‘MySJS’ Now Available With New Mobile App

In today’s always-on, information-at-your-fingertips world, we know you may want to check your portfolio on the go. Our new MySJS mobile app lets you do just that.

In today’s always-on, information-at-your-fingertips world, we know you may want to check your portfolio on the go. Our new mobile app lets you do just that, and provides you with the same information you can find at your MySJS site.

The free MySJS app is available for any Apple or Android device – just visit your App Store and search for “SJS Investment Services” to download.

Your login credentials for the mobile app are the same as for your MySJS website.

(The MySJS app is provided to SJS by a third-party partner of SJS.)

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

MarketPlus Investing: Choosing Your Target

The mix of stocks and bonds in a portfolio is the factor we believe has the most impact on expected risk and return. We stand ready to review your target with you.

By SJS Managing Director Jennifer Smiljanich

In this modern, mobile society, we all face a nearly unlimited menu of choices.

As it relates to work life alone, you can choose to stay at the same company for years, change jobs often, become part of the gig economy, retire and start a second career, or even run a business from your own home. Each path comes with different risks, and rewards.

The same is true with your investment portfolio. There are always many choices to consider:

What do I invest in – stocks or bonds – or both?

What about gold or real estate?

How do I invest – via mutual funds, individual securities, or Exchange Traded Funds (ETFs)

When do I invest – should I invest all at once or invest over time?

When do I need to make any changes?

Helping you answer these questions with a clear understanding of your needs, goals, and preferences is part of the MarketPlus Investing® process. Your MarketPlus Investing portfolio is made up of institutional quality mutual funds, which may include both stocks and bonds.

We think it’s important to take time to make sure that we find the right design for your life situation, with a foundation supported by academic learning and science. We consider many factors in determining the right portfolio mix for you, including your age, income need, time until you need to start taking withdrawals, the length of time you will need that income, your current level of income, and your personal comfort with the ups and downs in the market – to name just a few.

The relative mix of stocks and bonds in a portfolio is the factor we believe has the most impact on expected risk and return. Stocks have historically outperformed bonds, although there have been periods, notably the early 2000s, when bonds have outperformed stocks.

Data Source: Dimensional Fund Advisors

What’s the difference between the two? Stocks offer ownership in a company. If you hold Apple stocks, you own a portion of Apple. In contrast, if you own an Apple bond, you are lending money to Apple, and you are entitled to repayment of interest and principal on your loan. If Apple were to go bankrupt, bondholders have a preferred place in line ahead of stockholders for a return of their investment.

The target mix of mutual funds that may include both stocks and bonds in your MarketPlus investment portfolio likely will vary over time. Typically, the mix will tilt away from stocks and toward bonds as you get older. Other life events may lead you to adjust your allocation – maybe a change in your need for funds, loss of a spouse, retirement or career move, reduced comfort with risk, or an update to your investment purpose. Market factors may also affect your desired allocation, such as the interest rate environment or market cycle changes.

We stand ready and willing to review your target with you, and to help you discern the right choice for you, wherever you are on life’s journey.

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market. MarketPlus Investing® models consist of institutional quality mutual funds. Mutual fund investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Reap What You Sow

Investment droughts will arise. Instead of trying to predict when and where ‘rain’ may come, we recommend that you preemptively plant your assets in rich soil.

By SJS Senior Client Portfolio Manager Tom Kelly, CFA

Sometimes, things don’t happen as you might expect. The first quarter of 2019 will be remembered for bringing us the longest government shutdown in U.S. history, continued trade wars with China, lowered consumer confidence – and U.S. investment markets that were up more than 13 percent, as shown in the graph below.[1]

The year started out with a bang rivaling the fireworks displays of New Year’s Eve, as U.S. stocks posted their best January in 30 years – all of this coming on the tail of the bear market at the end of 2018.[2]

While there may have been temptation to act to protect against further losses, this more often than not leads to loss and regret. Prudent investors who stayed the course would have been rewarded for their discipline.

The first three months of 2019 have been a budding reminder that the markets efficiently price in information before we even know or hear about it. Market timing is a fool’s errand.

In fact, Nobel laureate William Sharpe – who created the Sharpe Ratio return/risk metric, which is used to help investors understand the return of an investment compared to its risk – determined that someone who tries to time the markets must be right 74 percent of the time in order to outperform a buy-and-hold approach on a risk-adjusted basis.[3],[4] The cost of being wrong gets exacerbated during periods of volatility, just as the desire to tweak and tinker increases.

Instead of market timing, MarketPlus Investing® is based in part on the idea that diversification may be a smarter way to increase expected return for a given level of risk. Adding diversification should increase the Sharpe Ratio, which helps demonstrate that excess returns above the “risk-free rate” (the return of a U.S. Treasury bill) are the result of good investment decisions instead of increased risk taking.[3]

Investment droughts will arise, so instead of trying to predict when and where the ‘rain’ might come, we recommend that you preemptively plant your assets in rich soil – a MarketPlus portfolio designed with comprehensive market coverage, calculated risk exposure, and cost-efficient implementation.

As spring approaches, the new green shoots popping up everywhere serve as a great reminder of the growth that follows the strain of a harsh winter. Just as the work is done far before you see the fruits of your labor, our science-based process of structuring and designing portfolios to help you achieve your financial goals has weathered the test of time, through seasons both good and bad.

So, go out and enjoy working in your garden, cultivating relationships, or rooting yourself in a new hobby this spring. You can be sure we’ll be following the same nurturing approach with your portfolio by maintaining the discipline of our MarketPlus Investing philosophy.

Sources:

[1] S&P 500, 2019 YTD Performance as of 3/31/2019. Morningstar.

[2] Amrith Ramkumar, “Stocks Post Best January in 30 Years.” Wall Street Journal, 2/1/2019.

[3] Marshall Hargrave, “Sharpe Ratio Definition.” Investopedia.com, 3/9/2019.

[4] William Sharpe, “Likely Gains from Market Timing.” Financial Analysts Journal, vol. 31/no. 2, 1975.

Important Disclosure Information:

Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Diversification does not assure a profit or protect against loss.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

10 Commandments … of Money

It seems like a good time to share one of our most requested SJS features – the 10 Commandments…of Money. We think good advice certainly bears repeating!

By SJS Founder & CEO Scott Savage

Now seems like a good time to share one of our most requested SJS features – the 10 Commandments … of Money.

We think good advice certainly bears repeating!

Thou shall diversify investments, because markets tend to be efficient.

Thou shall not live beyond thy means.

Thou shall not attempt to time the market.

Thou shall not give unearned money to thy children, robbing them of a vital learning opportunity.

Thou shall not abandon investment discipline during a Bear Market.

Thou shall not abandon investment discipline during a Bull Market.

Thou shall not covet thy neighbor’s hedge funds.

Thou shall not hire a money manager based on recent track records.

Thou shall not overpay for the delivery of investment advice.

Thou shall not pay undue taxes in an investment portfolio.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

MarketPlus Investing® – It Takes Discipline

Our quarterly Investment Committee meetings allow to reflect on and to evaluate the discipline of our MarketPlus Investing strategy, and what that means for you.

By SJS Managing Director Jennifer Smiljanich

The start of a new year always seems to be a good time for reflection. A time to think about the journey we took throughout the past year. A time to look forward to the year ahead. And, a time to think about a certain “D word.” That’s right, Discipline! That difficult thing we know we should work on, but still find ourselves struggling with.

We resolve to do all the right things, to choose to eat healthier, to make time for exercise, and to work on relationships with family and friends. Discipline. It’s hard.

At SJS, our quarterly Investment Committee meetings give us the opportunity to reflect on and to evaluate the discipline of our MarketPlus investment strategy, and what that means to you. Our commitment to you is that we will maintain the discipline of our investment philosophy and our science-based process of designing portfolios to help you achieve your financial goals in an up, down, or sideways market.

At times, we have made adjustments to the way in which we implement MarketPlus Investing on your behalf. Any investment change is subject to careful consideration, and may come as a result of market conditions, investment alternatives offering lower costs, more diversification, or better exposure to an investment premium. Since our beginning in 1995, our portfolios have seen a number of adjustments, about two dozen in total (graphic below).

We do know that it’s not easy being an investor, especially a patient one. As human beings, we are prone to an emotional response when we see the markets go up, and even more so when markets go down. Behavioral studies tell us that losses loom larger than gains – the pain of a loss is psychologically twice as powerful as the pleasure of a gain.[1]

We are here to offer you an ear to listen and a hand to hold when the markets are choppy. And we will continue to offer you a disciplined investment process that puts your portfolio in the way of market returns, and the anticipated benefits of investment premiums supported by academic research.

If we can free up some time for you to focus on the people and the causes you care about, well – that’s just another “plus.”

Sources:

[1] “Loss Aversion,” www.behavioraleconomics.com.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Stock Picking – Who’s Keeping Score?

Picking stocks is a very difficult game, even for the most seasoned professionals. We believe that diversification is the best way to manage stock investing risk.

By SJS Founder & CEO Scott Savage

Today’s financial media – where TV personalities and financial professionals alike freely offer their investment “picks of the day.” They might present well-founded arguments or emotional appeals when they recommend a buy or a sale to their audience. But you can bet they’ll always have some pick or prediction to make. What’s rare, though, is when those individuals are held accountable for how well their picks performed.

An exception to this is Barron’s – which we believe is a respected weekly financial publication – which takes the time to follow up on how their “Roundtable” has performed. Barron’s 2019 Roundtable is made up of what Barron’s refers to as “Wall Street’s smartest investors.”[1] Each year, Barron’s asks these experts for their opinions about the economy and the direction of the markets, and also invites them to provide a number of stock picks for the upcoming year.[2] At the beginning of the following year, Barron’s publishes what they call their “Roundtable Report Card,” and lets their readers be the judge of how well the industry experts fared.

In January 2018, nine of Barron’s experts – including Merrill Lynch’s Abby Joseph Cohen and Chairman and CEO of Gamco Investors, Mario Gabelli – looked into their respective crystal balls and made their picks. Each expert recommended anywhere from four to ten stocks for the year. How do you think their picks performed?

We took each Roundtable panelist’s picks and did a simple calculation to average their total return on the year, and then averaged those returns to come up with an overall average (mean).

We found those results interesting – the average manager’s stock picks actually declined more than 12% from January 15 to December 31, 2018. In fact, we found that only three of the nine Roundtable members’ picks had an average return that beat the -8.6% return of S&P 500 Index for the year.[2] While we respect the experience and collective knowledge of the group interviewed by Barron’s, the results of their 2018 stock selections support our long-held belief that picking stocks is a very difficult game, even for the most seasoned professionals.

We believe that diversification is the best way to manage the risk of investing in global stock markets. While diversification doesn’t mitigate all risks, it is a foundational component of MarketPlus Investing®, in which we carefully evaluate your exposure to risk.

In addition to broad diversification, we incorporate intentional biases toward small-cap, value, and profitable companies in your portfolios, which we’ve designed to efficiently capture market returns where they have historically occurred and where market indicators imply they will continue.[3] And we support the notion of accountability – letting you know how your portfolio has performed compared to an index invested in a similar mix of stocks and bonds.

While your portfolio might not always beat the index year in and year out, over time, your assets are diversified and allocated to best capture the returns of the market – and the goal is to do so with a smoother ride than if you held just a handful of stocks. We’ll remain true to our time-tested and disciplined process and remain accountable to you. And we’ll leave the stock picking to the experts.

Sources:

[1] “What’s Next for the Stock Market and the Economy, According to the Experts,” Barrons.com, January 14, 2019.

[2] “How Stock Picks from Our Experts Fared in 2018 – Roundtable Report Card,” Barrons.com, January 14, 2019.

[3] Past performance does not guarantee future results.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Industry Speak vs. ‘SJS Speak’

Have you ever read an article in a magazine or newsletter, and come away feeling more confused and with less understanding *after* having read it?

Could you repeat that, please?

By SJS Founder & CEO Scott Savage

Have you ever read an article in a magazine or newsletter, and come away feeling more confused and with less understanding *after* having read it?

Too often, those who write these types of articles spend their time using words that may make the writer sound smarter and well-informed without giving consideration to the people who are actually reading the article. They use lots of big words and industry jargon to give the impression that they REALLY know their stuff. But, in the end, you – the reader – don’t learn anything much.

Consider the following paragraph about SJS, written in a style that we like to call “industry-speak”:

Industry-Speak

Many of our clients come to us to help determine if their net worth is sufficient to fund their liquidity needs, to amortize their debt, and for help investing their 401(k) plans, Roth IRAs, and Trust accounts. They turn to us for a proper asset allocation as to maximize their total return while minimizing flow-through and realized capital gain taxes, and to help them understand how MarketPlus Investing® is better than active investments, including hedge funds, private equity, and Bitcoin. A Monte Carlo simulation is often used to determine the statistical probability of successfully matching assets and liabilities. Also, clients ask for advice on estate planning, gifting, and philanthropic options to consider. SJS provides periodic performance reporting, using time-weighted return calculations relative to an appropriate industry benchmark.

At SJS, we prefer to speak WITH you or TO you – never “at” you. We know some of you may like to read technical terms and take a deep dive into those jargon-infested waters. But many of you just want us to tell you what you need to know, with the message delivered in a concise, easy-to-understand way.

The following paragraph says basically the same things as the “industry-speak” item above – but in a way that we think cuts right to the heart of the matter:

SJS-Speak

As a client of SJS, you want to know whether you have enough money to retire comfortably and take care of the people you love. You want your money to be properly invested for your stage of life and circumstances, and to avoid paying unnecessary taxes. You want SJS to be accountable to your results and make sure that you, the client, are getting paid for the risks you are taking.

Industry-speak or SJS-speak – which do you prefer?

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

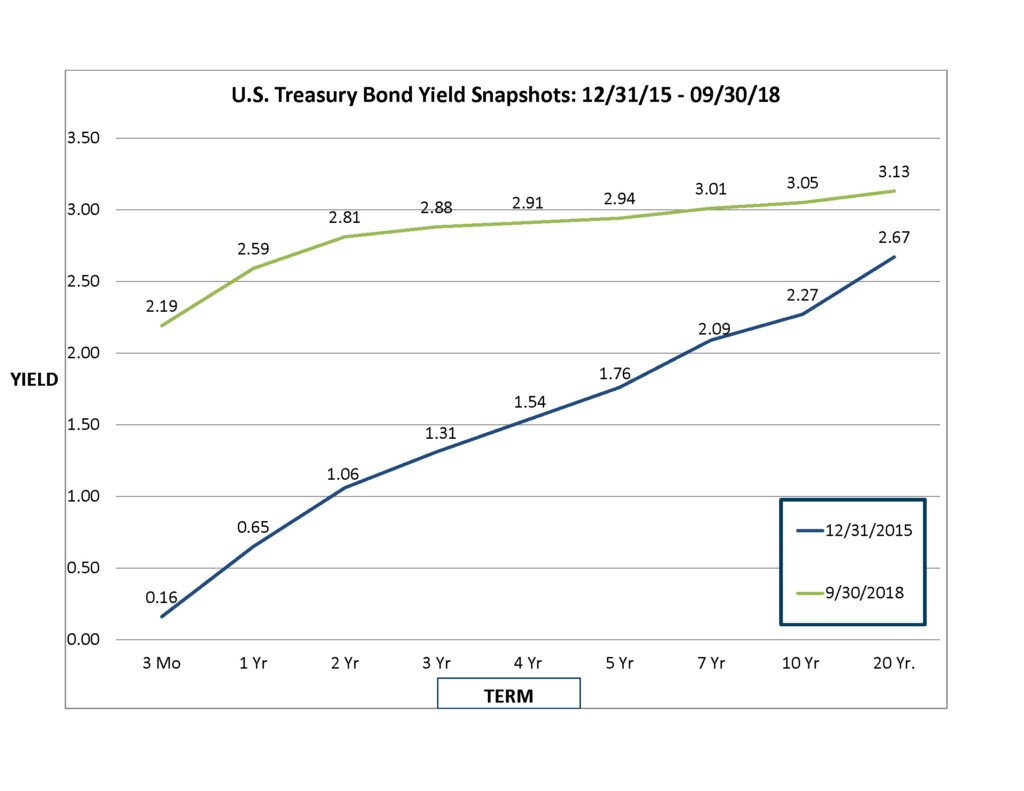

Bond Returns – Could The ‘Drought’ Be Ending?

In the bond market, we have been experiencing our own version of a “drought” over the past decade – a shortage of income (or, yield) from our bonds.

By SJS Director of Institutional Investment Management Kirk Ludwig

Whether you’re an SJS client living in Ohio or Arizona – or somewhere in between – chances are good that you have experienced an environmental drought at some point during your lifetime.

In the bond market, we have been experiencing our own version of a “drought” over the past decade – a shortage of income (or, yield) from our bonds, with respect to the fixed income allocations in our MarketPlus® portfolios. A drought begins and intensifies when there is a continued shortage of rainfall. Over time, the ground dries up. The “green” goes away as plants, shrubs, and trees die or fall dormant. The ground remains fertile but, in the absence of precipitation to generate new growth, crops fail to produce their yield.

Typically, we think of bonds, or fixed income, as the “safer” part of our portfolios, since they generate income while providing portfolio stability. However, since the Great Recession in 2007, short-term bond rates have hovered near zero percent, evaporating any income from this part of the portfolio.[1] Now that the U.S. economy is feeling more stable, the Federal Reserve has increased their target rate to 2.25%, which in turn has showered the bond market with a much needed income boost.[2]

Similar to how a gentle rainfall would not immediately end a weather drought, a gradual increase in interest rates doesn’t automatically lead to higher income. When interest rates go up, the principal value of a bond will actually adjust lower to make up for the higher market rate. This adjustment period often dampens fixed income returns in the short-term, but leads to a higher income stream in the future. As a result, the returns in fixed income investments year-to-date in your portfolio have been fairly flat.

We are eager to start capturing greater yields, but we have to be patient. In the current interest rate environment, the bond portion of our MarketPlus portfolios will gradually start capturing the increase in rates as shorter-term bonds mature and proceeds are reinvested at today’s higher yields. The Federal Reserve will likely continue to raise short-term rates in the near future, which means bond returns may continue to be flat for a while. However, we believe that we will soon start to see evidence of higher yields as they sprout within the portfolios.

A recovery following a drought is gradual. It doesn’t happen like a flood – instantly inundating. The recovery occurs by having a steady, soaking rain for a few days or more. Before you know it, your resources are recovering and the drought has ended.

Our hope is that our client portfolios start to benefit from these drought-ending rate increases, and that their future “harvest” will be more bountiful.

Sources:

[1] Daily Treasury Yield Curve Rates, U.S. Department of the Treasury.

[2] U.S. Rates and Bonds, Bloomberg.com.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Charitable Giving And Tax Considerations For Year-End

In the holiday season, what can you do to still fulfill your charitable intent, while also making tax-smart investing decisions?

By SJS Managing Director Jennifer Smiljanich

As the year winds down and we get ready to close the book on 2018, there are still many things to be done. Dinners to prepare, holiday gifts to buy, wish lists to fulfill.

In the hustle and bustle of the holiday season, there are even some things that can be done with respect to your investments.

As you likely know, there is a new tax law in effect this year – officially known as the Tax Cuts and Jobs Act – that went into effect on January 1, 2018. This new law changes some of the rules pertaining to charitable giving. In our conversations with you, this topic has come up with more frequency.

The new law doesn’t change the basic rules for charitable deductions (other than increasing the deduction limit for cash contributions from 50% to 60% of your adjusted gross income). But because the law nearly doubled the standard deduction (to $12,000 for single filers and $24,000 for married filers), fewer people will benefit from itemizing deductions.

So what can you do to still fulfill your charitable intent, while also making tax-smart decisions?

Consider gifting stocks, bonds or mutual funds with a tax gain to charity in lieu of a cash donation.

If you donate the securities directly to the charity, you do not pay tax on the gain, and because you do not owe tax on the security sale, you may be able to give a larger gift. We can help you facilitate your year-end gifting, subject to custodian deadlines.

If your tax preparer determines that your deductions may no longer exceed the standard deduction amount, there may be a benefit to bundling your charitable donations.

By adjusting the timing of donations to fall within a given calendar year, you might be able to increase your total deductions over the standard deduction, and see a potential tax benefit.

The rules for qualified charitable distributions still remain, allowing people older than 70 1/2 to transfer up to $100,000 from their IRAs to charity each year, and have it count as their required minimum distribution (RMD) without being added to their adjusted gross income.

The tax-free RMD from an IRA may be of greater benefit to those who can no longer itemize. Your charitable gift isn’t included in your adjusted gross income, and therefore isn’t taxed. We can help with any final distributions yet to be made.

As always, we’re happy to work with you, and your tax professional, to get things done in a way that makes sense for you. Please contact us if you have questions!

Important Disclosure Information:

SJS Investment Services does not provide tax advice. Please consult your tax professional for specific advice. This material has been prepared for informational purposes only.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Is Your Investment Professional A Butcher? Or A Dietitian?

In my experience, just about all broker dealers’ ads and marketing materials sure sound like they want you to believe they are in the advice business.

By SJS Founder & CEO Scott Savage

It’s a sunny Saturday afternoon. You’re in the mood to barbecue, so you hop in the car and head over to your friendly neighborhood butcher shop to get some meat to throw on the grill.

Or, maybe it’s a weekday afternoon, and you’re headed off to an appointment with a dietitian who is going to evaluate your diet and its healthfulness – or not – to help you figure out what you should be eating more of, or less of, and why.

Two different kinds of encounters, with very different end results. When you visit the butcher, you expect that he’s going to sell you some meat – and it will probably be tasty, although not necessarily healthy – and it will also be good for his bottom line to make the sale.

On the other hand, when you visit the dietitian, you can expect that she’s going to tell you what foods would be best for you to eat. Even though you’re probably paying her a fee for the appointment, her advice is given without any consideration to what might be in it for her.

Believe it or not, you can take the story of the butcher and the dietitian, and apply it to the investment world.

The storyboard below, created by the HighTower Company[1], shows the difference between an investment professional who works at a broker dealer – the butcher – and an investment professional who works for a Registered Investment Advisor (or RIA) such as SJS Investment Services – the dietitian.

Broker dealers (think – butcher) are supervised by a group called FINRA, a self-regulatory oversight body, or SRO. That’s right – broker dealers are supervising themselves. (FINRA is overseen by the Securities and Exchange Commission, which does have the power to approve or reject any rules FINRA may wish to adopt.)

RIAs (now, think – dietitian) are regulated directly by the Securities and Exchange Commission, and are held to what’s called “a fiduciary standard” by the SEC.

What does that mean? Simply put, firms like SJS have a responsibility to behave in a way that is in the best interest of our clients. There should be no conflicts of interest.

A broker dealer’s standard of care is one of what’s called “suitability.” As long as the investments being sold can be considered “suitable,” FINRA is satisfied. Even if the broker may recommend investment products to his clients because they offer him a higher commission – and not necessarily because the products may be in a client’s best interest.

How does that sound to you? Does a “suitable” investment sound good enough? Or are you thinking, “That doesn’t seem right. Somebody should make all investment professionals play by the same rules.”

There was an attempt to do so. In 2016, the Department of Labor introduced the Fiduciary Rule to require broker dealers to operate under the same standard of care as RIAs.

But, those broker dealers carry a lot of sway in Washington D.C. The Securities Industry and Financial Markets Association (SIFMA) and the Financial Services Institute (FSI), which represent the independent broker-dealer industry, argued in statements to the Fifth Circuit Court of Appeals that they are not in the business of advice, and not in an advice relationship of trust and confidence with their customers.[2],[3]

Go ahead, re-read that last paragraph.

In my experience, just about all broker dealers’ ads and marketing materials sure sound like they want you to believe they are in the advice business.

Sadly, the Fiduciary Rule went down in flames earlier this year. The SEC has proposed a new “Regulation Best Interest” rule that would establish a standard of care for all broker dealer representatives and require them to act in the best interest of their clients when making recommendations.[4] However, at this point in time, the “butcher versus the dietitian” remains the current state of things in the investment world. Investors still need to beware of a butcher in dietitian’s clothing.

We realize this scenario is complicated. Remember, we’re always here for you, to answer any questions you might have, or to simply talk through what we believe are the differences between a broker dealer, and an RIA like SJS. Just give us a call!

Sources:

[1] “HighTower Whiteboard Animation: Brokers vs. Fiduciaries,” YouTube.com, March 16, 2012.

[2] “DOL Rule One Step Closer to Death,” wealthmanagement.com, May 1, 2018.

[3] “Financial Industry Celebrates, Mourns Fiduciary Rule Decision,” www.fa-mag.com, March 16, 2018

[4] “Proposed Rule: Regulation Best Interest,” www.sec.gov, April 18, 2018.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Changing Or Creating A Trust?

When’s the last time you updated your trust document? Or, maybe your life circumstances have you considering a trust for the first time.

Let Us Help You Put Your Plan Into Action!

By SJS Managing Director Jennifer Smiljanich

When’s the last time you updated your trust document? Or, maybe your life circumstances have you considering one for the first time. No matter your situation, the process of changing or setting up a trust might be unfamiliar to you. We understand. The whole process is just not top of mind until, one day, it is.

Trusts are vehicles designed to protect and transfer wealth, but if you’re like many people, you don’t review your trust documents very often, or make changes to them. Many of us are part of the “set it and forget it” crowd until some life event, or just the sheer passing of the years, makes us think: “We probably should take a look at our trust and estate planning documents.” And then there’s the immediate follow-up surprise: “How many years has it been? Can’t be!”

Well, all that passing time, or just the unfamiliarity of a new trust, can leave you at a disadvantage when it comes to coordinating your investment management account titling and beneficiary designations with your trust documents. But here’s the good news. Let SJS Investment Services know your intentions, and we can help set your mind at ease.

As your investment advisors, we are here to help you through the process. That’s the first and most important reason to give us a call when you are considering a trust or making changes to the one(s) you have. It’s not enough to simply update your trust documents; you also have to implement your plan. Working with you and your estate planning professional, we’ll help you take care of changing beneficiaries on all your accounts, updating account titling, and all the other tedious but crucial tasks required to put your estate plan into action. As a client of SJS, please know that you have a partner to help you reach the finish line!

Also, let us know about any life transition you might be experiencing. Maybe it’s a marriage, the birth of a child, the loss of a spouse, a recent inheritance, a divorce, a new home, or a business sale. There are so many life situations. You’ll be comforted to know we have been there for our clients through them all. Many times!

We can help you navigate all of the forms and documents needed to change your name, address, beneficiaries, and so on for your investment accounts. When you work with SJS, your wealth isn’t the only thing we take care of. We take care of you. That’s why we’re here!

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.