This Too Shall Pass

As advisors and professional investors, we hold vivid memories of the times when markets are volatile and bear markets ensue.

By Scott Savage, CEO & Kevin Kelly, CFA, President.

Past as Prologue?

As advisors and professional investors, we hold vivid memories of the times when markets are volatile and bear markets ensue. So far, 2022 is going to be a year we won’t soon forget, joining 1987, 2000 through 2002, 2008 & 2009, and 2020, among others.

The primary culprit this year for lower bond and stock prices is an unexpected increase in short-term interest rates, reaching levels not seen in over fifteen years. The Federal Reserve that is responsible for the level of short-term rates has acted decisively, raising short term rates by 3.0% between March and September, attempting to halt and reverse the inflation rate from its current annual pace of 8%+. The Fed’s rate hikes flow directly to higher lending rates which tend to slow economic activity, thus increasing the risk of a recession.

All of this has been a significant headwind for stock and bond prices, giving the calendar year of 2022 its bear-market distinction.

Good Decisions vs. Good Predictions

Despite our opinions, we have never held ourselves out as predictors or market timers. However, we believe you rely on us to help make good decisions in a thoughtful and disciplined manner, in good markets and bad; decisions that involve re-balancing and making sure your long-term asset allocation targets are maintained. For your taxable accounts, we harvest losses where appropriate with the intention of deferring future taxes.

Last year at this time we made the decision to add a new alternative manager to our stable of asset managers. This decision has proved to be helpful thus far in 2022, adding some stability to the portfolio with our diversified alternatives fund (symbol: SRDAX) experiencing a nominal decline of 4% through September 30th, compared to much sharper drops of 25% for the MSCI ACWI and 15% for the Bloomberg U.S. Aggregate Bond Index. We continue to look for new managers and strategies that strive to improve the risk/reward profile of your portfolio.

The hard-to-find silver lining in such a difficult time is that going forward, the long-term expected rates of return on our capital market assumptions are higher than they were at the start of the year, due to more attractive price valuations as of September 30, 2022. Does this mean we are close to a bottom? That is never knowable in advance. But if history repeats, we want to make sure that your investments are well-positioned to benefit from rising asset prices, if and whenever that may come.

We remind ourselves, knowing that past performance is not indicative of future returns, that periods following past bear markets have offered very meaningful market returns, the historical “reward” in the risk reward trade-off:

Source: Russell Indexes, Jan 1979 – Sep 2022.

We can only speculate on the short-term vagaries of the markets, and in the meantime, we will keep making what we believe are the best decisions for you!

Important Disclosure Information:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

What Should You Do About A Recession?

We explore what is a recession, how the US stock market has performed before and after a recession, and how an investor can prepare for recessions.

By Investment Associate Bobby Adusumilli, CFA.

One common discussion topic with our clients recently is whether the US is in a recession. While it is commonly believed that a recession is a period of two or more consecutive quarters of negative economic (GDP) growth, that is not exactly how recessions are officially defined within the US. As of August 2022, the National Bureau of Economic Research (NBER) has not declared a recession in the US during any part of 2022.[1]

In an effort to better understand recessions, we explore how a recession is defined, what have been the recessions throughout US history, which indicators go in to determining a recession, how the US stock market has performed before and after a recession, and how an investor can prepare for recessions.

What Is A Recession?

The NBER's traditional definition of a recession is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The NBER believes that while each of the three criteria - depth, diffusion, and duration - needs to be met individually to some degree, extreme conditions revealed by one indicator may partially offset weaker indications from another.[2]

It is important to note that the start date for a recession is often declared in retrospect, meaning it is possible to be in a recession for a few months before it is officially declared.

Since 1928, there have been 15 recessions in the US lasting on average 12.5 months, according to the NBER.[1]

Source: “US Business Cycle Expansions and Contractions“. NBER, nber.org.

What Indicators Go In To Determining A Recession?

Data for all indicators can be found and downloaded from the Federal Reserve Bank of St. Louis FRED website. Indicators include:[2]

How Has The US Stock Market Performed Before A Recession?

Over the last 15 recessions, the S&P 500 has had an average annualized return of 15.80% during the two years before the start of a recession.[3] None of these two-year periods had a negative return. This is not a huge surprise, as the period before the start of a recession usually coincides with a peak in the business cycle.[1]

Sources: Dimensional Returns Web, NBER, Morningstar. Recession start dates are based on the US Business Cycle Expansions and Contractions data from the National Bureau of Economic Research. The S&P 500 total return index assumes reinvestment of all distributions. See Important Disclosure Information.

How Has The US Stock Market Performed After The Start Of A Recession?

Over the last 15 recessions, the S&P 500 has had an average annualized return of 5.97% during the two years following the start of recession.[3] While the average return is positive, the S&P 500 had a negative return in 5 of the 15 two-year periods. In some cases, the S&P 500 fell significantly (such as at the start of the Great Depression), fell but then rebounded quickly (such as during the start of the COVID-19 pandemic), or just didn’t really experience any outsized volatility (such as after World War II).[1]

Sources: Dimensional Returns Web, NBER, Morningstar. Recession start dates are based on the US Business Cycle Expansions and Contractions data from the National Bureau of Economic Research. The S&P 500 total return index assumes reinvestment of all distributions. See Important Disclosure Information.

Taking a longer-term view, the S&P 500 has eventually recovered and grown after all recessions over the past century, though in some recessions it has taken many years for this to happen.[3] The US stock market has been able to withstand the short-term volatility caused by recessions, growing significantly over time.

Sources: Dimensional Returns Web, NBER, Morningstar. Gray shaded areas represent periods of recession. Recession start and end dates are based on the US Business Cycle Expansions and Contractions data from the National Bureau of Economic Research. The S&P 500 total return index assumes reinvestment of all distributions. See Important Disclosure Information.

How Can You Prepare For A Recession?

Build Up Your Emergency Fund

An emergency fund can give you the ability and confidence to stick with your investment plan through a recession. The amount that you should save in your emergency fund partially depends on what would help you sleep comfortably at night if your investment portfolio begins to decline in value. Some people feel comfortable with an emergency fund with 6 months' worth of living expenses, while others prefer 1-2 years' worth of living expenses.

The idea behind an emergency fund as a way to make it through a recession is not new. Detailing his experiences living through the Great Depression, Benjamin Roth wrote in The Great Depression: A Diary, “This depression has indelibly impressed on my mind one thing - and that is the value of having on hand sufficient capital to cover emergencies. In the investment field it means the difference between success or failure to have enough capital to buy bargains when they are available or to hold on to investments thru thick and thin and not be forced to sell at a loss.“[4]

Diversify Across Stocks, Bonds, & Alternatives

Periods of negative US stock market performance are inevitable. By diversifying across global stocks, high-quality bonds, and alternative investments with low correlations to US stocks, you can help to limit the impact of a period of negative US stock market performance on your portfolio.

Review Your Asset Allocation Ahead Of Time

Your asset allocation refers to the amount of stocks, bonds, and alternatives that you hold in your investment portfolio. While it may be difficult to imagine how you may react to declines in your investment portfolio, we believe it is critical to choose a level of riskiness that you will be able to stick with during good investment times and bad.

Important Disclosure Information & Sources:

[1] “US Business Cycle Expansions and Contractions“. NBER, nber.org.

[2] “Business Cycle Dating Procedure: Frequently Asked Questions“. NBER, nber.org.

[3] The S&P 500 Index is a free float-adjusted market-capitalization-weighted index of 500 of the largest publicly traded companies in the United States.

[4] The Great Depression: A Diary. Benjamin Roth, 2010, Publicaffairs.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Inflation Protection Through Series I Savings Bonds

Series I Saving Bonds provide many of the benefits of TIPS, but may be even more beneficial during times of heightened inflation.

By Investment Associate Bobby Adusumilli, CFA.

In the book In Pursuit of the Perfect Portfolio, MIT Professor Andrew Lo interviews pioneering individuals in the investment industry - including Vanguard Founder John Bogle as well as Nobel Prize winners such as Eugene Fama and Robert Shiller - in order to answer a question that has captivated investors for generations: what is the perfect portfolio? While each interviewee gives hints as to what they consider the perfect portfolio, Andrew Lo ultimately concludes that there is no such thing as an everlasting perfect portfolio, writing, “Our Perfect Portfolio today is really just a snapshot of what’s best for you at the moment and in the current environment. Expected returns are ever evolving…. The pursuit of the Perfect Portfolio is all about adapting to our current income, our spending habits, our financial goals, the environment, and expected returns.“[1]

Nevertheless, the interviewees do provide some investments to consider. Andrew Lo writes, “If there is one specific asset that a majority of our authorities recommended for your Personal Portfolio, it’s TIPS (Treasury Inflation-Protected Securities). Inflation in recent years has been stable and low, but there is always the risk of macroeconomic change.“[1] TIPS are U.S. government-issued securities that generally increase in value with inflation and decrease in value with deflation, as measured by the nonseasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items.[2][3]

Source: FRED, as of July 31, 2022. See Important Disclosure Information.

Since the book came out in August 2021, U.S. inflation has risen significantly. As a result of this rise in inflation, TIPS (as measured by the Bloomberg U.S. TIPS Index 0-5 Years) have performed relatively well over the past year, outperforming the U.S. stock market (as measured by the Russell 3000) and the U.S. bond market (as measured by the Bloomberg U.S. Aggregate Bond Index), as shown in the below graph. However, because TIPS are subject to market demand as well as other structural features, TIPS have underperformed inflation (as measured by nonseasonally adjusted CPI-U) over the past year.

Sources: Dimensional Returns Web, U.S. Bureau of Labor Statistics. See Important Disclosure Information.

This lends the question: are there any investments that can provide more inflation protection than TIPS? Luckily, there may be.

Series I Saving Bonds provide many of the benefits of TIPS, but may be even more beneficial during times of heightened inflation.[4][5] Offered directly by the U.S Department of the Treasury through the treasurydirect.gov website, Series I Savings Bonds are 30-year government bonds designed to pay interest that matches (or even exceeds) inflation, as measured by the nonseasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items.[4]

The interest on Series I Savings Bonds is composed of two parts: a fixed rate that lasts for the entire time that you hold the bond, and the inflation interest rate that resets every six months. The rates are set on May 1 and November 1, and you are guaranteed the stated inflation interest rate for the first six months that you hold the bond, and then you are guaranteed the next set inflation interest rate for the following six months, and so on. The interest rate on Series I Savings Bond cannot go negative (though a negative inflation rate can decrease your fixed rate for that six-month period to a minimum of 0%), which is beneficial considering that the specific CPI index includes the volatile food and energy sectors.[3][6]

You can choose to defer paying taxes on the monthly interest that you receive until you redeem the bond. The interest on Series I Savings Bonds is only subject to federal income taxes, not state or local income taxes. You can redeem Series I Savings Bonds directly with the U.S. government via the treasurydirect.gov website after one year, subject to some limitations listed below.[4]

While Series I Savings Bonds have many benefits, there are some drawbacks:[4]

Each eligible person and entity can only purchase up to $10,000 in Series I Savings Bonds per year, thus limiting usefulness for higher net worth people and entities.

Except in rare circumstances, you cannot redeem your Series I Savings Bond within the first year.

If you redeem your Series I Savings Bond within five years of purchase, you lose the most recent three months' worth of interest.

If you decide not to pay taxes on the annual interest while you hold the bond, then the year you redeem a Series I Savings Bond, you may add a significant amount to your federal taxable income, thus increasing your federal taxes in that year.

You must buy Series I Savings Bonds through the treasurydirect.gov website; you cannot buy through another custodian, and your financial advisor cannot buy these bonds on your behalf.

You can only specify one beneficiary (via the Registration List section on your treasurydirect.gov account) per Series I Savings Bond.

If inflation falls back to low levels, Series I Savings Bonds may pay little interest.

Prominent financial journalists including Jason Zweig, Christine Benz, and John Rekenthaler have written about Series I Savings Bonds in recent weeks, and it’s easy to see why given the current inflation interest rate of 4.81% for the first six months if you purchase prior to November 1, 2022.[4][7][8][9] We believe that Series I Savings Bonds can provide value for investors over the near-term as well as the long-term. Whether using for an emergency fund, saving for a big purchase such as a home, or wanting to add diversification to your overall investment portfolio, Series I Savings Bonds can provide a safe and stable way to save money while minimizing loss of U.S. dollar purchasing power. And if inflation ends up rising again in future years, then by accumulating Series I Savings Bonds over time, you can provide some stability and growth for your portfolio at a time when other investments may suffer.

Important Disclosure Information & Sources:

[1] In Pursuit of the Perfect Portfolio. Andrew Lo & Stephen R. Foerster, 2021, Princeton University Press.

[2] “Treasury Inflation-Protected Securities (TIPS)“. U.S. Department of the Treasury, Bureau of the Fiscal Service, treasurydirect.gov.

[3] “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average“. Federal Reserve Bank of St. Louis, fred.stlouisfed.org.

[4] “Series I Savings Bonds“. U.S. Department of the Treasury, Bureau of the Fiscal Service, treasurydirect.gov.

[5] “Comparison of TIPS and Series I Savings Bonds“. U.S. Department of the Treasury, Bureau of the Fiscal Service, treasurydirect.gov.

[6] “Series I Savings Bonds Rates & Terms: Calculating Interest Rates“. U.S. Department of the Treasury, Bureau of the Fiscal Service, treasurydirect.gov.

[7] “Fight Runaway Inflation With I Bonds“. Jason Zweig, 29-Jul-2022, wsj.com.

[8] “Is It Too Late to Add Inflation Protection to Your Portfolio?“ Christine Benz, 22-Jul-2022, morningstar.com.

[9] “Run, Don’t Walk, for I Bonds“. John Rekenthaler, 10-Aug-2022, morningstar.com.

The Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL) is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers.

Russell 3000 TR USD Index is a market-capitalization-weighted index that measures the performance of the largest 3000 US companies representing approximately 98% of the investable US equity market.

Bloomberg US Aggregate Bond TR USD Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS.

Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0–5 Year Index is a market-weighted index measures the performance of inflation-protected public obligations of the U.S. Treasury that have a remaining maturity of less than five years

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

What Is Driving Inflation, And What Can You Do About It?

Global stock and bond markets have been tested by inflation many times in the past, and these markets have historically demonstrated their resilience in providing returns higher than inflation over time.

By Investment Associate Bobby Adusumilli, CFA.

It’s hard not to notice inflation these days - we see it in higher gas prices, higher grocery bills, and higher housing costs, among other areas. This is true beyond the U.S.: inflation rates in countries around the world are higher compared to recent history.[1]

For the one-year period ending May 31, 2022, the U.S. inflation rate (as measured by the CPI for All Urban Consumers Unadjusted Index) is 8.6%.[2] While most of the U.S. economy is experiencing some inflation, energy - which includes gasoline, oil, electricity, and other commodities - has experienced an outsized amount of inflation, approaching 35%.[2]

Source: “Consumer Price Index Summary“. U.S. Bureau of Labor Services, 10-Jun-2022, bls.gov. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. See Important Disclosure Information.

While these higher prices are difficult to handle right now, we believe there are some reasons for optimism regarding inflation. Energy prices spiked largely in response to effects from the COVID-19 pandemic as well as the war in Ukraine.[3] While we may experience elevated prices in the short-term, companies and markets tend to respond when there is high demand for a product, creating more competition and thus more supply, which should help constrain energy prices over time. Additionally, the Federal Reserve has been aggressively raising interest rates to combat inflation.[4] While this has hurt stock and bond prices recently, we believe this will help decrease inflation over time.[4]

Global bond markets are also expressing optimism that the U.S. inflation rate will fall back to more normal levels. For example, the 10-year breakeven inflation rate - which is a measure of what bond investors expect U.S. inflation to be over the next 10 years on average - is 2.33% as of June 30th, 2022.[5] While this is higher than the Federal Reserve’s goal of 2.00% inflation, bond markets do not expect medium- to long-term inflation to be anywhere close to the recent inflation rate.[5][6]

Source: FRED, as of June 30, 2022. The breakeven inflation rate represents a measure of expected inflation derived from 10-Year Treasury Constant Maturity Securities and 10-Year Treasury Inflation-Indexed Constant Maturity Securities. The latest value implies what market participants expect inflation to be in the next 10 years, on average. See Important Disclosure Information.

Given all of this information, we have designed MarketPlus Investing portfolios to have some built-in inflation protection. For example, MarketPlus Investing model portfolios with fixed income allocations have exposure to U.S. Treasury Inflation-Protected Securities (TIPS) as well as short-duration (<5 years) bonds, which tend to provide some protection from inflation. And while global stocks can underperform inflation over the short-term (< 5 years), research has demonstrated that global stocks tend to provide inflation protection over the intermediate- (5-10 years) and long-term (10+ years).[7]

Investors looking for additional inflation protection can also consider purchasing Series I Savings Bonds, which are 30-year savings bonds offered by the U.S. government designed to match the Consumer Price Index for All Urban Consumers inflation rate. Each individual can buy up to $10,000 worth of these bonds per year, and you can sell after one year, subject to some conditions.[8] While SJS cannot buy these bonds for you directly, we are supportive of Series I Savings Bonds as potential investments for inflation protection. You can find additional information on the treasurydirect.gov website.

Global stock and bond markets have been tested by inflation many times in the past, and these markets have historically demonstrated their resilience in providing returns higher than inflation over time.[7] While it may be difficult in the short-term, we believe that staying invested is the key to getting through this market volatility and inflation.

Important Disclosure Information & Sources:

[1] “Inflation Rate - By Country“. Trading Economics, June 2022, tradingeconomics.com.

[2] “Consumer Price Index Summary“. U.S. Bureau of Labor Services, 10-Jun-2022, bls.gov.

[3] “How High Is Inflation and What Causes It? What to Know“. Gabriel T. Rubin & David Harrison, 10-Jun-2022, wsj.com.

[4] “Fed Raises Rates by 0.75 Percentage Point, Largest Increase Since 1994“. Nick Timiraos, 15-Jun-2022, wsj.com.

[5] “10-Year Breakeven Inflation Rate“. Federal Reserve Bank of St. Louis, 30-Jun-2022, fred.stlouisfed.org.

[6] “Why does the Federal Reserve aim for inflation of 2 percent over the longer run?“ Board of Governors of the Federal Reserve System, 27-Aug-2020, federalreserve.gov.

[7] Stocks for the Long Run. Jeremy Siegel, 2014, McGraw Hill.

[8] “Series I Savings Bonds”. U.S. Department of the Treasury, June 2022, treasurydirect.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

History Is Merely A Lot Of Surprises

I would suggest that hoping things get back to “normal” would be inconsistent with history, and that moving optimistically forward in spite of fear, uncertainty, and doubt has been rewarded in the past.

“History is merely a lot of surprises. It can only prepare us to be surprised yet again.”

If nothing else, the last three years have painfully reinforced what Kurt Vonnegut, a counter-cultural idol of the 1960’s and 70’s, wrote.[1]

Just as the COVID-19 pandemic appeared to be evolving into an endemic disease, the surprise invasion by Russia into Ukraine continues to upend the lives of people in the war-torn country with negative implications for millions of people around the world. Add in the shock of higher inflation that is driving global interest rates higher and the value of financial assets lower, and Vonnegut’s words ring true.[2]

I would suggest that hoping things get back to “normal” would be inconsistent with history, and that moving optimistically forward in spite of fear, uncertainty, and doubt has been rewarded in the past.[3]

While this isn’t a Pollyannish prediction, as we all know that uncertainty and volatility in markets can increase, we take comfort in our fundamental beliefs that haven’t wavered since I started SJS:

We behave as if markets are efficient and are priced to reflect all known information, including the surprises we have experienced.

Trying to predict the short-term direction of markets is futile.

In the past, disciplined risk-taking has been rewarded over long periods of time, and we believe will be rewarded in the future.[3]

Unique portfolio design implemented in a disciplined manner is the value we bring to each and every client relationship.

The Team we have assembled - employees and partners alike - are giving their best every day, enabling us to act in your best interests.

My hope is that this is no surprise to you!

Important Disclosure Information & Sources:

[1] Slapstick or Lonesome No More! Kurt Vonnegut, 1999, Dial Press Trade Paperback.

[2] “Market perspectives June 2022“. Vanguard, 31-May-2022, vanguard.com.

[3] “Historical Returns on Stocks, Bonds and Bills: 1928-2021“. Aswath Damodaran, January 2022, pages.stern.nyu.edu.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What Makes A Great Investor?

In my opinion, investing is arguably the most competitive field in the world. So what differentiates a great investor from the rest?

By Investment Associate Bobby Adusumilli, CFA.

In my opinion, investing is arguably the most competitive field in the world. With financial and technological innovations in recent decades, almost anyone in most developed countries with a sum of money can buy and sell public stocks, bonds, mutual funds, ETFs, and other financial instruments. Additionally, regardless of their occupations, many people invest through 401(k)s, 403(b)s, 457 plans, IRAs, taxable accounts, and / or a number of other financial accounts. Even if their primary occupations take up most of their time, these people are also investors.

With billions (or even trillions) of dollars in potential gains at stake, investing has become increasingly competitive as time has gone on. Thousands of investment firms across the country employ smart people and cutting-edge technology, all in the pursuit of achieving higher returns. As a result, investment market prices are constantly adjusting from the buy and sell orders of sophisticated parties, making it very difficult for someone to outperform the market.[1][2]

So what differentiates a great investor from the rest?

Over a series of recent newsletters and articles, financial journalist Jason Zweig (author of Your Money and Your Brain, as well helped Nobel Prize-winning psychologist Daniel Kahneman write the bestselling book Thinking, Fast and Slow) details what he believes are the seven virtues of great investors.[3] We share these virtues below, providing our own experiences with each.

Discipline

Discipline is about creating a well-thought-out investment process appropriate for you, and then following your rules.[4] Discipline also helps you get out of your own way, particularly in the tough times. In our experience, the more disciplined an investor is, the better their investment returns tend to be. As John Bogle writes in his book Bogle On Mutual Funds: New Perspectives For The Intelligent Investor, “Successful investing involves doing just a few things right and avoiding serious mistakes.“[5]

Curiosity

Curiosity is driven by wanting to understand the world, wanting to get closer to what is true.[6] By being curious enough to understand what investment strategies work and why, you can potentially help yourself become a better investor.

Skepticism

Skepticism requires focusing on your foundational principles, and questioning arguments that differ from these principles.[7] For example, research demonstrates that most stock market investors underperform total stock market index funds, particularly over the long-term.[1] If someone tries to pitch you an investment that they say will outperform the stock market, and there is not enough good theory and evidence to back up their claim, then we would strongly caution you against purchasing that investment.

However, skepticism is not the same as pessimism. Skepticism also calls for open-mindedness when theory and evidence support a particular argument. As Howard Marks writes in his book The Most Important Thing, “Skepticism calls for pessimism when optimism is excessive. But it also calls for optimism when pessimism is excessive.“[8]

Independence

Independence means doing the right thing.[9] If others are doing the right thing, then independence doesn’t mean that you have to be alone. But if others around you are doing something that doesn’t align with your principles and investment strategy, then being independent means having the courage to stick with your investment plan, even if that means going against the crowd.

Humility

Humility means understanding the reality of your situation, not deceiving yourself.[10] Humility recognizes that you don’t control and know everything. As an investor, there will be times when you underperform others around you, and there will be times when you outperform. In our experience, performance is always subject to some degree of luck. Humility also means that there will be someone more successful at investing than you, and recognizing that that is okay as long as you have a sound investment strategy in place and you are making progress towards your goals.

Patience

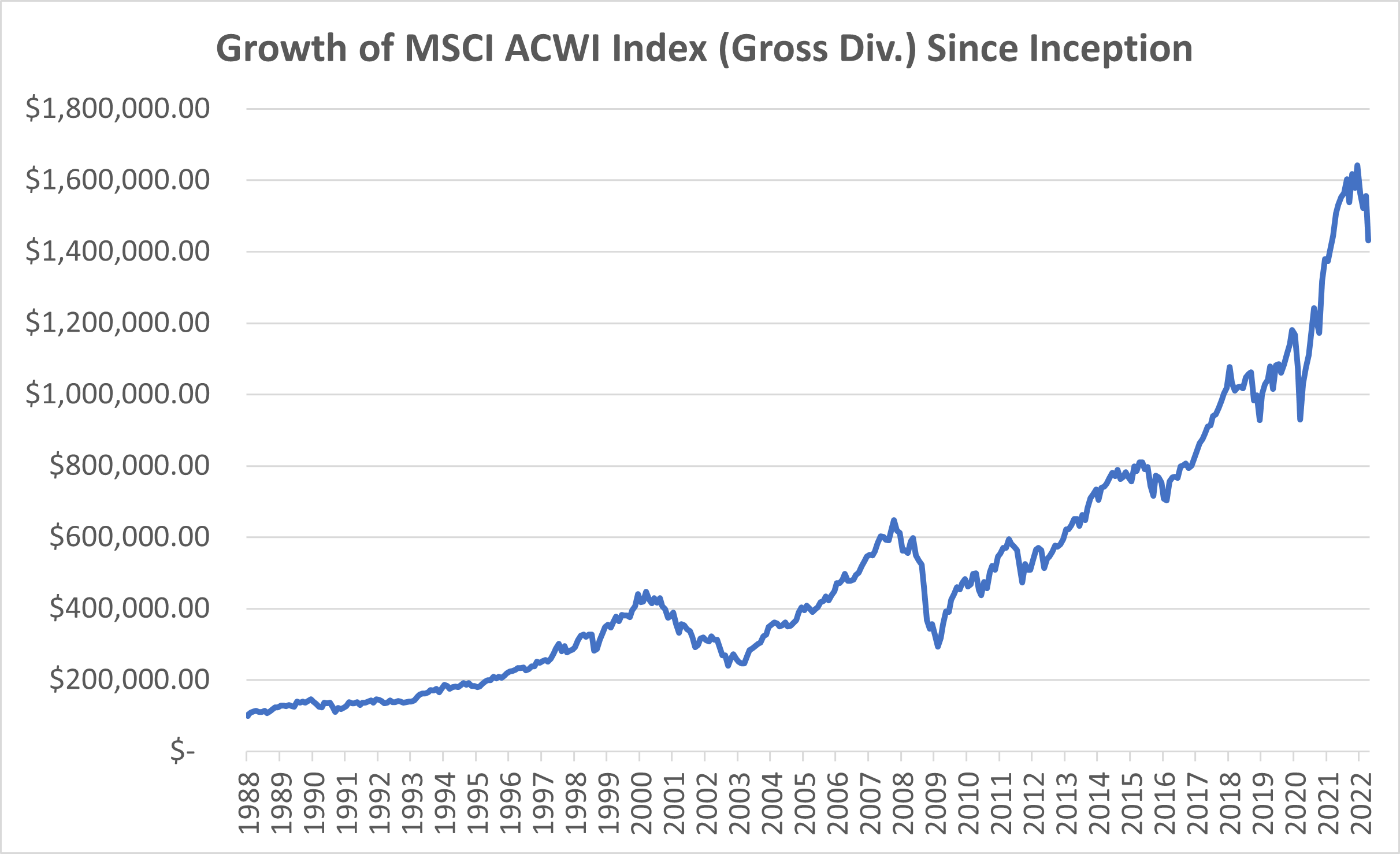

The longer you invest, the more time you are giving your investments to potentially grow, as the graph at the bottom of this article demonstrates.[11] While each investor has different circumstances and goals, in our experience, many of the best investors give themselves as much time as possible to grow their money; they have the patience to have the longest view in the room.

Courage

It is hard to be a great or even good investor. It is hard to continue investing when the market is going down, and it is hard to be disciplined enough to stick with your investment strategy when other strategies are booming.[3] If you create a well-thought-out investment plan backed by theory and evidence, then in our experience, having the courage to stick to your investment plan in both good times and bad tends to work out for people in the long run.

So What Can You Do To Become A Great Investor?

Research shows that the vast majority of stock market investors underperform the stock market, with greater underperformance as the period of time studied is lengthened.[1] While there are some people who outperform for a period of time, it is very hard to know who these people are in advance. Even if you know who they are, as the period of time increases, some of these great investors no longer achieve the same level of outperformance.

So what can you do to become a great investor? One strategy is to aim to be an above-average investor each year for a very long period of time. For example, research shows that just owning the stock market through an index fund will help you outperform most investors in most years as well as over time.[1] For example, if you had been able to own the global stock market as measured by the MSCI ACWI Index from 1988 (the index inception) through April 2022 (assuming reinvestment of all distributions; no other expenses or taxes considered), an initial investment of $100,000 would have grown to over $1,400,000. While the definition of a great investor is ambiguous, this performance seems like a great outcome to me.

Source: Dimensional Returns Web. See Important Disclosure Information.[12]

While future performance will differ from past performance, and while it was more difficult to invest in global investment strategies in the past, investors today have the ability to nearly match many global stock and bond indices even after considering fees.[13] Therefore, we believe that investing in low-cost, low-turnover, broadly-diversified global mutual funds and ETFs is a sound investment strategy that can potentially help a lot of people over the long-term.[14] And if you stick with a sound investment strategy long enough, you may become a great investor yourself.

Important Disclosure Information & Sources:

[1] “2022 Quantitative Analysis of Investment Behavior Report”. DALBAR, 2022, dalbar.com.

[2] “Why Do Investors Underperform?“ Bobby Adusumilli, 24-Jun-2021, sjsinvest.com.

[3] “The Secret to Braving a Wild Market“. Jason Zweig, 02-Mar-2022, wsj.com.

[4] “2020: The Sequel?“ Jason Zweig, 12-Jan-2022, The Intelligent Investor Newsletter - wsj.com.

[5] “Bogle On Mutual Funds: New Perspectives For The Intelligent Investor“. John Bogle, 2015, Wiley Investment Classics.

[6] “'The First Great Investing Virtue“. Jason Zweig, 19-Jan-2022, The Intelligent Investor Newsletter - wsj.com.

[7] “A New Month, A New Market?“ Jason Zweig, 08-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[8] “The Most Important Thing: Uncommon Sense for the Thoughtful Investor“. Howard Marks, 2011, Columbia Business School Publishing.

[9] “Stepping Away from the Herd“. Jason Zweig, 15-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[10] “On Humility and Independence“. Jason Zweig, 22-Feb-2022, The Intelligent Investor Newsletter - wsj.com.

[11] “Patience Amid Turbulence“. Jason Zweig, 02-Mar-2022, The Intelligent Investor Newsletter - wsj.com.

[12] The MSCI ACWI Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets, consisting of 47 country indices comprising 23 developed and 24 emerging market country indices. Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

[13] “Index funds“. Vanguard, vanguard.com.

[14] “MarketPlus Investing“. SJS Investment Services, sjsinvest.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Bitcoin & Cryptocurrencies: Do They Have A Place In Your Portfolio?

To help you better understand cryptocurrencies, we provide a short history, potential benefits, concerns, and how your portfolio can potentially benefit from cryptocurrencies.

By Founder & CEO Scott Savage.

Increasingly, this is a question that is posed to the SJS Team: Should I buy bitcoin?

While bitcoin and other cryptocurrencies have risen dramatically in price over the past ten years, most of the ideas underlying cryptocurrencies are not all that new, and cryptocurrencies are not as complicated as they may appear to be.[1] To help you better understand cryptocurrencies, we provide a short history, potential benefits, concerns, and how your portfolio can possibly benefit from cryptocurrencies.

History Of Cryptocurrencies

The idea behind a digital currency is not new. Starting around the 1980s, many individuals have attempted to create a digital currency, with each breakthrough building on top of past breakthroughs.[2] For example, in its early years, PayPal (which also now owns Venmo) was driven by the “idea of creating a new digital currency to replace the U.S. dollar.”[3] Technology and the internet have allowed for transactions to become faster, more secure, and lower cost. Many people in the US today don’t even use paper cash today, meaning the U.S. dollar already feels like a digital currency for them.

In 2008, another breakthrough occurred: an unknown person or team named Satoshi Nakamoto outlined a new cryptocurrency called bitcoin in a white paper, calling bitcoin, “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.“[4] Simply put, bitcoin is digital money that securely allows people to transact over the internet, without needing a bank or traditional financial intermediary involved.

Bitcoin’s single biggest innovation is the blockchain, which is the technology underlying bitcoin that allows for all historical transactions to be recorded for anyone around the world to access at any time. The blockchain also allows for transactions to happen almost instantaneously, securely, in a relatively low-cost manner, and be verified by anyone around the world.

21 million bitcoin is the maximum number of bitcoin that will ever be created.[4] Today, there are roughly 19 million bitcoin outstanding, and the remaining 2 million will be “mined” over the next 100+ years to compensate people for ensuring the accuracy of the blockchain.[4][5] You can own fractional interest of one bitcoin. In 2011, the price of one bitcoin exceeded $1 US dollar; by April 2022, the price of bitcoin is around $40,000 US dollars, meaning the total value of all bitcoin in existence today is roughly $750 billion.[5]

As with any lucrative technology, bitcoin and the blockchain have given risen to thousands of other cryptocurrencies and related digital assets. While we believe the vast majority of these digital assets won’t have value over the long-term, another cryptocurrency called Ethereum has made significant innovations building off of bitcoin, which is why it has become the second most valuable cryptocurrency behind bitcoin.[6]

If you would like more information on the history of bitcoin and cryptocurrencies, we recommend the book Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money by Nathaniel Popper.

Potential Benefits Of Cryptocurrencies

Transparency: Bitcoin is designed to be transparent, in efforts to limit the ability for a group of people or institutions to manipulate both bitcoin and the blockchain.

Limited amount of currency: Bitcoin and some other cryptocurrencies limit the amount of currency that will exist in the future. Many supporters believe this will help these cryptocurrencies serve as a store of value (this is why bitcoin is sometimes referred to as “digital gold”) as well as protection from inflation.[6] This is a major positive factor for people who are worried about governments printing money to pay off debts, which would devalue those currencies.[6]

Ability to hold around the world: Particularly for people who live in countries with volatile currencies or who move around the world, owning cryptocurrencies can be significantly more stable and secure for them compared to holding the local currencies.

Lower transaction costs: Cryptocurrencies may be able to help lower financial transaction fees over time. For example, many individuals in developing countries have to pay significant transaction fees in order to wire money to the US. Bitcoin can potentially reduce these transaction fees. Additionally, many people hope that the blockchain will help to lower (or even eliminate) credit card fees over time.

Privacy: Each bitcoin has a public key and a private key. Someone needs to use their private key (a long string of numbers and letters) in order to initiate a transaction. During a transaction, the public key is used by others on the blockchain to verify transactions. Both public and private keys are not associated with a person’s name, so as long as people don’t know that you own the private key and public key, then this can help to limit the chances that they will learn that you own that bitcoin.

Increasing adoption: Both individuals as well as institutions have been increasingly adopting the two largest cryptocurrencies (bitcoin and Ethereum) over the last few years.[7]

Concerns Of Cryptocurrencies

Volatility: Historically, even the largest cryptocurrencies have been highly volatile in price.[5] While this volatility is expected to decrease with increasing adoption, the volatility limits usefulness as an actual day-to-day currency.

Technological vulnerabilities: Cryptocurrencies and exchanges are subject to security risks, operational shutdowns, and hackers. For example, the Wall Street Journal estimates that approximately $3.2 billion worth of cryptocurrency was stolen in 2021.[8] However, the largest risks often impact newer and less-adopted cryptocurrencies and exchanges. In the coming years, the technology and infrastructure for the largest cryptocurrencies such as Bitcoin and Ethereum will become more robust, and hackings may become less common as a result.

Can lose your cryptocurrency: If you have a private wallet not affiliated with a major exchange, then if you lose your private key, you may potentially lose your cryptocurrency forever. For example, the New York Times recently estimated that nearly 20% of the total Bitcoin outstanding has been lost or is in stranded wallets.[9]

Increasing use of financial intermediaries: People and institutions are increasingly using financial intermediaries to store their cryptocurrencies.[7] This trend is in contrast to the initial vision for bitcoin.[4]

Less privacy than expected: Some people and institutions may not be able to achieve the level of privacy that they are hoping for with cryptocurrencies. For example, due to Russia’s war with Ukraine in 2022, Coinbase announced that it would block nearly 25,000 Russian-linked accounts (addresses) believed to be engaging in illicit activity, and governments around the world are also trying to seize Russian-linked cryptoassets.[10][11]

Limited current regulation, and potential for cumbersome regulation in the future: So far, regulation in countries around the world has lagged the growth of cryptocurrencies. However, governments are increasingly prioritizing regulation for cryptocurrencies, which could lead to uncertain effects. For example, China (which is expected to become the largest economy in the world by around 2030) has banned citizens from transacting in cryptocurrencies.[12] Additionally, the United States has not allowed for cryptocurrencies to be held directly in mutual funds and ETFs.[13] How will future regulation impact the value of cryptocurrencies?

How Can Your Portfolio Potentially Benefit From Bitcoin?

Market prices are driven by supply and demand. There is large and increasing demand for cryptocurrencies, and therefore we believe that cryptocurrencies are here to stay.

However, we don’t know what the aggregate market capitalization of cryptocurrencies will be, nor do we know how quickly cryptocurrencies will grow or decline, nor which ones will flourish and which ones will cease to exist. Bitcoin doesn’t have any earnings and doesn’t pay dividends, so we can’t value it like stocks.

What we do know is that cryptocurrencies have been quite volatile, and many clients are not comfortable investing in them. Additionally, for people who don’t do their homework, we view their buying of bitcoin as speculation, not investing.

Therefore, we do not invest client assets directly into cryptocurrencies. However, there are other ways to benefit from potential growth in cryptocurrencies. For example, there is an expansive options market for bitcoin where people and institutions do everything from speculating to hedging to achieving indirect exposure. In alignment with our view that cryptocurrencies are here to stay, we believe there are positive expected returns available in providing capital to the bitcoin options market. It is very complicated; we rely on an investment manager who has extensive experience with this market as part of a diversified alternatives mutual fund.[14] Additionally, due to their exposures to cryptocurrencies, some of the underlying stocks in the mutual funds and ETFs that we recommend may benefit from potential growth in cryptocurrencies.

The Ancient Chinese proverb famously says, “The best time to plant a tree was 20 years ago. The second best time is now.” When it comes to speculating in bitcoin, I would urge caution when applying this proverb to anything other than trees!

Important Disclosure Information & Sources:

[1] “Total Cryptocurrency Market Cap“. CoinMarketCap, 22-Apr-2022, coinmarketcap.com.

[2] “Cryptocurrency“. Wikipedia, wikipedia.org.

[3] Zero to One: Notes on Startups, or How to Build the Future. Peter Thiel & Blake Masters, 2014, Currency.

[4] “Bitcoin: A Peer-to-Peer Electronic Cash System“. Satoshi Nakamoto, 2008, bitcoin.org/en.

[5] “Total Circulating Bitcoin“. Blockchain, 22-Apr-2022, blockchain.com.

[6] Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money. Nathaniel Popper, 2016, Harper Paperbacks.

[7] “Our Thoughts on Bitcoin“. Ray Dalio & Rebecca Patterson, 28-Jan-2021, bridgewater.com.

[8] “Cryptocurrency-Based Crime Hit a Record $14 Billion in 2021“. Mengqi Sun & David Smagalla, 06-Jan-2022, wsj.com.

[9] “Lost Passwords Lock Millionaires Out of Their Bitcoin Fortunes”. Nathaniel Popper, 14-Jan-2021, nytimes.com.

[10] “Using Crypto Tech to Promote Sanctions Compliance“. Paul Grewal, 06-Mar-2022, coinbase.com.

[11] “The hunt for Russian crypto is on“. Benjamin Pimentel, 08-Mar-2022, protocol.com.

[12] “What's behind China’s cryptocurrency ban?“ Francis Shin, 31-Jan-2022, weforum.org.

[13] “SEC Delays Decision on Bitcoin ETFs Again“. Chitra Somayaji, 23-Jun-2021, wsj.com.

[14] “Stone Ridge 2020 Shareholder Letter“. Ross Stevens, 2020, stoneridgefunds.com/?tab=srdax.

Other resources that influenced this blog post.

“Cryptoassets: The Guide to Bitcoin, Blockchain, and Cryptocurrency for Investment Professionals“. Matt Hougan & David Lawant, 07-Jan-2021, cfainstitute.org/en.

“Why Bitcoin Matters“. Marc Andreesen, 11-Jan-2014, nytimes.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Structured Notes - Caveat Emptor! Buyer Beware!

We summarize structured notes as well as detail concerns we believe investors should understand before investing one penny.

By Founder & CEO Scott Savage.

We want to warn you about an investment product called structured notes. These derivative instruments typically purport to provide investors with a coupon payment higher than available in the bond market, as well as downside protection from the underlying reference asset, which is often a stock-based investment like the S&P 500 Index.[1] Sounds great, right? What could go wrong? A lot!

Below, we summarize structured notes as well as detail concerns we believe investors should understand before investing one penny. While risk management is the responsibility of each advisor who touts these investments, we want you to be aware of the risks in case someone recommends structured notes to you.

Summary

A structured note is a derivative instrument designed to typically provide both a regular coupon payment as well as some degree of principal protection compared to an underlying (usually stock) reference asset. Typically, the investor purchases an initial issue of the note from the sponsor (usually an investment bank) in exchange for coupon payments over the length of the note (often 1 to 5 years).

Generally, if the underlying reference asset only declines a little over the length of the note, the investor has a pre-specified level of principal protection and still receives the coupon payments. If the reference asset value falls below the predetermined knock-in level (the minimum value specified in the contract to receive coupon and principal payments), you may not receive all of the coupon payments and your principal amount would decline. When the reference asset increases over the note length, the investor usually receives the coupon payments and some principal upside based on the participation rate.[1]

Source: “Spotlight on… top issuers in the US“. Structured Retail Products, 07-Jan-2022, structuredretailproducts.com.[2]

Advantages

An investor can receive a coupon rate that is higher than yields available in the bond markets, while receiving some downside principal protection if the underlying reference asset declines.

Some structured note platforms are creating more competition among sponsors, which can help to create more investor-friendly structured notes.

Many banks offer structured notes for a wide variety of underlying stocks, indices, and other financial assets.

Concerns

Most structured notes are relatively complicated, often with dozens of pages of details such as protection (specified knock-in levels), maturity, coupon rates, and underlying reference assets.

Most structured notes are subject to multiple layers of fees, and the fees are often difficult to understand.

In terms of issuers, structured notes are primarily issued by large, predominantly Wall Street banks.[2]

Structured notes tend to have maturities of 1 to 5 years, meaning upon maturity you will have to review newer structured notes if you want to continue investing in structured notes.

Many structured notes can be redeemed (called) by the issuer, either automatically triggered based on the underlying reference investment or whenever the issuer has the right to call.

Typically, there are no federal or state insurance guarantees on the principal invested in structured notes. Additionally, structured notes tend to be senior, unsecured notes by the sponsor. If the sponsor is unable to make interest and / or principal payments, the investor may not receive the full note value.

Many structured notes do not provide full downside protection in case the reference asset falls below the knock-in level. The downside market protection may not fully cover your investment in more volatile market periods.[4]

Most notes have a relatively illiquid secondary market. Some notes allow the investor to sell back the notes to the sponsor, often at a discount to the current value.

Interest (excluding principal) from the notes can be complicated, and often considered taxable income if held within a taxable account.

Sponsors typically measure reference assets without dividends and other distributions.

Structured notes are over-the-counter investment products, which have less regulatory supervision compared to mutual funds and ETFs.

The total market for structured notes is not as competitive (particularly on costs and product features) as other investment products such as mutual funds and ETFs.[1]

Structured notes are not standardized across issuers.

In recent years, the U.S. Securities & Exchange Commission (SEC) has issued Investor Alerts & Bulletins detailing the risks of structured notes. In particular, the SEC encourages you to answer the following questions before purchasing a structured note:[5][6]

Conclusion

As we contemplate our duty to our clients as fiduciaries, SJS does not recommend structured notes to clients. They tend to be complex, primarily offered by Wall Street banks, have multiple layers of fees, and require a lot of work to fully understand each structured note.[1][2][4][5] Finally, we are not aware of any well-regarded institution or endowment fund that invests in structured notes. We wonder why?

Important Disclosure Information & Sources:

[1] “Why Structured Notes Might Not Be Right for You“. Jason Whitby, 11-Dec-2021, investopedia.com.

[2] “Spotlight on… top issuers in the US“. Structured Retail Products, 07-Jan-2022, structuredretailproducts.com.

[3] “Barclays to Book $591 Million Loss Due to Debt-Sale Snafu“. Anna Hirtenstein, 28-Mar-2022, wsj.com.

[4] “Structured Notes: The Risks of Insuring Against Risks“. Jason Zweig, 17-Oct-2014, wsj.com.

[5] “Structured Notes with Principal Protection: Note the Terms of Your Investment.” United States Securities and Exchange Commission, 01-Jun-2011, sec.gov.

[6] “Investor Bulletin: Structured Notes.” United States Securities and Exchange Commission, 12-Jan-2015, sec.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® models consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Statements contained in this report that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Market Corrections & Market Highs

We believe that trying to time when to get in and out, or what to buy and sell, represents little more than gambling.

By Chief Investment Officer Tom Kelly, CFA.

In 2021, the global stock market (as measured by the MSCI ACWI Index) continued to reach new high after new high, but this year is off to a different start.[1][2] After the slow and steady rise in 2021, the rather opposite slow and steady fall occurred throughout the first quarter of 2022.[1] Though some recovery happened in the last three weeks, market headlines continue to point out all the things to worry about such as war, inflation, and recession.[1] Challenging times may be ahead, especially with the continued conflict between Russia and Ukraine.

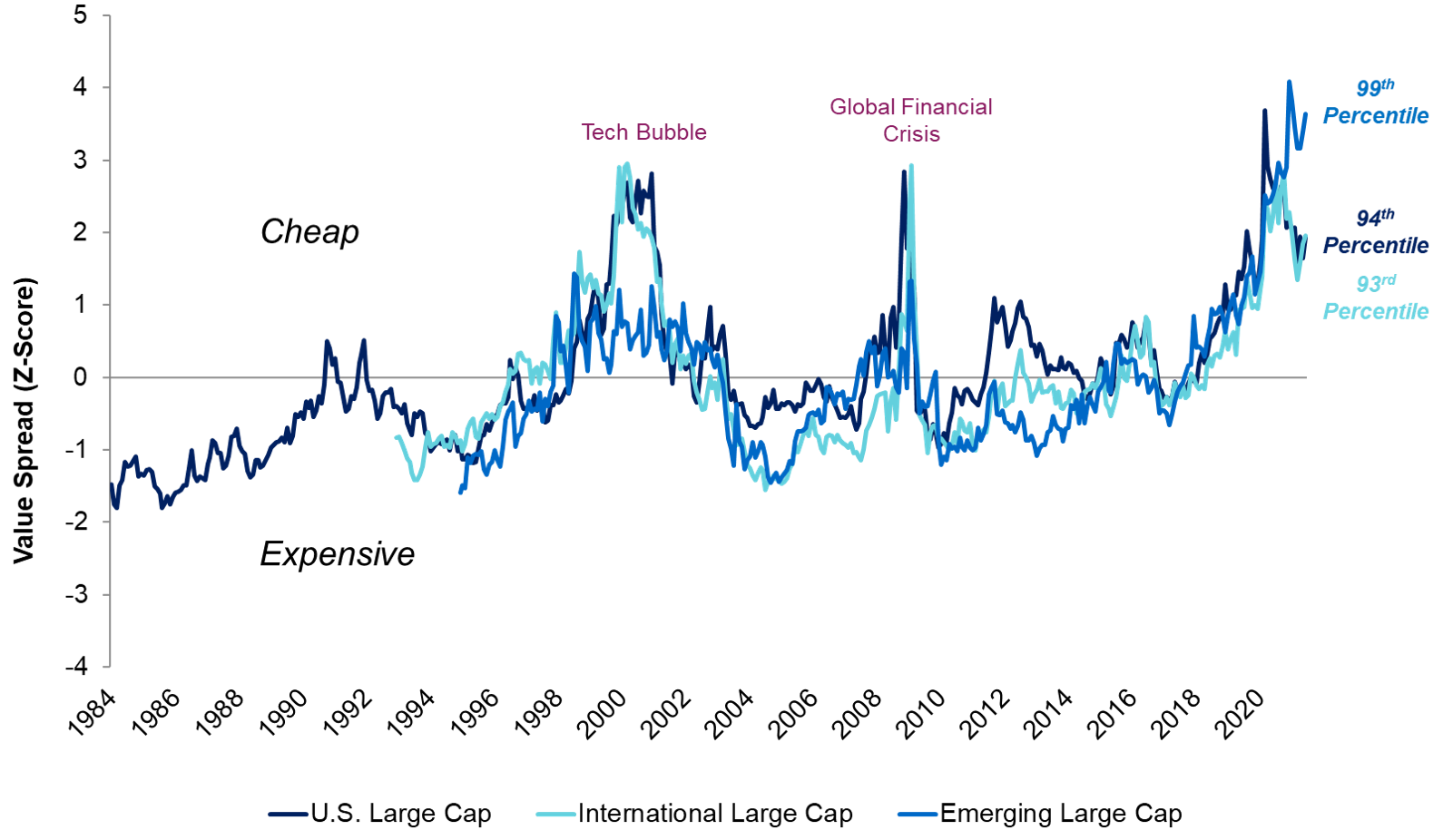

While not diminishing those challenges and the people affected, it may be an opportune time to take a step back for a wider perspective. When looked at as a whole, the stock market can sometimes seem tame and uninteresting during times of lesser volatility, and all fraught with despair during periods of higher volatility and drawdowns. However, the drawdown of 13% so far this year for the global stock market is not uncommon at all, and we often see intra-year drawdowns well into the double digits even when the end-of-year returns end up positive.[2] Over the last 20 years in the global stock market, intra-year drawdowns averaged 16%, yet calendar year returns were positive in 15 out of 20 of those years.[2] A gentle reminder to stay the course.

Source: Morningstar. See Important Disclosure Information.[2]

It is interesting to note that the “market” as a whole often masks the ups and downs of its individual stock components. Within the MSCI All Country World Index, 94% of the nearly 3,000 companies experienced a drawdown of at least -10% during 2021, and about half drew down 25% or more.[2] This in a year when there was lower volatility, limited geopolitical events, and the global stock market as a whole up 19%![2] This suggests the value of broad diversification.

When evaluating the underlying returns, there is often plenty to worry about and temptation to tinker. We believe that trying to time when to get in and out, or what to buy and sell, represents little more than gambling. MarketPlus Investing on the other hand is a disciplined process, centered around research and evidence, with diversification at the core.

Important Disclosure Information & Sources:

[1] “SJS Weekly Market Update”. SJS Investment Services, 2021-2022, sjsinvest.com.

[2] Morningstar. The global stock market is represented by the MSCI ACWI Index, which is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI Index consists of 47 country indices comprising 23 developed and 24 emerging market country indices.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

The Fed Poked The Bear

Rising interest rates are not always a bad thing. As interest rates move higher, the drop in value can be concerning, but in the longer-term, higher rates mean higher expected returns for investors, as bonds begin to produce more income.

By Senior Advisor Kirk Ludwig, CFIP, AIF®.

March 20th was the celebration of the Vernal Equinox and the Earth’s axis has once again shifted us into a new season. From the green pop of tulips sprouting to the warmth of the sunshine spilling through the windows, the United States began celebrating one of their most beloved seasons: The NCAA March Madness Basketball Tournament, or as many of us like to call it… Spring! Along with spring comes the chirping of migrating birds and the waking of hungry bears. This spring the Fed gave the “bond bear” a bit of a poke to get the season rolling.

After a two-year hibernation of zero percent interest rates, the Fed has embarked on the challenging mission of hiking interest rates to combat elevated inflation levels while not inducing a recession at the same time.[1] By increasing short-term interest rates and reducing the size of their balance sheet, the Fed will attempt to orchestrate a soft economic landing.[1] So how many times will they need to raise interest rates to accomplish their goal?

Now for the bad news “bear”… The Fed indicated their intent to continue raising rates into the near future.[1] As of the end of March, the market is expecting the Fed to raise rates eight to nine more times in 2022.[2] This number has changed multiple times in the past few weeks and will likely continue to adjust in the coming months.[2] As new information is presented to the market, bond yields will quickly reflect the possible changes which may occur as a result.

Why are rising rates viewed negatively by the market? Let’s revisit how bond values can change based on the change of market interest rates. Like a teeter-totter, when rates rise, bond values fall and vice versa. Additionally, the sensitivity of the price change is primarily impacted by the term length (maturity) of the bond. The longer the maturity, the more sensitive the price of the bond will likely be. With this recent move higher in yields, the S&P U.S. Aggregate Bond Market Index dropped 5.57% in the first three months of 2022.[3] One of the worst starts of the year on record.[3]

However, rising rates are not always a bad thing. As interest rates move higher, the drop in value can be concerning, but in the longer-term, higher rates mean higher expected returns for investors, as bonds begin to produce more income. The chart below shows the change in yields for three different time periods; 1.) 09/30/21 - before the Fed indicated their plan on raising rates, 2.) 12/31/21 – early stage of the Fed’s plan, and 3.) 03/31/22 – the market’s interpretation of future rates as of the end of the quarter:[2]

Source: “Daily Treasury Par Yield Curve Rates“. U.S. Department of the Treasury, treasury.gov.

As illustrated in the graph, current interest rates have moved markedly higher since the start of the year. Short-term rates - inside three years - have had the most dramatic move as the market prepares for future rate hikes. The longer maturities, which often provide more information about future growth and inflation expectations, have experienced a parallel shift higher. The shape of the yield curve prices in the future expected events, i.e. rate hikes, inflation, economic growth to name a few.

With all the uncertainties surrounding today’s markets, the day-to-day news can be distracting to investors. If you’re worried about how many more times the Fed is going raise rates, know that the market has already priced in that risk. Future inflation? Same answer. Possibility of future recessions… same! Therefore, trying to make long-term decisions on short-term news can often lead investors down the wrong path.

‘Ok, so what should we do now?’ SJS does not react to the short-term noise, but we do evaluate the longer-term expected risk and return characteristics of each segment of the portfolio and manage to those risks. Some of the adjustments that we have made on behalf of our clients:

Maintaining a shorter duration than the total bond market: We believe this reduces interest rate risk relative to the total broader US bond market, while still maintaining broad diversification.

Investing in shorter-term inflation-protected securities: We believe this hedges the portfolio against sharp increases in inflation, while still maintaining a relatively short duration.

Adding diversified alternative investments: We believe investing in diversified alternatives with low correlation to US stocks and bonds can help to redistribute expected risk, broaden diversification, and increase expected returns compared to US fixed income over the long-term.

While you are enjoying the shift into this new season, be comforted in knowing that SJS is continuously monitoring the market and keeping your best interests top of mind. As markets experience higher levels of uncertainty, the best course of action is to maintain a strong discipline with broad diversification. Yes, the hungry bear may seem scary, and you will likely want to run, but the market will eventually find its balance so we can all get back to monitoring our college basketball brackets.

Important Disclosure Information & Sources:

[1] “Fed Raises Interest Rates for First Time Since 2018“. Nick Timiraos, 17-Mar-2022, wsj.com.

[2] “Daily Treasury Par Yield Curve Rates“. U.S. Department of the Treasury, treasury.gov.

[3] “S&P U.S. Aggregate Bond Index“. S&P Dow Jones Indices, spglobal.com/spdji/en. The S&P U.S. Aggregate Bond Index is designed to measure the performance of publicly issued U.S. dollar denominated investment-grade debt.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

MarketPlus Investing® portfolios consist of institutional quality registered investment companies. Investment values will fluctuate, and shares, when redeemed, may be worth more or less than original cost.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Indices are not available for direct investment. Index performance does not reflect the expenses associated with management of an actual portfolio. Index performance is measured in US dollars. The index performance figures assume the reinvestment of all income, including dividends and capital gains. The performance of the indices was obtained from published sources believed to be reliable but which are not warranted as to accuracy or completeness.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

The Certainty of Uncertainty - Your Investments During Geopolitical Events

On the conflict in Ukraine, how that may impact investment markets, and what you can control within your investment portfolio.

By Chief Investment Officer Tom Kelly, CFA.

With conflict between Russia and Ukraine escalating in recent days - unfortunately leading to an invasion and war between the nations - we are reminded of the never-ending risks in the world.[1] Just as the light at the end of the tunnel of the pandemic begins to appear, the next global challenge presents itself. The only thing predictable is the unpredictability of the world.

From an investment perspective, global ramifications of war are certainly hard to determine. Military events - just like economic disruptions, natural disasters, and social turmoil - affect the stock market in many unpredictable ways. The tendency for investors is to try to predict and adjust based on events, but we believe markets are continually pricing in expectations and likelihoods of further developments, whether positive or negative.

One of the hardest things to do as an investor is to stay invested and committed to your investment plan, particularly during periods of great uncertainty. However as this graph demonstrates, markets have rewarded investors over long periods of time.[2] In our experience, the discipline to stick to their investment plan through the periods of greatest uncertainty often differentiates great investors from the rest.

Source: Morningstar Direct, S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. See Important Disclosure Information.[2]

Unfortunately, there have been many major armed conflicts over the last century to look to and see how markets might behave. As this table demonstrates, both US stock and bond markets still achieved positive returns during the years associated with major wars of the past.

Sources: “What Happens to the Market if America Goes to War?“ Mark Armbruster, cfainstitute.org. Dimensional Returns Web. The indices used for each asset class are as follows: the S&P 500 Index for large-Cap stocks; CRSP Deciles 6-10 for small-cap stocks; long-term US government bonds for long-term bonds; five-year US Treasury notes for five-year notes; long-term US corporate bonds for long-term credit; one-month Treasury bills for cash; and the Consumer Price Index for inflation. All index returns are total returns for that index. Returns for a war-time period are calculated as the returns of the index four months before the war and during the entire war itself. Returns for “All Wars” are the annualized geometric return of the index over all “war-time periods.” Volatility is the annualized standard deviation of the index over the given period. Past performance is not indicative of future results. See Important Disclosure Information.

For investors historically, wars have not been detrimental to long-term investment performance. We do not believe the current situation will be detrimental to long-term investors going forward. While no two conflicts are the same - and each more unfortunate than the last regarding the continued loss of human life and havoc on nations - humanity (and the markets) remain resilient. Industry and innovation continue. We hope and pray this time is the same.

For those who have a sound, diversified, personalized investment plan in place, we do not believe that now is the time to make any major changes. Instead of focusing on how external forces that you do not control may impact your investments, we recommend that you focus on what you can control. For our clients, we are doing the following on your behalf:

Investing, Not Speculating