Listening Pays Off

We have a saying: “When our clients talk, we listen.” Our best client relationships form not when we do a lot of talking, but when we do a lot of listening.

Hope Is Not Our Strategy

We all hope for things. But there are many situations where hope isn’t enough. With MarketPlus Investing, we use science and decades of research to guide us.

CARES ACT: Key Changes in Tax/Benefits Provisions for Families and Businesses

We want to share a summary of recent legislation that may affect you as you navigate through future decision-making for your families and businesses.

CARES ACT – Resources For Small Businesses And Nonprofits

To help small businesses and nonprofits, we have summarized a few key provisions of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

Grocery Stores And Equilibrium

As Americans, we have a history of navigating uncertainty and innovating our way through challenges. I believe we will get to the other side of the COVID-19 challenge together and grow through the process.

Working To Control What You Can

We can identify the risks we know of, craft an appropriate plan given those risks, act according to the plan, update the plan using new information, and repeat.

Resilience In The Face Of The Coronavirus

SJS believes in the resilience of people and markets to respond well in the face of new obstacles, with the current coronavirus as no exception.

Making Sense of the Future: SJS 2020 Capital Markets Expectations

SJS uses our Capital Market Expectations to help design a portfolio that is appropriate for you, and to share insights from the SJS Investment Committee.

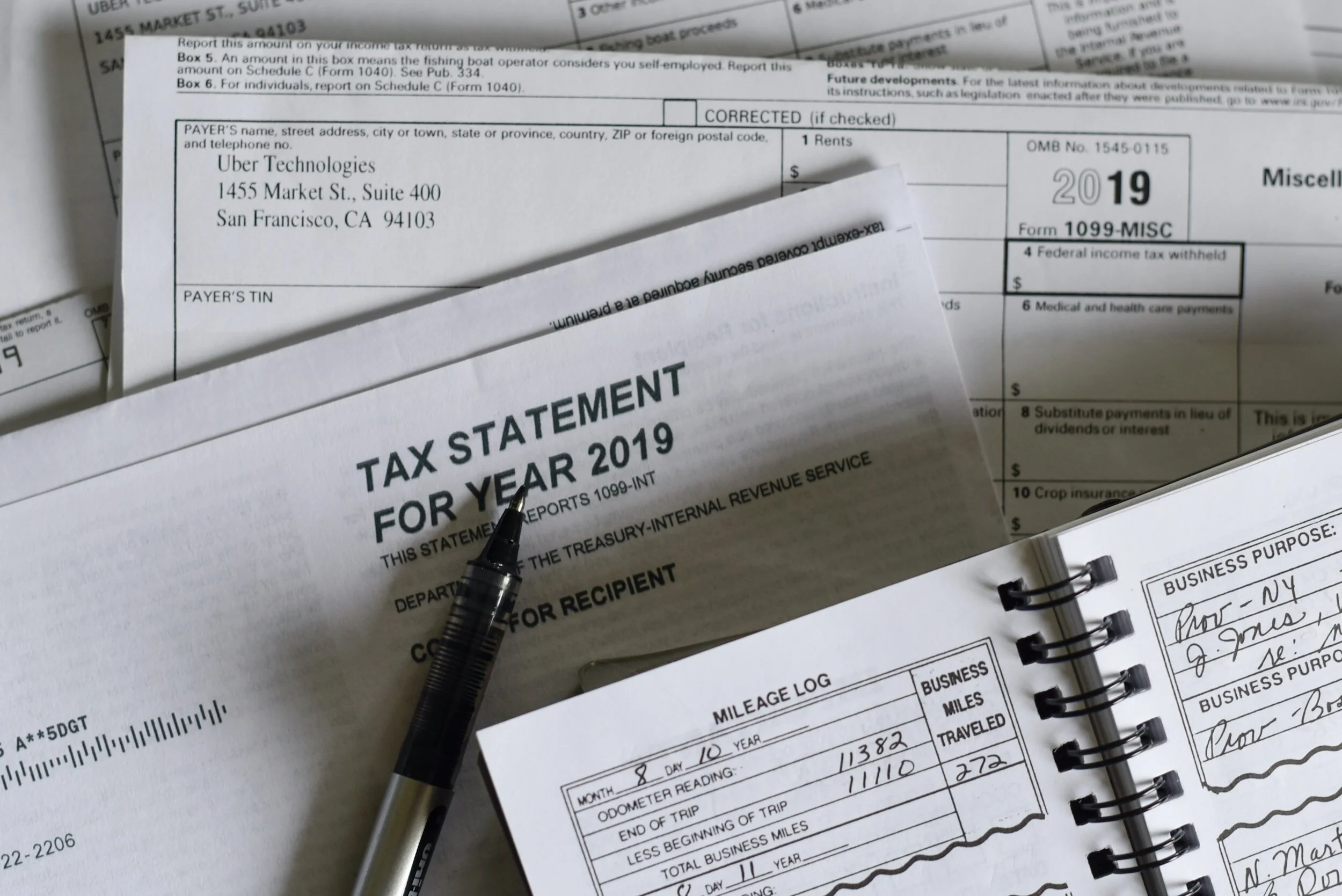

The SECURE Act Shifts The Rules Of Retirement

We’ve highlighted some of the more significant modifications within the SECURE Act that affect your retirement planning.

Increased 401(k), 403(b) Contribution Limits In Effect For 2020

The IRS has announced new retirement account contribution guidelines for 2020. Contributing more to your retirement accounts now can lead to a lower tax bill – not to mention more income in retirement.

When You Call, Use Your "Smart" Phone

Sometimes, it may be helpful to point to a market force that may be actionable for you or your loved ones. One such market force now? Falling mortgage rates.

What is YOUR Expected Return?

We understand that your investment return has a purpose, that your investments are connected to the people, enterprises, and causes that matter to you.

What Is The Value Of Your Advisor?

Studies have shown the estimated value of a financial advisor to be worth 1.6% to 4.1%, annually. SJS strives to implement many of these “value-add” services.

Never Fly Solo

We know a team is only as good as how well its members work together – for you, and for each other. So what are our secrets for achieving success as a team?

10 Commandments … of Money

It seems like a good time to share one of our most requested SJS features – the 10 Commandments…of Money. We think good advice certainly bears repeating!

Industry Speak vs. ‘SJS Speak’

Have you ever read an article in a magazine or newsletter, and come away feeling more confused and with less understanding *after* having read it?

Charitable Giving And Tax Considerations For Year-End

In the holiday season, what can you do to still fulfill your charitable intent, while also making tax-smart investing decisions?

Is Your Investment Professional A Butcher? Or A Dietitian?

In my experience, just about all broker dealers’ ads and marketing materials sure sound like they want you to believe they are in the advice business.

Changing Or Creating A Trust?

When’s the last time you updated your trust document? Or, maybe your life circumstances have you considering a trust for the first time.

5 Financial Tips For Your College Grad

Sometimes it takes a mistake – or two – to learn the lesson. To help avoid painful lessons, here are five tips to help your college grad get on solid ground.