MarketPlus Investing® – It Takes Discipline

Our quarterly Investment Committee meetings allow to reflect on and to evaluate the discipline of our MarketPlus Investing strategy, and what that means for you.

By SJS Managing Director Jennifer Smiljanich

The start of a new year always seems to be a good time for reflection. A time to think about the journey we took throughout the past year. A time to look forward to the year ahead. And, a time to think about a certain “D word.” That’s right, Discipline! That difficult thing we know we should work on, but still find ourselves struggling with.

We resolve to do all the right things, to choose to eat healthier, to make time for exercise, and to work on relationships with family and friends. Discipline. It’s hard.

At SJS, our quarterly Investment Committee meetings give us the opportunity to reflect on and to evaluate the discipline of our MarketPlus investment strategy, and what that means to you. Our commitment to you is that we will maintain the discipline of our investment philosophy and our science-based process of designing portfolios to help you achieve your financial goals in an up, down, or sideways market.

At times, we have made adjustments to the way in which we implement MarketPlus Investing on your behalf. Any investment change is subject to careful consideration, and may come as a result of market conditions, investment alternatives offering lower costs, more diversification, or better exposure to an investment premium. Since our beginning in 1995, our portfolios have seen a number of adjustments, about two dozen in total (graphic below).

We do know that it’s not easy being an investor, especially a patient one. As human beings, we are prone to an emotional response when we see the markets go up, and even more so when markets go down. Behavioral studies tell us that losses loom larger than gains – the pain of a loss is psychologically twice as powerful as the pleasure of a gain.[1]

We are here to offer you an ear to listen and a hand to hold when the markets are choppy. And we will continue to offer you a disciplined investment process that puts your portfolio in the way of market returns, and the anticipated benefits of investment premiums supported by academic research.

If we can free up some time for you to focus on the people and the causes you care about, well – that’s just another “plus.”

Sources:

[1] “Loss Aversion,” www.behavioraleconomics.com.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Stock Picking – Who’s Keeping Score?

Picking stocks is a very difficult game, even for the most seasoned professionals. We believe that diversification is the best way to manage stock investing risk.

By SJS Founder & CEO Scott Savage

Today’s financial media – where TV personalities and financial professionals alike freely offer their investment “picks of the day.” They might present well-founded arguments or emotional appeals when they recommend a buy or a sale to their audience. But you can bet they’ll always have some pick or prediction to make. What’s rare, though, is when those individuals are held accountable for how well their picks performed.

An exception to this is Barron’s – which we believe is a respected weekly financial publication – which takes the time to follow up on how their “Roundtable” has performed. Barron’s 2019 Roundtable is made up of what Barron’s refers to as “Wall Street’s smartest investors.”[1] Each year, Barron’s asks these experts for their opinions about the economy and the direction of the markets, and also invites them to provide a number of stock picks for the upcoming year.[2] At the beginning of the following year, Barron’s publishes what they call their “Roundtable Report Card,” and lets their readers be the judge of how well the industry experts fared.

In January 2018, nine of Barron’s experts – including Merrill Lynch’s Abby Joseph Cohen and Chairman and CEO of Gamco Investors, Mario Gabelli – looked into their respective crystal balls and made their picks. Each expert recommended anywhere from four to ten stocks for the year. How do you think their picks performed?

We took each Roundtable panelist’s picks and did a simple calculation to average their total return on the year, and then averaged those returns to come up with an overall average (mean).

We found those results interesting – the average manager’s stock picks actually declined more than 12% from January 15 to December 31, 2018. In fact, we found that only three of the nine Roundtable members’ picks had an average return that beat the -8.6% return of S&P 500 Index for the year.[2] While we respect the experience and collective knowledge of the group interviewed by Barron’s, the results of their 2018 stock selections support our long-held belief that picking stocks is a very difficult game, even for the most seasoned professionals.

We believe that diversification is the best way to manage the risk of investing in global stock markets. While diversification doesn’t mitigate all risks, it is a foundational component of MarketPlus Investing®, in which we carefully evaluate your exposure to risk.

In addition to broad diversification, we incorporate intentional biases toward small-cap, value, and profitable companies in your portfolios, which we’ve designed to efficiently capture market returns where they have historically occurred and where market indicators imply they will continue.[3] And we support the notion of accountability – letting you know how your portfolio has performed compared to an index invested in a similar mix of stocks and bonds.

While your portfolio might not always beat the index year in and year out, over time, your assets are diversified and allocated to best capture the returns of the market – and the goal is to do so with a smoother ride than if you held just a handful of stocks. We’ll remain true to our time-tested and disciplined process and remain accountable to you. And we’ll leave the stock picking to the experts.

Sources:

[1] “What’s Next for the Stock Market and the Economy, According to the Experts,” Barrons.com, January 14, 2019.

[2] “How Stock Picks from Our Experts Fared in 2018 – Roundtable Report Card,” Barrons.com, January 14, 2019.

[3] Past performance does not guarantee future results.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

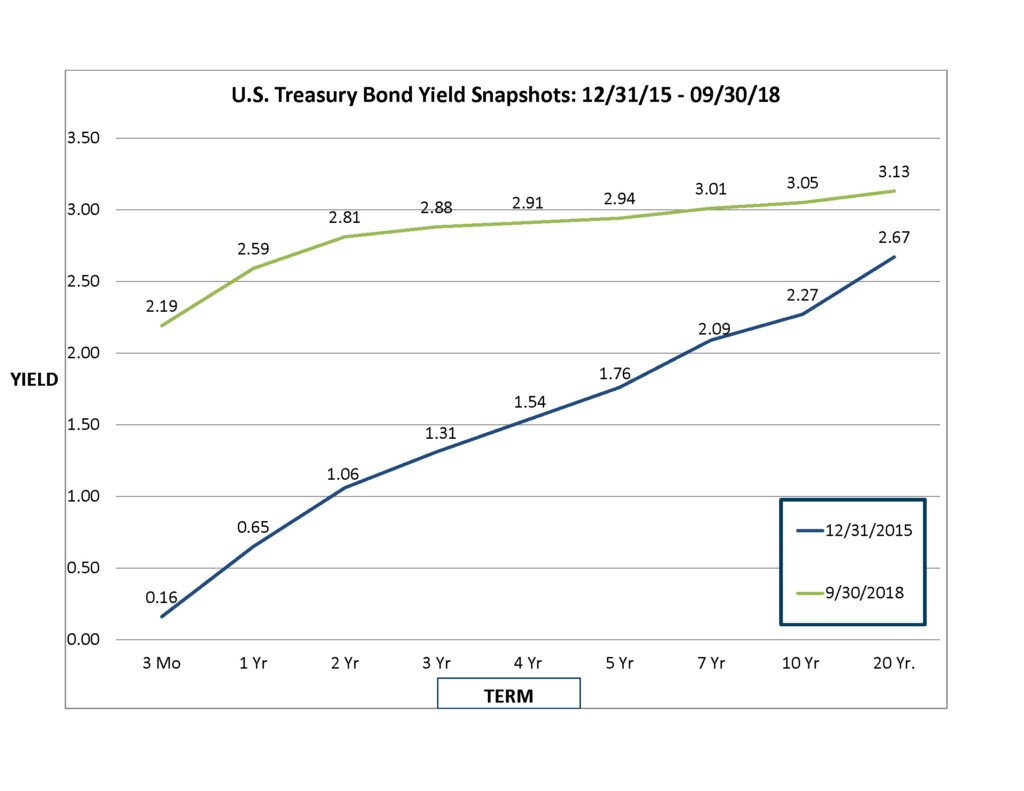

Bond Returns – Could The ‘Drought’ Be Ending?

In the bond market, we have been experiencing our own version of a “drought” over the past decade – a shortage of income (or, yield) from our bonds.

By SJS Director of Institutional Investment Management Kirk Ludwig

Whether you’re an SJS client living in Ohio or Arizona – or somewhere in between – chances are good that you have experienced an environmental drought at some point during your lifetime.

In the bond market, we have been experiencing our own version of a “drought” over the past decade – a shortage of income (or, yield) from our bonds, with respect to the fixed income allocations in our MarketPlus® portfolios. A drought begins and intensifies when there is a continued shortage of rainfall. Over time, the ground dries up. The “green” goes away as plants, shrubs, and trees die or fall dormant. The ground remains fertile but, in the absence of precipitation to generate new growth, crops fail to produce their yield.

Typically, we think of bonds, or fixed income, as the “safer” part of our portfolios, since they generate income while providing portfolio stability. However, since the Great Recession in 2007, short-term bond rates have hovered near zero percent, evaporating any income from this part of the portfolio.[1] Now that the U.S. economy is feeling more stable, the Federal Reserve has increased their target rate to 2.25%, which in turn has showered the bond market with a much needed income boost.[2]

Similar to how a gentle rainfall would not immediately end a weather drought, a gradual increase in interest rates doesn’t automatically lead to higher income. When interest rates go up, the principal value of a bond will actually adjust lower to make up for the higher market rate. This adjustment period often dampens fixed income returns in the short-term, but leads to a higher income stream in the future. As a result, the returns in fixed income investments year-to-date in your portfolio have been fairly flat.

We are eager to start capturing greater yields, but we have to be patient. In the current interest rate environment, the bond portion of our MarketPlus portfolios will gradually start capturing the increase in rates as shorter-term bonds mature and proceeds are reinvested at today’s higher yields. The Federal Reserve will likely continue to raise short-term rates in the near future, which means bond returns may continue to be flat for a while. However, we believe that we will soon start to see evidence of higher yields as they sprout within the portfolios.

A recovery following a drought is gradual. It doesn’t happen like a flood – instantly inundating. The recovery occurs by having a steady, soaking rain for a few days or more. Before you know it, your resources are recovering and the drought has ended.

Our hope is that our client portfolios start to benefit from these drought-ending rate increases, and that their future “harvest” will be more bountiful.

Sources:

[1] Daily Treasury Yield Curve Rates, U.S. Department of the Treasury.

[2] U.S. Rates and Bonds, Bloomberg.com.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Let’s Talk Finances … With Your Kids!

Maybe you’ve tried to talk with your kids about financial responsibility. Or maybe you haven’t. That’s okay. We can have the conversation on your behalf.

By SJS Advisor Andrew Schaetzke CFP®

Maybe you’ve tried to talk with your kids or grandkids many times about financial responsibility. Or maybe you haven’t wanted to bring up the “taboo” subject of money. That’s okay. We can. And we can have the conversation on your behalf. Just call us to set up an appointment to talk finances and how money works.

Every young person needs to know that money can be his or her friend… or enemy. We can help make it the first one, by covering a few basics with them over the course of about an hour. We can touch on everything from living within your means, to paying yourself first. We’ll even share how saving money works, and how to make it work for you. We’ll talk about the difference between good debt and bad debt and what happens if you have any of the latter.

You say your son or daughter isn’t a math fan? He or she will like hearing about and seeing this math. We’ll discuss what money invested today has the possibility to become in 30 years. And, what opportunities may be missed if those same dollars are spent impulsively on a purchase with little or no lasting value.

It’s an eye-opening education that may be difficult for parents to deliver, but something we do all day. Take us up on the offer. It costs nothing but could be worth so much. And, at the very least, can begin to plant the seed of financial awareness and responsibility. You’ve worked to provide for those you love in every other way. Here’s one more very important way to show you care.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Investment Advice You Don’t Hear Every Day

Many SJS clients have generated their wealth through concentrated bets that began as very small investments, perhaps sweat equity, and grew over time.

By SJS Founder & CEO Scott Savage

Andrew Carnegie – steel tycoon, philanthropist, and one of the wealthiest businessmen of the 19th century – once commented about creating wealth:

“Put all of your eggs in one basket. Then, watch that basket!”

Does that advice surprise you? Well, prepare to be even more surprised – because we agree wholeheartedly. Many SJS clients have generated their wealth through concentrated bets that began as very small investments, perhaps sweat equity, and grew over time to become significant. In other cases, their baskets didn’t do a very good job of nurturing those eggs. Some of our clients can tell tales of complete failures along the road to success. That may surprise you, too. Viewing accomplishments from the present day has a way of smoothing out the memories of past hardships, just as viewing financial markets at their current levels tends to smooth over memories of past volatility. This perspective comes with the passage of time.

Regardless of the bumps along the way, individual talent, innovation, and hard work applied to America’s free economy have historically yielded many success stories. We have plenty of these stories to share and see no reason why the future should be any less full of promise.

For clients who have spent their lives building their wealth, it can sometimes be difficult to give up their perceived “control” of their basket – of a business interest, real estate, or concentrated stock held over generations – and let us handle their investments. This “control,” which may be somewhat illusory, gets replaced with the so-called risk inherent in the financial markets. Maybe you’ve experienced similar feelings? This is completely normal, and can be a huge emotional obstacle to overcome. Some people never get there.

But we strive to help these investors see the benefits of making this trade off when the time is right, to give up the concentrated bet for a diversified portfolio that may offer a smoother experience over time. While investors may start off with all of their investment “eggs” in one basket, academic research and empirical evidence strongly support widespread holdings in the publicly traded financial markets. And consistent exposure to areas of the market that systematically add value are time-tested strategies to preserve and protect wealth. These strategies are the foundation of MarketPlus Investing®.

How does MarketPlus Investing fit into your picture? Eventually, the day may arrive when you know it’s time to preserve and protect your wealth, and move your eggs from that single basket into many, many more.

So, how can we help you “preserve” your wealth? First and foremost, by keeping you informed so you’re less likely to react to your emotions and potentially harm your portfolio. Emotions can be the great enemy of successful investing. And how can we help you “protect” your wealth, and from what? You might think market volatility is the only danger, but historically, inflation – and the associated decreased purchasing power – can be the bigger and historically persistent risk. It’s the white noise playing in the background of every minute of every day, and often doesn’t get the media play that an old fashioned market correction gets. This is yet another reason why we believe a well-diversified portfolio, designed with calculated risk exposure, can be so important to maintain wealth for the future needs of your families and loved ones. And this is the reason why we created MarketPlus Investing in the first place.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Three Common Mistakes Many Investors Make

Through helping clients invest through MarketPlus Investing, we have discovered three main reasons why investors often have difficulty investing on their own.

MarketPlus® Investing Helps Investors Avoid These Common and Costly Pitfalls

By SJS President Kevin Kelly, CFA

You’d think that anyone who wanted to be a highly successful investor could achieve that goal on his or her own, given all the access to financial information and the speed of information we enjoy today. After all, the Internet, television, radio, magazines—just about everywhere you turn—provide round-the-clock access to anyone who’s interested.

Why then does the 2014 edition of the “Quantitative Analysis of Investor Behavior” performed by DALBAR, a financial services research firm, confirm that individual investors’ portfolio performance trails overall market performance? And not just for one year, but for 30 years running. In 2013 alone, with the S&P 500 up about 32%, the average do-it-yourself mutual fund investor underperformed with an average 25.5% return.* Over the 30 years ending December 2013, the S&P 500 gained 11% annually while the average individual investor earned less than 4% annually. According to the AAII Journal, in some years the gap between the benchmark performance and the average individual investor portfolio was as high as 10%. (Steven Sears, The American Association of Individual Investors Journal, July 2012.)

Why the disparity? And why isn’t the gap smaller now that we have such easy access to information? Through our experience at SJS Investment Services helping clients invest through our time-tested process called MarketPlus Investing, we have discovered three main reasons why individual investors often have difficulty investing on their own:

Timing the Market

Individual investors often believe the best way to drive increased performance is to try to time the market. They watch the trends and attempt to get in when the market is low and get out when the market is high, then wait for it to drop again before getting back in. Our experience tells us this is a fool’s errand, and numerous studies prove it. Marlena Lee, in her paper titled “Stock Returns Over Business Market Cycles,” published in March 2009, demonstrates why trying to stay out of harm’s way through market timing is a less than optimal strategy. She calls it a “costly decision.”

Stock Picking

Individual investors sometimes try to pick one, two, or a handful of stocks that they think are going to out perform the market. And given the thousands of securities that are out there, the odds in an individual investor’s favor are pretty slim, particularly over time. MarketPlus Investing is a science-based process built on the Nobel Prize-winning work of Eugene F. Fama that places portfolio design at the center. Owning various asset classes instead of trying to pick stocks may minimize risk. And based on an investor’s financial goals, the focus is on designing a portfolio diversified across and within asset classes, not individual stocks.

Chasing Performance

Individual investors often choose an investment based on performance and with the assumption that that performance will continue. They, in essence, look to the past success of the fund manager and hope that the manager will have the same success in the future. In the study “Luck vs. Skill in the Cross Section of Mutual Fund Returns,” in the October 2010 issue of the Journal of Finance, the authors, Eugene F. Fama and Kenneth R. French, showed that active fund managers cannot accurately speculate on where individual prices are going to go and systematically beat the market. We couldn’t agree more. Our experience with new clients has been that they have rarely been rewarded by chasing performance.

At the root of these common mistakes that many individual investors make is the simple fact that too many investment decisions are made emotionally, without a process and in the absence of discipline. That’s perhaps the biggest asset we bring to our clients. At SJS Investment Services, we like building relationships with our clients and getting to know them, but when it comes to investing on their behalf, we have a process and a discipline. Our clients hire us to help guide their futures. But they really hire us to stick to our process, maintain discipline and be there for them. And it’s a role we’re equipped and honored to take on.

Important Disclosure Information:

It is not possible to invest directly in an index.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Annuities 101

Annuities are long-term investments designed to help you achieve your long-term goals. Annuities provide the benefit of tax-deferred growth of earnings.

By SJS Senior Advisor Gary Geiger

If you were to ask one hundred investors to describe or explain an annuity, you would likely get nearly one hundred different answers – some of them accurate, and others probably less so.

“Annuities are among the most bought, least understood” financial products, says Tim Maurer, of CNBC. One of the most common questions I hear from clients is, “What is an annuity, and how does it work?” When it comes to annuities, there are many, often complex, options out there, and it’s easy to understand the confusion. So how can you tell if an annuity is a good option for you?

First, the basics: annuities are long-term investments created by insurance companies and designed to help you achieve retirement or other long-term goals. Annuities provide the benefit of tax-deferred growth of earnings while your funds remain invested within the annuity.

Annuities may come with drawbacks, however. In general, all annuities lack liquidity and carry significant surrender charge penalties – which can be as high as 20%, and last for more than 15 years – should you decide to withdraw your money before your set term is up. Regardless of when you withdraw, all gains are taxed at ordinary income tax rates, not as capital gains.

There are three main types of annuities: fixed, variable, and equity-indexed, with variable annuities being the most common. Here is a quick overview of each type:

Fixed

Fixed annuities can be described as similar to a bank-issued CD. A fixed annuity pays you a guaranteed rate of interest for a set term.

Advantage: A fixed annuity may be an appealing choice if you are an investor who is cautious about the market’s ups and downs.

Disadvantage: If you choose to invest using a fixed annuity for an extended period of time, you could find that the rates do not keep pace with inflation or other comparable investments.

Variable

Variable annuities allow you to select how your money is invested within the available subaccounts, which are investments similar to mutual funds. During your retirement years, you may be able to convert the annuity value into a stream of income, which is determined by the performance of your investments.

Advantage: A variable annuity allows you to invest in stock and bond mutual funds, offering you an opportunity to earn a greater return.

Disadvantage: Variable annuities often have very high fees. Ongoing administrative, insurance, and management fees can add up to as high as 2% to 3% annually. Combine these costs with rider fees, and the annual costs can easily exceed 3% per year. There is also more risk associated with the investments, which can cause the value of your annuity to decline.

Equity-Indexed

This type of annuity is a combination of a fixed and the variable annuity. As with fixed annuities, your account comes with a guarantee of your principal.

Advantage: Your account return will be tied to the performance of a benchmark index; therefore, you have a chance to earn a greater return if your benchmark goes up.

Disadvantage: Equity-indexed annuities are typically very complex and come in a wide variety of forms. Because there are so many different versions and moving parts, the formulas and index participation rates can be difficult to understand.

For all three types of annuities, there are a number of options for converting the annuity value to a stream of payments, including lifetime payments, or payments for a specific period of time. This is called “annuitizing.” The ability to convert the annuity to these payments can help alleviate the fear that you may outlive your assets.

Additionally, you can typically purchase separate “riders” or options that pertain to withdrawal benefits and death benefits. These riders can vary from one annuity to another, or even from one insurance company to another. There are many, many payout options available, which can increase the complexity and lead to confusion.

Here at SJS, we understand that your future is important, and we know that annuity investments can be complicated, as there are so many variations available. It is important to understand what is guaranteed along with the rules to reap the potential benefits of annuities. Although we do not typically offer annuities as a primary investment tool because of their complexity and cost, we can help you evaluate any annuity you may already own. There may be more tax-efficient and less expensive ways to achieve the same outcome you’re seeking. We’ll be here every step of the way to help you determine the best options to reach your desired investment goals.

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.

Clearing Out The Noise

Is the media confused about what is actually happening in investing, or are they trying to confuse us? Good question – and one without a good answer. One of the best things you can do is to inform yourself before acting on any advice.

By Matt Miller

Just the other morning, as I was getting dressed with a “business news” channel playing in the background, I heard the announcer say: “There are more sellers than buyers in the market today!”

Instantly, I thought, “How misleading! It’s not as if there are orphan stocks out there looking for someone to buy them!”

As someone who strives to help guide your financial future, I can’t help but tune into these messages, which I believe are distorted. Is the media confused about what is actually happening in investing, or are they trying to confuse us? Good question – and one without a good answer.

One of the best things you can do is to inform yourself before acting on any advice. Here’s the first lesson: the financial markets are no different than any other kind of market. It’s a fact that for every seller of a share, there needs to be a buyer for that share. There is no pool of orphan shares waiting for buyers or sellers. Just like in any other market, for a transaction to occur, both the buyer and seller must each believe they are getting a good deal.

Wall Street has been known to paint distorted pictures, and they can cause urgency, panic and rash decision-making. On that same business channel, I also overheard the announcer discussing the current interest rate environment. He explained that when rates begin to increase, stocks will tumble as the cost of borrowing escalates. His prediction might end up being right, but markets aren’t that simple. Markets are constantly digesting all kinds of information, with rising rates being just one element of the financial landscape.

As we always do at SJS, let’s turn to data. The chart below documents the performance of equities during time periods of rising rates.[1]

Data needs to be much more robust than the four observations above for academics and researchers to conclude any kind of statistical significance, but the performance of stocks throughout the time periods shown does illustrate that rising interest rates don’t necessarily have a negative effect on equities.

It’s easy to want to look for that one answer, a singular “cause and effect” – but there are so many factors that can influence a stock’s price. The stock market is the ultimate crystal ball, with a stock’s price representing a vast array of information and the opinions of millions of intelligent market participants. Think about it the next time you get that “outstanding” stock tip at your neighbor’s barbecue. On average, there are more than 40 million trades a day representing more than $200 billion in volume.[2] The majority of these transactions are being done by extremely intelligent individuals who spend their entire lives researching securities. Do you really think the average consumer – or even media reporter – knows something that hasn’t already been factored into the price of that stock?

At SJS, we admit that we have no idea where the market will go tomorrow, but we do believe in markets and the long term historical return on invested capital. Ups and downs will happen, which is why a well-diversified, disciplined, long-term approach is a sound strategy. That’s one of the foundations of MarketPlus® Investing. If you’d like to learn more, or would like some clarity amidst the noise, we are here.

Important Disclosure and Sources:

[1] Graph source: Dimensional Fund Advisors. Russell 3000 excluded from the 1976-1980 analysis due to later inception date. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Performance data shown represents past performance and is no guarantee of future results. Performance for periods greater than one year are annualized. Instances of rising rates used in analysis are time periods where rates have increased by more than 150 basis points over at least 12 months. For illustrative purposes only. Data sources: The S&P data are provided by Standard & Poor’s Index Services Group; Russell data copyright, Russell Investment Group 1995-2013, all rights reserved; CRSP data provided by the Center for Research in Security Prices, University of Chicago.

[2] Trading data provided by Dimensional Fund Advisors

Suggested Reading

SJS Investment Services is proud to be #11 on CNBC’s 2025 Financial Advisor (FA) 100 list, an annual ranking of registered investment advisory (RIA) firms within the United States.[1]

Medicare Open Enrollment (October 15 – December 7, 2025) is the time to review your current healthcare coverage and make changes for the year ahead.

SJS Investment Services has been recognized in the Forbes / SHOOK 2025 list of America’s Top RIA (Registered Investor Advisor) Firms.

SJS Q1 2025 Outlook includes a market update, team highlights, SJS book club insights and important information on the social security fairness act.

The SJS Annual Report provides updates on the SJS Team, MarketPlus Investing®, SJS purpose, mission, & values, multi-family office services, and SJS community involvement.

To help you financially plan for 2025, we provide this resource with important numbers for the year.

The yield curve isn’t just an academic concept; it impacts real-life decisions.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

SJS began sponsoring an Assistance Dog at The Ability Center in Sylvania, Ohio. Assistance Dogs help individuals with disabilities achieve greater independence.

Stepping into 2025, SJS is filled with gratitude and excitement as we celebrate our 30th year serving you, our valued clients.

This Outlook includes a letter from Scott J. Savage on gratitude and excitement, what the yield curve means for you, planning financially for the new year, SJS puppy, and looking forward to Q1 2025.

SJS Investment Services has been recognized in CNBC’s 2024 FA 100 list, an annual ranking of registered investment advisory (RIA) firms within the USA.

SJS Investment Services has been recognized in the Forbes / SHOOK 2024 list of America’s Top RIA (Registered Investor Advisor) Firms.

Every four years, we get the same question (whether you have asked it, or you are thinking it) – how will the election affect my portfolio?

As we approach the end of the year, we want to highlight some important financial items to review before the new year.

This Outlook includes our discussion of election time, financial to-dos before the end of the year, new SJS Perrysburg office, SJS Team updates, and looking forward to Q4 2024.

SJS Investment Services has been recognized in Financial Advisor Magazine’s 2024 Registered Investment Advisor (RIA) Ranking, an annual ranking of independent investment advisory firms within the United States.

As I approach my 40th anniversary as a financial advisor, I can't help but look back on the road I've traveled.

While people commonly hold their cash within checking and savings accounts, we want to highlight three short-term, interest-bearing investments that can be held within your investment account.

This Outlook includes Founder & CEO Scott J. Savage’s gratitude for your 40 years of trust, how you can earn more interest on your cash, welcoming new SJS Team members, and looking forward to Q3 2024.

For five graduating high school Seniors who shadowed us recently, we asked each student to write a summary of what they learned during the week.

One of The Ability Center’s services is the Assistance Dog training program, which helps individuals with disabilities achieve greater independence.

When working with investment managers, we want them to share that same client-first philosophy and sit on the same side of the table with us.

We want to emphasize some best practices that can help us work together to ensure your information and assets remain safe.

The Outlook includes our evolving MarketPlus® Investing philosophy by standing on the shoulders of giants, and ways to help protect your personal information and financial assets. We also highlight The Ability Center and look forward to Q2 2024.

SRDAX is a shining example of the value alternatives can bring to traditional stock and bond strategies.

As we begin the new year, we have some ideas for concrete actions to start your new year on the right foot, financially.

Isn’t this picture magical? It's Main Street in Sylvania, Ohio, the small town where I founded SJS over 28 years ago!

The SJS Q4 2023 Outlook includes our insights on small town values, MarketPlus® Investing, and planning financially for the new year. We also highlight new SJS Team members and look forward to Q1 2024.

To help you financially plan for 2024, we provide this resource with important numbers for the upcoming year.