SJS Outlook: Q2 2022

SJS Q2 2022 Outlook including our insights on what is driving stock market returns, what you can do about inflation, more members of the SJS family, and looking forward to Q3 2022.

What Is Driving Inflation, And What Can You Do About It?

Global stock and bond markets have been tested by inflation many times in the past, and these markets have historically demonstrated their resilience in providing returns higher than inflation over time.

By Investment Associate Bobby Adusumilli, CFA.

It’s hard not to notice inflation these days - we see it in higher gas prices, higher grocery bills, and higher housing costs, among other areas. This is true beyond the U.S.: inflation rates in countries around the world are higher compared to recent history.[1]

For the one-year period ending May 31, 2022, the U.S. inflation rate (as measured by the CPI for All Urban Consumers Unadjusted Index) is 8.6%.[2] While most of the U.S. economy is experiencing some inflation, energy - which includes gasoline, oil, electricity, and other commodities - has experienced an outsized amount of inflation, approaching 35%.[2]

Source: “Consumer Price Index Summary“. U.S. Bureau of Labor Services, 10-Jun-2022, bls.gov. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. See Important Disclosure Information.

While these higher prices are difficult to handle right now, we believe there are some reasons for optimism regarding inflation. Energy prices spiked largely in response to effects from the COVID-19 pandemic as well as the war in Ukraine.[3] While we may experience elevated prices in the short-term, companies and markets tend to respond when there is high demand for a product, creating more competition and thus more supply, which should help constrain energy prices over time. Additionally, the Federal Reserve has been aggressively raising interest rates to combat inflation.[4] While this has hurt stock and bond prices recently, we believe this will help decrease inflation over time.[4]

Global bond markets are also expressing optimism that the U.S. inflation rate will fall back to more normal levels. For example, the 10-year breakeven inflation rate - which is a measure of what bond investors expect U.S. inflation to be over the next 10 years on average - is 2.33% as of June 30th, 2022.[5] While this is higher than the Federal Reserve’s goal of 2.00% inflation, bond markets do not expect medium- to long-term inflation to be anywhere close to the recent inflation rate.[5][6]

Source: FRED, as of June 30, 2022. The breakeven inflation rate represents a measure of expected inflation derived from 10-Year Treasury Constant Maturity Securities and 10-Year Treasury Inflation-Indexed Constant Maturity Securities. The latest value implies what market participants expect inflation to be in the next 10 years, on average. See Important Disclosure Information.

Given all of this information, we have designed MarketPlus Investing portfolios to have some built-in inflation protection. For example, MarketPlus Investing model portfolios with fixed income allocations have exposure to U.S. Treasury Inflation-Protected Securities (TIPS) as well as short-duration (<5 years) bonds, which tend to provide some protection from inflation. And while global stocks can underperform inflation over the short-term (< 5 years), research has demonstrated that global stocks tend to provide inflation protection over the intermediate- (5-10 years) and long-term (10+ years).[7]

Investors looking for additional inflation protection can also consider purchasing Series I Savings Bonds, which are 30-year savings bonds offered by the U.S. government designed to match the Consumer Price Index for All Urban Consumers inflation rate. Each individual can buy up to $10,000 worth of these bonds per year, and you can sell after one year, subject to some conditions.[8] While SJS cannot buy these bonds for you directly, we are supportive of Series I Savings Bonds as potential investments for inflation protection. You can find additional information on the treasurydirect.gov website.

Global stock and bond markets have been tested by inflation many times in the past, and these markets have historically demonstrated their resilience in providing returns higher than inflation over time.[7] While it may be difficult in the short-term, we believe that staying invested is the key to getting through this market volatility and inflation.

Important Disclosure Information & Sources:

[1] “Inflation Rate - By Country“. Trading Economics, June 2022, tradingeconomics.com.

[2] “Consumer Price Index Summary“. U.S. Bureau of Labor Services, 10-Jun-2022, bls.gov.

[3] “How High Is Inflation and What Causes It? What to Know“. Gabriel T. Rubin & David Harrison, 10-Jun-2022, wsj.com.

[4] “Fed Raises Rates by 0.75 Percentage Point, Largest Increase Since 1994“. Nick Timiraos, 15-Jun-2022, wsj.com.

[5] “10-Year Breakeven Inflation Rate“. Federal Reserve Bank of St. Louis, 30-Jun-2022, fred.stlouisfed.org.

[6] “Why does the Federal Reserve aim for inflation of 2 percent over the longer run?“ Board of Governors of the Federal Reserve System, 27-Aug-2020, federalreserve.gov.

[7] Stocks for the Long Run. Jeremy Siegel, 2014, McGraw Hill.

[8] “Series I Savings Bonds”. U.S. Department of the Treasury, June 2022, treasurydirect.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Should You Use A Donor-Advised Fund?

To help you figure out the best way for you to donate to the organizations you care about, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

With the growth in global investment markets in recent years, many investors are donating more to their communities and the causes they care about than ever before.[1] Based on Giving USA’s 2021 Annual Report, U.S. charities received a record $471.44 billion in donations in 2020, with more than two-thirds of these donations coming from individuals and families.[1]

Figuring out the best way for you to donate can be complex. There are a lot of different options on how to donate, including:

Creating a donor-advised fund

Creating a charitable trust

Creating a private foundation

Each option has its own benefits and tradeoffs regarding taxes, costs, and flexibility. By understanding your options and creating the charitable strategy most appropriate for your situation, you can increase the chances that the organizations you most care about will receive the money that you intend for them.

To help you figure out the best way for you to donate to the organizations you care about, we provide the below resource. As always, we are here to help you as you begin your charitable journey. We can provide resources, experience and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

[1] “2021 Annual Report“. Giving USA, 2021, givingusa.org.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

History Is Merely A Lot Of Surprises

I would suggest that hoping things get back to “normal” would be inconsistent with history, and that moving optimistically forward in spite of fear, uncertainty, and doubt has been rewarded in the past.

“History is merely a lot of surprises. It can only prepare us to be surprised yet again.”

If nothing else, the last three years have painfully reinforced what Kurt Vonnegut, a counter-cultural idol of the 1960’s and 70’s, wrote.[1]

Just as the COVID-19 pandemic appeared to be evolving into an endemic disease, the surprise invasion by Russia into Ukraine continues to upend the lives of people in the war-torn country with negative implications for millions of people around the world. Add in the shock of higher inflation that is driving global interest rates higher and the value of financial assets lower, and Vonnegut’s words ring true.[2]

I would suggest that hoping things get back to “normal” would be inconsistent with history, and that moving optimistically forward in spite of fear, uncertainty, and doubt has been rewarded in the past.[3]

While this isn’t a Pollyannish prediction, as we all know that uncertainty and volatility in markets can increase, we take comfort in our fundamental beliefs that haven’t wavered since I started SJS:

We behave as if markets are efficient and are priced to reflect all known information, including the surprises we have experienced.

Trying to predict the short-term direction of markets is futile.

In the past, disciplined risk-taking has been rewarded over long periods of time, and we believe will be rewarded in the future.[3]

Unique portfolio design implemented in a disciplined manner is the value we bring to each and every client relationship.

The Team we have assembled - employees and partners alike - are giving their best every day, enabling us to act in your best interests.

My hope is that this is no surprise to you!

Important Disclosure Information & Sources:

[1] Slapstick or Lonesome No More! Kurt Vonnegut, 1999, Dial Press Trade Paperback.

[2] “Market perspectives June 2022“. Vanguard, 31-May-2022, vanguard.com.

[3] “Historical Returns on Stocks, Bonds and Bills: 1928-2021“. Aswath Damodaran, January 2022, pages.stern.nyu.edu.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Phantom Stock Plans

Business owners are looking for compelling ways to attract and retain talent. One approach to achieve this goal is through implementing a phantom stock plan.

By Founder & CEO Scott Savage.

Today more than ever, business owners are looking for compelling ways to attract and retain talent in a highly competitive labor market. One approach to achieve this goal used by some business owners is through implementing a phantom stock plan. This type of plan affords business owners a way to reward key employees for past service and to align their interest with that of the company going forward.[1]

What Is A Phantom Stock Plan?

A phantom stock plan qualifies as a type of deferred compensation plan, contractually tying monetary compensation directly to the value of the business if certain conditions are met.

The idea of phantom stock is that it simulates ownership, providing the means for an employer to offer employees the potential benefit of company growth while avoiding the complications of transferring actual ownership. In practice, when the phantom shares are earned by the employee, a valuation date is set. Then, a formula is used to imitate the actual stock value, and the payout is based on the value of those shares.[2]

Note: Working with tax and legal professionals to set up this type of plan is important for proper execution.

Why Choose A Phantom Stock Plan?

A phantom stock plan can potentially succeed because it provides mutual benefits and protections for both the employer and employee.

For the employer, along with avoiding ownership dilution, it affords flexibility in selecting who is eligible for participation. Compared with employer-sponsored (ERISA) plans, which require benefits to be available to each employee, a phantom stock plan allows for the employer to offer participation to key employees and adjust values on an individual basis.[1] Additionally, this type of plan can help lead to less employee turnover, through both vesting period requirements and, in some cases, non-compete agreements.[3]

For the employee, participating in this plan is a bonus for their dedication to the company, and can endure into the future. Specifically, it can provide a predictable stream of cash flow after leaving the company or into retirement. In addition, if the company is sold, the plan typically vests immediately, offering protection in case ownership changes.

Final Thoughts

As you, a business owner, consider options to motivate your employees, a phantom stock plan is a valuable tool to build a mutually beneficial agreement with key employees within your organization. We believe this type of plan is a great way to potentially help propel the growth of your business, while giving you the ability to reward the people who help make it possible.

Important Disclosure Information & Sources:

[1] “Phantom Stock Plan“. Adam Hayes, 22-May-2022, investopedia.com.

[2] “An Introduction To Phantom Stock And Stock Appreciation Rights“. Gary Pattengale, 22-Feb-2022, bdfllc.com.

[3] “Phantom Stock Plan“. Corporate Finance Institute, 10-Mar-2021, corporatefinanceinstitute.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

SJS Investment Services Welcomes Austin Grizzell!

We would like to welcome Austin Grizzell to the SJS Team in Scottsdale, Arizona! Austin serves as Associate Advisor.

We would like to welcome Austin Grizzell to the SJS Team in Scottsdale, Arizona! Austin serves as Associate Advisor, working alongside Senior Advisor Jennifer Smiljanich, CFP® to serve our clients, particularly with financial planning, investment analyses, and portfolio management.

Austin brings to SJS a wealth of experience in the financial industry. During his nine years at Vanguard, Austin progressed from a Client Service Specialist to a Senior Financial Planner, helping high net worth families accomplish their financial goals. He has also held various positions at Charles Schwab, JPMorgan Chase, and ACGE, Inc.

A native of Arizona, Austin graduated from Arizona State University in 2013 with bachelor’s degrees in finance and economics. He earned his CFP® certification in 2016.

Outside of SJS, Austin volunteers with the Wounded Warrior Project as well as the Pat Tillman Foundation. In his free time, he enjoys hiking, painting, and spending time with friends and family.

We feel very grateful that Austin decided to join SJS. Please join us in welcoming Austin to the SJS Team!

Important Disclosure Information:

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Two Graduating High School Students Shadow SJS Investment Services

For two graduating high school Seniors who shadowed us recently, we asked each student to write a 2-3 paragraph summary of what they learned during the week.

One of our favorite traditions at SJS Investment Services is when students shadow us for a week. Many current SJS Team members first learned about SJS through shadowing, so it brings back good memories for us. It is also an opportunity for us to teach the next generation of investors some of what we have learned, as well as learn from them.

From May 09-13, 2022, two graduating Seniors from St. John’s Jesuit High School - Jacob Kelly and Michael Leslie - shadowed the SJS Team in Sylvania, Ohio. Throughout the week, they did activities including:

Learned about the importance of investing, as well as different ways of investing

Introduced to retirement and other investment accounts (ex. IRA, 401(k), 529, HSA, etc.)

Read The Investment Answer by Daniel C. Goldie and Gordon S. Murray

Created sample financial simulations

Presented an investment-related idea for the SJS Team to consider

We asked each student to write a 2-3 paragraph summary of what they learned during the week, which we share below. We thank Jacob and Michael for spending the week with us, and we wish them well as they embark on their college journeys!

Jacob Kelly

This senior project has allowed me to expand my knowledge of investing and different investment account types much farther than what I previously knew. Being fairly uninformed did help me to keep an open-minded approach, which paid off immensely when discussing the many accounts available to me now as well as later on in life. Learning more about SJS was something very eye-opening to me, as they try to understand the problems people face in today’s world. Their philosophy is very similar to what St. John’s has preached to me through the “The Grad at Grad”. Putting people first is what the “Grad at Grad” strives to achieve, and I have seen throughout my time here that everyone wants success for their clients. SJS has its own form of this, though more expanded, through its many values for all of the clients within their firm to make them feel more as a friend than a customer.

Understanding a company can take you far, but without discipline and patience to gain the full knowledge of what you are going into can cause confusion. This is where I felt the staff at SJS helped immensely to make a comfortable environment for those new to investing or trading. I had zero idea how to open any investment accounts before entering SJS, and now I feel more confident in my knowledge of investment accounts, Roth accounts, and even just IRAs. The biggest takeout for me: time is an asset that can depreciate as fast as it gives value.

Michael Leslie

After spending a week at SJS, I’ve expanded my knowledge and understanding of the stock market. They took our project as an opportunity to really mentor us in their philosophy. Not only did they teach about stocks, but they gave me a lot of advice about life in general. Going into this week I had little to no information about where to even start to invest. With the help of Bobby, I am now confident that by staying disciplined and taking smart risks, I can gain a head up on other young people my age.

The mentorship will definitely go a long way for me, but how this company functions will certainly stick with me. Having a couple of high school kids hanging around the office for an entire week is something I would imagine to maybe create stress and could feel like a burden. I did not get this feeling from anyone here throughout the week. Everyone that I talked to seemed so nice and truly made me feel like they wanted us there. The Advisors clearly collaborate well, which really makes this office feel like a true team. Several members of the team took us out to lunch, which is something that they did not need to do but went a long way. Going into my career, I will not be able to help but compare other companies to SJS.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What Makes A Great Investor?

In my opinion, investing is arguably the most competitive field in the world. So what differentiates a great investor from the rest?

By Investment Associate Bobby Adusumilli, CFA.

In my opinion, investing is arguably the most competitive field in the world. With financial and technological innovations in recent decades, almost anyone in most developed countries with a sum of money can buy and sell public stocks, bonds, mutual funds, ETFs, and other financial instruments. Additionally, regardless of their occupations, many people invest through 401(k)s, 403(b)s, 457 plans, IRAs, taxable accounts, and / or a number of other financial accounts. Even if their primary occupations take up most of their time, these people are also investors.

With billions (or even trillions) of dollars in potential gains at stake, investing has become increasingly competitive as time has gone on. Thousands of investment firms across the country employ smart people and cutting-edge technology, all in the pursuit of achieving higher returns. As a result, investment market prices are constantly adjusting from the buy and sell orders of sophisticated parties, making it very difficult for someone to outperform the market.[1][2]

So what differentiates a great investor from the rest?

Over a series of recent newsletters and articles, financial journalist Jason Zweig (author of Your Money and Your Brain, as well helped Nobel Prize-winning psychologist Daniel Kahneman write the bestselling book Thinking, Fast and Slow) details what he believes are the seven virtues of great investors.[3] We share these virtues below, providing our own experiences with each.

Discipline

Discipline is about creating a well-thought-out investment process appropriate for you, and then following your rules.[4] Discipline also helps you get out of your own way, particularly in the tough times. In our experience, the more disciplined an investor is, the better their investment returns tend to be. As John Bogle writes in his book Bogle On Mutual Funds: New Perspectives For The Intelligent Investor, “Successful investing involves doing just a few things right and avoiding serious mistakes.“[5]

Curiosity

Curiosity is driven by wanting to understand the world, wanting to get closer to what is true.[6] By being curious enough to understand what investment strategies work and why, you can potentially help yourself become a better investor.

Skepticism

Skepticism requires focusing on your foundational principles, and questioning arguments that differ from these principles.[7] For example, research demonstrates that most stock market investors underperform total stock market index funds, particularly over the long-term.[1] If someone tries to pitch you an investment that they say will outperform the stock market, and there is not enough good theory and evidence to back up their claim, then we would strongly caution you against purchasing that investment.

However, skepticism is not the same as pessimism. Skepticism also calls for open-mindedness when theory and evidence support a particular argument. As Howard Marks writes in his book The Most Important Thing, “Skepticism calls for pessimism when optimism is excessive. But it also calls for optimism when pessimism is excessive.“[8]

Independence

Independence means doing the right thing.[9] If others are doing the right thing, then independence doesn’t mean that you have to be alone. But if others around you are doing something that doesn’t align with your principles and investment strategy, then being independent means having the courage to stick with your investment plan, even if that means going against the crowd.

Humility

Humility means understanding the reality of your situation, not deceiving yourself.[10] Humility recognizes that you don’t control and know everything. As an investor, there will be times when you underperform others around you, and there will be times when you outperform. In our experience, performance is always subject to some degree of luck. Humility also means that there will be someone more successful at investing than you, and recognizing that that is okay as long as you have a sound investment strategy in place and you are making progress towards your goals.

Patience

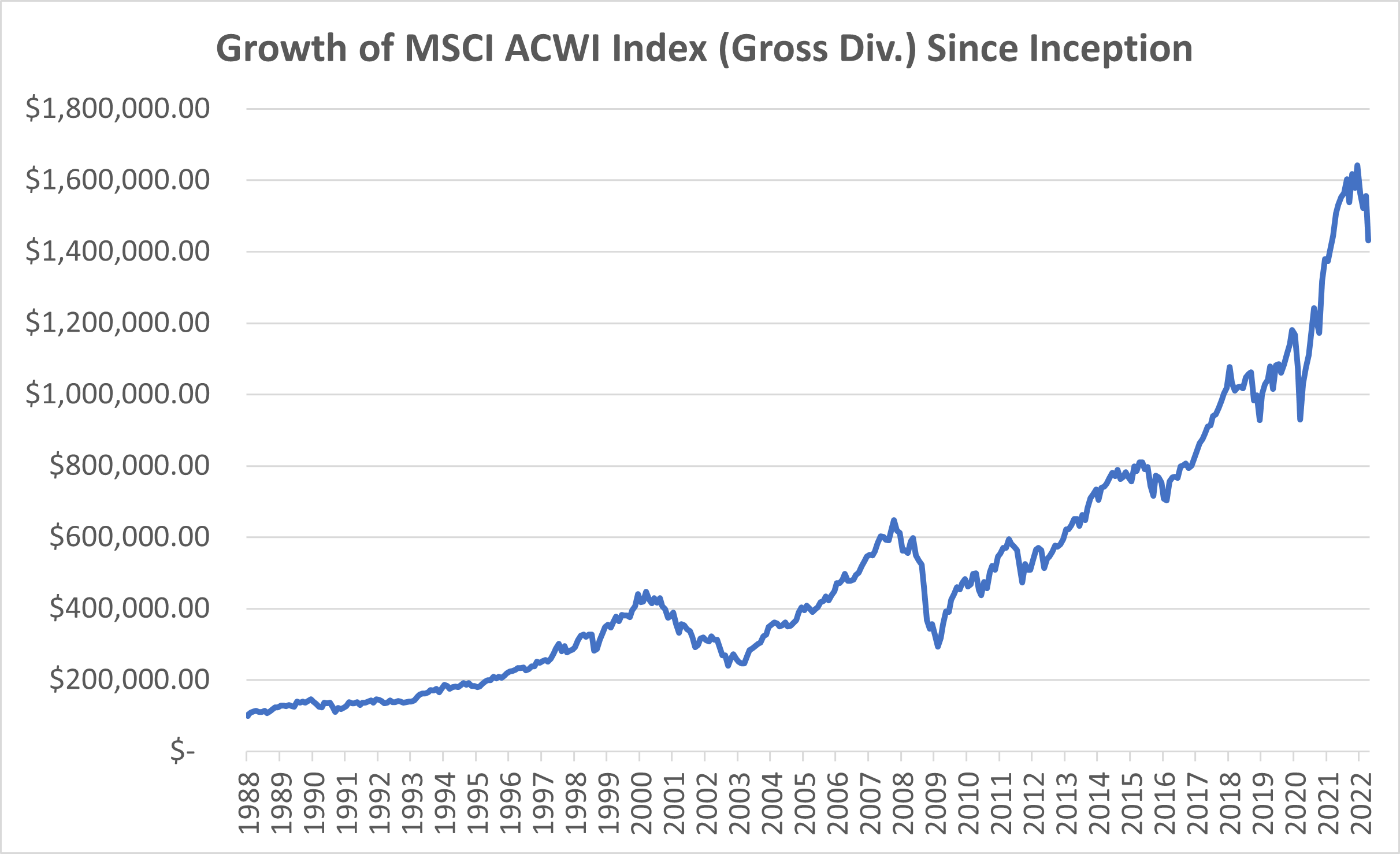

The longer you invest, the more time you are giving your investments to potentially grow, as the graph at the bottom of this article demonstrates.[11] While each investor has different circumstances and goals, in our experience, many of the best investors give themselves as much time as possible to grow their money; they have the patience to have the longest view in the room.

Courage

It is hard to be a great or even good investor. It is hard to continue investing when the market is going down, and it is hard to be disciplined enough to stick with your investment strategy when other strategies are booming.[3] If you create a well-thought-out investment plan backed by theory and evidence, then in our experience, having the courage to stick to your investment plan in both good times and bad tends to work out for people in the long run.

So What Can You Do To Become A Great Investor?

Research shows that the vast majority of stock market investors underperform the stock market, with greater underperformance as the period of time studied is lengthened.[1] While there are some people who outperform for a period of time, it is very hard to know who these people are in advance. Even if you know who they are, as the period of time increases, some of these great investors no longer achieve the same level of outperformance.

So what can you do to become a great investor? One strategy is to aim to be an above-average investor each year for a very long period of time. For example, research shows that just owning the stock market through an index fund will help you outperform most investors in most years as well as over time.[1] For example, if you had been able to own the global stock market as measured by the MSCI ACWI Index from 1988 (the index inception) through April 2022 (assuming reinvestment of all distributions; no other expenses or taxes considered), an initial investment of $100,000 would have grown to over $1,400,000. While the definition of a great investor is ambiguous, this performance seems like a great outcome to me.

Source: Dimensional Returns Web. See Important Disclosure Information.[12]

While future performance will differ from past performance, and while it was more difficult to invest in global investment strategies in the past, investors today have the ability to nearly match many global stock and bond indices even after considering fees.[13] Therefore, we believe that investing in low-cost, low-turnover, broadly-diversified global mutual funds and ETFs is a sound investment strategy that can potentially help a lot of people over the long-term.[14] And if you stick with a sound investment strategy long enough, you may become a great investor yourself.

Important Disclosure Information & Sources:

[1] “2022 Quantitative Analysis of Investment Behavior Report”. DALBAR, 2022, dalbar.com.

[2] “Why Do Investors Underperform?“ Bobby Adusumilli, 24-Jun-2021, sjsinvest.com.

[3] “The Secret to Braving a Wild Market“. Jason Zweig, 02-Mar-2022, wsj.com.

[4] “2020: The Sequel?“ Jason Zweig, 12-Jan-2022, The Intelligent Investor Newsletter - wsj.com.

[5] “Bogle On Mutual Funds: New Perspectives For The Intelligent Investor“. John Bogle, 2015, Wiley Investment Classics.

[6] “'The First Great Investing Virtue“. Jason Zweig, 19-Jan-2022, The Intelligent Investor Newsletter - wsj.com.

[7] “A New Month, A New Market?“ Jason Zweig, 08-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[8] “The Most Important Thing: Uncommon Sense for the Thoughtful Investor“. Howard Marks, 2011, Columbia Business School Publishing.

[9] “Stepping Away from the Herd“. Jason Zweig, 15-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[10] “On Humility and Independence“. Jason Zweig, 22-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[11] “Patience Amid Turbulence“. Jason Zweig, 02-Mar-2022, The Intelligent Investor Newsletter - wsj.com.

[12] The MSCI ACWI Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets, consisting of 47 country indices comprising 23 developed and 24 emerging market country indices. Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

[13] “Index funds“. Vanguard, vanguard.com.

[14] “MarketPlus Investing“. SJS Investment Services, sjsinvest.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Bitcoin & Cryptocurrencies: Do They Have A Place In Your Portfolio?

To help you better understand cryptocurrencies, we provide a short history, potential benefits, concerns, and how your portfolio can potentially benefit from cryptocurrencies.

By Founder & CEO Scott Savage.

Increasingly, this is a question that is posed to the SJS Team: Should I buy bitcoin?

While bitcoin and other cryptocurrencies have risen dramatically in price over the past ten years, most of the ideas underlying cryptocurrencies are not all that new, and cryptocurrencies are not as complicated as they may appear to be.[1] To help you better understand cryptocurrencies, we provide a short history, potential benefits, concerns, and how your portfolio can possibly benefit from cryptocurrencies.

History Of Cryptocurrencies

The idea behind a digital currency is not new. Starting around the 1980s, many individuals have attempted to create a digital currency, with each breakthrough building on top of past breakthroughs.[2] For example, in its early years, PayPal (which also now owns Venmo) was driven by the “idea of creating a new digital currency to replace the U.S. dollar.”[3] Technology and the internet have allowed for transactions to become faster, more secure, and lower cost. Many people in the US today don’t even use paper cash today, meaning the U.S. dollar already feels like a digital currency for them.

In 2008, another breakthrough occurred: an unknown person or team named Satoshi Nakamoto outlined a new cryptocurrency called bitcoin in a white paper, calling bitcoin, “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.“[4] Simply put, bitcoin is digital money that securely allows people to transact over the internet, without needing a bank or traditional financial intermediary involved.

Bitcoin’s single biggest innovation is the blockchain, which is the technology underlying bitcoin that allows for all historical transactions to be recorded for anyone around the world to access at any time. The blockchain also allows for transactions to happen almost instantaneously, securely, in a relatively low-cost manner, and be verified by anyone around the world.

21 million bitcoin is the maximum number of bitcoin that will ever be created.[4] Today, there are roughly 19 million bitcoin outstanding, and the remaining 2 million will be “mined” over the next 100+ years to compensate people for ensuring the accuracy of the blockchain.[4][5] You can own fractional interest of one bitcoin. In 2011, the price of one bitcoin exceeded $1 US dollar; by April 2022, the price of bitcoin is around $40,000 US dollars, meaning the total value of all bitcoin in existence today is roughly $750 billion.[5]

As with any lucrative technology, bitcoin and the blockchain have given risen to thousands of other cryptocurrencies and related digital assets. While we believe the vast majority of these digital assets won’t have value over the long-term, another cryptocurrency called Ethereum has made significant innovations building off of bitcoin, which is why it has become the second most valuable cryptocurrency behind bitcoin.[6]

If you would like more information on the history of bitcoin and cryptocurrencies, we recommend the book Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money by Nathaniel Popper.

Potential Benefits Of Cryptocurrencies

Transparency: Bitcoin is designed to be transparent, in efforts to limit the ability for a group of people or institutions to manipulate both bitcoin and the blockchain.

Limited amount of currency: Bitcoin and some other cryptocurrencies limit the amount of currency that will exist in the future. Many supporters believe this will help these cryptocurrencies serve as a store of value (this is why bitcoin is sometimes referred to as “digital gold”) as well as protection from inflation.[6] This is a major positive factor for people who are worried about governments printing money to pay off debts, which would devalue those currencies.[6]

Ability to hold around the world: Particularly for people who live in countries with volatile currencies or who move around the world, owning cryptocurrencies can be significantly more stable and secure for them compared to holding the local currencies.

Lower transaction costs: Cryptocurrencies may be able to help lower financial transaction fees over time. For example, many individuals in developing countries have to pay significant transaction fees in order to wire money to the US. Bitcoin can potentially reduce these transaction fees. Additionally, many people hope that the blockchain will help to lower (or even eliminate) credit card fees over time.

Privacy: Each bitcoin has a public key and a private key. Someone needs to use their private key (a long string of numbers and letters) in order to initiate a transaction. During a transaction, the public key is used by others on the blockchain to verify transactions. Both public and private keys are not associated with a person’s name, so as long as people don’t know that you own the private key and public key, then this can help to limit the chances that they will learn that you own that bitcoin.

Increasing adoption: Both individuals as well as institutions have been increasingly adopting the two largest cryptocurrencies (bitcoin and Ethereum) over the last few years.[7]

Concerns Of Cryptocurrencies

Volatility: Historically, even the largest cryptocurrencies have been highly volatile in price.[5] While this volatility is expected to decrease with increasing adoption, the volatility limits usefulness as an actual day-to-day currency.

Technological vulnerabilities: Cryptocurrencies and exchanges are subject to security risks, operational shutdowns, and hackers. For example, the Wall Street Journal estimates that approximately $3.2 billion worth of cryptocurrency was stolen in 2021.[8] However, the largest risks often impact newer and less-adopted cryptocurrencies and exchanges. In the coming years, the technology and infrastructure for the largest cryptocurrencies such as Bitcoin and Ethereum will become more robust, and hackings may become less common as a result.

Can lose your cryptocurrency: If you have a private wallet not affiliated with a major exchange, then if you lose your private key, you may potentially lose your cryptocurrency forever. For example, the New York Times recently estimated that nearly 20% of the total Bitcoin outstanding has been lost or is in stranded wallets.[9]

Increasing use of financial intermediaries: People and institutions are increasingly using financial intermediaries to store their cryptocurrencies.[7] This trend is in contrast to the initial vision for bitcoin.[4]

Less privacy than expected: Some people and institutions may not be able to achieve the level of privacy that they are hoping for with cryptocurrencies. For example, due to Russia’s war with Ukraine in 2022, Coinbase announced that it would block nearly 25,000 Russian-linked accounts (addresses) believed to be engaging in illicit activity, and governments around the world are also trying to seize Russian-linked cryptoassets.[10][11]

Limited current regulation, and potential for cumbersome regulation in the future: So far, regulation in countries around the world has lagged the growth of cryptocurrencies. However, governments are increasingly prioritizing regulation for cryptocurrencies, which could lead to uncertain effects. For example, China (which is expected to become the largest economy in the world by around 2030) has banned citizens from transacting in cryptocurrencies.[12] Additionally, the United States has not allowed for cryptocurrencies to be held directly in mutual funds and ETFs.[13] How will future regulation impact the value of cryptocurrencies?

How Can Your Portfolio Potentially Benefit From Bitcoin?

Market prices are driven by supply and demand. There is large and increasing demand for cryptocurrencies, and therefore we believe that cryptocurrencies are here to stay.

However, we don’t know what the aggregate market capitalization of cryptocurrencies will be, nor do we know how quickly cryptocurrencies will grow or decline, nor which ones will flourish and which ones will cease to exist. Bitcoin doesn’t have any earnings and doesn’t pay dividends, so we can’t value it like stocks.

What we do know is that cryptocurrencies have been quite volatile, and many clients are not comfortable investing in them. Additionally, for people who don’t do their homework, we view their buying of bitcoin as speculation, not investing.

Therefore, we do not invest client assets directly into cryptocurrencies. However, there are other ways to benefit from potential growth in cryptocurrencies. For example, there is an expansive options market for bitcoin where people and institutions do everything from speculating to hedging to achieving indirect exposure. In alignment with our view that cryptocurrencies are here to stay, we believe there are positive expected returns available in providing capital to the bitcoin options market. It is very complicated; we rely on an investment manager who has extensive experience with this market as part of a diversified alternatives mutual fund.[14] Additionally, due to their exposures to cryptocurrencies, some of the underlying stocks in the mutual funds and ETFs that we recommend may benefit from potential growth in cryptocurrencies.

The Ancient Chinese proverb famously says, “The best time to plant a tree was 20 years ago. The second best time is now.” When it comes to speculating in bitcoin, I would urge caution when applying this proverb to anything other than trees!

Important Disclosure Information & Sources:

[1] “Total Cryptocurrency Market Cap“. CoinMarketCap, 22-Apr-2022, coinmarketcap.com.

[2] “Cryptocurrency“. Wikipedia, wikipedia.org.

[3] Zero to One: Notes on Startups, or How to Build the Future. Peter Thiel & Blake Masters, 2014, Currency.

[4] “Bitcoin: A Peer-to-Peer Electronic Cash System“. Satoshi Nakamoto, 2008, bitcoin.org/en.

[5] “Total Circulating Bitcoin“. Blockchain, 22-Apr-2022, blockchain.com.

[6] Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money. Nathaniel Popper, 2016, Harper Paperbacks.

[7] “Our Thoughts on Bitcoin“. Ray Dalio & Rebecca Patterson, 28-Jan-2021, bridgewater.com.

[8] “Cryptocurrency-Based Crime Hit a Record $14 Billion in 2021“. Mengqi Sun & David Smagalla, 06-Jan-2022, wsj.com.

[9] “Lost Passwords Lock Millionaires Out of Their Bitcoin Fortunes”. Nathaniel Popper, 14-Jan-2021, nytimes.com.

[10] “Using Crypto Tech to Promote Sanctions Compliance“. Paul Grewal, 06-Mar-2022, coinbase.com.

[11] “The hunt for Russian crypto is on“. Benjamin Pimentel, 08-Mar-2022, protocol.com.

[12] “What's behind China’s cryptocurrency ban?“ Francis Shin, 31-Jan-2022, weforum.org.

[13] “SEC Delays Decision on Bitcoin ETFs Again“. Chitra Somayaji, 23-Jun-2021, wsj.com.

[14] “Stone Ridge 2020 Shareholder Letter“. Ross Stevens, 2020, stoneridgefunds.com/?tab=srdax.

Other resources that influenced this blog post.

“Cryptoassets: The Guide to Bitcoin, Blockchain, and Cryptocurrency for Investment Professionals“. Matt Hougan & David Lawant, 07-Jan-2021, cfainstitute.org/en.

“Why Bitcoin Matters“. Marc Andreesen, 11-Jan-2014, nytimes.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Structured Notes - Caveat Emptor! Buyer Beware!

We summarize structured notes as well as detail concerns we believe investors should understand before investing one penny.

By Founder & CEO Scott Savage.

We want to warn you about an investment product called structured notes. These derivative instruments typically purport to provide investors with a coupon payment higher than available in the bond market, as well as downside protection from the underlying reference asset, which is often a stock-based investment like the S&P 500 Index.[1] Sounds great, right? What could go wrong? A lot!

Below, we summarize structured notes as well as detail concerns we believe investors should understand before investing one penny. While risk management is the responsibility of each advisor who touts these investments, we want you to be aware of the risks in case someone recommends structured notes to you.

Summary

A structured note is a derivative instrument designed to typically provide both a regular coupon payment as well as some degree of principal protection compared to an underlying (usually stock) reference asset. Typically, the investor purchases an initial issue of the note from the sponsor (usually an investment bank) in exchange for coupon payments over the length of the note (often 1 to 5 years).

Generally, if the underlying reference asset only declines a little over the length of the note, the investor has a pre-specified level of principal protection and still receives the coupon payments. If the reference asset value falls below the predetermined knock-in level (the minimum value specified in the contract to receive coupon and principal payments), you may not receive all of the coupon payments and your principal amount would decline. When the reference asset increases over the note length, the investor usually receives the coupon payments and some principal upside based on the participation rate.[1]

Source: “Spotlight on… top issuers in the US“. Structured Retail Products, 07-Jan-2022, structuredretailproducts.com.[2]

Advantages

An investor can receive a coupon rate that is higher than yields available in the bond markets, while receiving some downside principal protection if the underlying reference asset declines.

Some structured note platforms are creating more competition among sponsors, which can help to create more investor-friendly structured notes.

Many banks offer structured notes for a wide variety of underlying stocks, indices, and other financial assets.

Concerns

Most structured notes are relatively complicated, often with dozens of pages of details such as protection (specified knock-in levels), maturity, coupon rates, and underlying reference assets.

Most structured notes are subject to multiple layers of fees, and the fees are often difficult to understand.

In terms of issuers, structured notes are primarily issued by large, predominantly Wall Street banks.[2]

Structured notes tend to have maturities of 1 to 5 years, meaning upon maturity you will have to review newer structured notes if you want to continue investing in structured notes.

Many structured notes can be redeemed (called) by the issuer, either automatically triggered based on the underlying reference investment or whenever the issuer has the right to call.

Typically, there are no federal or state insurance guarantees on the principal invested in structured notes. Additionally, structured notes tend to be senior, unsecured notes by the sponsor. If the sponsor is unable to make interest and / or principal payments, the investor may not receive the full note value.

Many structured notes do not provide full downside protection in case the reference asset falls below the knock-in level. The downside market protection may not fully cover your investment in more volatile market periods.[4]

Most notes have a relatively illiquid secondary market. Some notes allow the investor to sell back the notes to the sponsor, often at a discount to the current value.

Interest (excluding principal) from the notes can be complicated, and often considered taxable income if held within a taxable account.

Sponsors typically measure reference assets without dividends and other distributions.

Structured notes are over-the-counter investment products, which have less regulatory supervision compared to mutual funds and ETFs.

The total market for structured notes is not as competitive (particularly on costs and product features) as other investment products such as mutual funds and ETFs.[1]

Structured notes are not standardized across issuers.

In recent years, the U.S. Securities & Exchange Commission (SEC) has issued Investor Alerts & Bulletins detailing the risks of structured notes. In particular, the SEC encourages you to answer the following questions before purchasing a structured note:[5][6]

Conclusion

As we contemplate our duty to our clients as fiduciaries, SJS does not recommend structured notes to clients. They tend to be complex, primarily offered by Wall Street banks, have multiple layers of fees, and require a lot of work to fully understand each structured note.[1][2][4][5] Finally, we are not aware of any well-regarded institution or endowment fund that invests in structured notes. We wonder why?

Important Disclosure Information & Sources:

[1] “Why Structured Notes Might Not Be Right for You“. Jason Whitby, 11-Dec-2021, investopedia.com.

[2] “Spotlight on… top issuers in the US“. Structured Retail Products, 07-Jan-2022, structuredretailproducts.com.

[3] “Barclays to Book $591 Million Loss Due to Debt-Sale Snafu“. Anna Hirtenstein, 28-Mar-2022, wsj.com.

[4] “Structured Notes: The Risks of Insuring Against Risks“. Jason Zweig, 17-Oct-2014, wsj.com.

[5] “Structured Notes with Principal Protection: Note the Terms of Your Investment.” United States Securities and Exchange Commission, 01-Jun-2011, sec.gov.

[6] “Investor Bulletin: Structured Notes.” United States Securities and Exchange Commission, 12-Jan-2015, sec.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Scott Savage Recognized In The Forbes 2022 Ranking Of Best-In-State Wealth Advisors

SJS Investment Services Founder & CEO Scott Savage has been recognized in the Forbes 2022 ranking of Best-In-State Wealth Advisors in Ohio, as part of a ranking of wealth advisors within the United States.

SJS Investment Services Founder & CEO Scott Savage has been recognized in the Forbes 2022 ranking of Best-In-State Wealth Advisors in Ohio, as part of a ranking of wealth advisors within the United States.[1]

“Recognition by one of the financial industry’s most respected publications is humbling, and simply reflective of the faith, commitment, and loyalty the SJS Team has demonstrated over the last 26 years,” says Scott.

The Forbes 2022 ranking of Best-In-State Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria, gained through telephone, virtual and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years experience, and the algorithm weights factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Neither Forbes or SHOOK receive a fee in exchange for rankings. SHOOK Research received 34,925 nominations, invited 19,640 advisors to complete their online survey, performed 14,476 telephone interviews, conducted 2,657 in-person interviews at advisors’ location, and conducted 1,311 Web-based interviews. Additional information about the ranking methodology can be found here.[2]

SJS Investment Services responded to an email survey provided by SHOOK Research, providing quantitative information including AUM size, AUM growth, typical client relationship size, and minimum account size for new business. Neither Scott Savage nor any other employees of SJS Investment Services provided any payment to Forbes or SHOOK Research in exchange for rankings, nor participated in any other interviews with Forbes or SHOOK Research, nor is aware of who nominated Scott for the ranking.

If you would like to learn more about how Scott and the SJS team work with families, business owners, and institutions, please reach out to us. We are always here to listen and assist.

Important Disclosure Information & Sources:

[1] “Forbes Best-In-State Wealth Advisors”. Jason Bisnoff & SHOOK Research, 07-Apr-2022, forbes.com.

[2] “Methodology: Forbes Best-In-State Wealth Advisors 2022“. R.J. Shook, 07-Apr-2022, forbes.com.

Past performance is no guarantee of future results. There is no guarantee investment strategies will be successful.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

MarketPlus Investing

Video on our MarketPlus Investing philosophy.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® portfolios consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Statements contained in this video that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Suggested Reading

SJS Outlook: Q1 2022

SJS Q1 2022 Outlook including our insights on market corrections and market highs, the rise in interest rates, “The Fastest Company In The World”, and looking forward to Q2 2022.

Market Corrections & Market Highs

We believe that trying to time when to get in and out, or what to buy and sell, represents little more than gambling.

By Chief Investment Officer Tom Kelly, CFA.

In 2021, the global stock market (as measured by the MSCI ACWI Index) continued to reach new high after new high, but this year is off to a different start.[1][2] After the slow and steady rise in 2021, the rather opposite slow and steady fall occurred throughout the first quarter of 2022.[1] Though some recovery happened in the last three weeks, market headlines continue to point out all the things to worry about such as war, inflation, and recession.[1] Challenging times may be ahead, especially with the continued conflict between Russia and Ukraine.

While not diminishing those challenges and the people affected, it may be an opportune time to take a step back for a wider perspective. When looked at as a whole, the stock market can sometimes seem tame and uninteresting during times of lesser volatility, and all fraught with despair during periods of higher volatility and drawdowns. However, the drawdown of 13% so far this year for the global stock market is not uncommon at all, and we often see intra-year drawdowns well into the double digits even when the end-of-year returns end up positive.[2] Over the last 20 years in the global stock market, intra-year drawdowns averaged 16%, yet calendar year returns were positive in 15 out of 20 of those years.[2] A gentle reminder to stay the course.

Source: Morningstar. See Important Disclosure Information.[2]

It is interesting to note that the “market” as a whole often masks the ups and downs of its individual stock components. Within the MSCI All Country World Index, 94% of the nearly 3,000 companies experienced a drawdown of at least -10% during 2021, and about half drew down 25% or more.[2] This in a year when there was lower volatility, limited geopolitical events, and the global stock market as a whole up 19%![2] This suggests the value of broad diversification.

When evaluating the underlying returns, there is often plenty to worry about and temptation to tinker. We believe that trying to time when to get in and out, or what to buy and sell, represents little more than gambling. MarketPlus Investing on the other hand is a disciplined process, centered around research and evidence, with diversification at the core.

Important Disclosure Information & Sources:

[1] “SJS Weekly Market Update”. SJS Investment Services, 2021-2022, sjsinvest.com.

[2] Morningstar. The global stock market is represented by the MSCI ACWI Index, which is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI Index consists of 47 country indices comprising 23 developed and 24 emerging market country indices.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

The Fed Poked The Bear

Rising interest rates are not always a bad thing. As interest rates move higher, the drop in value can be concerning, but in the longer-term, higher rates mean higher expected returns for investors, as bonds begin to produce more income.

By Senior Advisor Kirk Ludwig, CFIP, AIF®.

March 20th was the celebration of the Vernal Equinox and the Earth’s axis has once again shifted us into a new season. From the green pop of tulips sprouting to the warmth of the sunshine spilling through the windows, the United States began celebrating one of their most beloved seasons: The NCAA March Madness Basketball Tournament, or as many of us like to call it… Spring! Along with spring comes the chirping of migrating birds and the waking of hungry bears. This spring the Fed gave the “bond bear” a bit of a poke to get the season rolling.

After a two-year hibernation of zero percent interest rates, the Fed has embarked on the challenging mission of hiking interest rates to combat elevated inflation levels while not inducing a recession at the same time.[1] By increasing short-term interest rates and reducing the size of their balance sheet, the Fed will attempt to orchestrate a soft economic landing.[1] So how many times will they need to raise interest rates to accomplish their goal?

Now for the bad news “bear”… The Fed indicated their intent to continue raising rates into the near future.[1] As of the end of March, the market is expecting the Fed to raise rates eight to nine more times in 2022.[2] This number has changed multiple times in the past few weeks and will likely continue to adjust in the coming months.[2] As new information is presented to the market, bond yields will quickly reflect the possible changes which may occur as a result.

Why are rising rates viewed negatively by the market? Let’s revisit how bond values can change based on the change of market interest rates. Like a teeter-totter, when rates rise, bond values fall and vice versa. Additionally, the sensitivity of the price change is primarily impacted by the term length (maturity) of the bond. The longer the maturity, the more sensitive the price of the bond will likely be. With this recent move higher in yields, the S&P U.S. Aggregate Bond Market Index dropped 5.57% in the first three months of 2022.[3] One of the worst starts of the year on record.[3]

However, rising rates are not always a bad thing. As interest rates move higher, the drop in value can be concerning, but in the longer-term, higher rates mean higher expected returns for investors, as bonds begin to produce more income. The chart below shows the change in yields for three different time periods; 1.) 09/30/21 - before the Fed indicated their plan on raising rates, 2.) 12/31/21 – early stage of the Fed’s plan, and 3.) 03/31/22 – the market’s interpretation of future rates as of the end of the quarter:[2]

Source: “Daily Treasury Par Yield Curve Rates“. U.S. Department of the Treasury, treasury.gov.

As illustrated in the graph, current interest rates have moved markedly higher since the start of the year. Short-term rates - inside three years - have had the most dramatic move as the market prepares for future rate hikes. The longer maturities, which often provide more information about future growth and inflation expectations, have experienced a parallel shift higher. The shape of the yield curve prices in the future expected events, i.e. rate hikes, inflation, economic growth to name a few.

With all the uncertainties surrounding today’s markets, the day-to-day news can be distracting to investors. If you’re worried about how many more times the Fed is going raise rates, know that the market has already priced in that risk. Future inflation? Same answer. Possibility of future recessions… same! Therefore, trying to make long-term decisions on short-term news can often lead investors down the wrong path.

‘Ok, so what should we do now?’ SJS does not react to the short-term noise, but we do evaluate the longer-term expected risk and return characteristics of each segment of the portfolio and manage to those risks. Some of the adjustments that we have made on behalf of our clients:

Maintaining a shorter duration than the total bond market: We believe this reduces interest rate risk relative to the total broader US bond market, while still maintaining broad diversification.

Investing in shorter-term inflation-protected securities: We believe this hedges the portfolio against sharp increases in inflation, while still maintaining a relatively short duration.

Adding diversified alternative investments: We believe investing in diversified alternatives with low correlation to US stocks and bonds can help to redistribute expected risk, broaden diversification, and increase expected returns compared to US fixed income over the long-term.

While you are enjoying the shift into this new season, be comforted in knowing that SJS is continuously monitoring the market and keeping your best interests top of mind. As markets experience higher levels of uncertainty, the best course of action is to maintain a strong discipline with broad diversification. Yes, the hungry bear may seem scary, and you will likely want to run, but the market will eventually find its balance so we can all get back to monitoring our college basketball brackets.

Important Disclosure Information & Sources:

[1] “Fed Raises Interest Rates for First Time Since 2018“. Nick Timiraos, 17-Mar-2022, wsj.com.

[2] “Daily Treasury Par Yield Curve Rates“. U.S. Department of the Treasury, treasury.gov.

[3] “S&P U.S. Aggregate Bond Index“. S&P Dow Jones Indices, spglobal.com/spdji/en. The S&P U.S. Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® portfolios consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Buy-Sell Agreements for Business Owners: Why You Should Have One

This article explores how a buy-sell agreement works, why we strongly recommend one for our business owner clients who share company ownership, and how we can help with implementation.

By Founder & CEO Scott Savage.

Business ownership, especially starting a business, can be overwhelming. Over the years, we have seen business owners make two types of mistakes:

Errors of commission, or an incorrect decision, which include paying too much for real estate, hiring the wrong people, or buying the wrong inventory.

Errors of omission, or missed opportunities, which include not having a board of advisors, not hiring a tax expert to help with structuring the business, or not creating a buy-sell agreement.

Although mistakes are inevitable, it is possible to take steps to avoid errors of omission. This article explores how a buy-sell agreement works, why we strongly recommend one for our business owner clients who share company ownership, and how we can help with implementation.

What is a Buy-Sell Agreement?

“The beginning of wisdom is the definition of terms.” —Socrates

Stated simply, a buy-sell agreement is a legal document made between two or more shareholders of a privately held corporation or entity. The agreement helps the business streamline the transition between owners after a triggering event, such as death, disability, divorce, or disagreement.

The agreement works by establishing a valuation method for the business. There are various ways to determine the value of a business, including:

Fixed Price Approach: Setting a fixed price of the business, typically on an annual basis.

Formula Approach: Agreeing on a formula that utilizes components such as cash flow or assets to determine the price.

Finally, the buy-sell agreement will include a funding strategy. It can be funded or unfunded, but typically people will fund buy-sell arrangements with insurance, which is what we generally recommend.

Why Have a Buy-Sell Agreement?

A buy-sell agreement can greatly simplify a transition between business owners. Without an agreement in place, you can anticipate holdups, delays, and potentially, litigation in transferring ownership to the other shareholders. A buy-sell agreement aids in bypassing these issues, helping the business to move forward during times of change.

Some business owners think such an agreement is useful once their company gains in value, not at the outset. But we encourage anyone who is starting a company with someone else to get a buy-sell agreement in place. You never know what will happen, and this agreement can prevent a lot of trouble and heartache.

How SJS Can Help

Depending on the needs and company structure, we can help advise on the proper approach to a buy-sell agreement. We are able to coordinate the process with attorneys and tax professionals to help you create an agreement that is effective and valuable.

This is part of the ongoing service we provide and one that isn’t simply drafted and put on the shelf. Buy-sell agreements become part of a dynamic, ongoing conversation with our business owner clients. We can monitor the company’s growth and indicate if our client should fund or update the agreement given the company’s increase in value.

Schedule a complimentary discovery meeting today to discuss what’s on your mind and how we may be able to help.

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What Should You Do About Student Loans?

By understanding and preparing for the benefits as well as costs of higher education options, you can make better higher education decisions for your family for both now and the future.

By Investment Associate Bobby Adusumilli, CFA.

For many people, going to college is a dream come true. While in college, they grow and evolve as people, meet close friends, and have some of the best times of their lives. College degrees often provide people with the skills and qualifications that they need in order to get the jobs that they want. From an earnings perspective, getting a college degree is an important steppingstone in increasing career earnings as well as improving career opportunities, particularly for people who come from more disadvantaged backgrounds.[1]

And yet, earning a college degree is a real financial burden for a lot of people. As demonstrated below, the total student loan debt in the US reached a record $1.75 trillion in 2021, equating to nearly $38,000 per student who borrows.[2][3] Even 20 years after graduation, roughly half of borrowers still have around $20,000 in student loan debt on average. Student loan debt is even greater for people who pursue master’s or doctorate degrees, sometimes amounting to hundreds of thousands of dollars.[4] The costs of college have been only going up over the past 20 years, meaning student loan debts will remain a major burden for a lot of people throughout their lives.[2]

Source: “Student Loan Debt Statistics”. Melanie Hanson, 01-Mar-2022, educationdata.org.

By understanding and preparing for the benefits as well as costs of higher education options, you can make better higher education decisions for your family for both now and the future. In order to help your family with this, we first detail the different types of student loans and repayment options. Then we provide some actions that both parents and students can consider in efforts to lower the costs of higher education.

Types of Student Loans

If you need to take out student loans, you can borrow from the federal government and / or private lenders. Due to interest rates, qualification criteria, and repayment options, most people tend to borrow from the federal government. As further detailed by the Wall Street Journal, there are four primary types of federal student loans:[4]

Direct Subsidized (Stafford) Loans are available to undergraduates based on their financial needs. As long as you are enrolled in college at least half-time, you don’t begin accruing interest until six months after graduation.

Direct Unsubsidized (Stafford) Loans are available for both undergraduate and graduate students. Undergraduates typically receive lower interest rates. You begin accruing interest as soon as you take out the loan.

Direct Parent PLUS Loans allow parents of undergraduate students to borrow up to the full cost of attendance of the school. Interest begins accruing immediately.

Direct Grad PLUS Loans allow graduate students to borrow up to the full cost of attendance of the school. Interest begins accruing immediately.

In terms of lowest interest rate, the priority tends to be Direct Subsidized (Stafford) Loans, then Direct Unsubsidized (Stafford) Loans, then Direct Grad PLUS Loans, then Direct Parent PLUS Loans.[4]

Some people decide to take out private loans from third-party lenders such as SoFi and Earnest, particularly if they want to consolidate their outstanding loans into one loan in order to potentially take advantage of a lower interest rate. However, private loans are usually subject to more stringent rules, and you may need to spend more time monitoring private loans in order to keep taking advantage of lower interest rates.

Student Loan Repayment Options