Office: (419) 885-2626

Toledo, Ohio Metropolitan Area

Molly LaClair

Associate Advisor

Molly serves as Associate Advisor, working alongside Senior Advisors to serve our clients, particularly with financial planning, investment analyses, and presentations. Molly is both a team and client favorite, known for her reliability, acumen, communication skills, and integrity.

A Northwest Ohio native, Molly earned her Bachelor of Science degree in Finance from Miami University, as well as her MBA from the University of Toledo. After spending several years as a project analyst and process improvement specialist with ProMedica, Molly initially joined SJS in 2018 to help existing and prospective clients through investment portfolio analyses, client presentations, and financial plans. Molly also had an Ohio Real Estate Salesperson license from 2023-2024.

When she’s not at SJS, Molly enjoys spending time with her family – especially her three young children – visiting the area metroparks and neighborhood parks in Perrysburg, where her family resides.

At SJS, we often talk about what it means to build a better life. While investing and financial planning play an important role, we know the foundation of a better life is much broader than simply making sound financial decisions. Living a more meaningful life often starts with small, consistent habits.

SJS Investment Services creates a weekly market update to summarize performance characteristics for major stock and bond indices.

Every January, Wall Street releases its newest flurry of S&P 500 year‑end predictions. And inevitably, we’re asked where we think the market is headed. At SJS, we certainly have opinions, but we don’t publish short-term market forecasts or build client portfolios around them. Because, quite simply, no one knows where markets will land. Not us, not the loudest voices on TV, and not even the banks that publish those targets with great confidence.

Are valuations excessively high? Do record earnings justify selling? Headlines that stir fear are not new. Investors often get caught up in market noise, but recognizing that news headlines are often written to prioritize clicks over nuanced truth can reduce stress.

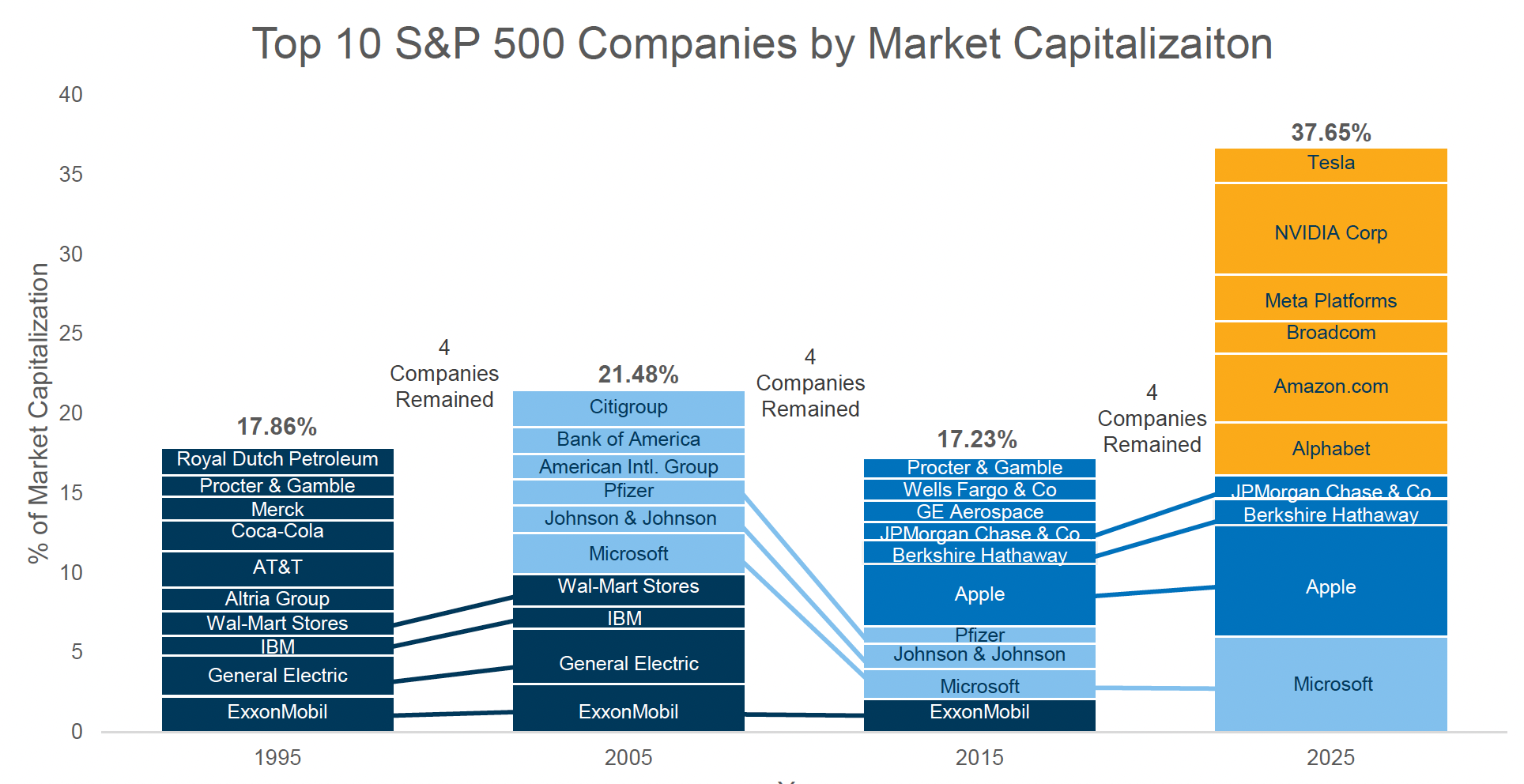

Do you remember when AOL was the internet? When hearing “You’ve got mail” felt like a small event, and logging on meant you were connected to the future?

The beginning of 2026 is a natural checkpoint to make sure your saving, gifting, and protection strategies still match the life you are living today. Your financial planning can benefit from a fresh look at the start of each year and we have a some actionable ideas to start the new year on the right foot, financially.

2025 closed out with global stock markets delivering another remarkable year, capping one of the strongest three-year stretches in stock market history. The April correction now feels like a distant memory as tariff shocks came and went.

As we excitedly look forward to the year ahead, we remain deeply committed to empowering you to build a better life and providing the peace of mind you deserve.

Each quarter, we create an outlook that covers topics including general investment market conditions, financial planning considerations, and SJS news.

This fall, we had the pleasure of working with Isaac Saffold, an intern from Georgetown University. Isaac joined us through a meaningful connection — he was referred by the Georgetown football coach, as SJS Senior Advisor Andrew Schaetzke also played on the team. It’s a great example of how strong relationships open doors and create opportunities.