our doors in 1995. We're proud of our ability to continuously improve our methods to meet your evolving needs.

This milestone year holds special significance as SJS sees promising developments on the horizon. As market dynamics continue to evolve, we're optimistic about opportunities in emerging asset classes and our access to the best managers in these spaces. Through these new opportunities, we aim to continually build on our MarketPlus® Investing strategy. Our experienced team has successfully guided you through good markets and bad, and we're confident in our ability to navigate the future.

An industry-leading investment approach has always been foundational to SJS, along with meeting your daily needs, all the time, every time. We are selectively growing the team, improving systems, and exploring new technology, including artificial intelligence (AI). Just as the internet, years ago, seemed daunting and changed much, AI also offers efficiencies and enhancements to how we work. At the same time, at the top of my worry list is cybersecurity and threats to our information systems. One of the best ways I believe we can fight this growing threat is to know our clients by name and by voice, which reduces the risk that a bad actor can successfully come between us.

As we celebrate our 30th year, we're particularly excited about strengthening our community engagement, charitable initiatives, and expanding our service offerings for clients and their families. We believe that informed clients make better choices. SJS is dedicated to providing you and your family with the insights and resources needed to not only navigate an increasingly complex financial landscape, but to feel a sense of empowerment and greater purpose while doing so.

I would like to conclude with a personal note. As a pioneer in the registered investment advisory (RIA) industry (yes, that means I am an elder!), I’ve watched with concern as many of my competitors have chosen to sell or merge their firms with private equity-backed organizations. In my opinion, these decisions prioritize shareholder returns over long-term client and employee relationships. While these transitions may maximize a RIA owner’s bank account in the short run, it is my opinion that over time it will come at the cost of client satisfaction and employee dedication - which have been pivotal to building a firm like ours. Let me be clear: this is not the future of SJS. We are steadfastly committed to remaining independent and focused on what matters most - working on the same side of the table as you and supporting our dedicated employees and their families, for generations to come.

Cheers to another 30 years of friendship, growth, innovation, and success. At the end of the day, our goal is your peace of mind.

SJS Team at Brookwood Metropark in Toledo, Ohio.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Suggested Reading

SJS Outlook: Q4 2024

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services Recognized In CNBC's 2024 FA 100 List

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

“The faith, commitment, and loyalty you have demonstrated as clients over the last 29 years has made this recognition possible! Thank you!” says SJS Founder & CEO Scott J. Savage.

CNBC enlisted data provider AccuPoint Solutions to assist with the ranking of registered investment advisors for the 2024 FA 100 list. The methodology consisted of first analyzing a variety of core data points from AccuPoint Solutions’ proprietary database of registered investment advisors. This analysis started with an initial list of 40,896 RIA firms from the Securities and Exchange Commission regulatory database. Through a process by CNBC and AccuPoint Solutions, the list was eventually cut to 903 RIAs with those firms meeting CNBC’s proprietary criteria. CNBC staff sent an email survey to all those firms that met the initial criteria to gather more details. The CNBC team verified that data with the SEC regulatory database. CNBC. CNBC and AccuPoint also considered additional information including the advisory firm’s regulatory/compliance record, number of years in the business, number of certified financial planners, number of employees, number of investment advisors registered with the firm, the ratio of investment advisors to total number of employees, total assets under management, percentage of discretionary assets under management, total accounts under management, number of states where the RIA is registered, and country of domicile. AccuPoint once again applied CNBC’s proprietary weighted categories to further refine and rank the firms, ultimately creating the list of the top 100 firms. CNBC receives no compensation from placing financial advisory firms on their list. Neither SJS Investment Services nor any of its employees provided any payment to CNBC or AccuPoint in exchange for rankings. Additionally, an advisor’s appearance on this ranking does not constitute an individual endorsement by CNBC of any firm. Further methodology information can be found on the CNBC website.[1][2]

If you would like to learn more about how we work with families, business owners, and organizations, please reach out to us. We are always here to listen and assist.

Important Disclosure Information & Sources:

[1] “FA 100: CNBC ranks the top-rated financial advisory firms of 2024”. CNBC.com Staff, 02-Oct-2024, cnbc.com.

[2] “Here’s how we determine the FA 100 ranking for 2024“. CNBC.com Staff, 02-Oct-2024, cnbc.com.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. Past performance is no guarantee of future results. There is no guarantee investment strategies will be successful.

Suggested Reading

SJS Investment Services Recognized In The Forbes / SHOOK 2024 List Of America's Top RIA Firms

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investment Advisor) Firms.[1]

“The faith, commitment, and loyalty you have demonstrated as clients over the last 29 years has made this recognition possible! Thank you!” says SJS Founder & CEO Scott J. Savage.

In its introduction to this year’s Top RIA Firms webpage, the publisher affirmed, “The third annual Forbes/Shook Top RIA list highlights firms that have strong track records when it comes to stewarding client wealth and preserving it for the long term.”[1]

As detailed on the methodology webpage, the Forbes / SHOOK 2024 list of America’s Top RIA Firms, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone, virtual and in-person due diligence interviews, and quantitative data. The algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK Research receive a fee in exchange for rankings. SHOOK Research received 46,212 nominations based on thresholds, invited 25,103 firms to complete their online survey, performed 21,417 telephone interviews, conducted 5,246 in-person interviews at advisors’ location, and conducted 1,545 virtual interviews. Additional information about the ranking methodology can be found on the Forbes website.[2]

In May 2024 and August 2024, SJS Investment Services responded to an email survey provided by SHOOK Research, providing quantitative information including AUM size, revenue, typical client relationship size, and minimum account size for new business. Neither SJS Investment Services nor any of its employees provided any payment to Forbes or SHOOK Research in exchange for rankings.

If you would like to learn more about how the SJS Team works with families, business owners, and institutions, please feel free to reach out to us. We are always here to listen and assist.

Important Disclosure Information & Sources:

[1] “America’s Top RIA Firms”. Sergei Klebnikov & SHOOK Research, 08-Oct-2024, forbes.com.

[2] “Methodology: America’s Top RIA Firms 2024“. R.J. Shook, 08-Oct-2024, forbes.com.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. Past performance is no guarantee of future results. There is no guarantee investment strategies will be successful.

Suggested Reading

New SJS Perrysburg, Ohio Office!

We are proud to share our new office location in the historic River House building at 115 West Front Street, Perrysburg, OH 43551!

We are proud to share our new office location in the historic River House building at 115 West Front Street, Perrysburg, OH 43551!

We are excited to offer a second location in Northwest Ohio, aimed at providing more convenience for our clients in the Perrysburg area and beyond.

SJS was founded in 1995 with a mission to provide a major money center management experience while maintaining small town values and putting the client first, all the time, every time. Each of our offices in Sylvania, Chicago, Scottsdale, and Perrysburg help us to better serve our clients and connect with our communities.

We are looking forward to hosting meetings with a scenic view of the Maumee River, and encourage you to explore the shops and restaurants when you stop by for a visit!

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Suggested Reading

Election Time

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

By Chief Investment Officer Tom Kelly, CFA.

It is that time again. Political ads inundate your commercial breaks and news feeds. Elections are about a month away, with the focus being the battle for the White House. Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

For SJS, this is the eighth time we have been through this cycle and our answer has not changed – we do not know! It is not that we do not care, we just rely on the core fundamentals of MarketPlus® Investing as our guide:

Markets are efficient and are priced fairly.

Speculating is futile.

Global markets have rewarded investors over the long term.

Portfolio design matters most.

The markets – stocks, bonds, real estate, commodities, you name it – are all considering millions of data points, such as growth prospects, geopolitical challenges and opportunities, and yes, even who holds the White House and how that might affect the markets. But all that information is incorporated in the prices, both the prospects of risk and reward. That does not mean that prices are always right, but that you are being fairly compensated for the risk you take. Over time we believe investors are rewarded, and assuming appropriate portfolio design and diversification, this can assist in achieving your investing goals.

As things stand, the election odds for Kamala Harris and Donald Trump are roughly 50% / 50%, but come November 5th, those odds will end at 100% / 0% or 0% / 100% (barring some undetermined swing states). We will likely see some volatility leading up to and potentially even after the election, as markets weigh new developments. Take courage along the way, knowing we have designed your portfolios to navigate any political environment, and we will be there to adjust whenever the time comes.

Source: Morningstar, as of September 30, 2024. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market. Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States. See Important Disclosure Information.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Financial To-Dos Before The End Of The Year

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

By Investment Associate Bobby Adusumilli, CFA.

As we approach the end of the year, we want to highlight some important financial items to review before the new year:

Contributing to workplace retirement plans, health savings accounts, and 529 plans for education: Each of these accounts help you to save and potentially invest in tax-advantaged ways, though all contributions need to be completed prior to December 31st.

Required minimum distributions (RMDs) from pre-tax retirement plans: For those age 72+ who need to take RMDs from retirement accounts such as a Traditional IRA, ensuring that your RMDs are satisfied prior to December 31st can help you avoid a potential financial penalty from the IRS.

Charitable donations as well as gifting to loved ones: Particularly in a positive return investment year, it may be advantageous to donate appreciated securities from a taxable account. Additionally, for those age 70.5+, you are able to make qualified charitable distributions (QCDs) directly from your Traditional IRA worth up to $105,000 prior to December 31st. For those gifting to individuals, you can gift $18,000 per beneficiary without being subject to gift tax.

Private fund tax forms: For those investing directly in private funds, you may have received K-1 tax forms relating to your investments, which may need to be included as part of your taxes due by October 15th.

As always, we would be happy to assist you in reviewing your finances to help ensure you are achieving your financial goals.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

SJS Outlook: Q3 2024

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Welcomes Ryan Stoller!

We would like to welcome Ryan Stoller to the SJS Team! Ryan serves SJS and our clients as an Associate Advisor.

We would like to welcome Ryan Stoller to the SJS Team!

Ryan serves SJS and our clients as an Associate Advisor. Growing up as the son of a poultry farmer in the small town of Van Wert, Ohio, Ryan developed a strong work ethic and a deep commitment to client service. He earned a bachelor’s degree in Business Administration from Lourdes University, with minors in Psychology and Theology, while also playing baseball for the Grey Wolves.

Before joining SJS, Ryan worked as a financial advisor in Van Wert, Ohio. After marrying, he moved back to Toledo, where he taught at Perrysburg Schools as an intervention specialist. However, his passion for finance and helping clients led him back to the financial advising industry. Ryan joined SJS in August 2024 and is eager to continue growing within the industry.

In his free time, Ryan is active in his local church, where he leads multiple men’s groups and serves in the youth group. He also enjoys exploring Toledo’s Metroparks, playing pickleball with friends, and cheering on the Ohio State Buckeyes.

We are really grateful that Ryan decided to join our Team - please join us in welcoming Ryan!

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Thank You Elizabeth Molique & Isabelle Szenderski!

We asked SJS interns Elizabeth Molique and Isabelle Szenderski to write a summary of what they did throughout the summer.

This summer, we had the pleasure of working with Elizabeth Molique and Isabelle Szenderski during their internships with us. We asked each of them to write a summary of what they did throughout the summer. We really enjoyed getting to know Elizabeth and Isabelle, value all of their contributions to improving SJS, and wish them all the best going forward!

Elizabeth Molique

During my summer internship, I had the opportunity to engage in a variety of impactful projects. I’m incredibly thankful for the opportunity to work at SJS. Collaborating with my colleagues in the Scottsdale office and beyond was an enriching experience, and I’m grateful for the valuable lessons and insights gained throughout this journey.

Client cash flow and investment planning: Developed and updated client cash flow simulations, portfolios, and retirement plans using eMoney and Morningstar. Actively participated in client meetings to discuss and refine these plans.

Portfolio optimization: Conducted detailed reviews of client portfolios to identify and recommend enhancements for potential improved performance and alignment with financial goals.

Development of financial literacy resources: Designed and produced detailed financial literacy materials for internal and external audiences. These included documents on strategic charitable giving (e.g., donor advised funds, qualified required minimum distributions), student loan forgiveness regulations, comprehensive financial literacy presentations, and fact sheets about portfolio funds for institutional clients.

Investment research and analysis: Executed comprehensive research on prospective investments by evaluating Morningstar data, financial ratios, 10-K reports, and expert analyses, providing valuable insights to support strategic investment decisions.

Internal data management: Updated and managed internal spreadsheets related to net assets and trust files for SJS, ensuring precise and current data maintenance.

Professional development: Engaged in a series of webinars to deepen my industry knowledge, including Charles Schwab Market Talks, Charles Schwab Women in Wealth, AQR Diversifying Strategies Fund Feature, Dimensional Webinars, Avantis Behavioral Finance Webinar, among others.

Isabelle Szenderski

I am truly grateful for the opportunity I have been given to be a summer intern with SJS. I learned what it means to work with an empowering team that values each employee in the company and in return creates a strong connection with clients as “You come first. All the time. Every time.” is an essential part of the mission at SJS. Throughout my internship I had the privilege of engaging in a multitude of marketing projects. In addition I was able to learn the importance of investing and financial literacy as to further my knowledge and expand my career opportunities.

In my internship I had the pleasure of working on a variety of impactful projects:

Website updates: Strategized recommendations and implemented changes to improve the SJS website, with the goal of enhancing client and prospective client engagement.

Social media advancement: Researched and developed a strategy to enhance the SJS social media presence to promote company awareness, including executing a content and posting schedule for LinkedIn.

Client delivery enhancements: Collaborated on updating client presentation templates and financial documents to aid in client meetings.

SJS history research and timeline creation: Conducted internal research to create a historical timeline to be added to the SJS website, to better connect with clients and prospective clients.

SJS swag: Worked with local companies to design new SJS branded materials such as water bottles, golf polos, hats, and sweatshirts.

Assisting in planning events: Helped organize SJS client events as well as the first inaugural family parking lot party.

Professional development: Gained proficiency in financial literacy from SJS team members and participated in client meetings to enhance understanding.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Suggested Reading

SJS Investment Services Recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor Ranking

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.[1]

“Thank you, Financial Advisor Magazine, for recognizing SJS Investment Services again this year in the RIA ranking. It is a true honor and speaks loudly to the care we deliver to our clients, as well as their continued faith and trust in our firm, in our MarketPlus® Investing process, and in our Team,” says SJS Founder & CEO Scott J. Savage.

Financial Advisor (FA) Magazine’s 2024 RIA Survey & Ranking is a ranking based on assets under management as of December 31, 2023. FA Magazine orders firms from largest to smallest, based on AUM reported by firms that voluntarily complete and submit FA Magazine’s survey by the given deadline. To be eligible for the ranking, firms must be independent registered investment advisors and file their own ADV statement with the SEC, and provide financial planning and related services to individual clients. The survey did not apply to hybrid RIAs and corporate RIAs. SJS completed the survey in April 2024 using data as of December 31, 2023. There is no fee to apply or to secure placement within the ranking. Additional information regarding the 2024 RIA Survey & Ranking can be found on the Financial Advisor Magazine website.[1][2]

If you would like to learn more about how we work with families and organizations, please reach out to us. We are always here to listen and assist.

Important Disclosure Information & Sources:

[1] “FA RIA Survey & Ranking 2024”. Financial Advisor Magazine, July 2024, fa-mag.com.

[2] “2024 RIA Survey & Ranking: RIAs Confront Their Own Success”. Eric Rasmussen, 12-Jul-2024, fa-mag.com.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. Past performance is no guarantee of future results. There is no guarantee investment strategies will be successful.

Hyperlinks to third-party information are provided as a convenience.