Planning (Financially) For The New Year

We have some suggestions for concrete actions to start your new year on the right foot, financially.

By Senior Advisor Jennifer Smiljanich, CFP® & Associate Advisor Austin Grizzell, CFP®.

The ending of one year and the transition to a new year offers an opportunity for reflection on past events, and a look forward to a new beginning. To that end, we have some suggestions for concrete actions to start your new year on the right foot, financially.

Review Retirement Contributions

In 2023, the IRS is boosting retirement contribution limits to new highs - who knew there was a silver lining to inflation? The new amounts allow those of us with earned income to save more for retirement. Please review your 2022 contributions vs. the new 2023 limits for retirement plans and IRAs if you are inclined to maximize those contributions.

2023 Selected Retirement Plan Contribution Limits

Source: “Retirement Topics - Contributions“. IRS, irs.gov.

Consider Gifting Goals

Like retirement plan contributions limits, the IRS also increased the amount you may gift to an individual recipient to $17,000 in 2023, without affecting lifetime gift tax exemptions.

Keep SJS Apprised Of Trusted Advisor Changes

We want to keep up with changes affecting your family, including changes to your attorneys, accountants, or bankers. Please let us know if you have made changes to the professionals you work with. Tax season is fast approaching, and we want to ensure we are sharing tax documents with your current accountant and contacting the correct attorney on any strategy updates. Likewise, if you have changed banking relationships, we would like to be sure we have instructions on file to send funds to you in a timely manner when you need them.

Update Your Estate Plan

Over time, family dynamics change. It is a good practice to regularly review your beneficiary designations. They should match your current wishes and align with your estate planning documents. Reviewing your estate planning documents periodically is also recommended, at least every five years or when there is a major change in your life situation.

Take Inventory

As we move through different phases of our financial lifecycle, we often accumulate assets and move on to the next thing. Is there a reason to keep a retirement plan in place from a former employer? Am I really monitoring my "play stock" portfolio? Can I simplify my portfolio? Your SJS advisor can help you evaluate whether these investments align with how you view risk and investing today, and whether they are supporting your goals!

Keep Your Wealth Protected

We focus many of our interactions around market outlooks, how your portfolio is doing, and how it supports what matters to you. Wealth accumulation is only part of the equation, the other piece is wealth protection. We strive to help keep your personal data safe, including avoiding sending personal information via email and reaching out to you to confirm that requests we receive from you are legitimate. Taking additional steps like changing passwords periodically and adding two-factor authentication can help to keep your information safe.

As always, we are here to help you put your best foot forward. We are glad to meet with you to help keep you on track!

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

5 Investing Lessons Learned & Re-learned In 2022

The end of the year provides a great time for us to reflect on recent experience to divine lessons to help us going forward.

By Chief Investment Officer Tom Kelly, CFA & Investment Associate Bobby Adusumilli, CFA.

The end of the year provides a great time for us to reflect on recent experience to divine lessons to help us going forward. We want to highlight five lessons that we have learned and re-learned throughout 2022.

Volatility Can Happen Quickly

From a year-to-date performance perspective through November, 2022 has been the worst year for global stocks since the Great Recession from 2007-2009.[1] After more than a decade of positive performance, we knew that global stocks (as measured by the MSCI All Country World Index (ACWI)) having a down year was entirely possible.[1] What has been particularly unusual about 2022 is that U.S. bonds (as measured by the Bloomberg U.S. Aggregate Bond Index) have experienced their worst calendar year performance in the history of the index going back to 1976.[2]

Stock market volatility is to be expected - it is one of the trade-offs in pursuing higher expected returns, as this graph demonstrates:[1]

Source: Morningstar, as of November 30, 2022. Returns are based on total return of the MSCI All Country World Index, which is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. See Important Disclosure Information.[1]

In comparison, bond markets typically have much lower volatility than stocks. However, due to higher-than-expected inflation in 2022, the U.S. Federal Reserve has raised interest rates dramatically throughout 2022, which has led to an upward shift in interest rates across maturities:[2][3]

Source: Department of U.S. Treasury, as of November 30, 2022. See Important Disclosure Information.

As a consequence of the rapid increase in U.S. interest rates, existing U.S. investment grade bonds have had to decline in price in order to compensate prospective investors to buy existing bonds versus new bonds with higher interest rates. This is partially why the U.S. investment grade bond market has suffered this year:[2]

Source: Morningstar, as of November 30, 2022. Returns are based on total return of the Bloomberg US Aggregate Bond Index, which is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. See Important Disclosure Information.[2]

Unfortunately, it is very difficult to know when volatility will occur and what changes to make to investment portfolios ahead of time. While sometimes client portfolios experience short-to-medium-term pain, we believe that strategically designing portfolios for the long-term is most likely to benefit the majority of our clients.

For Investment-Grade Bonds, Duration Is Critical

While current yield is a good predictor of return for investment-grade bonds over their maturities (which tend to be higher-quality bonds with low expected risk of default), duration is the most important factor that influences investment-grade bond prices over the short-term.[4] Duration measures a bond portfolio’s price sensitivity to interest rate changes. Because interest rates have risen dramatically throughout 2022, higher-duration bonds have experienced significantly worse performance than shorter-duration bonds in 2022:

Sources: Morningstar, S&P as of November 30, 2022. Duration measures a bond’s or fixed income portfolio’s price sensitivity to interest rate changes. The S&P indices are broad, comprehensive, market-value weighted indices that seeks to measure the performance of their respective markets. See Important Disclosure Information.

Given recent performance, you may be wondering: if the U.S. Treasury yield curve is nearly flat, meaning investors are getting paid nearly the same interest regardless of maturity, why would you buy longer-term bonds? There are two important factors to consider:

The future is uncertain. It is very difficult to predict how interest rates will change relative to what the market is already pricing in. With longer-duration investment grade bonds currently yielding higher than the market’s priced-in expected inflation rates, we think it makes sense for long-term investors to have some exposure to longer-duration bonds.[5][6] Additionally, shorter-duration bonds have reinvestment risk, meaning that if interest rates have fallen by the time the bond matures, then new bonds may have to be purchased at lower interest rates. Longer-maturity investment grade bonds can allow you to “lock-in” an interest rate for longer.

If / when the U.S. Federal Reserve reduces interest rates, longer-duration bonds will likely benefit more in price compared to shorter-duration bonds.

As investment advisors, we continuously monitor duration and credit quality across the bond investments that we recommend. While this year has been rough, we believe the outlook is significantly brighter for bond investors.

Alternatives Are Becoming More & More Important

Alternative investments include asset classes that behave differently than publicly-traded stocks and bonds. Some of these asset classes include private equity, private debt, real estate, infrastructure, natural resources, insurance / reinsurance, and other more complex trading strategies.

High-quality alternative investments have historically been primarily offered to ultra-high net worth institutions and families. Many of the world’s top investors have had significant allocations to alternatives for decades.[7] With advances in investment technology, more and more investors now have access to alternative investments. As a result, the demand for alternative investments is expected to increase in the coming years.

Alternative investments have important tradeoffs to consider. They typically cost more in fees, are more complex, and are less transparent compared to publicly-traded stocks and bonds. Additionally, alternative investments often have lock-up periods, tax inefficiencies, and usually involve more account management. As a result, it is critical to do thorough due diligence before choosing an alternative investment.

In late 2021, SJS added the Stone Ridge Diversified Alternatives Fund (SRDAX) to MarketPlus Investing models.[8][9] While the timing was fortunate given the recent struggles of publicly-traded stocks and bonds, we believe that alternative investments can provide meaningful diversification benefits to client portfolios over the long-term.[8] We are focusing most of our investment research and due diligence efforts on alternatives, with the hope of finding more beneficial investments for our clients.

There Is Always Something Smart To Do

Even when stocks and bonds are struggling, there are smart things that investors can do to potentially help their investment portfolios over time:

Rebalancing means selling investments that are higher than your target allocations, and buying investments that are under-allocated, with the goal of maintaining your target level of risk.

Tax loss harvesting for taxable accounts allows for realized net capital losses to be used to offset current / future capital gains, sell investments that you no longer want to hold, and offset up to $3,000 of your federal taxable income for the current year and future years.

Adding to investments that have attractive expected risk/return characteristics. For example, we believe that allocating to what we think are high-quality alternative investments may be able to help client portfolios over time, though there are no guarantees. Additionally, we previously wrote about Series I Savings Bonds, which are bonds offered by the U.S. government that pay you interest based on the CPI-U inflation index.

Revisiting asset location, which involves placing the most tax-inefficient investments in tax-advantaged accounts. For example, most alternative investments tend to be tax-inefficient, paying high amounts of dividends, interest, and capital gains. Therefore, we have prioritized placing these alternative investments within tax-advantaged client accounts when possible.

Long-Term Investors Have An Advantage

One theme that shows up over and over again in research and our experience with clients is that investors with long time horizons (10+ years) have an advantage over those with short time horizons (<5 years) when it comes to withstanding volatility in order to capture market performance over time.[10][11] Beyond just their time horizon, we have found that investors who are able to keep recent events within perspective of long-term history are better able to stay committed to their investment plan even in the midst of difficulty. For example, despite experiencing 15 recessions, societal changes, and periods of political difficulties, the U.S. stock market (as measured by the S&P 500) has still grown over 10,000-times its initial value from January 1926 through November 2022, as depicted in this graph:

-Sources: NBER, Morningstar, as of November 30, 2022. Recession start and end dates are based on the US Business Cycle Expansions and Contractions data from the NBER. Gray shaded areas represent periods of recession. The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States. The S&P 500 total return index assumes reinvestment of all distributions. See Important Disclosure Information.

While there are no guarantees that the stock market going forward will experience positive performance like the past, we believe in the global economy and innovation. As a result, we believe that stocks and bonds can continue to provide positive returns over the next 10+ years on average, though volatility will cause year-to-year performance differences. While nothing is certain, we are optimistic about the future.

Important Disclosure Information & Sources:

[1] Source: Morningstar, Dimensional Returns Web, as of November 30, 2022. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets.

[2] Source: Morningstar, Dimensional Returns Web, as of November 30, 2022. The Bloomberg US Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

[3] “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average“. Federal Reserve Bank of St. Louis, 30-Nov-2022, fred.stlouis.org.

[4] “SJS 2021 Capital Markets Expectations: Making Sense Of The Future“. SJS Investment Services, 04-Feb-2021, sjsinvest.com.

[5] “5-Year Breakeven Inflation Rate“. Federal Reserve Bank of St. Louis, 30-Nov-2022, fred.stlouis.org.

[6] “10-Year Breakeven Inflation Rate“. Federal Reserve Bank of St. Louis, 30-Nov-2022, fred.stlouis.org.

[7] Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment. David Swensen, 2009, Free Press.

[8] “Stone Ridge Diversified Alternatives Fund“. Stone Ridge Asset Management, stoneridgefunds.com.

[9] MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost. There are limitations inherent in model allocations. In particular, model performance may not reflect the impact that economic and market factors may have had on the advisor's decision making if the advisor were actually managing client money. Not to be construed as investment advice.

[10] “Quantitative Analysis of Investor Behavior“. DALBAR, dalbar.com.

[11] “Are Stocks Riskier Than Bonds?“ Bobby Adusumilli, 07-May-2021, sjsinvest.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Four High School Seniors Intern With SJS Investment Services

We asked each student to write a summary of what they learned during the internship, which we share here. We thank Kleiston, CJ, Beckham, and Zach for spending their internship with us, and we wish them well going forward!

One of our favorite traditions at SJS Investment Services is when students intern with us. It is an opportunity for us to teach the next generation of investors some of what we have learned, as well as learn from them.

From August to December 2022, four Seniors from St. John’s Jesuit High School - Kleiston Bonnell, CJ Hornbeak, Beckham Schmitz, and Zachary Zitkovic - interned with the SJS Team in Sylvania, Ohio. Throughout their internship, they did activities including:

Learn about a wide variety of topics on personal finance, from taxes to insurance to the financial costs with having a family

Study the importance of investing, as well as different ways of investing

Introduction to retirement and other investment accounts (ex. IRA, 401(k), 529, HSA, etc.)

Research different investors and specific investments

Read The Investment Answer by Daniel C. Goldie and Gordon S. Murray as well as The Psychology of Money by Morgan Housel, which they get to keep

Meet with most members of the SJS Team as well as some local business leaders

Create a LinkedIn profile (Kleiston, CJ, Beckham, Zach) and resume

Present an investment-related idea for the SJS Team to consider

We asked each student to write a summary of what they learned during the internship, which we share below. We thank Kleiston, CJ, Beckham, and Zach for spending their internship with us, and we wish them well going forward!

Kleiston Bonnell

I very much enjoyed my time at SJS. The staff was welcoming and very conversational. Bobby mentored us throughout the semester. We started with the basics such as what is a stock and a bond and how each works. We also learned early on some of the key characteristics of people who have become and stayed wealthy. We were provided with two books at the start, The Psychology of Money and The Investment Answer.

As our time continued, we met with many of the SJS team members to talk and sit in on calls with them. We would continue to sit with Bobby and learn about more of the jargon of the financial field such as REITS (real estate investment trusts) and ETFs (exchange traded funds). We learned about a way to get a head start on our future with a Roth IRA. We learned about different investment accounts such as 401(k)s, which are retirement plans offered by your job. We also learned about the 529 plan, which can be used to pay for education expenses.

Halfway through the internship, we met with a SJJ alumnus named Paul Kwapich, who runs River Asset Management. We were able to talk with him about his experience getting started in the real estate field. Coming to the end of our internship, I am very thankful for Kevin and Scott for giving us the opportunity to join them at SJS. And I would also like to thank Bobby for taking the time to mentor us and give us a head start on investing and helping us set ourselves up for success.

CJ Hornbeak

During my internship at SJS Investment Services, I have learned many things about the stock market, as well as many ways to save and potentially gain money. Because investments can lose money over short or even long periods, I need some stable money to keep and not invest (emergency account). I learned the difference between a stock and bond. A stock is a piece of ownership in a company you can buy yourself, and a bond is like a loan to a company or government. Also, owning a share of a REIT is like owning part of real estate, and with that comes the importance of paying off the buildings, taxes, and bonds.

I learned about mutual funds and ETFs, which are types of pooled investment securities. I also learned about different types of investment accounts, such as taxable accounts. I learned about Roth IRAs, in which you must contribute after-tax money. If you follow the rules, your contributions and earnings can grow tax-free, and you can withdraw them tax-free and penalty-free starting at age 59.5.

We went to Paul Kwapich’s real estate company, which owns, operates, and finances income-generating real estate. Bobby also gave us a book called The Psychology of Money, which talks about how dealing with money can be hard for many people. Doing well with money isn’t guaranteed - it’s a lot about how you behave. We also learned how a lot of wealthier people end up losing their wealth by buying nicer things and spending too much money instead of saving money and spending less.

I learned about FICA taxes, which provide necessary funding for the government to pay Social Security and Medicare benefits. FICA taxes are payroll taxes that occur before retirement plan contributions. Medicare provides healthcare primarily for people age 65 and older. Social Security provides income for people as they get older. We also learned about other taxes, as well as about tax deductions. Lastly, I learned about venture capital investing, which provides capital to startup companies and small businesses that may have long-term growth potential.

Beckham Schmitz

During my time at SJS Investment Services, I have been able to broaden my knowledge of the business world. Interning with SJS has presented me with a lot of opportunities and experiences. I had no idea what I was getting myself into when I first joined the internship program at St. John’s. However, I am very fortunate that I decided to intern with SJS and am grateful for the knowledge it has left me.

During my time at SJS, I have undergone many talks and activities with Bobby Adusumilli. He gave us a rundown of the ins and outs of business. He taught us about managing money and strategies to potentially help set ourselves up for our futures. Also, he taught us a lot of business vocabulary so that we can better comprehend investment markets. Additionally, I am thankful for the different SJS team members we had the opportunity to speak with. Being able to see the different jobs and ask specific questions regarding their positions was very informative. I think learning how to start and operate a business will prepare us for our futures.

I am very thankful to the SJS team for allowing me to intern with them. This internship has left me with a lot of new knowledge and skills. I think this time spent at SJS will better set me up for my future and leave me with connections. I appreciate everyone at SJS for giving us their time and broadening our knowledge in their fields.

Zachary Zitkovic

SJS has helped me learn some of the necessary knowledge needed in order to make smart financial decisions. I really enjoyed and valued our lessons in learning how to manage money. This is a crucial skill that can be vital at such a young age to accumulate wealth over time. You must learn what “enough” is for you. When you learn how to budget but enjoy your money in a humble fashion, it can lead to smarter financial decisions and greater profits in the long run. Whether it means living below your means, value of paying taxes and bills on time, or just learning the value of investing in a broad-market index mutual fund instead of trying to beat the market, I truly can say I’m much more knowledgeable now than I was before this internship. These skills learned will live with me for the rest of my life and I am blessed to have been given the opportunity to be introduced to them at such a young age.

I think it’s incredibly important for many people to know that past performance on the market can’t guarantee what the future may look like. I learned in the book The Psychology of Money (given to us by the Advisors) that almost nothing is ever as good or as bad as you think. It helps to be level-headed in the investment world and not rush decisions because of a high or a low. The best money lesson I've learned over the past few months is that your money mindset is more important than the number in your bank account. If you fear money or think you're terrible with money, that may become true. It was also great learning about the different retirement plans like the IRA and 401(k). You may have the option to do Roth plans where you tax the money you put in right away, or Traditional where it’s taxed when it comes out. Roth is popular among younger investors but both are good plans depending on the company you may work for.

These 75 hours spent at SJS have been some of the most important and crucial time in all my time at St. John’s. It was great seeing how there’s so many different ways to achieving financial success. I’ve realized this based on all the different SJS team members, CEOs, and popular figures we researched, and learned how there’s no one straight path to achieving wealth. It was amazing learning about all the different stories and paths to see how people got to where they are today. The ability to learn from the employees at SJS has been nothing short of a blessing. Bobby has done an incredible job giving us the basics of many financial topics. We were even given the opportunity to tour and learn at Paul Kwapich’s real estate business River Asset Management. There, we were able to learn about the basics of real estate, much like how Bobby taught us in finance. The connections I’ve made with all the team members at SJS and their connections will be relationships that I will cherish for the rest of my life.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Important Financial Planning Numbers For 2023

To help you financially plan for 2023, we provide this resource with important numbers for the upcoming year.

By Senior Advisor Andrew Schaetzke, CFP®.

When planning for the coming year, it can be hard to keep track of all of the new financial and tax information. There are many important financial numbers to be aware of for 2023, including:

Tax rates and brackets, such as for federal income tax, capital gains tax, Social Security tax, and estate tax

Deductions, exemptions, and tax credits

Retirement plan (401(k), 403(b), 457, IRA SIMPLE IRA) and Health Savings Account (HSA) contribution limits

Required Minimum Distribution (RMD) table for tax-deferred retirement accounts

Medicare premiums & IRMAA surcharges

To help you financially plan for 2023, we provide the resource below. As always, we are here to help your family throughout your financial journey. We can provide resources, experience, and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Please click on the images below to view the PDF.

Important Disclosure Information & Sources:

This resource was created by fpPathfinder. SJS pays an annual subscription in order to license resources from fpPathfinder.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

What Financial Issues Should You Consider Before Year-End?

To help you assess financial issues to consider for the rest of 2022, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

With the end of the year approaching, now may be a good time to review your investments and other financial matters for the rest of 2022, as well as plan for 2023. To help you assess financial issues to consider before year-end, we provide the resource below. As always, we are here to help you and your family throughout your financial journey. We can provide resources, experience, and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Please click on the images below to view a PDF version.

Important Disclosure Information & Sources:

This resource was created by fpPathfinder. SJS pays an annual subscription in order to license resources from fpPathfinder.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

SJS Investment Services Recognized In The Forbes / SHOOK Research 2022 List Of America's Top RIA Firms

SJS Investment Services has been recognized in the Forbes / SHOOK Research 2022 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Investment Services has been recognized in the Forbes / SHOOK Research 2022 list of America’s Top RIA (Registered Investment Advisor) Firms.[1]

“Recognition by one of the financial industry’s most respected publications is humbling, and simply reflective of the faith, commitment, and loyalty the SJS team has demonstrated to our wonderful clients over the last 27 years,” says SJS Founder & CEO Scott Savage.

The Forbes / SHOOK Research 2022 list of America’s Top RIA Firms, developed by SHOOK Research, is based on an algorithm of qualitative criteria, mostly gained through telephone, virtual and in-person due diligence interviews, and quantitative data. The algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK research receive a fee in exchange for rankings. SHOOK Research received 36,535 nominations based on thresholds, invited 21,116 firms to complete their online survey, performed 15,342 telephone interviews, conducted 3,250 in-person interviews at advisors’ location, and conducted 1,357 virtual interviews. Additional information about the list methodology can be found here.[2]

In April 2022, SJS Investment Services responded to an online survey provided by SHOOK Research, providing quantitative and qualitative information including AUM size, AUM growth, typical client relationship size, and minimum account size for new business. Additionally, SJS Investment Services participated in a telephone interview with SHOOK Research in June 2022. Neither SJS Investment Services nor any of its employees provided any payment to Forbes or SHOOK Research in exchange for rankings.

If you would like to learn more about how the SJS team works with families, business owners, and institutions, please feel free to reach out to us. We are always here to listen and assist.

Important Disclosure Information And Sources:

[1] “America’s Top RIA Firms 2022”. Sergei Klebnikov & SHOOK Research, 25-Oct-2022, forbes.com.

[2] “Methodology: America’s Top RIA Firms 2022”. R.J. Shook, 25-Oct-2022, forbes.com.

Past performance is no guarantee of future results. There is no guarantee investment strategies will be successful.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

The Gold Rush?

History has shown that over long periods of time, gold has often failed to outpace inflation, even before considering fees.

By Chief Investment Officer Tom Kelly, CFA.

We all like to consider ourselves investors, but sometimes find ourselves speculators. It can be exciting to predict, tinker, and attempt to outsmart, trying to find the golden opportunities to strike it big. Sometimes it pays off, but many times it leaves us emptyhanded. Good investing is often boring: global diversification in cash flow-producing companies; holding for the long-term; patience in valuations. Anyone can do that, right? Many can, but few do.

Take, for example, the parties in the California Gold Rush of the mid-1800s. Prospectors from all over the world went to California with the hopes of finding that illustrious metal; few made it big, while most ended up with nothing.[1] However, retailers selling the prospecting supplies, merchants, and transporters benefited greatly from the growth of the economy. Samuel Brannan was said to be the wealthiest man in California at the time.[2] His profession? Publicizing the Gold Rush in newspapers and running a store selling picks, shovels, and pans. The difference in investing vs. speculating.

While you might have thought we learned our lesson, the original 49ers aren’t the only speculators in gold. To a large extent, the gold bugs of today are just as starry-eyed as those of the past, betting on gold as an inflation hedge. However, history has shown that over long periods of time, gold has often failed to outpace inflation, even before considering fees. Just look at inflation (as measured by the CPI-U index) vs. gold (as measured by the gold spot price from Bloomberg) returns since 1980.[3][4]

Sources: Morningstar, as of September 2022. Inflation is represented by the Consumer Price Index for All Urban Consumer (CPI–U), not seasonally adjusted. The Gold Spot Price is based on USD returns from composite prices from Bloomberg. See Important Disclosure Information.[3][4]

Since 1980, gold has failed to live up to its luster as an antidote to inflation. The U.S. stock market (as measured by the S&P 500) on the other hand: up nearly 9,000% over that same period.[5] However, it is important to note that the S&P 500 has had periods of up to 17 years when it has underperformed CPI-U inflation on an annualized basis.[6] Nonetheless, while past performance is no guarantee of future results, this may be a lesson the next time you hear others panning the stock markets.

Important Disclosure Information & Sources:

[1] “California Gold Rush“. History.com Editors, 10-Aug-2022, history.com.

[2] “Samuel Brannan: Gold Rush Entrepreneur“. PBS, pbs.org.

[3] The Consumer Price Index for All Urban Consumers: All Items (CPI-U) is a price index of a basket of goods and services paid by urban consumers, including roughly 88 percent of the total population, accounting for wage earners, clerical workers, technical workers, self-employed, short-term workers, unemployed, retirees, and those not in the labor force. Returns data sourced from Morningstar.

[4] The gold spot price is measured by composite USD price returns as measured by Bloomberg. Returns data sourced from Morningstar.

[5] The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States. Returns data sourced from Morningstar.

[6] “Are Stocks Riskier Than Bonds?“ Bobby Adusumilli, 07-May-2021, sjsinvest.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience.

Metroparks Toledo: Redefining Our Region

Further expansion, connection, and exceptional maintenance of existing Metroparks will continue to elevate our region in the eyes of the world and in the hearts of those who call Toledo home.

An interview with Scott Savage, who is Founder & CEO of SJS Investment Services as well as the President of the Board of Park Commissioners of Metroparks Toledo. This interview is part of our Stories of Giving & Achievement Series, highlighting organizations doing great work in the community.

Scott, how did you get involved with the Metroparks Toledo?

That answer will take us back over 20 years. That’s when the Metroparks Board asked me, along with former Toledo Fire Chief-turned-Mayor Mike Bell, to chair a very visionary 10-year land levy with one goal: fund the expansion of Metroparks Toledo. Built into that expansion was an acquisition of ecologically critical land. As a person who treasures and appreciates the ecological uniqueness of this part of the world, I was all in. The levy went through, and that land today is primarily part of what is known as the Oak Openings Corridor.

Source: “Oak Openings Preserve Metropark”. Metroparks Toledo, metroparkstoledo.com.

It must have been amazing to achieve that goal. What happened next?

It was, and I can tell you, after that, I was hooked on how this kind of work could make an impact on the people, the economy, and of course, wildlife. Most people don’t realize that this part of Northwest Ohio is unlike anywhere else in the world. After this one project, I felt called to help restore this vital ecology, and I realized it could happen while providing parks the community can enjoy. It didn’t have to be one or the other.

A few years later in 2007, Probate Judge Jack Puffenberger appointed me to join the three-person governing board responsible for overseeing Metroparks Toledo. I was both honored and very eager to do whatever I could to grow this park system. As part of that early work, we established the Mission of Metroparks Toledo, which fifteen years later is the same: to preserve and protect our natural resources for the benefit and enjoyment of all citizens in Lucas County and, I’ll add, the roughly seven million visitors we expect in 2022 alone.

Source: “Providence River Bluff Trail”. Metroparks Toledo, metroparkstoledo.com.

That vision must have been inspiring to the Metroparks team.

It was. And lofty. The park system is nothing like it is today. I’d say in 2007, Metroparks Toledo was an excellent park system, but it was mostly a suburban park system with only one of the handful of parks in operation in the actual City of Toledo. That would be Swan Creek Preserve Metropark which is a park in the district today.

So did you aim to bring more parks to the City of Toledo?

The short answer to that is, yes. But the Park Commissioners and the Team at Metroparks Toledo decided to do something even more ambitious. We decided a worthy vision would be to make sure every citizen in Lucas County would live within five miles of a Metropark.

That was lofty. At that time I bet most of the city’s residents were a long drive from a Metropark.

You’re right. But I am happy to report that our vision is a reality. Today, every citizen of Lucas County lives within five miles of a Metropark, making it easier for all people to access the physical and mental health benefits parks provide. In the process, we have brought the limelight to our region by winning the 2020 National Gold Medal Award in the large district category for excellence in parks and recreation management, the most prestigious honor in the parks and recreation industry.[1] I believe we can honestly say Toledo has the best parks in America.

That is impressive, and I’m sure getting to #1 in America was no easy feat.

Well, there are a lot of steps between any vision and its achievement, and plenty of stories. Maybe in future blogs, we can talk about some of them. I will say here that it has been gratifying to help transform the place we call home and help it gain the attention it deserves as a renaissance city, an ecologically important region, and a place for diverse people and families to live and thrive.

I have a feeling from your enthusiasm, you’re not done.

You’re right, and I’ll go even further to say, the best is yet to come! Yes, you may have read about it in the paper or online or seen it on the news. It’s the most ambitious project-to-date - The Glass City Riverwalk - and it is already redefining our region even more in the eyes of the world. Phase one is open and operating with more phases in construction now. The $200 million dollar project will create 300 new acres of connected green space on the East and West sides of the Maumee River, Downtown Toledo, and the Glass City Riverwalk. It will restore ecologically-sensitive habitats, and provide recreation for everyone. Studies have shown this project will drive more than $2 billion in economic impact.[2] For a $200 million price tag to return $2 billion, I’d say that’s a very good financial investment, not to mention we get a beautiful park to enjoy!

Source: “The Glass City Riverwalk”. Metroparks Toledo, metroparkstoledo.com.

At the core of it, all this work has been an investment, hasn’t it?

Yes, it has. And we aren’t done. Already in the works is an increased expansion and more connections between parks, further elevating our reputation as a premier place to live and work. The investment of time, knowledge, funds, and more from all who are involved is how this is happening. And in my experience, we are all thrilled to give because, quite simply, we all love this place or we wouldn’t be here. Why not do everything we can to make our region even better for the people here today and for the generations of the future? I’m humbled and feel so blessed to have been a part of this thing we call Metroparks Toledo for the last fifteen-plus years.

Important Disclosure Information & Sources:

[1] “Metroparks Receives National Gold Medal Award“. Metroparks Toledo, 28-Oct-2020, metroparkstoledo.com.

[2] “Glass City Riverwalk”. Metroparks Toledo, glasscityriverwalk.com.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

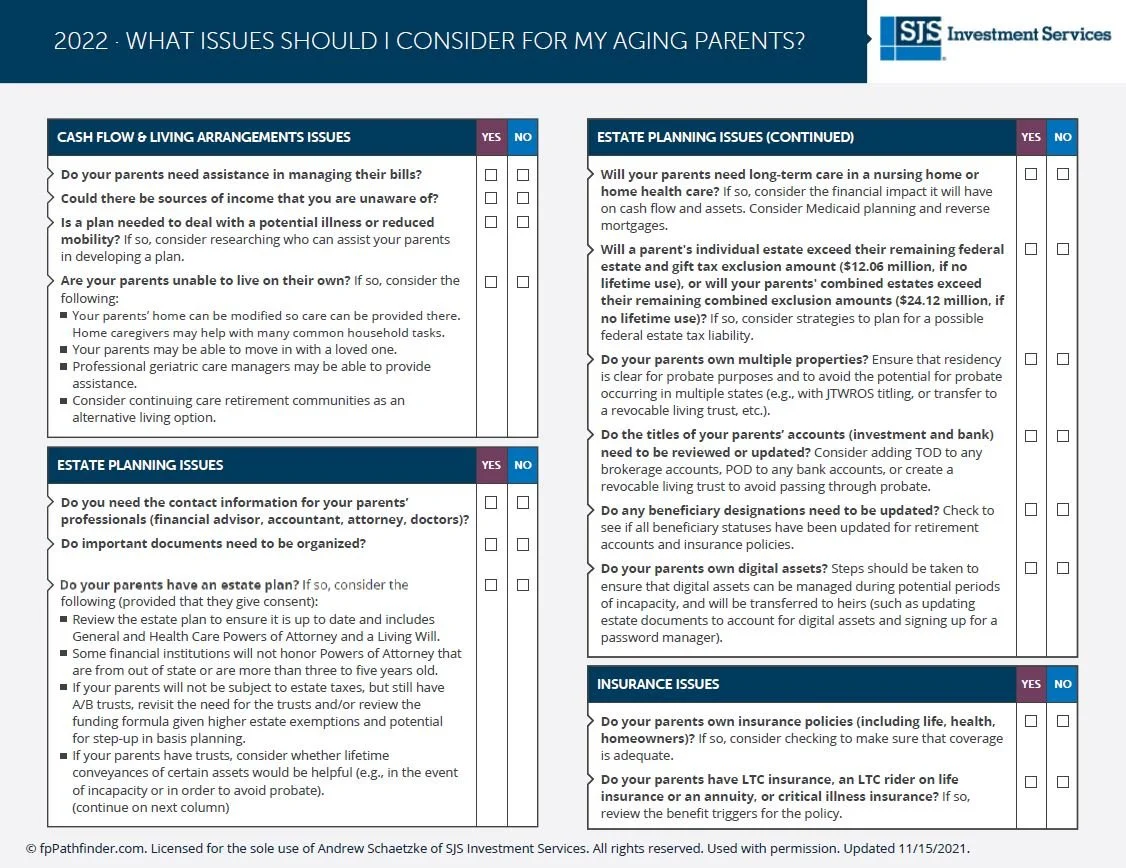

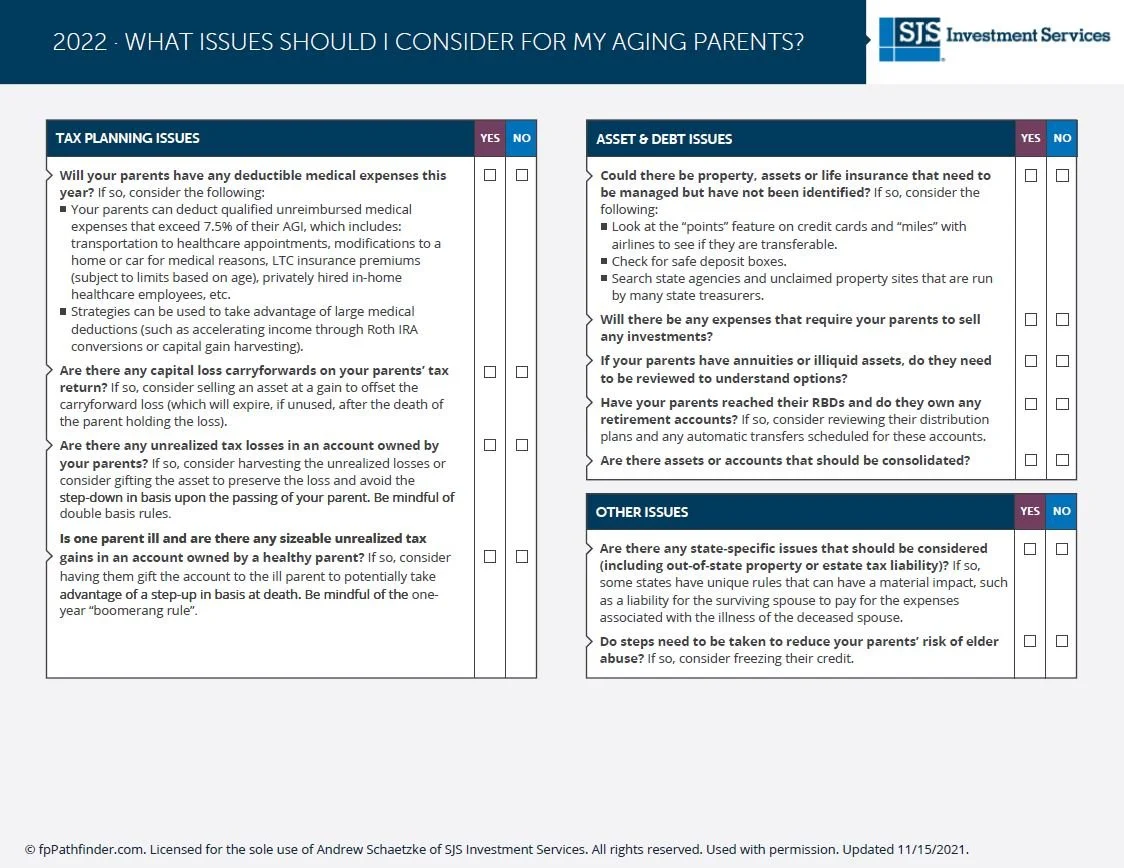

Helping Your Parents Financially Prepare For The Future

To help you assess ways that you can assist your parents with financial matters, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

As we are growing up, we rely on our parents for so many things, such as shelter, food, money, and love. As we become adults, we usually rely on our parents less and less. At the same time, many children want to help their aging parents, or parents may even need help as they grow older.

Unfortunately, helping parents plan for the future has become an increasingly pressing concern. Largely due to effects of the COVID-19 pandemic, the average life expectancy for Americans has declined over the last couple years.[1]

By creating plans ahead of time, you can help your parents feel more prepared and ease their burdens should they experience any troubles. There are many financial matters that you can potentially assist your parents with, including:

Planning for the desired quality of assisted living conditions and care that they may want and need as they grow older

Managing their bills, particularly relating to insurance and medical expenses

Organizing their documents, passwords, and other important information

Developing their estate plan

Tax planning

To help you assess ways that you can assist your parents with financial matters, we provide the resource below. As always, we are here to help your family throughout your financial journey. We can provide resources, experience, and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

[1] “Provisional Life Expectancy Estimates for 2021“. Elizabeth Arias, Betzaida Tejada-Vera, Kenneth D. Kochanek, & Farida B. Ahmad, August 2022, cdc.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Stories Of Giving & Achievement: The Series

These are stories of achievement that can only come through caring enough about you, your communities, and the world to give our time, financial support, our passion to offer a helping hand to those in their time of need.

When we say, “You come first. All the time. Every time,” we certainly mean you, the individual. But we also mean you, the community. Yes, SJS Investment Services has had a nearly three-decade-long track record of putting the communities where you live first, whether that be Toledo, Ohio; Phoenix, Arizona; Chicago, Illinois, or elsewhere in the U.S. and even the world.

“I believe that the measure of any community is how that community walks hand-in-hand with the most vulnerable among us. And that positive results come by doing the hard things,” says SJS Founder & CEO Scott Savage.

Candidly, Scott has never wanted to talk publicly about our giving; but, he does agree that sharing with you all the good news, and all the impact our efforts are making, is a positive that can fuel more progress. Perhaps even inspire others to give more to great causes.

So introducing, “Stories of Giving & Achievement: The Series.” We promise that within these articles in our upcoming Quarterly Outlooks and blog posts on our website, we will temper the self-serving photos of us and stories where we give ourselves pats on the back. That’s not our style. What you will see are stories of achievement that can only come through caring enough about you, your communities, and the world to give our time, financial support, our passion to offer a helping hand to those in their time of need.

Important Disclosure Information:

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training.

Suggested Reading

SJS Outlook: Q3 2022

The SJS Q3 2022 Outlook includes our insights on the performance of global markets so far in 2022, supporting our communities, a new member of the SJS Team, and looking forward to Q4 2022.

This Too Shall Pass

As advisors and professional investors, we hold vivid memories of the times when markets are volatile and bear markets ensue.

By Scott Savage, CEO & Kevin Kelly, CFA, President.

Past as Prologue?

As advisors and professional investors, we hold vivid memories of the times when markets are volatile and bear markets ensue. So far, 2022 is going to be a year we won’t soon forget, joining 1987, 2000 through 2002, 2008 & 2009, and 2020, among others.

The primary culprit this year for lower bond and stock prices is an unexpected increase in short-term interest rates, reaching levels not seen in over fifteen years. The Federal Reserve that is responsible for the level of short-term rates has acted decisively, raising short term rates by 3.0% between March and September, attempting to halt and reverse the inflation rate from its current annual pace of 8%+. The Fed’s rate hikes flow directly to higher lending rates which tend to slow economic activity, thus increasing the risk of a recession.

All of this has been a significant headwind for stock and bond prices, giving the calendar year of 2022 its bear-market distinction.

Good Decisions vs. Good Predictions

Despite our opinions, we have never held ourselves out as predictors or market timers. However, we believe you rely on us to help make good decisions in a thoughtful and disciplined manner, in good markets and bad; decisions that involve re-balancing and making sure your long-term asset allocation targets are maintained. For your taxable accounts, we harvest losses where appropriate with the intention of deferring future taxes.

Last year at this time we made the decision to add a new alternative manager to our stable of asset managers. This decision has proved to be helpful thus far in 2022, adding some stability to the portfolio with our diversified alternatives fund (symbol: SRDAX) experiencing a nominal decline of 4% through September 30th, compared to much sharper drops of 25% for the MSCI ACWI and 15% for the Bloomberg U.S. Aggregate Bond Index. We continue to look for new managers and strategies that strive to improve the risk/reward profile of your portfolio.

The hard-to-find silver lining in such a difficult time is that going forward, the long-term expected rates of return on our capital market assumptions are higher than they were at the start of the year, due to more attractive price valuations as of September 30, 2022. Does this mean we are close to a bottom? That is never knowable in advance. But if history repeats, we want to make sure that your investments are well-positioned to benefit from rising asset prices, if and whenever that may come.

We remind ourselves, knowing that past performance is not indicative of future returns, that periods following past bear markets have offered very meaningful market returns, the historical “reward” in the risk reward trade-off:

Source: Russell Indexes, Jan 1979 – Sep 2022.

We can only speculate on the short-term vagaries of the markets, and in the meantime, we will keep making what we believe are the best decisions for you!

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

SJS Welcomes Ryan Walter!

We would like to welcome Ryan to the SJS Team in Sylvania, Ohio! Ryan serves as Client Service Associate.

We would like to welcome Ryan Walter to the SJS Team in Sylvania, Ohio! Ryan serves as Client Service Associate, working alongside Jeff Yost and Lisa Denstorff to serve our clients through trading, reporting, account management, and communications with clients and other professionals.

An Ohio native, Ryan grew up in Toledo, graduating from St. John's Jesuit High School in 2005. He received a Bachelor of Science in Business Administration degree from the University of Toledo (UT). Ryan began his career at Hileman Associates, working his way up to a Senior Pension Analyst with a primary focus on corporate retirement accounts. His duties included working with trustees, ensuring plan compliance within IRS and DOL regulations, and focusing on business development.

Ryan's interest in investing has flourished over time, with an emphasis on working more closely with families to help them achieve their financial goals. He values working in a culture with a client-first approach and was delighted to join SJS in August 2022.

Outside of work, Ryan loves spending time with his wife Nikki and son Edwin, as well as his two dogs Sherlock and Bilbo. In his free time, Ryan enjoys running, international travel, working on projects around the house, and offering a helping hand to family and friends.

We are very grateful that Ryan decided to join SJS. Please join us in welcoming Ryan to the SJS Team!

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Supporting You At A Time Of Loss

When you lose a loved one, particularly a spouse, we are here for you. We have helped many individuals over the last twenty-seven years find their footing and renewed confidence.

By Managing Director & Senior Advisor Jennifer Smiljanich, CFP®.

Confident. Secure. Serene. These adjectives go out the window when we experience the loss of a spouse. Suddenly, the whole world can seem daunting and unfamiliar. How does one find their footing and balance?

We know that losing a spouse is one of the most stressful challenges of our lifetime. AdventHealth ranks the stress level above other life events, like divorce, job loss, new responsibilities in marriage, or becoming a parent.[1]

When you lose a loved one, particularly a spouse, we are here for you. We have helped many individuals over the last twenty-seven years find their footing and renewed confidence. How do we do that?

First, we understand that a surviving spouse needs time to grieve and to find a path forward. It is a process, and it takes time. You need to be with family and loved ones. You’re learning to live without them, and it includes taking over new responsibilities, changing family dynamics, spending time alone, and struggling with a new normal. Grief isn’t limited to a state of mind, and it doesn’t just gradually fade. Many times the last thing a surviving spouse wants to be doing is making financial decisions.

We encourage the surviving spouse to be patient and deliberate to make financial decisions, especially those that are significant. A family member of mine confided that for a year after her husband passed away, she felt like she was in a fog. She had a difficult time remembering things and felt panicked at the thought of having to decide. At this stage, we want to help the survivor evaluate financial steps that should be taken – reviewing benefits, pensions, medical plans, and Social Security.

Finally, as time goes on, we can help with financial education and co-thinking longer-term decisions. Chances are the deceased spouse managed at least some of the financial decision-making. For us, helping the survivor feel confident that their investments are positioned to help them achieve their goals is important. We can help model decision-making for the longer term, perhaps downsizing or moving to a single-story home; considering a move closer to adult children or other family; gifting to family or charity; or adjusting estate documents to account for changes in circumstances. Our goal is to ensure you have all the facts to make thoughtful decisions.

As SJS has developed our relationship with you over the years, we have celebrated your successes and joyful times, and have been honored to be of service to you in your times of personal challenge and loss. We stand ready to be there when you need us to listen, or to hold a hand. You come first.

Important Disclosure Information & Sources:

[1] “Death of a Loved One is the Number One Stress Driver — Learn How to Cope“. AdventHealth, 05-Mar-2019, adventhealth.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

What Should You Do About A Recession?

We explore what is a recession, how the US stock market has performed before and after a recession, and how an investor can prepare for recessions.

By Investment Associate Bobby Adusumilli, CFA.

One common discussion topic with our clients recently is whether the US is in a recession. While it is commonly believed that a recession is a period of two or more consecutive quarters of negative economic (GDP) growth, that is not exactly how recessions are officially defined within the US. As of August 2022, the National Bureau of Economic Research (NBER) has not declared a recession in the US during any part of 2022.[1]

In an effort to better understand recessions, we explore how a recession is defined, what have been the recessions throughout US history, which indicators go in to determining a recession, how the US stock market has performed before and after a recession, and how an investor can prepare for recessions.

What Is A Recession?

The NBER's traditional definition of a recession is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The NBER believes that while each of the three criteria - depth, diffusion, and duration - needs to be met individually to some degree, extreme conditions revealed by one indicator may partially offset weaker indications from another.[2]

It is important to note that the start date for a recession is often declared in retrospect, meaning it is possible to be in a recession for a few months before it is officially declared.

Since 1928, there have been 15 recessions in the US lasting on average 12.5 months, according to the NBER.[1]

Source: “US Business Cycle Expansions and Contractions“. NBER, nber.org.

What Indicators Go In To Determining A Recession?

Data for all indicators can be found and downloaded from the Federal Reserve Bank of St. Louis FRED website. Indicators include:[2]

How Has The US Stock Market Performed Before A Recession?

Over the last 15 recessions, the S&P 500 has had an average annualized return of 15.80% during the two years before the start of a recession.[3] None of these two-year periods had a negative return. This is not a huge surprise, as the period before the start of a recession usually coincides with a peak in the business cycle.[1]

Sources: Dimensional Returns Web, NBER, Morningstar. Recession start dates are based on the US Business Cycle Expansions and Contractions data from the National Bureau of Economic Research. The S&P 500 total return index assumes reinvestment of all distributions. See Important Disclosure Information.

How Has The US Stock Market Performed After The Start Of A Recession?

Over the last 15 recessions, the S&P 500 has had an average annualized return of 5.97% during the two years following the start of recession.[3] While the average return is positive, the S&P 500 had a negative return in 5 of the 15 two-year periods. In some cases, the S&P 500 fell significantly (such as at the start of the Great Depression), fell but then rebounded quickly (such as during the start of the COVID-19 pandemic), or just didn’t really experience any outsized volatility (such as after World War II).[1]

Sources: Dimensional Returns Web, NBER, Morningstar. Recession start dates are based on the US Business Cycle Expansions and Contractions data from the National Bureau of Economic Research. The S&P 500 total return index assumes reinvestment of all distributions. See Important Disclosure Information.

Taking a longer-term view, the S&P 500 has eventually recovered and grown after all recessions over the past century, though in some recessions it has taken many years for this to happen.[3] The US stock market has been able to withstand the short-term volatility caused by recessions, growing significantly over time.

Sources: Dimensional Returns Web, NBER, Morningstar. Gray shaded areas represent periods of recession. Recession start and end dates are based on the US Business Cycle Expansions and Contractions data from the National Bureau of Economic Research. The S&P 500 total return index assumes reinvestment of all distributions. See Important Disclosure Information.

How Can You Prepare For A Recession?

Build Up Your Emergency Fund

An emergency fund can give you the ability and confidence to stick with your investment plan through a recession. The amount that you should save in your emergency fund partially depends on what would help you sleep comfortably at night if your investment portfolio begins to decline in value. Some people feel comfortable with an emergency fund with 6 months' worth of living expenses, while others prefer 1-2 years' worth of living expenses.

The idea behind an emergency fund as a way to make it through a recession is not new. Detailing his experiences living through the Great Depression, Benjamin Roth wrote in The Great Depression: A Diary, “This depression has indelibly impressed on my mind one thing - and that is the value of having on hand sufficient capital to cover emergencies. In the investment field it means the difference between success or failure to have enough capital to buy bargains when they are available or to hold on to investments thru thick and thin and not be forced to sell at a loss.“[4]

Diversify Across Stocks, Bonds, & Alternatives

Periods of negative US stock market performance are inevitable. By diversifying across global stocks, high-quality bonds, and alternative investments with low correlations to US stocks, you can help to limit the impact of a period of negative US stock market performance on your portfolio.

Review Your Asset Allocation Ahead Of Time

Your asset allocation refers to the amount of stocks, bonds, and alternatives that you hold in your investment portfolio. While it may be difficult to imagine how you may react to declines in your investment portfolio, we believe it is critical to choose a level of riskiness that you will be able to stick with during good investment times and bad.

Important Disclosure Information & Sources:

[1] “US Business Cycle Expansions and Contractions“. NBER, nber.org.

[2] “Business Cycle Dating Procedure: Frequently Asked Questions“. NBER, nber.org.

[3] The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States.

[4] The Great Depression: A Diary. Benjamin Roth, 2010, Publicaffairs.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Inflation Protection Through Series I Savings Bonds

Series I Saving Bonds provide many of the benefits of TIPS, but may be even more beneficial during times of heightened inflation.

By Investment Associate Bobby Adusumilli, CFA.

In the book In Pursuit of the Perfect Portfolio, MIT Professor Andrew Lo interviews pioneering individuals in the investment industry - including Vanguard Founder John Bogle as well as Nobel Prize winners such as Eugene Fama and Robert Shiller - in order to answer a question that has captivated investors for generations: what is the perfect portfolio? While each interviewee gives hints as to what they consider the perfect portfolio, Andrew Lo ultimately concludes that there is no such thing as an everlasting perfect portfolio, writing, “Our Perfect Portfolio today is really just a snapshot of what’s best for you at the moment and in the current environment. Expected returns are ever evolving…. The pursuit of the Perfect Portfolio is all about adapting to our current income, our spending habits, our financial goals, the environment, and expected returns.“[1]

Nevertheless, the interviewees do provide some investments to consider. Andrew Lo writes, “If there is one specific asset that a majority of our authorities recommended for your Personal Portfolio, it’s TIPS (Treasury Inflation-Protected Securities). Inflation in recent years has been stable and low, but there is always the risk of macroeconomic change.“[1] TIPS are U.S. government-issued securities that generally increase in value with inflation and decrease in value with deflation, as measured by the nonseasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items.[2][3]

Source: FRED, as of July 31, 2022. See Important Disclosure Information.

Since the book came out in August 2021, U.S. inflation has risen significantly. As a result of this rise in inflation, TIPS (as measured by the Bloomberg U.S. TIPS Index 0-5 Years) have performed relatively well over the past year, outperforming the U.S. stock market (as measured by the Russell 3000) and the U.S. bond market (as measured by the Bloomberg U.S. Aggregate Bond Index), as shown in the below graph. However, because TIPS are subject to market demand as well as other structural features, TIPS have underperformed inflation (as measured by nonseasonally adjusted CPI-U) over the past year.

Sources: Dimensional Returns Web, U.S. Bureau of Labor Statistics. See Important Disclosure Information.

This lends the question: are there any investments that can provide more inflation protection than TIPS? Luckily, there may be.

Series I Saving Bonds provide many of the benefits of TIPS, but may be even more beneficial during times of heightened inflation.[4][5] Offered directly by the U.S Department of the Treasury through the treasurydirect.gov website, Series I Savings Bonds are 30-year government bonds designed to pay interest that matches (or even exceeds) inflation, as measured by the nonseasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items.[4]

The interest on Series I Savings Bonds is composed of two parts: a fixed rate that lasts for the entire time that you hold the bond, and the inflation interest rate that resets every six months. The rates are set on May 1 and November 1, and you are guaranteed the stated inflation interest rate for the first six months that you hold the bond, and then you are guaranteed the next set inflation interest rate for the following six months, and so on. The interest rate on Series I Savings Bond cannot go negative (though a negative inflation rate can decrease your fixed rate for that six-month period to a minimum of 0%), which is beneficial considering that the specific CPI index includes the volatile food and energy sectors.[3][6]

You can choose to defer paying taxes on the monthly interest that you receive until you redeem the bond. The interest on Series I Savings Bonds is only subject to federal income taxes, not state or local income taxes. You can redeem Series I Savings Bonds directly with the U.S. government via the treasurydirect.gov website after one year, subject to some limitations listed below.[4]

While Series I Savings Bonds have many benefits, there are some drawbacks:[4]

Each eligible person and entity can only purchase up to $10,000 in Series I Savings Bonds per year, thus limiting usefulness for higher net worth people and entities.

Except in rare circumstances, you cannot redeem your Series I Savings Bond within the first year.

If you redeem your Series I Savings Bond within five years of purchase, you lose the most recent three months' worth of interest.

If you decide not to pay taxes on the annual interest while you hold the bond, then the year you redeem a Series I Savings Bond, you may add a significant amount to your federal taxable income, thus increasing your federal taxes in that year.

You must buy Series I Savings Bonds through the treasurydirect.gov website; you cannot buy through another custodian, and your financial advisor cannot buy these bonds on your behalf.

You can only specify one beneficiary (via the Registration List section on your treasurydirect.gov account) per Series I Savings Bond.

If inflation falls back to low levels, Series I Savings Bonds may pay little interest.

Prominent financial journalists including Jason Zweig, Christine Benz, and John Rekenthaler have written about Series I Savings Bonds in recent weeks, and it’s easy to see why given the current inflation interest rate of 4.81% for the first six months if you purchase prior to November 1, 2022.[4][7][8][9] We believe that Series I Savings Bonds can provide value for investors over the near-term as well as the long-term. Whether using for an emergency fund, saving for a big purchase such as a home, or wanting to add diversification to your overall investment portfolio, Series I Savings Bonds can provide a safe and stable way to save money while minimizing loss of U.S. dollar purchasing power. And if inflation ends up rising again in future years, then by accumulating Series I Savings Bonds over time, you can provide some stability and growth for your portfolio at a time when other investments may suffer.

Important Disclosure Information & Sources:

[1] In Pursuit of the Perfect Portfolio. Andrew Lo & Stephen R. Foerster, 2021, Princeton University Press.

[2] “Treasury Inflation-Protected Securities (TIPS)“. U.S. Department of the Treasury, Bureau of the Fiscal Service, treasurydirect.gov.

[3] “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average“. Federal Reserve Bank of St. Louis, fred.stlouisfed.org.

[4] “Series I Savings Bonds“. U.S. Department of the Treasury, Bureau of the Fiscal Service, treasurydirect.gov.

[5] “Comparison of TIPS and Series I Savings Bonds“. U.S. Department of the Treasury, Bureau of the Fiscal Service, treasurydirect.gov.

[6] “Series I Savings Bonds Rates & Terms: Calculating Interest Rates“. U.S. Department of the Treasury, Bureau of the Fiscal Service, treasurydirect.gov.

[7] “Fight Runaway Inflation With I Bonds“. Jason Zweig, 29-Jul-2022, wsj.com.

[8] “Is It Too Late to Add Inflation Protection to Your Portfolio?“ Christine Benz, 22-Jul-2022, morningstar.com.

[9] “Run, Don’t Walk, for I Bonds“. John Rekenthaler, 10-Aug-2022, morningstar.com.

The Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL) is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers.

Russell 3000 TR USD Index is a market-capitalization-weighted index that measures the performance of the largest 3000 US companies representing approximately 98% of the investable US equity market.

Bloomberg US Aggregate Bond TR USD Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS.

Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0–5 Year Index is a market-weighted index measures the performance of inflation-protected public obligations of the U.S. Treasury that have a remaining maturity of less than five years

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

When A Client Dies

Without question, the hardest part of being an advisor is when a client dies.

By Founder & CEO Scott Savage.

Without question, the hardest part of being an advisor is when a client dies.

Sadly, I have mourned the passing of many clients, including some who had been clients for over three decades. When you plan, dream and work with individuals, their families and organizations for such a long time, experiencing death together is hard, and hard to describe.