40 Years Of Trust

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

By Founder & CEO Scott J. Savage.

What is life but a series of transitions?

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled. You have traveled it with me, perhaps for many years. Have I thanked you lately for that early trust? Well, a thank you may be overdue.

Like so many young professionals, I was eager to build a career 40 years ago and provide for my family by taking care of my growing list of clients. And by "taking care," I mean advising. After all, my title was financial advisor.

Along the way, a few wise mentors taught me to listen first. I took their advice, and with every client, I translated what I heard into investment strategies. How many days and nights did I worry as the market rose and fell and rose again? I spent countless hours rebalancing assets and optimizing investment portfolios as the opportunities presented themselves.

For many years, I thought that my only role was to make sure that clients were compensated for the risks they were taking. It was a high-stakes game I took very seriously, just as we do now. It took years for me to realize how much more there was to this career as a financial advisor and the real value of that role. The time I spent talking with clients, learning about their families and businesses, and helping them navigate the milestones became the most meaningful hours of my day. Especially when we could work through those big and bigger life and business events that come with uncertainty. These meetings became welcome breaks from the unending undulations of the Dow.

As SJS grew, we built a team to manage the investments and all that goes with them. I found myself in the room among very smart people. That allowed me to spend more and more time helping long-time clients I had come to know as they navigated their lives. We had a shared history and earned trust. I steadily listened even more and talked even less as conversations went well beyond seeking to understand financial goals. They moved to deeper conversations about what’s really important in life. I heard countless times, "You’re the only person I can talk to about this." When I say it is my honor, I mean it.

My clients taught me that being an advisor was more about trust than it was about advising. "Adding value," which has always been our company’s mantra, began to manifest through more than just the investment performance. It came through being a trusted advisor.

Life does not stand still, and over the last 10-plus years, "adding value" has transitioned to "adding meaning." Today, when I advise people and institutions, the focus is on family or institutional dynamics, health challenges, life and death, family office issues, philanthropy, and legacy. These are topics that occupy bigger and bigger parts of my day. Many times, the issues are messy and filled with difficult dynamics, ambiguity, and complexity. They are puzzles of intense meaning that ignite a fire in me - a fire to solve, or resolve.

Here I am, 40 years into this career, and I still love my job. It has transitioned from advising about finances to helping people discover and frame their legacy, and, ultimately, what their life is all about. It is an experience that truly goes beyond words.

As I get ready for the next day of my life, I know more transitions are in store. I have a feeling that as I continue to help families and institutions, trust and meaning will remain a part of the mix. So will gratitude.

Thank you for 40 years and your gift of trust.

SJS 20-Year Club: Kirk Ludwig, Kevin Kelly, Meredith Sleet, Scott J. Savage, Jeff Yost.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Suggested Reading

Earning More Interest On Your Cash

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

By Investment Associate Bobby Adusumilli, CFA.

One of our roles as advisors is to look for opportunities to allow your money to work better for you. Cash is often one of the most overlooked assets when it comes to improving someone’s investment returns. People may have large amounts of cash for a variety of reasons: emergency fund, saving for a house down payment, planning to buy a new car, etc. We often see people accumulating cash in their checking account without really thinking about it. Particularly today, with short-term U.S. Treasury bonds paying upwards of 5% interest on an annualized basis, we view this as a missed opportunity to earn more interest.

There are many ways to potentially increase the amount of interest you receive on your cash savings while still investing in something that is low risk and readily transferable to your checking account within a few business days. While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment brokerage account:

Sources: Average Interest-Bearing Checking Account and Average Savings Account: "Bankers Resource Center: National Rates and Rate Caps". FDIC, 20-May-2024, fdic.gov. Schwab Value Advantage Money Fund (SWVXX): "Schwab Value Advantage Money Fund® - Investor Shares". Charles Schwab, 31-May- 2024, schwabassetmanagement.com. One-Month Treasury Bill: "Daily Treasury Par Yield Curve Rates". U.S. Department of the Treasury, 31-May-2024, treasury.gov. Dimensional Ultrashort Bond ETF: "DUSB: Ultrashort Fixed Income ETF". Dimensional Fund Advisors, 31-May-2024, dimensional.com. Yield will not necessarily equal realized returns. See Important Disclosure Information.

Money market fund: A mutual fund that continually invests in ultrashort-term (around one-month on average), high-quality bonds. Money market funds accrue interest daily (interest is typically paid monthly) and are not expected to fluctuate in price. As a mutual fund, they are subject to an expense ratio. A good proxy to determine how the interest rate of a money market fund may change over time is to take the interest of a one-month Treasury bill and subtract the expense ratio.

U.S. Treasuries: Treasury bills, notes, and bonds (Treasuries) are issued directly by the U.S. government for terms ranging from one month to thirty years, as detailed in the chart below. They are subject to federal income tax, but not state or local income tax. Treasury bonds are often cheaper to buy and hold than money market funds, though you have to decide what you want to do with the money when the Treasury matures. You can sell Treasuries before they mature, though the value does fluctuate if sold before maturity. You can buy Treasuries through most major investment brokerage platforms including Charles Schwab.

Ultrashort bond ETF: An ETF (exchange traded fund) that continually invests in ultrashort-term, investment-grade bonds. Ultrashort bond ETFs typically range in average maturity from three months to one year. Compared to a money market fund, ultrashort bond ETFs usually invest in slightly longer-term bonds and have more exposure to corporate bonds, though any additional risk is typically accompanied by higher expected interest. Many ultrashort bond ETFs have lower expense ratios than various money market funds. It is important to note that ultrashort bond ETFs will fluctuate in price to some degree.

With interest rates rising over the last few years, we have had a lot of conversations about cash with clients. If you would like to discuss ways you can earn more on your cash, please feel free to reach out to us.

Source: U.S. Department of the Treasury, as of June 30, 2024. See Important Disclosure Information.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

SJS Outlook: Q2 2024

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

Five Graduating High School Students Shadow SJS Investment Services

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of our favorite traditions is when students intern with us. It is an opportunity for us to teach the next generation of investors some of what we have learned, as well as learn from them.

From April 29th through May 3rd, five Seniors from St. John’s Jesuit High School - Andrew Balcerzak, Declan Loisel, Evan Skolmowski, Jude Dzierwa, and Travis Friddell - interned with the SJS Team in Sylvania, Ohio. Throughout their internship, they did activities including:

Learn about a wide variety of topics on personal finance

Study the importance of investing, as well as different ways of investing

Introduction to retirement and other investment accounts (ex. IRA, 401(k), 529, HSA, etc.)

Started reading The Investment Answer by Daniel C. Goldie and Gordon S. Murray as well as The Psychology of Money by Morgan Housel

Meet with most members of the SJS Team

Create LinkedIn profiles

Present an investment-related idea for the SJS Team to consider

We asked each student to write a summary of what they learned during the week. We thank Andrew, Declan, Evan, Jude, and Travis for spending their senior project week with us, and we wish them well going forward!

Andrew Balcerzak

My week at SJS for my senior project was great. I came into this experience wanting to gain a better understanding of the basics of finance and what exactly goes on in a financial firm. I got a well-rounded view of the company and what everyone does in it. Whether it was making trades, analyzing certain stocks, learning what the advisors do, or even life advice, I felt that I gained knowledge from the time spent at SJS.

It was an eye-opening experience to see how much goes into the planning of people's futures. I found out the importance of reading and being a lifelong learner as everyone at SJS is reading some sort of financial book to evolve their ideas and approaches to finance. We had the opportunity to sit in an investment committee meeting - to see the amount of research that goes into picking certain investments was kind of surprising to me. I enjoy analyzing graphs and learning about compound interest, so when we sat down and got to look at some of the projections, I was fascinated by it. With that being said, the best piece of advice I learned is to invest early because it’s difficult to catch up with people who have been investing and spending wisely. The basics of investing don’t have to be hard - when you begin to dive in is when you find certain intricacies.

Another great part of my experience was learning about the social aspects of business. We sat down with multiple advisors, and learned that some of their social skills are natural and some have been learned over time. We sat down with Mr. Savage for lunch and he explained some of the aspects of advisor and client meetings. My takeaway from lunch is to be a genuine person and learn about people on a personal level - it makes conversations very easy and builds connections that aren’t fake.

Lastly, we dedicated a few hours to talking about taxes and certain types of accounts that people use. Taxes are very complicated once you get into the weeds, but on the surface, a chunk of taxes is you paying into things like Social Security that you’ll later benefit from. Certain accounts - such as a Roth IRA or a 401(k) - offer certain advantages that taxable accounts fail to offer, but come with some restrictions on when you can use the money. One of the things on my to-do list is to open a Roth IRA as soon as I get a job because it seems like a no-brainer to start my life of investing at a young age.

Declan Loisel

At SJS, what I learned goes beyond simple financial ideas - it was a comprehensive immersion into the dynamics of wealth creation and management. From understanding the fundamentals of stocks, bonds, and alternatives to diving into the depths of retirement accounts, we gained a holistic perspective on the power of investing. The firm's emphasis on building a diversified portfolio emphasizes the principle that strategic allocation across different asset classes is key to long-term growth and risk mitigation. With insights into the historical performance of the stock market, we were able to grasp the significance of compound interest, seeing the exponential potential of sound investment strategies.

Navigating through the maze of tax implications and regional disparities, we uncovered insights into optimizing financial decisions. Learning how varying tax brackets and state-specific regulations impact investment outcomes highlights the importance of holistic financial planning. By striving to maintain specific percentages of different investments, SJS balances returns and volatility. Beyond the numbers, the internship experience at SJS filled me with a sense of fulfillment and excitement as we discovered our passion for the field. Aspiring to embark on careers in finance, we gained some technical understanding as well as a deep appreciation for the multi-faceted nature of the industry.

Evan Skolmowski

Firstly, I want to express my gratitude to SJS for allowing me to come shadow. During this week, I have gotten to speak with and observe a dozen different people and learn unique pieces of information from each of them. Coming into the office on Monday, all I thought I knew about a bond was that it was some form of government currency. I now know investing in bonds is generally a form of fixed income, with a typically lower but more consistent rate of growth compared to domestic or international stocks. Some of the most useful pieces of information I’ll take away is the importance of diversification and staying true to the investment process over time, meaning I must discipline myself to always put away a fraction of a paycheck, and not pull it all out when there’s a dip in the market and things get scary.

I plan to begin investing as well as pour over books and articles deciding where I’ll begin my long-term investments, rather than have all of my money in faster individual stocks. At this point in time, I’ve thought about fifty different careers I could have in the future from astronaut to being the president, but I’ve always known I wanted to make enough money to live comfortably. My dad got me interested in the world of finance, but it’s always been slightly difficult to understand some of what he’s talking about on a larger scale. I’m extremely thankful that SJS has helped me to understand and get a better grasp on more of these ideas and terminologies.

Jude Dzierwa

During my one-week internship at SJS, I got to learn a ton about how finance works. Right from the start, I picked up basic stuff like what stocks, bonds, and derivatives are about. I saw how professionals manage portfolios and why it's so important to spread out risks by diversifying.

I also learned about taxes and how they affect the world. I saw how different states get taxed on different things. More populated states like California and New York have a higher income tax than states like Arkansas and Ohio. There are also taxes when you invest in the market such as capital gains taxes (particularly when an investment is sold within a year), unless the investment is in a retirement account like a Roth IRA.

As the week went on, I dug into financial analysis, trying to figure out how to judge how well companies are doing and how to read their financial reports. Doing mock trades helped me see how things play out in real time, and watching how the team deals with clients showed me the importance of personal connections in finance. Overall, it was a crash course in investments that gave me some solid skills to take forward.

Travis Friddell

This week shadowing SJS has been an amazing experience that I am extremely grateful for. I have witnessed day-to-day operations, meetings, and have observed what financial advisors and managers need to do to manage someone’s portfolio.

Learning how to manage someone’s portfolio was a very interesting experience. I have learned what it means to balance the risks of a portfolio. Many people depend on their financial advisor to help them make the right decisions with their money. There are many unfamiliar terms I have learned this week that I need to understand in the future, but that hasn’t stopped me from understanding what happens here at SJS.

Something I learned about as well this past week was types of jobs and positions in the financial world. One of the things I wanted to leave SJS with was a better idea of what type of career I truly want to pursue after college. I have learned about careers like a financial planner, portfolio manager, financial analyst. I am so grateful for this opportunity and everything I have learned. Thank you SJS for this experience that I will never forget!

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

SJS Welcomes Robert Schaefer!

We would like to welcome Robert Schaefer to the SJS Team! As an Advisor, Robby works with both individual and institutional clients.

We would like to welcome Robby Schaefer to the SJS Team!

As an Advisor, Robby brings a wealth of experience to SJS, where he works with both individual and institutional clients. Since starting his career in the investment services industry in 2011, Robby has experience in various roles, including advisor, trust officer, and entrepreneur. Most recently, he founded and operated his own advisory practice before joining SJS. Prior to that, he served private wealth clients at U.S. Bank and Fifth Third Bank in Cincinnati.

As a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional and a Certified Trust and Fiduciary Advisor (CTFA), Robby has expertise in guiding clients through their financial journeys. He holds an MBA from the University of Cincinnati Lindner College of Business and a bachelor's degree in finance from the Miami University Farmer School of Business.

Robby is actively involved in his community. He graduated from the Rocky River Citizen Police Academy, is a member of the Rocky River Chamber of Commerce, and volunteers with Junior Achievement of Greater Cleveland.

Originally from Sylvania, Robby now calls Rocky River, OH home, where he lives with his wife Kelcie and their children Cici and J.R. His deep roots in Northern Ohio enable him to serve clients across the region and beyond effectively.

Outside of work, Robby enjoys starting his day with pickup basketball or cycling and cherishes evenings spent with his family and friends.

We are really grateful that Robby decided to join our Team - please join us in welcoming Robby!

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Scott Savage Recognized In The Forbes / SHOOK 2024 Best-In-State Wealth Advisors Ranking

SJS Investment Services Founder & CEO Scott J. Savage has been recognized in the Forbes / SHOOK 2024 Best-In-State Wealth Advisors in Ohio ranking, as part of a ranking of wealth advisors within the United States.

SJS Investment Services Founder & CEO Scott J. Savage has been recognized in the Forbes / SHOOK 2024 Best-In-State Wealth Advisors ranking, as part of a ranking of wealth advisors within the United States.[1]

“This recognition is affirming to our Team, and we attribute this to the faith, commitment, and loyalty that our clients have demonstrated to SJS over the last 28 years,” says Scott.

As detailed in the ranking methodology, the Forbes / SHOOK 2024 Best-In-State Wealth Advisors ranking, developed by SHOOK Research, “is based on an algorithm of qualitative criteria learned through telephone, virtual and in-person due diligence interviews, and quantitative data such as revenue trends and assets under management. The algorithm additionally weighs factors such as service models, compliance records and industry experience, and focuses on those that encompass best practices in their approach to working with clients.”[2] Advisors have a minimum of seven years experience. Portfolio performance is not a criterion. Neither Forbes nor SHOOK Research receive a fee in exchange for rankings.[2] SHOOK Research received 44,990 nominations, invited 23,876 advisors to complete their online survey, performed 20,412 telephone interviews, conducted 4,926 in-person interviews at advisors’ locations, and conducted 1,507 virtual interviews. Additional information about the ranking methodology can be found here.[2]

In August 2023, SJS Investment Services responded to an email survey provided by SHOOK Research, providing quantitative information including AUM size, AUM growth, typical client relationship size, and minimum account size for new business. Neither Scott Savage nor any other employees of SJS Investment Services provided any payment to Forbes or SHOOK Research in exchange for rankings.

If you would like to learn more about how Scott and the SJS Team work with families, business owners, and institutions, please feel free to reach out to us. We are always here to listen and assist.

Important Disclosure Information & Sources:

[1] “Best-In-State Wealth Advisors”. Sergei Klebnikov & SHOOK Research, 03-Apr-2024, forbes.com.

[2] “Methodology: Best-In-State Wealth Advisors 2024”. R.J. Shook, 03-Apr-2024, forbes.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Our Family Has Grown By Four Feet!

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

Community is one of our Words of the Year at SJS. Our team members, individually and collectively, strive to put our communities first.

In this spirit, we recently donated to The Ability Center to support their Assistance Dog program. As detailed on their website, The Ability Center works to make our community the most disability friendly in the nation by increasing independence for people with disabilities, discovering true passions, and changing the community’s perception of disability.

One of their services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence by training and placing service and skilled companion dogs to aid with the individual’s daily needs. The Ability Center has also placed over 30 school facility dogs as well.

The SJS Team took on the task of naming one of the puppies. Jennifer Smiljanich, Managing Director in our Scottsdale office, submitted the winning name, Lira. Our Team also had the fun opportunity to meet Lira and her siblings.

The Ability Center is doing fantastic work serving our community. If you would like to learn more about The Ability Center, you can visit abilitycenter.org.

Katie Floyd and Katie Cristofoli overrun by active pups.

Ryan Walter taking one for the team.

Lira playing with her toy.

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Standing On The Shoulders Of Giants: The Evolution Of MarketPlus® Investing

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

By Chief Investment Officer Tom Kelly, CFA.

When he founded SJS in 1995, Scott J. Savage set out to provide a major money center management experience while maintaining small town values and putting the client first, all the time, every time. A novel idea back then in a world where the stockbroker business model was (and still is) embedded with conflicts of interest. There had to be a better way, to sit on the same side of the table as our clients and align our interests. It is this founding "first principle" from which everything else flows. And still to this day it allows us to filter everything we do through that same lens. For example, when working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

Stone Ridge Asset Management, one of the investment managers we work with, shares similar first principles. Stone Ridge aims to provide investors with access to diversifying investment strategies (such as reinsurance and alternative lending) that have low correlations to global stocks and bonds.[1] Many of these investment strategies have been historically difficult to access for most investors.

The search for investment strategies that perform differently from global stocks and bonds led us to Stone Ridge, but what kept us interested was their alignment with their clients and partners. Stone Ridge founder Ross Stevens studied at the University of Chicago under famed professor Eugene Fama, who won the Nobel Prize in Economic Sciences in 2013. The name Fama may sound familiar, as his market efficiency work has influenced MarketPlus® Investing. However, Stevens believes that Fama’s greater contribution is his work on the principal-agent problem. At many companies, ownership and day-to-day management are mostly separate. This can lead to each side having different information as well as contrasting motivations. As a result, decisions are often made by both ownership and management that are not best for the various stakeholders.

Stone Ridge seeks to minimize the principal-agent problem through partnering with industry leaders, sharing risk directly alongside them (gains and losses), and collaborating using proprietary data and evaluation techniques. Additionally, Stone Ridge employees invest in the various investment strategies, paying full fees like clients do.

In our first meeting with Stevens several years ago, he spoke about Stone Ridge’s culture. He shared insights on the investment strategies, like reinsurance, where they are one of the largest capital providers to reinsurance companies and partnering with them through risk-sharing – sitting on the same side of the table.[2] He then recounted the origin story of Stone Ridge, which is named after the small town in upstate New York that he holds special – all this from his office overlooking Wall Street. Talk about a major money center experience with small town values!

Important Disclosure Information & Sources:

[1] “Strategies”. Stone Ridge Asset Management, stoneridgeam.com.

[2] “Reinsurance”. Stone Ridge Funds, stoneridgefunds.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Protecting Your Personal Information & Financial Assets

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

By Investment / Compliance Associate Bobby Adusumilli, CFA.

While the returns of your investment portfolio are important, so are your personal information and assets. With technology advancements in recent years, protecting your information is becoming as important as ever. We have been updating our practices and policies to ensure that your information and assets remain secure. We also want to emphasize some best practices that can help us work together to ensure your information and assets remain safe:

Multi-Factor Authentication: When logging into various websites and programs, having at least one additional login layer - such as a pin number, email, text message, and / or authentication app - can significantly decrease the chances of your data getting compromised. In light of this, we recently made the decision to require multi-factor authentication for all MySJS Portals. While this adds an extra step for people logging in to their MySJS Portals, we believe this will help protect sensitive client information.

Sharing Information Securely: Simply sending an email with sensitive information is one of the easiest ways for hackers to access your data. Other ways to share your information more securely include using a trusted document-sharing portal (such as your MySJS Portal), password-protecting the relevant file, encrypting the email, and (old-school) mailing the relevant documents.

Skeptical Of Requests For Sensitive Information: Scammers are coming up with increasingly clever ways to ask for your information, such as sending convincing emails as well as phone calls pretending to be someone else (today, scammers can call from a phone number that you think is legitimate as well as use a voice software to sound like someone else). At SJS, our general rule of thumb is that all requests for information are illegitimate until proven otherwise. Additionally, when we receive a one-off email to withdraw money from your account, SJS requires you to call us to provide verbal authorization for the withdrawal request.

Storing Your Personal Information In Safe Places: For both physical and digital information, it is important to store your personal information in safe places, and to only share this information with people you trust. For example, you can use a password-protected file, a secure online password storage service, or a safe-deposit box kept in a hidden location. We recently ordered waterproof and fire-resistant envelopes that people can store their documents in - if you would like one, please let us know.

Avoid Public Computers & Wi-Fi: Public computers and Wi-Fi are relatively easy ways that hackers can access your personal information. Using personal Wi-Fi hotspots from your phone can limit the need to use public computers and Wi-Fi.

When In Doubt, Meet In-Person: Even with all of the different technologies and ways to communicate with each other, many times the best way to get work done both effectively and securely is in-person. Our favorite parts of our days are meeting with our clients face-to-face.

As always, we are here to help, and we are glad to meet with you to discuss how you can better keep your information secure!

Important Disclosure Information:

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Suggested Reading

SJS Outlook: Q1 2024

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

Inside MarketPlus® Investing – Fund Spotlight: SRDAX

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

By Founder & CEO Scott J. Savage.

What lights me up and has made our clients money in 2023? Diversified alternatives!

After an extensive year-long due diligence process by our Investment Committee seeking to access additional markets while staying true to the core MarketPlus® Investing philosophy, SJS approved the Stone Ridge Diversified Alternatives Fund (SRDAX) as a potential client investment in December 2021. SRDAX is an open-end mutual fund designed to provide access to five underlying investment strategies that have historically performed differently than global stocks and bonds: reinsurance, market risk transfer, style premia, alternative lending, and single-family rental homes.[1] All of these underlying strategies seek systematic income streams.

Starting in December 2021, we began adding SRDAX to client portfolios that we deemed to be appropriate. As of the end of 2023, the fund finished up over 19% for the year.[2]

Source: Stone Ridge Asset Management. Data from April 30, 2020 (inception of the fund) through December 29, 2023. Total return includes reinvestment of all distributions. Tax implications are not considered. Past performance does not guarantee future results. Short-term results may not be indicative of long-term performance. See Important Disclosure Information.

No investment that purports a return over the risk-free rate will move up consistently, and SRDAX is no different. For example, in November 2023, SRDAX declined almost 1% for the month. It just so happened that coincident with this short-term decline, global stocks and U.S. bonds rallied, up 9.3% and 4.5% respectively in November (as measured by the MSCI All Country World Index and the Bloomberg U.S. Aggregate Bond Index, respectively.)[2]

While November 2023 is anecdotal, we believe it is also evidence that SRDAX returns are not only uncorrelated to the performance of global stocks and bonds, but they are unrelated. Since adding this strategy to our client portfolios, SRDAX has been an excellent diversifier to our MarketPlus® Investing strategies (see table, below). We don’t believe the 2023 pace of return is sustainable due to underlying investment conditions; however, it is a shining example of the value alternatives can bring to traditional stock and bond strategies. Namely, providing expected returns commensurate with the risk that is being assumed while not following the ups and downs of the publicly traded stock and bond markets.

Source: Stone Ridge Asset Management, Morningstar. The MSCI All Country World Index captures large and mid cap representation across 23 developed market and 24 emerging market countries, covering approximately 85% of the global investable equity opportunity set. The Bloomberg U.S. Aggregate Bond Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. Tax implications are not considered. See Important Disclosure Information.

In supplementing traditional bond strategies with an alternative income-seeking strategy, the diversification through SRDAX is as close to a free lunch we have found over the past couple of years. The search for what’s next to add to our MarketPlus® Investing portfolios continues.

Important Disclosure Information & Sources:

[1] Source: Stone Ridge Asset Management.

[2] Source: Morningstar.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

MarketPlus® Investing models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Planning (Financially) For The New Year

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

By Senior Advisor Jennifer Smiljanich, CFP® & Associate Advisor Austin Grizzell, CFP®.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Review Retirement Contributions & Gifting Goals

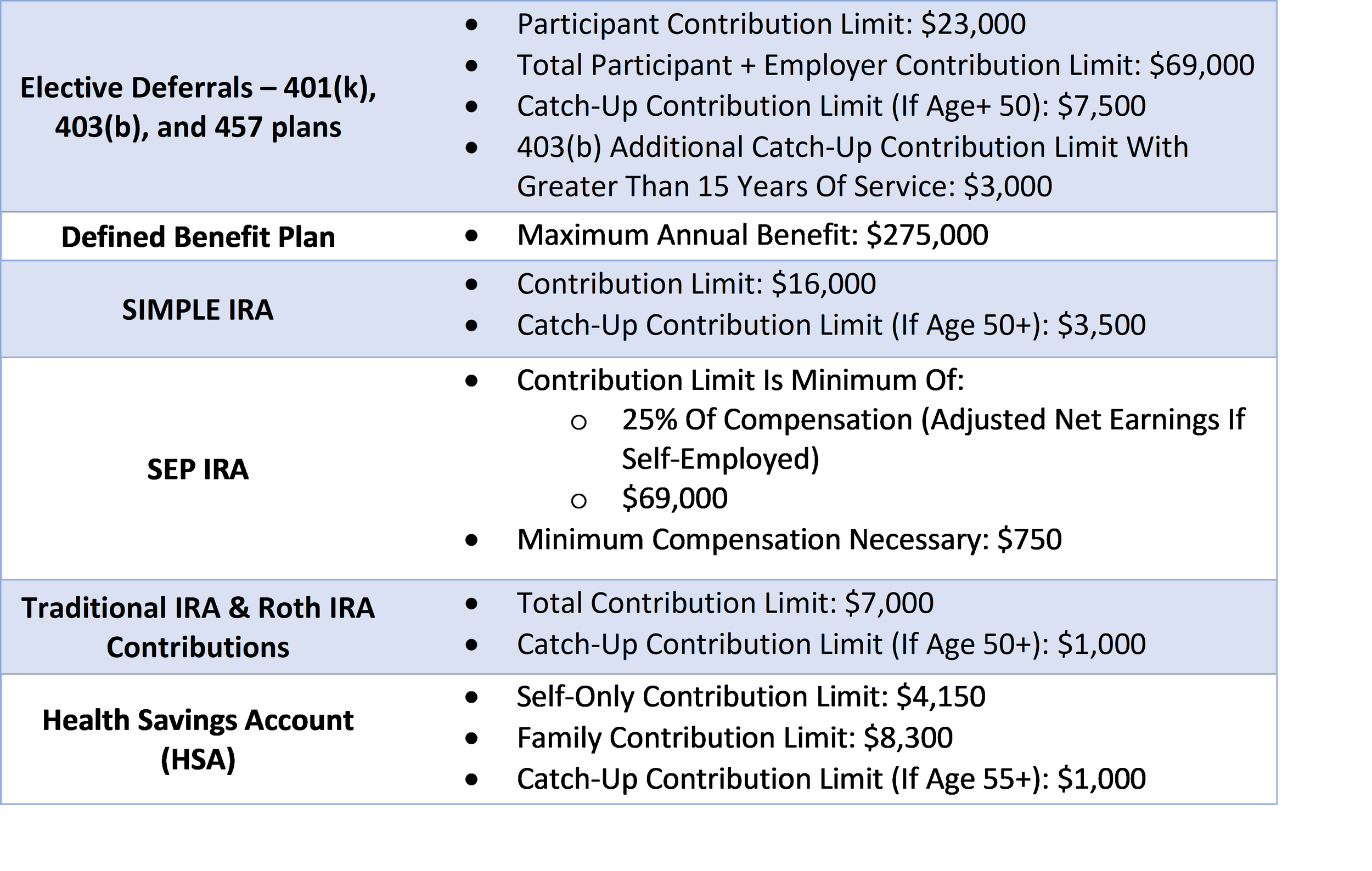

In 2024, the IRS is boosting retirement contribution limits to new highs, as detailed in the table below. The IRS is also increasing the amount you may gift to an individual recipient to $18,000 in 2024, without affecting lifetime gift tax exemptions.

2024 Select Retirement Plan Contribution Limits

Source: “Retirement Topics - Contributions“. IRS, irs.gov. See Important Disclosure Information

Notify Your Accountant

It is important to notify your accountant of any contributions or donations that may have a tax consequence, as your tax documents that you provide your accountant may not explicitly state all of your contributions and donations. For example, retirement plan contributions, charitable donations (particularly qualified charitable distributions (QCDs) from your Traditional IRA if you are over age 70 1/2), and 529 plan contributions can all potentially help you save on taxes.

Keep SJS Apprised Of Trusted Advisor Changes

We want to keep up with changes affecting your family, including changes to your attorneys, accountants, or bankers. Please let us know if you have made changes to the professionals you work with.

Update Your Estate Plan

It is a good practice to regularly review your beneficiary designations to ensure they match your current wishes and align with your estate planning documents. Reviewing your estate planning documents periodically is also recommended, at least every five years or when there is a major change in your life situation.

Keep Your Wealth Protected

Wealth accumulation is only part of the equation; the other piece is wealth protection. We strive to help keep your personal data safe, including avoiding sending personal information via email and reaching out to you to confirm that requests we receive from you are legitimate. Taking additional steps like changing passwords periodically and adding multi-factor authentication can help to keep your information safe.

As always, we are here to help you put your best foot forward. We are glad to meet with you to help keep you on track!

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Small Town Values

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

By Founder & CEO Scott J. Savage.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The image is a true example of a community serving its citizens and business owners to make the holiday season festive. Nothing about this light display was easy. In fact, it was the opposite. Difficult and time intensive. But clearly the Sylvania workforce took pride in their craft.

What drove that? Perhaps knowing their effort and skill would make a difference for people of all ages. A difference in the form of much needed lifting of spirits, bringing smiles and gratitude for living in this wonderful place. And probably a lot of pride to show their own children, grandchildren, their mom and dad that they had a hand in making life a little better for all of us!

Here’s to the communities in this great country where SJS has the privilege to live and to help prosper - in 2024 and beyond!

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

SJS Outlook: Q4 2023

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

SJS Welcomes Jeff Lewis!

We would like to welcome Jeff Lewis to the SJS Team! Jeff is an Associate Advisor, working alongside Senior Advisors to serve our clients.

We would like to welcome Jeff Lewis to the SJS Team!

Jeff is an Associate Advisor, working alongside Senior Advisors to serve our clients, particularly with financial planning and investment analyses. Additionally, Jeff will be helping with business consultation and strategic planning for our non-profit and small business clients.

Originally from Texas, Jeff grew up outside of the Houston area. He spent two years as a starting pitcher on the baseball team at Howard Junior College in West Texas before graduating with a Bachelor of Science in Psychology from the University of Houston. Jeff also received a Master of Science in Theological Studies from the University of St. Thomas in Houston. In 2018, Jeff obtained his MBA in Accounting and Finance from Regis University in Denver, Colorado.

Jeff spent the past 15 years in Colorado as an executive leader in the non-profit sector. He was the Executive Director for the Missionary Sisters of the Sacred Heart at Mother Cabrini Shrine in Golden, Colorado. Jeff helped to grow the organization through strategic planning, financial development, fundraising, and capital improvements.

Jeff, his wife, and four children recently moved to Ohio to be closer to family. He enjoys dinners out with his wife, playing golf and baseball with his boys, and spending quality time with his identical twin girls.

We are really grateful that Jeff decided to join our Team. Please join us in welcoming Jeff!

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Welcome (Back) Molly LaClair!

Most recently part of the SJS Team from 2018 to 2021, we are thrilled to say that Molly LaClair has decided to re-join the SJS Team as an Associate Advisor!

Most recently part of the SJS Team from 2018 to 2021, we are thrilled to say that Molly LaClair has decided to re-join the SJS Team as an Associate Advisor!

A Northwest Ohio native, Molly earned her Bachelor of Science degree in Finance from Miami University, as well as her MBA from the University of Toledo. After spending several years as a project analyst and process improvement specialist with ProMedica, Molly initially joined SJS in 2018 to help existing and prospective clients through investment portfolio analyses, client presentations, and financial plans. Most recently, Molly obtained her Ohio Real Estate Salesperson license in 2023.

Molly is both a team and client favorite, known for her reliability, acumen, communication skills, and integrity. Molly will be working closely with the Senior Advisors at SJS to serve our clients, with an emphasis on financial planning and client presentations.

When she’s not at SJS, Molly enjoys spending time with her family – especially her three young children – visiting the area metroparks and neighborhood parks in Perrysburg, where her family resides.

We are really grateful to be working with Molly again. Please join us in welcoming back Molly!

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Important Financial Planning Numbers For 2024

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

By Senior Advisor Andrew Schaetzke, CFP®.

When planning for the coming year, it can be hard to keep track of all of the new financial and tax information. There are many important financial numbers to be aware of for 2024, including:

Tax rates and brackets, such as for federal income tax, capital gains tax, Social Security tax, and estate tax

Certain tax deductions, exemptions, and credits

Retirement plan (401(k), 403(b), IRA, SIMPLE IRA) and Health Savings Account (HSA) contribution limits

Required minimum distribution (RMD) table for certain tax-deferred retirement accounts

Medicare premiums & IRMAA surcharges

To help you financially plan for 2024, we provide the resource below. As always, we are here to help your family throughout your financial journey. We can provide resources, experience, and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Please click on the images below to view the PDF.

Important Disclosure Information & Sources:

This resource was created by fpPathfinder. SJS pays an annual subscription in order to license resources from fpPathfinder.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

SJS Investment Services Recognized In The Forbes / SHOOK 2023 List Of America's Top RIA Firms

SJS Investment Services has been recognized in the Forbes / SHOOK 2023 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Investment Services has been recognized in the Forbes / SHOOK 2023 list of America’s Top RIA (Registered Investment Advisor) Firms.[1]

“This recognition is affirming to our Team, and we attribute this to the faith, commitment, and loyalty that our clients have demonstrated to SJS over the last 28 years,” says SJS Founder & CEO Scott J. Savage.

In the introduction to this year’s Top RIA Firms webpage, the authors affirmed, “All of the RIAs on Forbes list have strong pedigrees when it comes to providing a steady hand for clients and preserving their wealth over the long term.”[1]

As detailed on the methodology webpage, the Forbes / SHOOK 2023 list of America’s Top RIA Firms, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone, virtual and in-person due diligence interviews, and quantitative data. The algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK Research receive a fee in exchange for rankings. SHOOK Research received 42,643 nominations based on thresholds, invited 23,100 firms to complete their online survey, performed 18,417 telephone interviews, conducted 4,281 in-person interviews at advisors’ location, and conducted 1,487 virtual interviews. Additional information about the ranking methodology can be found on the Forbes website.[1][2]

In April 2023 and August 2023, SJS Investment Services responded to an email survey provided by SHOOK Research, providing quantitative information including assets under management, revenue, typical client relationship size, and minimum account size for new business. Neither SJS Investment Services nor any of its employees provided any payment to Forbes or SHOOK Research in exchange for rankings.

If you would like to learn more about how the SJS team works with families, business owners, and institutions, please feel free to reach out to us. We are always here to listen and assist.

Important Disclosure Information & Sources:

[1] “America’s Top RIA Firms”. Sergei Klebnikov & SHOOK Research, 10-Oct-2023, forbes.com.

[2] “Methodology: America’s Top RIA Firms 2023”. R.J. Shook, 10-Oct-2023, forbes.com.

Past performance is no guarantee of future results. There is no guarantee investment strategies will be successful.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

You Can't Take It With You

In addition to family gifting, many individuals support giving to organizations that aim to help their communities. We highlight some strategies to make the most of your giving dollars.

By Managing Director & Senior Advisor Jennifer Smiljanich, CFP®.

Giving to family members or charitable organizations is a highly personal decision, often tied with emotional strings. We make gifts aligned with our values, and our choice to give, or not to give, tells other people something about us. I have always felt a strong connection to Catholic Charities. In 1951, my father’s family emigrated to the United States from Germany with a few suitcases and a dream of a better life. His family received clothing from Catholic Charities to make their transition to America easier. Now I want to give that opportunity to someone else!

For some, gifting to family takes precedence over making donations to charity. Keep in mind that you may gift up to $17,000 per individual in 2023, without generating gift tax. Gifts can be made to individuals using cash or securities.[1] Various types of account structures, including 529 Plans, trusts, and Roth IRAs, may be used to help your loved ones accomplish their future goals, and your own.

In addition to family gifting, many individuals support giving to organizations that aim to help their communities. Below, we’ve highlighted some strategies to make the most of your giving dollars:

1. Consider making gifts using IRA dollars: for those age 70 ½ or older in 2023, you may request that your IRA custodian cut a check directly to a charity (called a qualified charitable distribution (QCD)). This strategy works well for individuals who cannot itemize deductions on their tax return. Each IRA dollar given to a qualified non-profit organization does not count as taxable income to the IRA owner. Additionally, for those taking required minimum distributions (RMDs), these donations can be used to satisfy your RMDs.[2]

2. Donate highly appreciated securities: if you are making a meaningful gift to a qualified charity, you may be able to donate a stock, mutual fund, or exchange traded fund (ETF) in kind. By doing so, you can avoid realizing the gain on the security at sale (and the resulting tax). The charity can sell the security and does not realize the gain if they are a qualified organization.[3] A win for both the giver and receiver! Consider this example of donating $50,000 of securities directly to charity:

3. Donor advised funds: these types of accounts can be held through a community foundation or custodian, including Schwab, Fidelity, and Vanguard. An individual can donate cash or securities to fund an account; using highly appreciated securities is most advantageous. At the time of funding, the donor receives a tax deduction up to the value of the securities / cash donated. The original securities are then sold and may be invested in other securities. Then, the donor may use the account to make donations all at once, or over time, to charitable organizations. There are some caveats - the receiving charity must be a legitimate qualified charity and the donor cannot use donor advised funds in a way that the donor receives some benefit (i.e. to pay for a gala dinner).[4] Unfortunately, a QCD from an IRA may not be directed to a donor advised fund.

4. Cash is always an option: for smaller gifts, one-time gifts, and gifts to smaller organizations that might not have a brokerage account to receive securities, cash might be the simplest and most effective option.

Finally, some states offer tax credits for charitable donations that might be used to help families paying private school tuition or to aid other charitable organizations. Tax credits reduce taxes due dollar-for-dollar. Ohio recently began a tax credit program to support scholarship granting organizations (such as some private schools), up to $750 per individual or $1,500 per married couple.[5] Arizona also offers tax credits for donations to selected charitable organizations and foster care organizations.[6]

We are available to help you, in coordination with your tax or estate professional, consider how to best accomplish your giving goals to family or to organizations aligned with your values. While gifts must be completed before December 31st to count for the current tax year, giving can be done throughout the year to support the people and causes that are near and dear to you.

Important Disclosure Information & Sources:

[1] “Frequently Asked Questions on Gift Taxes”. Internal Revenue Service, 2023, irs.gov.

[2] “IRA FAQs - Distributions (Withdrawals)”. Internal Revenue Service, 2023, irs.gov.

[3] “About Publication 526, Charitable Contributions”. Internal Revenue Service, 2023, irs.gov.

[4] “Donor-advised Funds”. Internal Revenue Service, 2023, irs.gov.

[5] “Scholarship Donation Credit”. Ohio Department of Taxation, 2023, tax.ohio.gov.

[6] “Credits for Contributions to QCOs and QFCOs”. Arizona Department of Revenue, 2023, azdor.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. Forward looking statements include expressed expectations of future events and the assumptions on which the expressed expectations are based. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience.

Growing Your Cash

You can consider putting excess cash into a money market fund, short-term U.S. Treasury bonds, or a short-term bond mutual fund / ETF.

By Chief Investment Officer Tom Kelly, CFA.

Interest rates are up everywhere. Except perhaps your bank account. While the Federal Reserve's rate hikes and skyrocketing mortgage rates dominate headlines, the fine print in your bank account statement, revealing the interest rate on your savings, isn’t making the same amount of noise. Perhaps it should, and for all the wrong reasons.

The national average rate for a bank savings account is a paltry 0.45%, as of September 2023.[1] While these rates have been low for quite some time, there have not been obvious and safe alternatives… until recently! One-month Treasury Bills now yield 5.55% on an annualized basis as of September 29, 2023.[2] Additionally, one-year rates are at 5.46% as of September 29, 2023.[3] These are short-term rates we haven’t seen in over 20 years.

See Important Disclosure Information.[1][2][3]

One of the key roles of an advisor is to identify opportunities in the market. And while they don’t always exist, or persist, we believe that this is an important area to pick up yield if you have excess cash on the side. You can consider putting that excess cash into a higher-yield money market fund, short-term U.S. Treasury bonds, or a short-term bond mutual fund / ETF. Please reach out to us to discuss the best options for your situation.

Important Disclosure Information & Sources:

[1] “National Deposit Rates: Savings, Percent, Monthly, Not Seasonally Adjusted”. FRED, September 2023, fred.stlouisfed.org.

[2] “Market Yield on U.S. Treasury Securities at 1-Month Constant Maturity, Quoted on an Investment Basis, Percent, Monthly, Not Seasonally Adjusted”. FRED, September 2023, fred.stlouisfed.org.

[3] “Market Yield on U.S. Treasury Securities at 1-Year Constant Maturity, Quoted on an Investment Basis, Percent, Monthly, Not Seasonally Adjusted”. FRED, September 2023, fred.stlouisfed.org.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training.

Hyperlinks to third-party information are provided as a convenience.