Helping Your Parents Financially Prepare For The Future

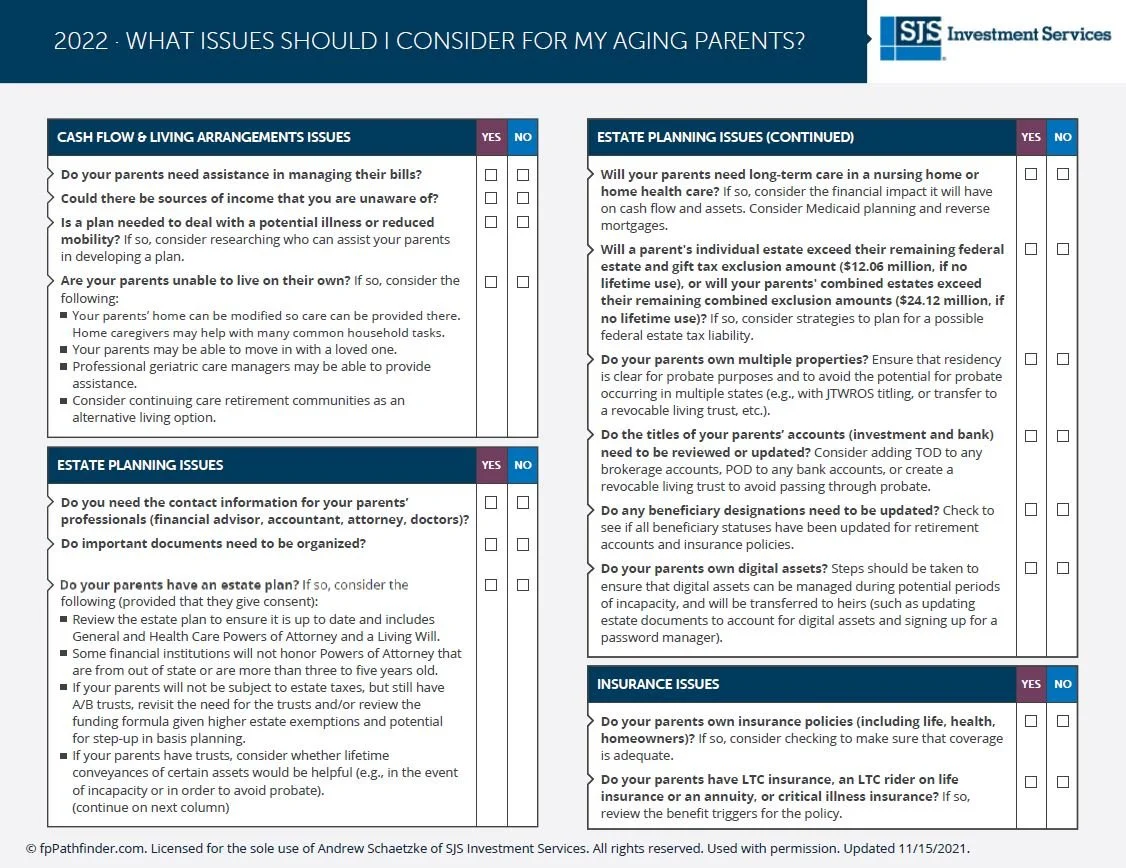

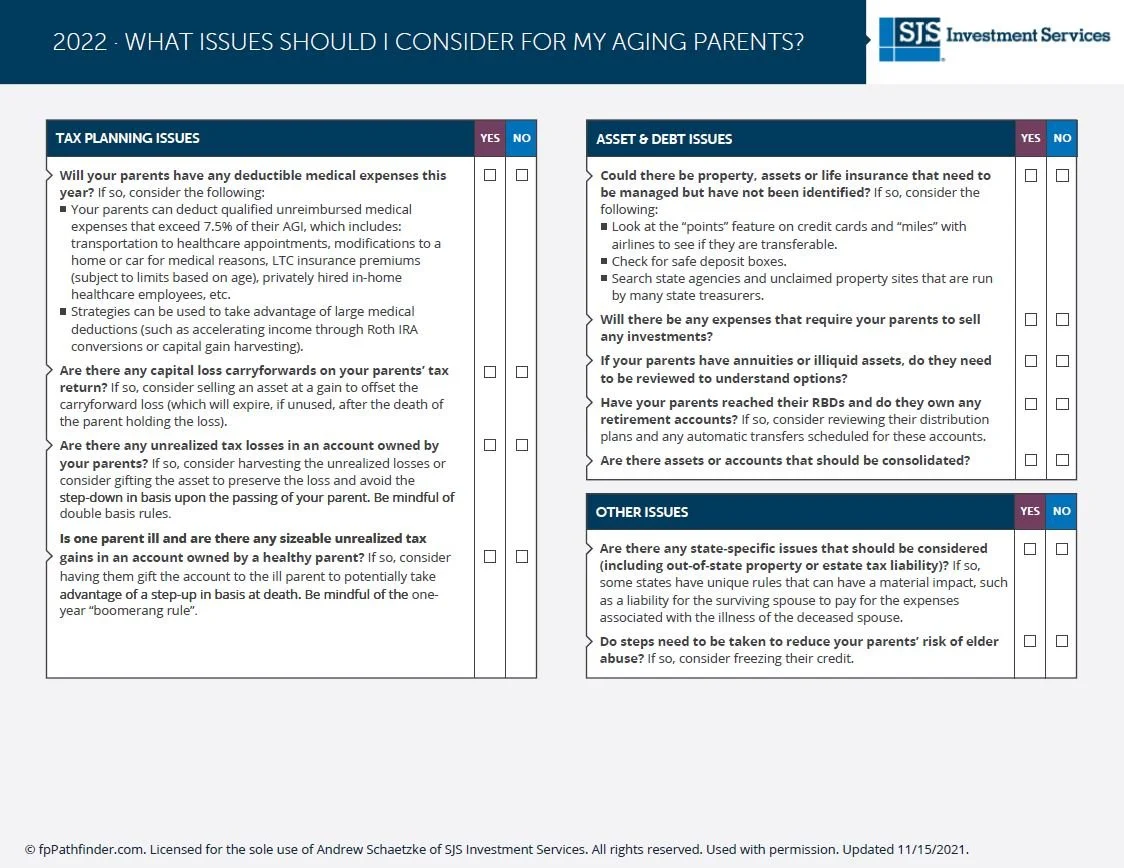

To help you assess ways that you can assist your parents with financial matters, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

As we are growing up, we rely on our parents for so many things, such as shelter, food, money, and love. As we become adults, we usually rely on our parents less and less. At the same time, many children want to help their aging parents, or parents may even need help as they grow older.

Unfortunately, helping parents plan for the future has become an increasingly pressing concern. Largely due to effects of the COVID-19 pandemic, the average life expectancy for Americans has declined over the last couple years.[1]

By creating plans ahead of time, you can help your parents feel more prepared and ease their burdens should they experience any troubles. There are many financial matters that you can potentially assist your parents with, including:

Planning for the desired quality of assisted living conditions and care that they may want and need as they grow older

Managing their bills, particularly relating to insurance and medical expenses

Organizing their documents, passwords, and other important information

Developing their estate plan

Tax planning

To help you assess ways that you can assist your parents with financial matters, we provide the resource below. As always, we are here to help your family throughout your financial journey. We can provide resources, experience, and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

[1] “Provisional Life Expectancy Estimates for 2021“. Elizabeth Arias, Betzaida Tejada-Vera, Kenneth D. Kochanek, & Farida B. Ahmad, August 2022, cdc.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

Supporting You At A Time Of Loss

When you lose a loved one, particularly a spouse, we are here for you. We have helped many individuals over the last twenty-seven years find their footing and renewed confidence.

By Managing Director & Senior Advisor Jennifer Smiljanich, CFP®.

Confident. Secure. Serene. These adjectives go out the window when we experience the loss of a spouse. Suddenly, the whole world can seem daunting and unfamiliar. How does one find their footing and balance?

We know that losing a spouse is one of the most stressful challenges of our lifetime. AdventHealth ranks the stress level above other life events, like divorce, job loss, new responsibilities in marriage, or becoming a parent.[1]

When you lose a loved one, particularly a spouse, we are here for you. We have helped many individuals over the last twenty-seven years find their footing and renewed confidence. How do we do that?

First, we understand that a surviving spouse needs time to grieve and to find a path forward. It is a process, and it takes time. You need to be with family and loved ones. You’re learning to live without them, and it includes taking over new responsibilities, changing family dynamics, spending time alone, and struggling with a new normal. Grief isn’t limited to a state of mind, and it doesn’t just gradually fade. Many times the last thing a surviving spouse wants to be doing is making financial decisions.

We encourage the surviving spouse to be patient and deliberate to make financial decisions, especially those that are significant. A family member of mine confided that for a year after her husband passed away, she felt like she was in a fog. She had a difficult time remembering things and felt panicked at the thought of having to decide. At this stage, we want to help the survivor evaluate financial steps that should be taken – reviewing benefits, pensions, medical plans, and Social Security.

Finally, as time goes on, we can help with financial education and co-thinking longer-term decisions. Chances are the deceased spouse managed at least some of the financial decision-making. For us, helping the survivor feel confident that their investments are positioned to help them achieve their goals is important. We can help model decision-making for the longer term, perhaps downsizing or moving to a single-story home; considering a move closer to adult children or other family; gifting to family or charity; or adjusting estate documents to account for changes in circumstances. Our goal is to ensure you have all the facts to make thoughtful decisions.

As SJS has developed our relationship with you over the years, we have celebrated your successes and joyful times, and have been honored to be of service to you in your times of personal challenge and loss. We stand ready to be there when you need us to listen, or to hold a hand. You come first.

Important Disclosure Information & Sources:

[1] “Death of a Loved One is the Number One Stress Driver — Learn How to Cope“. AdventHealth, 05-Mar-2019, adventhealth.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice.

Hyperlinks to third-party information are provided as a convenience.

Suggested Reading

When A Client Dies

Without question, the hardest part of being an advisor is when a client dies.

By Founder & CEO Scott Savage.

Without question, the hardest part of being an advisor is when a client dies.

Sadly, I have mourned the passing of many clients, including some who had been clients for over three decades. When you plan, dream and work with individuals, their families and organizations for such a long time, experiencing death together is hard, and hard to describe.

The trusting relationships we have been fortunate to build, foster and nurture create emotional bonds that are impossible to describe with words. At times, the weight and gravity of the responsibility I feel has gotten in the way of a good night of sleep.

Often our clients leave behind families and organizations who rely on us to see their legacies through. Even after death, our clients rely on us to do right by those left behind.

Important Disclosure Information & Sources:

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

How Should You Donate To Charitable Organizations?

We detail a few ways that you can donate to charitable organizations in order to help you determine what strategy would be financially best for you.

By Investment Associate Bobby Adusumilli, CFA.

Most of us accumulate money in order to support ourselves and our families. We also use our money and resources to make a positive difference for the communities and organizations that we care most about. Research has even found that donating money to a charitable cause is one of the best ways to use money to make ourselves happier.[1] Do good, feel good.

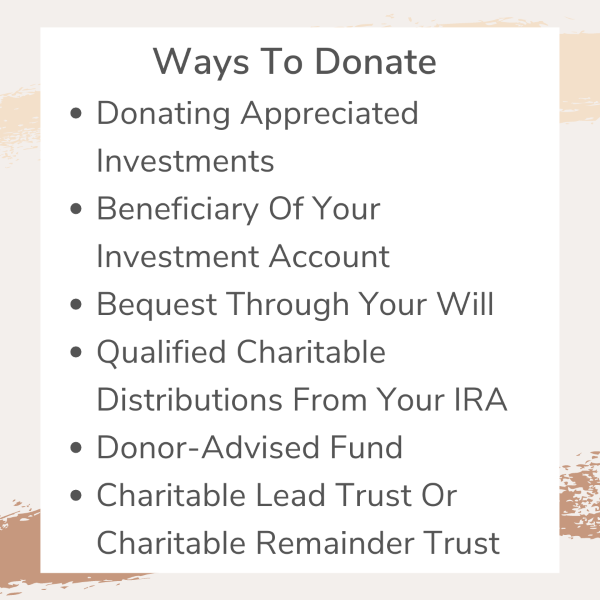

While cash is usually the easiest form of donation, it may not be the best way for you financially. Depending on the situation, some ways make more financial sense than others. Below, we detail a few ways that you can donate to charitable organizations in order to help you determine what strategy would be financially best for you. As always, please work with your tax professional as well as your estate planning professional when developing and implementing your charitable plan.

Donating Appreciated Investments

Whether it's a stock, bond, mutual fund, ETF, real estate, or another investment type, you may be able to donate the appreciated investment directly to the charity. If you have held the investment for more than one year, you can potentially deduct the full market value of your investment from your income taxes for that year, and you may also be able to avoid capital gains taxes.[2] Not all charities can accept all types of investments, so please work with the charity to determine if they can receive an investment you are interested in donating.

Beneficiary Of Your Investment Account

Specifying a charitable organization as your beneficiary on an investment account is one of the easiest ways for you to leave assets for a charity when you pass away. You can specify the charity as a beneficiary to receive a percentage of your investment account in the future, hopefully benefitting from any investment growth over time.[3] Additionally, if the charity is the beneficiary of your Traditional (pre-tax) IRA, then the charity may not have to pay federal income taxes like a child or grandchild may have to.

Your beneficiaries on your accounts typically take priority over bequests in your will, so please ensure that your beneficiaries and bequests in your will are consistent. One potential downside for this option is that depending on how you have set up your finances, your financial assets may need to go through the probate process, which can be complicated and time-intensive.

Bequest Through Your Will

Through bequests, you can use your will to help specify where your assets will go when you pass way. Some common types of bequests include:[4]

General Bequest: You specify a sum of money to be donated to the charity.

Percentage Bequest: You specify a percentage of your estate to be left to the charity.

Specific Bequest: You specify that a particular asset that you own is left to the charity, such as real estate or an investment.

Residuary Bequest: Once all other bequests have been satisfied, the charity receives some percentage of your estate.

If you choose to leave a bequest in your will, it is important to work with an estate professional.

Qualified Charitable Distributions From Your IRA

A Qualified Charitable Distribution (QCD) allows someone age 70 1/2 (earlier than the RMD age of 72) or older to make donations directly from your IRA to an eligible charity. Each eligible person can donate up to $100,000 per year in QCDs, which can count towards your required minimum distribution (RMD). By donating directly from your IRA, you avoid increasing your adjusted gross income, and a QCD will not cause your Social Security income to be subject to more taxes.[5] Some IRA administrators may charge a fee or have other limitations for QCDs, so please work with your IRA administrator to determine whether you can complete a QCD.

Donor-Advised Fund

A donor-advised fund (DAF) is an account you establish at a community foundation or a qualified custodian like Schwab Charitable. You make an irrevocable contribution of assets (such as cash, stocks, bonds, or real estate) to the DAF, for which you may be able to receive an immediate tax deduction. You may be able to keep the asset as is within the DAF, or you can sell the asset and invest in a selection of investments (often mutual funds and ETFs) offered on the public charity’s platform. You can elect for the DAF to make contributions to your intended charity on a timeline you specify. A DAF can help you ensure that the money will go towards your intended charity both while you are living as well as after you pass away, though DAFs typically have an annual fee. Some donor-advised platforms have limitations on what types of assets they can accept as donations and to which charities they will donate to.[6]

Charitable Lead Or Charitable Remainder Trust

A charitable lead trust is an irrevocable split-interest trust in which a charity receives proceeds from the trust during its life, and other non-charitable beneficiaries receive remaining assets once the trust terminates.[7]

A charitable remainder trust is an irrevocable split-interest trust in which non-charitable beneficiaries receives proceeds from the trust during its life, and a charity receives remaining assets once the trust terminates.[7]

If properly implemented, these trusts can have tax advantages for you. Creating and implementing these trusts usually entails significant fees, and it is important to work with an estate professional.

Conclusion

Donating can help you leave a positive impact on the world. By controlling what you can ahead of time through thoughtfully implementing your charitable plan, you can increase the chances that the money makes it to your intended charitable organizations. If you have any questions or want to discuss which charitable planning strategies may make sense for you, please feel free to reach out to us.

Important Disclosure Information & Sources:

[1] “Happy Money: The Science of Happier Spending”. Elizabeth Dunn & Michael Norton, 2014, Simon & Schuster.

[2] “Benefits of Donating Appreciated Non-Cash Assets to Charity“. Schwab Charitable, 21-May-2020, schwabcharitable.org.

[3] “Naming a Charity as a Beneficiary“. Trust & Will, trustandwill.com.

[4] “What are bequests?“ Fidelity Charitable, fidelitycharitable.org.

[5] “How to Reduce Your Taxes and AGI by Giving to Charity“. Mark P. Cussen, 08-May-2022, investopedia.com.

[6] “What is a Donor-Advised Fund (DAF)?“ National Philanthropic Trust, nptrust.org.

[7] “How to donate to charity in your will“. Thrivent, 31-May-2022, thrivent.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Should You Pay Off Your Mortgage Early?

To help you figure out whether you should pay off your mortgage early, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

For many people, their home serves as a place to live, where they raise their families, and as a store of wealth. From a financial perspective, their home is the single biggest asset for the average American.[1] Because of that, people often spend a lot of time considering the finances for their home.

One of the foremost financial considerations for most people when determining what home to buy is the type and terms of a mortgage. Many people have a specific repayment schedule on their mortgage over a time period often ranging from 10 to 30 years.

Sometimes, people have the ability to pay off part of their mortgage early. From a financial perspective, just because you have the ability to pay off part of your mortgage early doesn’t necessarily mean that would be best. The decision depends on many factors including:

Your upcoming liabilities

Your opportunity costs, such as your ability to earn a different return from investments

Your emergency fund

Economic conditions

Interest rates, and your ability to refinance

What would help you sleep at night

To help you figure out whether you should pay down your mortgage early, we provide the below resource. As always, we are here to help you throughout your financial journey. We can provide resources, experience, and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

[1] “Survey of Consumer Finances (SCF)“. Board of Governors of the Federal Reserve System, 2020, federalreserve.gov.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Should You Use A Donor-Advised Fund?

To help you figure out the best way for you to donate to the organizations you care about, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

With the growth in global investment markets in recent years, many investors are donating more to their communities and the causes they care about than ever before.[1] Based on Giving USA’s 2021 Annual Report, U.S. charities received a record $471.44 billion in donations in 2020, with more than two-thirds of these donations coming from individuals and families.[1]

Figuring out the best way for you to donate can be complex. There are a lot of different options on how to donate, including:

Creating a donor-advised fund

Creating a charitable trust

Creating a private foundation

Each option has its own benefits and tradeoffs regarding taxes, costs, and flexibility. By understanding your options and creating the charitable strategy most appropriate for your situation, you can increase the chances that the organizations you most care about will receive the money that you intend for them.

To help you figure out the best way for you to donate to the organizations you care about, we provide the below resource. As always, we are here to help you as you begin your charitable journey. We can provide resources, experience and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Important Disclosure Information & Sources:

[1] “2021 Annual Report“. Giving USA, 2021, givingusa.org.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Phantom Stock Plans

Business owners are looking for compelling ways to attract and retain talent. One approach to achieve this goal is through implementing a phantom stock plan.

By Founder & CEO Scott Savage.

Today more than ever, business owners are looking for compelling ways to attract and retain talent in a highly competitive labor market. One approach to achieve this goal used by some business owners is through implementing a phantom stock plan. This type of plan affords business owners a way to reward key employees for past service and to align their interest with that of the company going forward.[1]

What Is A Phantom Stock Plan?

A phantom stock plan qualifies as a type of deferred compensation plan, contractually tying monetary compensation directly to the value of the business if certain conditions are met.

The idea of phantom stock is that it simulates ownership, providing the means for an employer to offer employees the potential benefit of company growth while avoiding the complications of transferring actual ownership. In practice, when the phantom shares are earned by the employee, a valuation date is set. Then, a formula is used to imitate the actual stock value, and the payout is based on the value of those shares.[2]

Note: Working with tax and legal professionals to set up this type of plan is important for proper execution.

Why Choose A Phantom Stock Plan?

A phantom stock plan can potentially succeed because it provides mutual benefits and protections for both the employer and employee.

For the employer, along with avoiding ownership dilution, it affords flexibility in selecting who is eligible for participation. Compared with employer-sponsored (ERISA) plans, which require benefits to be available to each employee, a phantom stock plan allows for the employer to offer participation to key employees and adjust values on an individual basis.[1] Additionally, this type of plan can help lead to less employee turnover, through both vesting period requirements and, in some cases, non-compete agreements.[3]

For the employee, participating in this plan is a bonus for their dedication to the company, and can endure into the future. Specifically, it can provide a predictable stream of cash flow after leaving the company or into retirement. In addition, if the company is sold, the plan typically vests immediately, offering protection in case ownership changes.

Final Thoughts

As you, a business owner, consider options to motivate your employees, a phantom stock plan is a valuable tool to build a mutually beneficial agreement with key employees within your organization. We believe this type of plan is a great way to potentially help propel the growth of your business, while giving you the ability to reward the people who help make it possible.

Important Disclosure Information & Sources:

[1] “Phantom Stock Plan“. Adam Hayes, 22-May-2022, investopedia.com.

[2] “An Introduction To Phantom Stock And Stock Appreciation Rights“. Gary Pattengale, 22-Feb-2022, bdfllc.com.

[3] “Phantom Stock Plan“. Corporate Finance Institute, 10-Mar-2021, corporatefinanceinstitute.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Buy-Sell Agreements for Business Owners: Why You Should Have One

This article explores how a buy-sell agreement works, why we strongly recommend one for our business owner clients who share company ownership, and how we can help with implementation.

By Founder & CEO Scott Savage.

Business ownership, especially starting a business, can be overwhelming. Over the years, we have seen business owners make two types of mistakes:

Errors of commission, or an incorrect decision, which include paying too much for real estate, hiring the wrong people, or buying the wrong inventory.

Errors of omission, or missed opportunities, which include not having a board of advisors, not hiring a tax expert to help with structuring the business, or not creating a buy-sell agreement.

Although mistakes are inevitable, it is possible to take steps to avoid errors of omission. This article explores how a buy-sell agreement works, why we strongly recommend one for our business owner clients who share company ownership, and how we can help with implementation.

What is a Buy-Sell Agreement?

“The beginning of wisdom is the definition of terms.” —Socrates

Stated simply, a buy-sell agreement is a legal document made between two or more shareholders of a privately held corporation or entity. The agreement helps the business streamline the transition between owners after a triggering event, such as death, disability, divorce, or disagreement.

The agreement works by establishing a valuation method for the business. There are various ways to determine the value of a business, including:

Fixed Price Approach: Setting a fixed price of the business, typically on an annual basis.

Formula Approach: Agreeing on a formula that utilizes components such as cash flow or assets to determine the price.

Finally, the buy-sell agreement will include a funding strategy. It can be funded or unfunded, but typically people will fund buy-sell arrangements with insurance, which is what we generally recommend.

Why Have a Buy-Sell Agreement?

A buy-sell agreement can greatly simplify a transition between business owners. Without an agreement in place, you can anticipate holdups, delays, and potentially, litigation in transferring ownership to the other shareholders. A buy-sell agreement aids in bypassing these issues, helping the business to move forward during times of change.

Some business owners think such an agreement is useful once their company gains in value, not at the outset. But we encourage anyone who is starting a company with someone else to get a buy-sell agreement in place. You never know what will happen, and this agreement can prevent a lot of trouble and heartache.

How SJS Can Help

Depending on the needs and company structure, we can help advise on the proper approach to a buy-sell agreement. We are able to coordinate the process with attorneys and tax professionals to help you create an agreement that is effective and valuable.

This is part of the ongoing service we provide and one that isn’t simply drafted and put on the shelf. Buy-sell agreements become part of a dynamic, ongoing conversation with our business owner clients. We can monitor the company’s growth and indicate if our client should fund or update the agreement given the company’s increase in value.

Schedule a complimentary discovery meeting today to discuss what’s on your mind and how we may be able to help.

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What Should You Do About Student Loans?

By understanding and preparing for the benefits as well as costs of higher education options, you can make better higher education decisions for your family for both now and the future.

By Investment Associate Bobby Adusumilli, CFA.

For many people, going to college is a dream come true. While in college, they grow and evolve as people, meet close friends, and have some of the best times of their lives. College degrees often provide people with the skills and qualifications that they need in order to get the jobs that they want. From an earnings perspective, getting a college degree is an important steppingstone in increasing career earnings as well as improving career opportunities, particularly for people who come from more disadvantaged backgrounds.[1]

And yet, earning a college degree is a real financial burden for a lot of people. As demonstrated below, the total student loan debt in the US reached a record $1.75 trillion in 2021, equating to nearly $38,000 per student who borrows.[2][3] Even 20 years after graduation, roughly half of borrowers still have around $20,000 in student loan debt on average. Student loan debt is even greater for people who pursue master’s or doctorate degrees, sometimes amounting to hundreds of thousands of dollars.[4] The costs of college have been only going up over the past 20 years, meaning student loan debts will remain a major burden for a lot of people throughout their lives.[2]

Source: “Student Loan Debt Statistics”. Melanie Hanson, 01-Mar-2022, educationdata.org.

By understanding and preparing for the benefits as well as costs of higher education options, you can make better higher education decisions for your family for both now and the future. In order to help your family with this, we first detail the different types of student loans and repayment options. Then we provide some actions that both parents and students can consider in efforts to lower the costs of higher education.

Types of Student Loans

If you need to take out student loans, you can borrow from the federal government and / or private lenders. Due to interest rates, qualification criteria, and repayment options, most people tend to borrow from the federal government. As further detailed by the Wall Street Journal, there are four primary types of federal student loans:[4]

Direct Subsidized (Stafford) Loans are available to undergraduates based on their financial needs. As long as you are enrolled in college at least half-time, you don’t begin accruing interest until six months after graduation.

Direct Unsubsidized (Stafford) Loans are available for both undergraduate and graduate students. Undergraduates typically receive lower interest rates. You begin accruing interest as soon as you take out the loan.

Direct Parent PLUS Loans allow parents of undergraduate students to borrow up to the full cost of attendance of the school. Interest begins accruing immediately.

Direct Grad PLUS Loans allow graduate students to borrow up to the full cost of attendance of the school. Interest begins accruing immediately.

In terms of lowest interest rate, the priority tends to be Direct Subsidized (Stafford) Loans, then Direct Unsubsidized (Stafford) Loans, then Direct Grad PLUS Loans, then Direct Parent PLUS Loans.[4]

Some people decide to take out private loans from third-party lenders such as SoFi and Earnest, particularly if they want to consolidate their outstanding loans into one loan in order to potentially take advantage of a lower interest rate. However, private loans are usually subject to more stringent rules, and you may need to spend more time monitoring private loans in order to keep taking advantage of lower interest rates.

Student Loan Repayment Options

While your future finances may be uncertain, we believe that choosing and sticking with a repayment plan can help you both pay off your student loans quicker as well as better plan other aspects of their finances. Private loans typically have strict criteria and scheduled repayments. Federal student loans usually provide borrowers with more flexibility. As further detailed by the Wall Street Journal, here are some ways that you can choose to repay federal student loans:[4]

The Standard Repayment Plan allows you to pay a fixed monthly amount with the goal of paying off the loan in 10 years. You are automatically enrolled in this plan, though you can choose a different repayment plan.

The Graduated Repayment Plan starts out with lower monthly payments and increases them about every two years, with the goal of paying off the loan within 10 years. This option may make sense if you expect your income to steadily increase.

The Extended Repayment Plan allows you to pay either a fixed or steadily increasing monthly amount over 25 years. You must have at least $30,000 in federal loans to qualify.

The Revised Pay as You Earn (REPAYE) Repayment Plan sets monthly payments at 10% of your discretionary income, which the US government calculates based on income and family size. The balance is forgiven after around 20-25 years.

The Pay As You Earn (PAYE) Repayment Plan sets monthly payments at 10% of your discretionary income. The balance is forgiven after around 20 years.

The Income-Based Repayment Plan sets monthly payments at 10% to 15% of your discretionary income. The balance is forgiven after around 20-25 years.

The Income-Contingent Repayment Plan sets monthly payments at the lower of 20% of your discretionary income or the amount you would pay on a fixed 12-year repayment plan. The balance is forgiven after around 25 years.

Under Public Service Loan Forgiveness, you must work for a nonprofit or government agency for 10 years, after which the loans would be forgiven. However, this plan is subject to strict rules, and the vast majority of people have not qualified in the past, though eligibility may expand in the years to come.[6]

The Loan Simulator for the US Department of Education allows you to compare what you would pay over time under the various repayment options.

When evaluating which repayment option best suits your situation, we generally recommend to pay off your student loans as fast as reasonably possible. Interest adds up over time, and debt can be a psychological burden. Additionally, we do not believe that people should expect the US government to further forgive federal student loans. By paying off student loans quicker, you can allow yourself to focus on other parts of your financial life, such as raising a family and preparing for retirement.

Helping Your Child Prepare For Higher Education Costs

Especially for parents who have time to help their child prepare for higher education, you can consider the following:

Apply for financial aid: While each school has different eligibility criteria, many schools offer needs-based financial aid as well as merit-based scholarships to eligible students. In order to determine whether you qualify, you should complete both the FAFSA form as well as the CSS Profile.

Apply for private scholarships: Many private organizations offer both needs-based as well as merit-based scholarships to students. While each organization has a different application process, you can ask your school counselor for organizations that other students have received private scholarships from. In addition, you can check out the websites Scholarships.com, Cappex, Scholly, and Going Merry.

Invest in a 529 account: 529 accounts are state-sponsored investment plans that allow people to save and invest after-tax money, with the gains being tax-free so long as the proceeds are used for qualified education expenses for the beneficiary. Additionally, many states offer state tax deductions for contributions to a 529 plan. You can find more information about 529 plans on the Saving for College website.

Analyze the costs and prospects of college options with your child: Each college has different costs, financial aid, scholarship criteria, and median career earnings prospects. By reviewing the various college and financial options with your child, you can increase their understanding of both the benefits and costs of the school that they ultimately choose. The College Navigator tool can help you compare the costs of colleges compared to people who are in a similar financial situation as you. For students who qualify for financial aid, the College Financing Plan is a standardized form provided by most colleges to help students understand and compare the expected college costs. The College Scorecard from the US Department of Education allows you to compare earnings and debt data for different degrees across various colleges.

If you want to loan your child money for school, set up a repayment plan: In order to help their children with student loans, many parents decide to loan their children some of the money for college, often with a low interest rate and more flexible repayment timeline. For parents who do this, we often recommend for you to create a promissory note to be signed by both you and your child that details the student loan repayment terms and schedule.

Higher education can be transformative for students, but it is important to recognize the costs of higher education. As you and your child are evaluating higher education options, we can provide resources, experience, and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions or would like to talk through anything.

Important Disclosure Information & Sources:

[1] “How Big is the Racial Wealth Gap?“ Nick Maggiulli, 02-Jun-2020, ofdollarsanddata.com.

[2] “Student Loan Debt Statistics”. Melanie Hanson, 01-Mar-2022, educationdata.org.

[3] “Average Student Loan Debt”. Melanie Hanson, 10-Jul-2021, educationdata.org.

[4] “The WSJ Guide to Student Loans“. Wall Street Journal, 2022, wsjplus.com.

[5] “Consumer Price Index for All Urban Consumers: Tuition, Other School Fees, and Childcare in U.S. City Average“. Federal Reserve Bank of St. Louis, 2021, fred.stlouisfed.org.

[6] “Public-Service Loan ‘Forgiveness’: Answers to Common Questions“. Cheryl Winokur Munk, 03-Dec-2021, wsj.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

What Should You Consider When Starting A Business?

To help you figure out what you need to do in order to start your business, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

For aspiring entrepreneurs, deciding what business you want to start and when you want to start it are great first steps in the entrepreneurial journey. Starting a business can be thrilling, but there is also a lot that you need to do to get it up and running. If you set up good structures and processes when you start your business, this can go a long way in helping the sustainability of your business and making your life easier over time.

To help you figure out what you need to do in order to start your business, we provide the below resource. From this, you may come away with answers and action items for the following:

How should I fund my business?

What legal structure should I use for my business?

What do I need in place in order to have business partners and a business succession plan?

What do I need to consider from a tax perspective?

What insurance and other benefits should I have in place?

As always, we are here to help you as you begin your entrepreneurial journey. We can provide resources, experience and strategies that may be valuable to you. Please feel free to reach out to us if you have any questions.

Please click on the below images to view.

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Will Social Security Run Out Of Money?

With an aging population and less people paying into Social Security, it is natural to wonder whether Social Security will be around for the long-term. So what can be done?

By Investment Associate Bobby Adusumilli, CFA.

When President Franklin Roosevelt signed the Social Security Act in 1935, his initial intention was the following:[1]

Source: “Historical Background And Development Of Social Security”. Social Security Administration, ssa.gov.

As time went on, Social Security expanded, and many people began relying on it as their primary source of income.[1] As of 2021, almost 90% of people age 65+ in the United States receive Social Security benefits, providing nearly 30% of their income on average.[2] Furthermore, 14% of people ages 65+ rely on Social Security for at least 90% of their income.[2] Social Security also supports disabled, widowed, and divorced individuals.[2]

As a result of its growth, the decline of defined benefits pension plans, and other demographic trends, Social Security’s resources will become increasingly stretched in the years to come.[3][4] The average age in the US has increased significantly over the past 100 years, and people are living longer in retirement.[2] The Social Security Administration projects that there will be 2.3 workers paying into Social Security for each person receiving Social Security income in 2035, compared to 2.7 as of 2021.[2]

In their 2021 report detailing the current and projected future state of Social Security, the Social Security Board of Trustees wrote, “The Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivors benefits, will be able to pay scheduled benefits on a timely basis until 2033, one year earlier than reported last year. At that time, the fund's reserves will become depleted and continuing tax income will be sufficient to pay 76 percent of scheduled benefits.“[4]

Source: “The 2021 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds”. The Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, 2021, ssa.gov.

With an aging population and less people paying into Social Security, it is natural to wonder whether Social Security will be around for the long-term. Yet even given all of the above concerns, we are optimistic that Social Security will continue similarly (though not the exact same) to its current form for the rest of the 21st century. We believe it is important for too many people to go away.

So what can be done to increase the likelihood that Social Security will persist for the long-term? Building off of potential solutions listed in the book Get What’s Yours: The Revised Secrets To Maxing Out Your Social Security, some combination of the below strategies may help to increase Social Security’s longevity:[5]

Raising the Social Security (FICA) tax rates, which are currently 6.2% for each of the employee and employer (12.4% total) on compensation up to the 2022 Social Security wage base of $147,000.[6] Economist Alicia Munnell of Boston College’s Center for Retirement Research has estimated that raising the FICA tax rates by roughly 1.2% for each of the employee and employer - for a 14.8% total FICA tax - could potentially eliminate the projected Social Security shortfall over the next 70 years.[5]

Increasing the wage base ceiling on FICA taxes, which is currently $147,000. The wage base ceiling grows annually based on the US inflation rate.[6]

Increasing the amount of Social Security benefits subject to federal income taxes. Currently, anywhere from 0% to 85% of Social Security benefits are taxable, depending on your taxable federal income.

Extending the full retirement age, which is currently around age 67 for most people.[8]

Lowering Social Security benefits for Americans with higher incomes.

Certain demographic changes can also help fund Social Security, including:

People working longer, meaning longer periods of time that an individual would pay into Social Security. This is already happening for older generations.[9]

Increased worker productivity, which may lead to more US economic growth. For example, due to technologies developed in recent years, many companies were able to keep operations running relatively well throughout the initial stages of the COVID-19 pandemic, which would not have been possible in the past.[10]

Although Social Security can be complex, a lot of people rely on Social Security income, which is why we help people analyze their options so that they can receive all of the benefits that they are eligible for. If you would like help determining when it would be best for you or someone you love to begin taking Social Security, please feel free to reach out to us.

Important Disclosure Information & Sources:

[1] “Historical Background And Development Of Social Security“. Social Security Administration, ssa.gov.

[2] “Social Security Fact Sheet“. Social Security Administration, 2021, ssa.gov.

[3] “The Rise, Fall, and Complexities of the Defined-Benefit Plan“. Troy Adkins, 23-Aug-2021, investopedia.com.

[4] “Status of the Social Security and Medicare Programs“. Social Security and Medicare Boards of Trustees, 2021, ssa.gov.

[5] Get What’s Yours: The Revised Secrets To Maxing Out Your Social Security. Laurence Kotlikoff, Philip Moeller, & Paul Solman, 2016, Simon & Schuster.

[6] “Contribution And Benefit Base“. Social Security Administration, ssa.gov.

[7] “Income Taxes And Your Social Security Benefit“. Social Security Administration, ssa.gov.

[8] “Retirement Benefits“. Social Security Administration, ssa.gov.

[9] “Seniors Are Working Longer - Out Of Choice And Necessity“. Sasha-Ann Simons, 07-Jan-2020, npr.org.

[10] “How COVID-19 has pushed companies over the technology tipping point—and transformed business forever“. McKinsey & Company, 05-Oct-2020, mckinsey.com.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Selling Your Business To Employees

All business exits have pros and cons. Recently, I was introduced to a business owner who had just completed selling his company to a long-time loyal employee.

By Founder & CEO Scott Savage.

Recently, I was introduced to a business owner who had just completed selling his company to a long-time loyal employee. He described to me that despite higher offers from private equity-backed buyers, he chose to sell it at a lower price to a key employee who has the respect of other employees and the business' customers.

The business owner felt strongly that had an outsider purchased his small business, then before too long his key employees would be looking for another job. Additionally, he reasoned that his loyal customer base would be better served - after all, they are the reason he was going to be able to exit on his terms.

The buyer came up with a down payment. Rather than using a bank to finance the balance of the purchase price, the business owner took a seller’s (promissory) note, so the new owner can pay off the balance over time with profits from the business.

All business exits have pros and cons, but I am convinced that the sentiments shared with me and the actions taken by this benevolent business seller increase the likelihood that the business he started nearly 30 years ago will survive and thrive!

Important Disclosure Information & Sources:

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

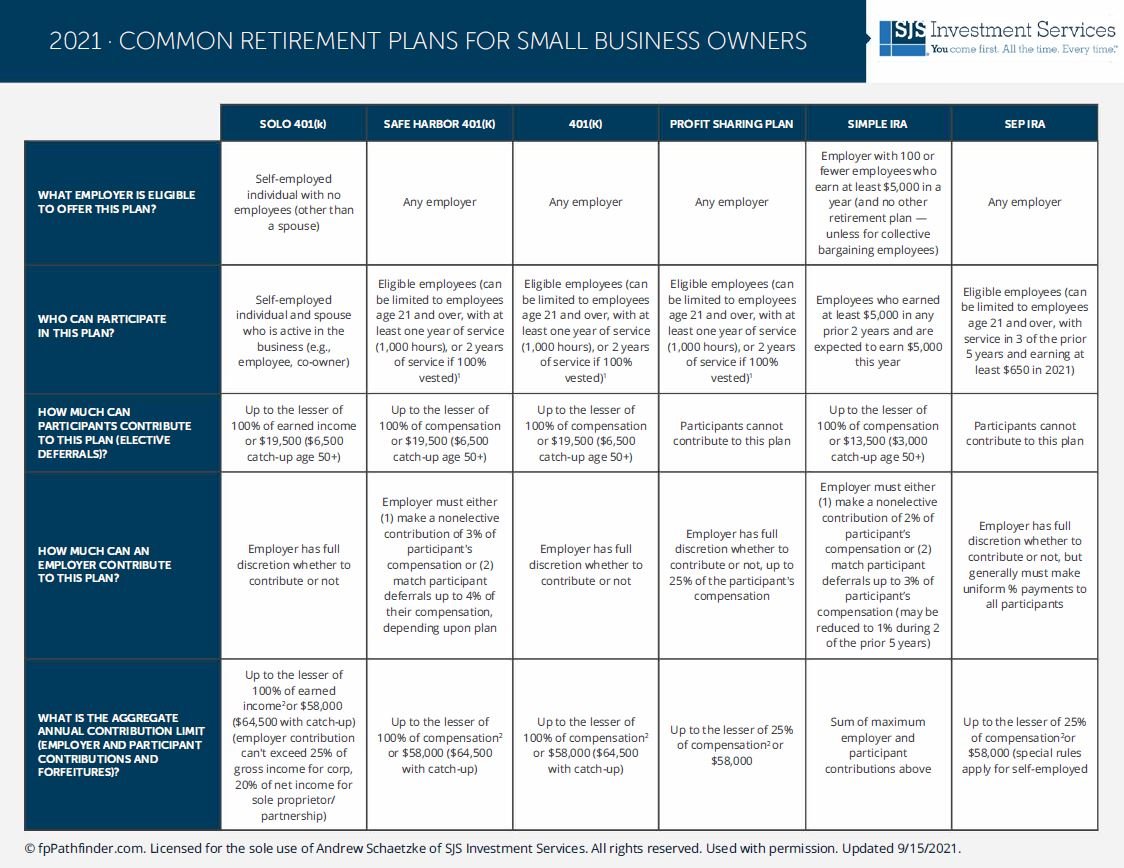

Pension Plan Options For Small Business Owners

To help you differentiate among the most commonly adopted pension plans by small businesses, we provide this resource.

By Senior Advisor Andrew Schaetzke, CFP®.

For many people, retirement plans, pension plans, and Social Security serve as their primary means for income during retirement. As a small business owner, the specific plans that you offer within your business can dramatically improve the financial behaviors and long-term investment results of your colleagues.[1]

While defined-benefit pension plans were very popular through the 1970s, only 15% of private-sector workers are offered defined-benefit pension plans through their employers today.[2] Nevertheless, when implemented well, pension plans can still be a potentially cost-effective way to help employees have more income in retirement.

To help you differentiate among the most commonly adopted pension plans by small businesses, we provide the below resource. From this, you may come away with answers and action items for the following:

Who can participate in the pension plan?

Can employees contribute to the plan?

How and when are benefits paid?

What are the possible vesting schedules?

As always, we are here to help you evaluate the best pension plan for your business. Please feel free to reach out to us if you have any questions.

Please click on the below images to view.

Important Disclosure Information & Sources:

[1] “Nudge: The Final Edition“. Richard Thaler & Cass Sunstein, 2021, Penguin Books.

[2] “The Demise of the Defined-Benefit Plan“. James McWhinney, 18-Dec-2021, investopedia.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal professional or tax professional for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

How Your Finances May Change In 2022

We detail changes to official federal legislation, proposed legislation, and other financial planning considerations that may impact you and your family in 2022.

By Senior Advisor Andrew Schaetzke, CFP®.

Last fall when the Build Back Better Act was introduced in Congress, we expected taxes could increase significantly for certain families as well as businesses. However, the proposed tax plan has changed often and significantly during congressional negotiations. While the legislation is not yet finalized, if passed in 2022, we do not expect that the Build Back Better tax plan will result in as many big changes as we initially anticipated.

Based on current proposed legislation, the following points summarize the provisions that could impact you and your family:

New federal income tax surcharge on higher earners: Households would have to pay an additional 5% surcharge on modified adjusted gross income (MAGI) above $10 million, as well as an additional 3% on MAGI above $25 million. For earners with greater than $25 million in MAGI, this could result in a top federal tax rate around 45%, which could not be decreased by taking large itemized deductions or the qualified business income deduction.[1]

Expansion of the 3.8% net investment income tax (NIIT) for S corporations and partnerships: The 3.8% net investment income tax on capital gains, taxable interest, dividends, passive rents, annuities, and royalties would be expanded to apply to active business income for pass-through firms.[1]

State and local tax (SALT) deduction for federal income taxes: The cap on the SALT federal income tax deduction would increase from $10,000 to $80,000 starting in 2022 through 2030.[1]

Extension of the enhanced Child Tax Credit (CTC) through 2022: The enhanced child tax credit - $3,600 for each child under age 6, as well as $3,000 for each child ages 6-17 - would extend into 2022 for joint filers with MAGI less than $150,000 ($112,500 for single filers).[1]

Limitations on Individual Retirement Accounts (IRAs) contributions for wealthier households: No longer would allow for contributions to IRAs with balances greater than $10 million. Additionally, IRAs with balances greater than $10 million may have accelerated required minimum distribution (RMD) requirements.[1]

Increased IRS funding: The IRS would receive increased funding for hiring and improving operations, which could lead to more audits for wealthier households.[1]

While the effective date for this legislation is uncertain, we expect the changes could be effective retroactively, as of January 01, 2022.

There have been some other annual cost-of-living and government-controlled changes that may affect you and your family in 2022:

5.9% cost-of-living adjustment for Social Security: For individuals currently or planning to receive Social Security payments in 2022, your benefits will be 5.9% higher than 2021 due to inflation.[2]

Lower required minimum distributions RMDs from Traditional IRAs, Traditional 401(k)s / 403(b)s / 457 plan, and Roth 401(k)s / Roth 403(b)s: If you are required to take an RMD from one of these accounts, your RMD as a percentage of your portfolio will be slightly lower in 2022 due to an increase in life expectancy.[3]

Federal student loan interest payments frozen until May 01, 2022: Due to ongoing effects from the pandemic, the Biden administration extended a freeze on federal student loan interest payments from February 01, 2022 to May 01, 2022.[4]

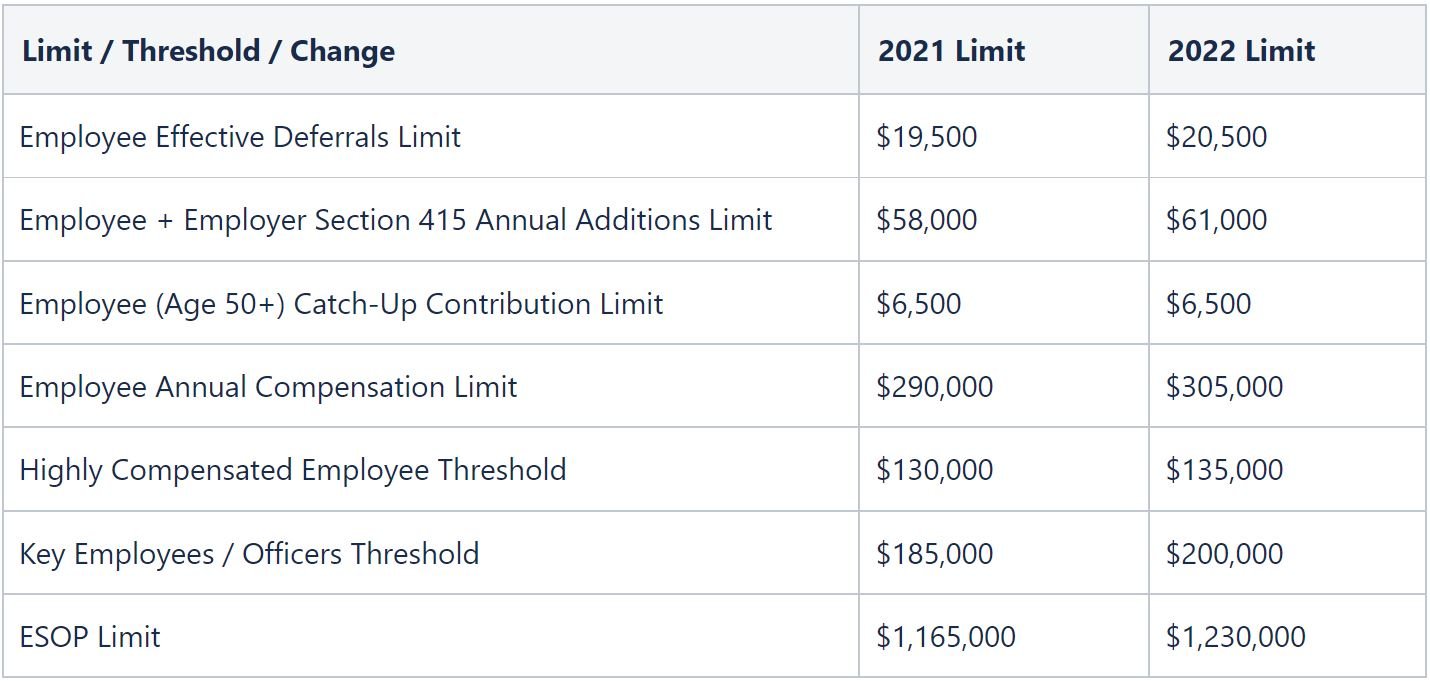

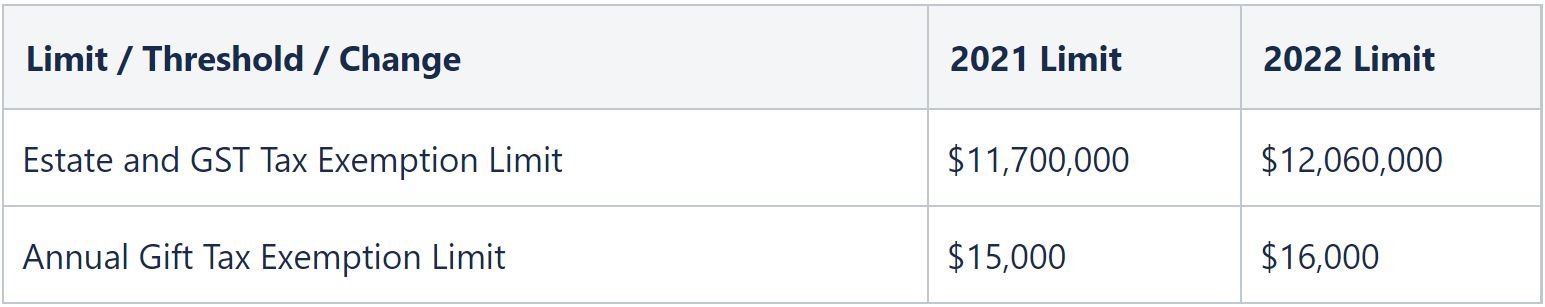

Changes to retirement plan contribution limits, estate tax exemption, and gift tax exemption: Various limits and exemptions have increased for 2022, primarily resulting from inflation. For example, the maximum employee contribution limit to 401(k)s / 403(b)s / 457 plans is increasing from $19,500 to $20,500. Additionally, the annual gift tax exemption is increasing from $15,000 to $16,000. You can find more information here.

As part of your financial planning process for 2022, there are a few ways that you can implement your plan while potentially lowering your federal income taxes:

Contribute to tax-advantaged investment accounts: Depending on your eligibility, you may be able to contribute to tax-advantaged investment accounts such as 401(k) / 403(b) / 457 retirement plans, IRA, Health Savings Account (HSA), and 529 plans in order to save for specific purposes while also potentially lowering your taxes. Additionally, you have until April 15, 2022 to contribute to your IRA and HSA for 2021 if eligible.

Charitable contributions and donor-advised funds: Because of the rise in many investment markets over the past few years, many people hold taxable investments with large unrealized gains. By directly gifting these taxable investments to eligible charitable organizations or creating a donor-advised fund, you can potentially lower federal income taxes for 2022 while giving to the organizations you want to support.

Tax loss harvesting: Particularly during volatile market periods, tax loss harvesting allows you to sell eligible taxable investments with losses, and use these losses to offset realized taxable capital gains. With tax rates expected to increase for certain taxpayers in 2022, tax loss harvesting could prove increasingly valuable.

As federal legislation evolves, we will continue to update you on any changes that may impact you. Additionally, you can find well-written summaries of the proposed financial changes on the Tax Foundation (taxfoundation.org) website. As always, please feel free to reach out to us if you have any questions or want clarity on how the proposed changes may affect you.

Important Disclosure Information & Sources:

[1] “House Build Back Better Act: Details & Analysis of Tax Provisions in the Budget Reconciliation Bill“. Tax Foundation, 02-Dec-2021, taxfoundation.org.

[2] “Cost-of-Living Adjustment (COLA) Information for 2022“. Social Security, ssa.gov.

[3] “Required Minimum Distribution Calculator“. U.S. Securities and Exchange Commission, investor.gov.

[4] “The White House Will Freeze Federal Student Loan Repayments Until May 1“. Katie Rogers and Tara Siegel Bernard, 22-Dec-2021, nytimes.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

What's Next? Life After Selling Your Business

In my experience, a successful business exit requires honesty, especially with the person in the mirror. Acknowledging your dependence on the success of the business is worthy of contemplation and soul-searching.

By Founder & CEO Scott Savage.

Many business owners I have had the honor to advise over the years share a common experience: Their identity is linked to that of their business. One client told me he was terrified to sell his business because he couldn’t imagine a life post-sale.

As I wrote in my ebook, a common experience for most business owners immediately after the sale is an emotional let-down, and in some instances regretting their decision. One client told me that knowing what he knows now, he would never have sold his business at the price he did. That was 5 years after the sale!

In my experience, a successful business exit requires honesty, especially with the person in the mirror. Acknowledging your dependence on the success of the business is worthy of contemplation and soul-searching before you assemble your team of advisors, get a valuation of your company, decide on strategic buyers or private equity buyers, and launching a sales process.

One client of mine was at the closing table after a year-long sale process, and just could not close for fear of becoming “irrelevant”.

In most instances, this emotion letdown - “seller’s remorse” - is quickly replaced with new opportunities, overdue time spent with loved ones, volunteering time and talents with a beloved not-for-profit, or finally having the time to focus on physical and mental health & wellness.

My Dad always said, “We’re all replaceable.” Even as I write this, I wonder how much of my identity is linked to my business.

Important Disclosure Information & Sources:

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

Saving For Emergencies

Emergency savings can help you weather the toughest times, providing a cushion so that you can stay committed to your financial plan for the long-term.

By Senior Advisor Andrew Schaetzke, CFP® and Investment Associate Bobby Adusumilli, CFA.

Do you have money saved for emergencies?

Emergency savings can provide support in case something very unexpected happens. Unfortunately, most people and businesses don’t have enough saved. According to Bankrate’s 2021 Emergency Savings Survey, half of Americans have less than three months’ worth of expenses covered in an emergency fund.[1] That total includes 1 in 4 Americans who specified that they don’t have an emergency fund.[1] Based on research from the JPMorgan Chase Institute from 2016, approximately 50% of small businesses have 27 cash buffer days or less, meaning they would run out of cash within 27 days if revenue suddenly stopped coming in.[2]

By preparing for emergencies in advance, you are controlling what you can in order to be ready for the unexpected. Emergency savings can give you some peace of mind and allow you to maintain your focus on the long-term with your finances. We hope the below information helps you figure out what to do with your emergency savings.

How much should I save for emergency savings?

For most people, we recommend that you have at least 3-6 months' worth of living expenses in emergency savings. Some people like to have >1 years' worth of living expenses, particularly if they have health problems, dangerous jobs, or would just sleep better knowing they have more money saved.

How quickly should I fund my emergency savings?

Below are some general considerations, though please work with your financial professional to develop a plan appropriate for you:

First pay off any necessary short-term expenses.

Prioritize paying off any high-interest debts. However, many people like the security of also having emergency savings. Even if you prioritize paying off high-interest debts, you can still save slowly (such as $20 per week) for emergency savings.

After high-interest debts are paid off, prioritize growing your emergency savings to at least 3-6 months' worth of living expenses. While doing this, continue paying off any lower-interest debts.

After you paid off your high-interest debts and have enough emergency savings, then consider saving and investing more via tax-advantaged accounts. You can come up with a plan to help you save a little each week while also continuing to pay off any lower-interest debts.

When should I use my emergency savings?

When this cash is necessary for an urgent expense. While each situation is different, we typically recommend that people use their emergency savings before withdrawing from any long-term investments. However, we believe that people should replenish their emergency savings as soon as feasible.

Where should I keep my emergency savings?

The goal of emergency savings is to have cash for when you need it. Behaviorally, people are more likely to spend their savings unnecessarily if they frequently view the balance and if it is stored in the same place as other financial assets.[3] Therefore, we think people should keep their emergency savings separate from other financial assets.

Below are some options on where you can store your emergency savings:

Savings Account

Many online banks, local banks, and credit unions offer secure and low-hassle savings accounts that provide you with some monthly interest. The interest is subject to federal, state, and local income taxes, but the interest is usually more than you would receive in a checking account.

Make sure to choose a savings account which is FDIC-insured up to $250,000, as well as a trusted and reliable financial institution that will allow for quick and penalty-free withdrawals when needed.[4] For additional information on potential savings accounts, see this website from Nerdwallet.[5]

High-Quality Short-Term Bonds

Another option is to invest in high-quality short-term bonds. These bonds may provide more interest / yield than a savings account, but these bonds will fluctuate more in value compared to savings accounts. Certain high-quality short-term bonds (particularly municipal bonds) may be exempt from federal, state, and / or local taxes.

For many people, the easiest way to invest in high-quality short-term bonds is via a well-diversified low-cost ETF or mutual fund.

Short-Term Treasury Inflation Protected Securities (TIPS)

TIPS are offered by the US government to protect against inflation. The principal increases with inflation and decreases with deflation, as measured by the Consumer Price Index.[6] When it matures, you are paid the adjusted principal or original principal, whichever is greater. While TIPS are subject to federal income taxes, they are typically exempt from state and local taxes. Particularly if TIPS are in high demand, then investors may earn less than the rate of inflation.[6]

While you can buy short-term TIPS directly from the US government via the TreasuryDirect website, many people find it easiest to invest in TIPS via a well-diversified low-cost ETF or mutual fund.

Source: FRED, as of October 01, 2021. The Consumer Price Index for All Urban Consumers: All Items (CPIAUCSL) is a measure of the average monthly change in the price for goods and services paid by urban consumers between any two time periods. It can also represent the buying habits of urban consumers.

Series I Savings Bonds

Series I savings bonds are 30-year savings bonds offered to US residents by the US government, designed to match the US inflation rate.[7] Each individual can buy up to $10,000 of Series I savings bonds per year, and you can buy in increments of $25. You are restricted from selling your Series I savings bond within the first year, but after that you can redeem directly with the US government. If you sell within the first five years, you forfeit three months' worth of interest. When a Series I savings bond matures, you are paid the adjusted principal or original principal, whichever is greater. Series I savings bonds are subject to federal income taxes, but they are typically exempt from state and local taxes.[7]

You can buy Series I Savings Bond online directly from the US government via the TreasuryDirect website.

Conclusion

We can’t predict the future, but we can prepare for it. Particularly when times are toughest, that is when emergency savings can provide the most security for you. Emergency savings can help you weather the toughest times, providing a cushion so that you can stay committed to your financial plan for the long-term.

The idea of emergency savings is not new. The legendary investor Warren Buffett routinely talks about the importance of holding a large cash reserve for his company, largely driven by the teachings from his grandfather Ernest Buffett.[8] Below is a letter from Ernest Buffett to his family on the benefits of a cash reserve. [8] We hope you enjoy this, and as always feel free to reach out to us at SJS if you have any questions about emergency savings.

Source: “Berkshire Hathaway 2010 Shareholder Letter“. Warren Buffett, 2011, berkshirehathaway.com.

Important Disclosure Information & Sources:

[1] “Survey: More than half of Americans couldn’t cover three months of expenses with an emergency fund“. Sarah Foster, 21-Jul-2021, bankrate.com.

[2] “Cash is King: Flows, Balances, and Buffer Days: Evidence from 600,000 Small Businesses”. JPMorgan Chase & Co. Institute, September 2016, jpmorganchase.com.

[3] Your Money & Your Brain. Jason Zweig, 2008, Simon & Schuster.

[4] “Deposit Insurance FAQs.“ Federal Deposit Insurance Corporation, fdic.gov.

[5] “8 Best High-Yield Online Savings Accounts of November 2021“. Margarette Burnette, 01-Nov-2021, nerdwallet.com.

[6] “Treasury Inflation-Protected Securities (TIPS)“. U.S. Department of the Treasury, treasurydirect.gov.

[7] “Series I Savings Bonds“. U.S. Department of the Treasury, treasurydirect.gov.

[8] “Berkshire Hathaway 2010 Shareholder Letter“. Warren Buffett, 2011, berkshirehathaway.com.

There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against a loss in a declining market.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. SJS Investment Services does not provide legal or tax advice. Please consult your legal or tax professionals for specific advice. This material has been prepared for informational purposes only.

Statements contained in this article that are not statements of historical fact are intended to be and are forward looking statements. All forward looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

The "NOT SO" Great Resignation

Successful leaders I have been around focus on their employee experience because their employees are the folks who usually interact with their customers.

By Founder & CEO Scott Savage.

Do you treat each and every one of your employees like they are the most important person in the world?

In my opinion, there are two reasons to do so:

First: To each of your employees, they are the most important person in the world!

Second: They are the people who control your customer experience!

Business owners and leaders usually tell me that they are customer-centric. “It’s all about the customer.” Heck, my company’s tagline is “You come first. All the time. Every time.”

Successful leaders I have been around focus on their employee experience because their employees are the folks who usually interact with their customers.

In business circles, 2021 is being called “The Year of The Great Resignation.”[1] According to the Bureau of Labor Statistics, a record 8.7 million people resigned from their positions in the months of August and September alone.[2]

Many have speculated on the “Why” behind these numbers, and just about every business we work with has numerous unfilled positions that are stunting growth prospects and forcing innovation in hiring and retention practices. COVID-19, career switching, trouble with child and family care, and a surge in early retirements are combining to empower the workforce like never before.[1]

Source: U.S. Bureau of Labor Statistics, Job Openings: Total Nonfarm [JTSJOR], retrieved from FRED, Federal Reserve Bank of St. Louis, as of November 29, 2021. The job openings rate is computed by dividing the number of job openings by the sum of employment and job openings and multiplying that quotient by 100.

Many employers react to this “threat” with fear-based behavior. One company I am aware of stopped their drug screening for prospective new employees.

I believe employers who see this time as an opportunity to understand what their employees and prospective employees value about their work - and create the conditions that reflect these values - will thereby elevate both the employees' as well as the business' experiences. For example, we often help employers design their 401(k) plans in a way that both reflect their company values and are valued by their employees. This may require a newer and deeper understanding of what your business stands for.

Research is clear that after an employee feels like they are paid a “market” rate, their job satisfaction at work is driven by non-compensation factors.[3] As Daniel Pink writes about in his bestselling book Drive: The Surprising Truth About What Motivates Us, people are looking for three essential elements in order to find meaning and motivation in their careers:[3]

Autonomy - the desire to direct our own lives

Mastery - the urge to get better and better at something that matters

Purpose - the yearning to do what we do in the service of something larger than ourselves.

As employers, if we can help our colleagues focus on what they do best, then we as founders and CEOs can focus more on what we do best. This can help everyone enjoy their careers more, decrease employee turnover, and lead to better business results.

Important Disclosure Information & Sources:

[1] “Who Is Driving the Great Resignation?“ Ian Cook, 15-Sep-2021, hbr.org.

[2] “Job Openings and Labor Turnover – September 2021“. U.S. Bureau of Labor Statistics, 12-Nov-2021, bls.gov.

[3] Drive: The Surprising Truth About What Motivates Us. Daniel H. Pink, 2011, Riverhead Books.

Advisory services are provided by SJS Investment Services, a registered investment advisor (RIA) with the SEC. Registration does not imply a certain level of skill or training. This material has been prepared for informational purposes only.

Hyperlinks to third-party information are provided as a convenience and we disclaim any responsibility for information, services or products found on websites or other information linked hereto.

Suggested Reading

2022 IRS Changes - Retirement Plans and Social Security

To help you plan for 2022, we provide this information regarding limits, thresholds, and changes for retirement plans and Social Security.

By Senior Advisor Andrew Schaetzke, CFP®.

Every year, the Internal Revenue Service (IRS) updates dollar contribution limits and other aspects of defined contribution plans like 401(k)s, tax-qualified defined benefit plans, and Social Security. Particularly with the rise in inflation this year, some of the dollar limits have gone up significantly more than in years past.[1][2]

To help you plan for 2022, we provide the below information regarding limits, thresholds, and changes for these retirement plans and Social Security.[1][3] Additionally, we are actively monitoring other legislation making its way through Congress, particularly relating to President Biden’s Build Back Better Framework.[4] As legislative bills become law, we will provide you with more important updates.

401(k), 403(b), 457(b), ESOP, Profit-Sharing Plans

Traditional IRA / Roth IRA

Defined Benefits Plan

Social Security

Estate and Gift Taxes

Important Disclosure Information & Sources:

[1] “2022 Limitations Adjusted as Provided in Section 415(d), etc.“. IRS, irs.gov.

[2] “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average“. Federal Reserve Bank of St. Louis, stlouisfed.org.

[3] “2022 IRS Plan Limits“. Newport Group, 04-Nov-2021, newportgroup.com.

[4] “The Build Back Better Framework“. The White House, whitehouse.gov.